| | | | | | | Presented By Barclays Investment Bank | | | | Axios Markets | | By Dion Rabouin ·Oct 20, 2020 | | Good morning! Was this email forwarded to you? Sign up here. (Today's Smart Brevity count: 1,236 words, < 5 minutes.) 🚨Situational awareness: Goldman Sachs agreed with DOJ to pay over $2 billion for the bank's role in Malaysia's multibillion dollar scandal at state fund 1MDB, sources told Bloomberg. 🎙 "I do therefore invite my fellow citizens in every part of the United States, and also those who are at sea and those who are sojourning in foreign lands, to set apart and observe the last Thursday of November next, as a day of Thanksgiving." - See who said it and why it matters at the bottom. | | | | | | 1 big thing: Trust in the Fed keeps falling |  Data: Axios/Ipsos poll; Note: ±3.3% margin of error; Chart: Axios Visuals Americans' trust in the Fed fell again in October, with just 34% saying they have a fair amount or a great deal of trust in the central bank in the latest Axios/Ipsos poll. What's happening: While trust in the Fed rises with age, income level and among those who say they know more about the institution, there was not a single group where even half of respondents said they trusted the Fed. - Most groups register below 40%, including college graduates, higher-income earners and Americans between 50 and 64 years old.

Why it matters: Popular opinion guides Congress, which is charged with overseeing the Fed. - That's why chair Jerome Powell has taken extraordinary steps to improve the Fed's standing on Capitol Hill and with the general public.

- The Fed faced intense scrutiny and criticism in the years following the 2008 Great Recession.

What it means: Respondents were asked how much they trusted the Fed to look out for them and their family — a great deal, a fair amount, not very much, or none at all. - That was followed by a question about how much they knew about the Fed — a lot, a little, not very much, or nothing at all.

Between the lines: The latest survey shows that the distrust Americans hold does not reflect a lack of education, low income or youth, and that even the majority of respondents knowledgeable about the Fed have little or no trust in it. Yes, but: "Trust in everything is going down," Ipsos Public Affairs SVP Chris Jackson tells Axios, noting that trust in employers as well as state, local and federal officials has declined for each group in recent months to near their lowest levels since polling began in mid-March. Yes, but, but: Trust in the Fed is the lowest among all of those groups, except for the federal government, which declined to 30% of respondents — just four percentage points below net trust in the Fed. By the numbers: The stock market's continued rise in the face of a still-weak economy may be a double-edged sword. - When the S&P 500 was at 2,930 in May, 47% of respondents said they had a fair amount or a great deal of trust in the Fed, versus 51% who had little or no trust.

- This month, with the S&P at 3,483, 34% have at least some trust and 64% hold not very much or none.

|     | | | | | | Bonus content: The hero of the economy | | Not everyone is a critic. Jaret Seiberg, financial services and housing policy analyst for Cowen Washington Research Group, told me on the Voices of Wall Street podcast last week that Powell "should be deemed the hero of the economy." - "He has done more than any other Fed chairman in history to expand the central bank's role and to try to keep this COVID-19 crisis from becoming a second Great Depression."

|     | | | | | | 2. Catch up quick | | House Speaker Nancy Pelosi says her Tuesday deadline for reaching a pre-election stimulus bill deal remains in place after a nearly one-hour phone call with Treasury Secretary Steven Mnuchin. (CNBC) SoftBank's new public stock trading arm has increased positions to more than $20 billion. (Bloomberg) Fed vice chair Richard Clarida said in a speech that "additional support from monetary — and likely fiscal — policy will be needed." (Speech) Foxconn's "eighth wonder of the world," a 20 million-square-foot electronic manufacturing complex that in 2017 promised 13,000 jobs, is little more than an empty shell, years after receiving billions in taxpayer subsidies. (The Verge) |     | | | | | | A message from Barclays Investment Bank | | New episode: The Flip Side podcast on U.S. housing reform | | |  | | | | Barclays Head of Research Jeff Meli and MIT Finance Professor Deborah Lucas debate what role, if any, Fannie Mae and Freddie Mac should play in the future of the U.S. housing finance market. Hear what they had to say in the latest podcast episode. | | | | | | 3. The 2020 holidays may just kill Main Street |  Data: Deloitte; Chart: Axios Visuals Online retail and e-commerce have been chipping away at brick-and-mortar businesses over the years but the combination of the coronavirus pandemic and the 2020 holiday season may prove to be a knockout blow. State of play: Anxious consumers say financial concerns and health worries will push them to spend less money this year and to do more of their limited spending online. Driving the news: Deloitte's latest global survey of consumers finds shoppers plan to spend an average of $1,387 per household, down 7% from 2019. - With nearly one-third (29%) of respondents saying that their household's financial situation is worse this year than last, 38% of consumers say they plan to spend less on the holidays, the most since the Great Recession.

By the numbers: Almost 51% of holiday shoppers feel anxious about shopping in-store, and 64% of holiday budgets are expected to be spent online. - Spending is expected to shift to non-gift purchases for celebrations at home (up 12% from 2019), and travel is expected to decline 34% year over year.

- The average shopping window is expected to be 1.5 weeks shorter this year.

On the other side: Amazon's Prime Day — the unofficial start of the 2020 holiday shopping season — delivered a 71% increase in spending from U.S. shoppers over 2019's July event and a 66% increase globally, according to Salesforce data. - Traffic to digital sites increased by 40%, even eclipsing 2019's Black Friday (9% growth) and Cyber Monday (11% growth) digital traffic.

