| Well that, as Ron Burgundy would say, escalated quickly. China's foreign ministry is accusing the Trump administration of "major retrogression" on climate and being an environmental "troublemaker." Why it matters: China's unusual statement Monday widens the rupture between the world's largest carbon emitters as global climate efforts are flagging and the pandemic's effect on emissions is too small to be consequential in the long term. Our thought bubble, via Axios' Bethany Allen-Ebrahimian: This is a pretty smart line of attack for Beijing, which seems to have determined that a world increasingly wary of China would still welcome its climate leadership, particularly given the U.S. abandonment of this issue under President Trump. Driving the news: The Chinese statement knocks the U.S. for being the largest cumulative greenhouse gas source in history. - That's true, though China surpassed the U.S. as the world's largest annual polluter roughly 15 years ago and the gap has only widened.

- China attacks Trump's decision to abandon the Paris Agreement and the administration's moves to roll back Obama-era emissions rules.

- But it goes far beyond climate and hits Trump's record on biodiversity and more.

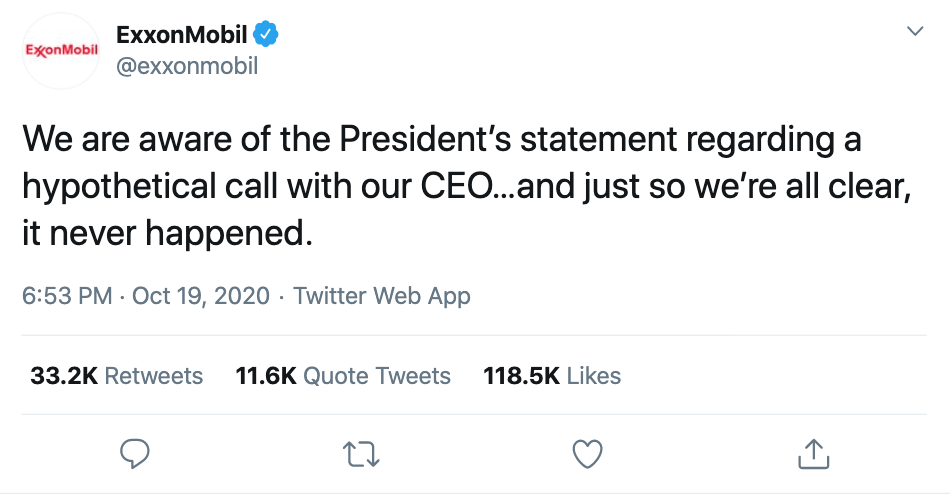

Catch up fast: China's accusations follow the State Department's Sept. 25 statement attacking China over its massive emissions growth this century, its record on marine debris and logging, and other areas. - The State's strongly worded missive, in turn, had come three days after China's surprise announcement that it would aim for "carbon neutrality" by 2060 and a CO2 emissions peak before 2030.

Between the lines: It's hard to untether the flare-up from the election. - Climate diplomacy expert Andrew Light said China is looking to be seen as a leader even in a world where the U.S. resumes taking big steps.

- "It looks to me like they are trying to get ahead of a possible Biden win and reversal of Trump's positions on domestic and international climate and environment," said Light, a senior climate aide in former President Obama's State Department.

What we're watching: The upcoming election. Joe Biden has vowed a mix of new international climate policies beyond simply rejoining the Paris deal. When it comes to China specifically, his proposals include... - Ramping up pressure on China to make its global Belt and Road Initiative on infrastructure more climate-friendly.

- Encouraging future U.S.-China agreements on CO2, but making them "contingent on China eliminating unjustified export subsidies for coal and other high-emissions technologies."

The other side: A State Department spokesperson, in a statement responding to China's new attack, said the U.S. has "long recognized China's abysmal environmental record and called on China to improve in various international fora." - "We continue to call on China to not just make empty promises and release statements but actually invest in improving the quality of its own air, water, and soil."

|

No comments:

Post a Comment