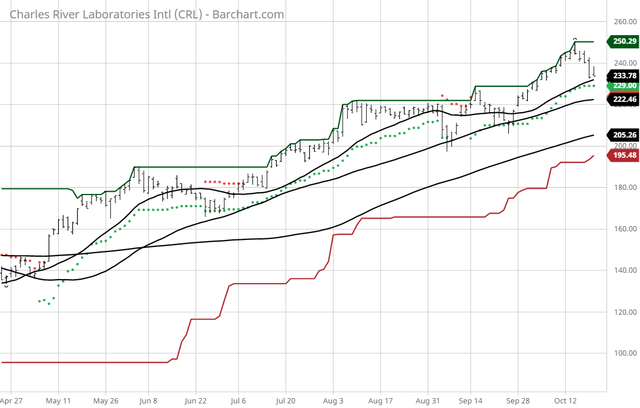

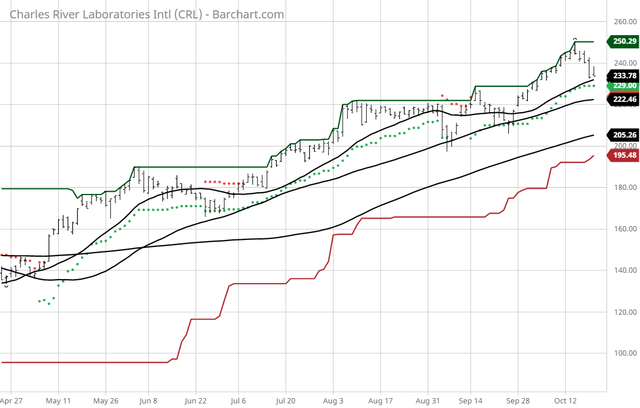

The Barchart Chart of the Day belongs to the medical services company Charles River Laboratories (CRL). I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent prices appreciation. Since the Trend Spotter signaled a buy on 9/15 the stock gained 3.96%. Charles River Laboratories International, Inc., an early-stage contract research company, provides drug discovery, non-clinical development, and safety testing services. It operates through three segments: Research Models and Services (RMS), Discovery and Safety Assessment (DSA), and Manufacturing Support (Manufacturing). The RMS segment produces and sells research model strains primarily purpose-bred rats and mice for use by researchers. It also provides a range of services to assist its clients in supporting the use of research models in research and screening non-clinical drug candidates, including genetically engineered models and services, insourcing solutions, and research animal diagnostic services. The DSA segment offers early and in vivo discovery services for the identification of a druggable target through delivery of non-clinical drug and therapeutic candidates ready for safety assessment; and safety assessment services, such as bioanalysis, drug metabolism, pharmacokinetics, safety pharmacology, toxicology, and pathology services. The Manufacturing segment provides in vitro methods for conventional and rapid quality control testing of sterile and non-sterile biopharmaceuticals, and consumer products. It also offers specialized testing of biologics that are outsourced by pharmaceutical and biotechnology companies; and avian vaccine services that provide specific-pathogen-free fertile chicken eggs, SPF chickens, and diagnostic products used to manufacture vaccines.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. Barchart technical indicators: - 100% technical buy signal

- 87.40+ Weighted Alpha

- 74.64% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 16 new highs and up 6.78% in the last month

- Relative Strength Index 55.17%

- Technical support level at 229.53

- Recently traded at 233.42 with a 50 day moving average of 222.47

Fundamental factors: - Market Cap $11.58 billion

- P/E 33.75

- Revenue expected to grow 8.80% this year and another 9.70% next year

- Earnings estimated to increase 7.90% this year, an additional 16.30% next year and continue to compound at an annual rate of 11.30% for the next 5 years

- Wall Street analysts issued 12 strong buy, 1 buy and 1 hold recommendation on the stock

- The individual investors following the stock on Motley Fool voted 241 to 12 that the stock will beat the market

- 4,240 investors are monitoring the stock on Seeking Alpha

The #1 strategy that could have sent you 20 years with no losing years… Trophy Trades have already proven to have the potential to earn you as much as $13.5 million dollars… But it’s never been released to the public before - now that changes for you

More on this symbol: |

No comments:

Post a Comment