While the rising tide of Prime Day has lifted all retail boats in the past, this year brick-and-mortar firms haven't seen nearly the same benefit. - According to data from foot traffic tracking firm Placer.ai, Whole Foods saw visits fall 32.1%, while Target, Walmart and Best Buy were down 15.9%, 19.1%, and 11.6%, respectively, compared to July 2019.

What's next: A new poll from Alignable finds 45% of consumers shifted from local purchasing to online shopping when their COVID-19 fears were greatest and many have not gone back. - More than half (52%) say they don't expect to change their current shopping habits for the holiday season.

- Another 16% plan to increase their spending at national, online retailers instead of shopping locally.

The bottom line: Alignable survey analysts note, "Given this data, there's a chance some Main St. retailers will completely miss out on much of the holiday shopping season — devastating news for many who are already in jeopardy of shutting down for good." |     | | | | | | 4. "Corporate redlining" has cost Black neighborhoods millions | | The number of SBA loans to Black-owned businesses has decreased 84% from its peak before the 2008 financial crisis, according to a new report from the Business Journals, citing lending data from the agency's flagship 7(a) program. - Overall 7(a) loans declined 53% during that time.

Why it matters: The precipitous decline in loans to Black-owned businesses, in particular, was despite 48% growth in the economy, a 101% increase in bank deposits and an 82% jump in commercial loans, the report notes. Where it stands: "White neighborhoods receive roughly twice as much per person in small-business loans compared with Black neighborhoods," the data show. - "Likewise, majority-white neighborhoods, on average, receive roughly twice as many small-business loans per capita."

Details: The country's four largest banks — Citi, Bank of America, JPMorgan and Wells Fargo — which hold roughly 35% of the nation's deposits, made 91% fewer 7(a) loans to Black-owned businesses in 2019 than in 2007. How it works: Since banks are prohibited from collecting data on the race and ethnicity of borrowers, the reporters interviewed Black business owners in each of the company's 44 markets and conducted a demographic analysis of small-business lending using census tracts. The big picture: Experts say the data underscore the way bank and government policy have exacerbated racial disparities in wealth generation, homeownership rates, educational attainment and other measures of financial equality. The last word: "I don't think most Americans understand the severity of the problem," Orv Kimbrough, CEO of Midwest BankCentre, said in the report. |     | | | | | | 5. "Just so we're all clear" | Screenshot of a tweet from ExxonMobil's Twitter account At a campaign rally Monday, President Trump said he could easily call ExxonMobil's CEO or other chief executives and get millions in campaign contributions. - Trump went on to say that while he "would raise a billion dollars in one day if I wanted to, I don't want to do that."

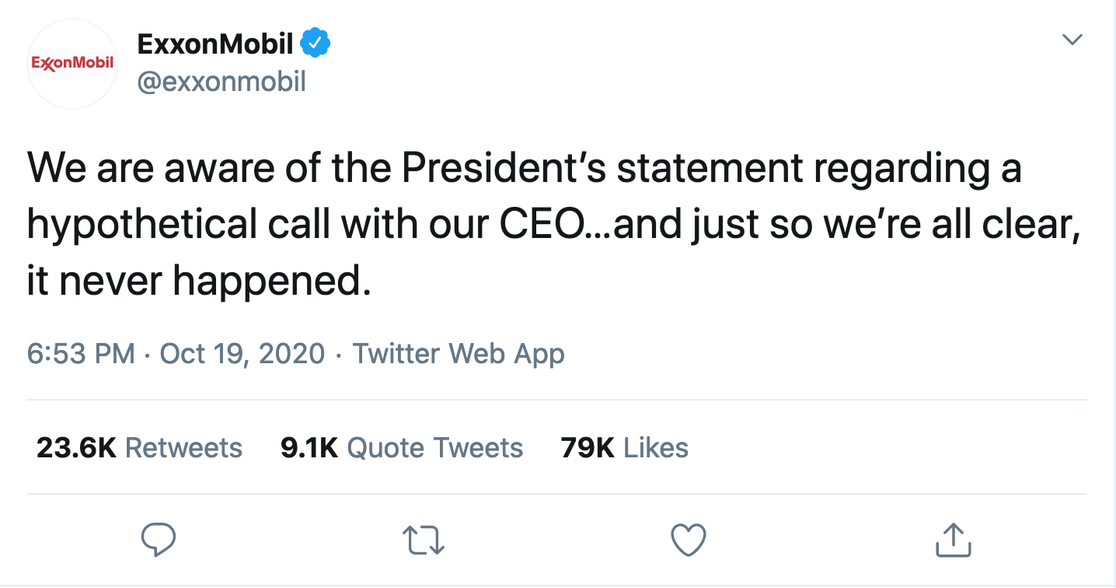

|     | | | | | | A message from Barclays Investment Bank | | Addressing a growing homeownership divide | | |  | | | | Barclays Research found rising income inequality in the U.S. is strongly associated with lower homeownership rates, especially in states with higher Black populations. What role should the government play in the mortgage market? Explore the report. | | | | Thanks for reading! Quote: "I do therefore invite my fellow citizens in every part of the United States, and also those who are at sea and those who are sojourning in foreign lands, to set apart and observe the last Thursday of November next, as a day of Thanksgiving." Why it matters: On Oct. 20, 1864, President Abraham Lincoln formally established Thanksgiving as a national holiday. | | | | Axios thanks our partners for supporting our newsletters.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment