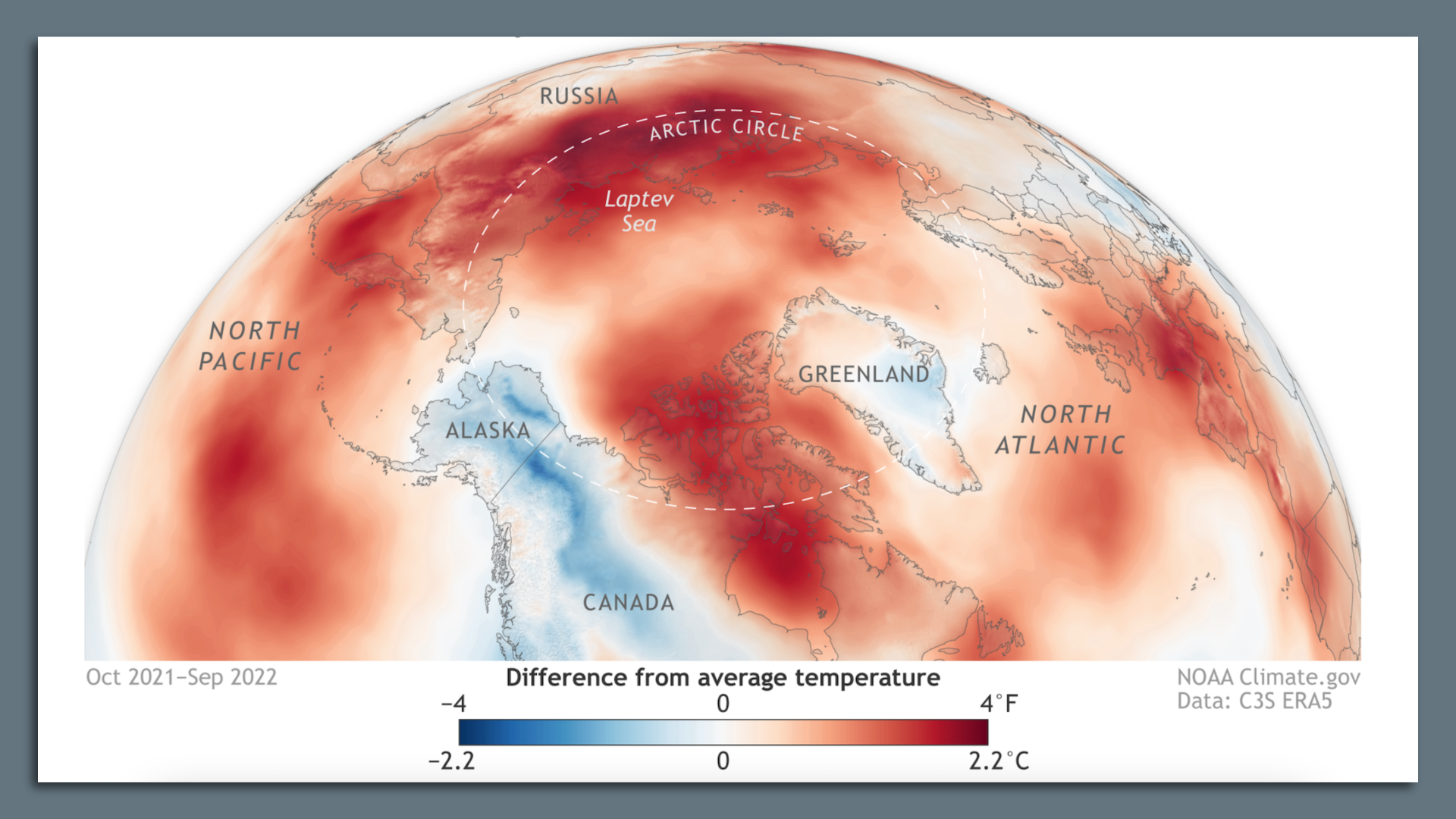

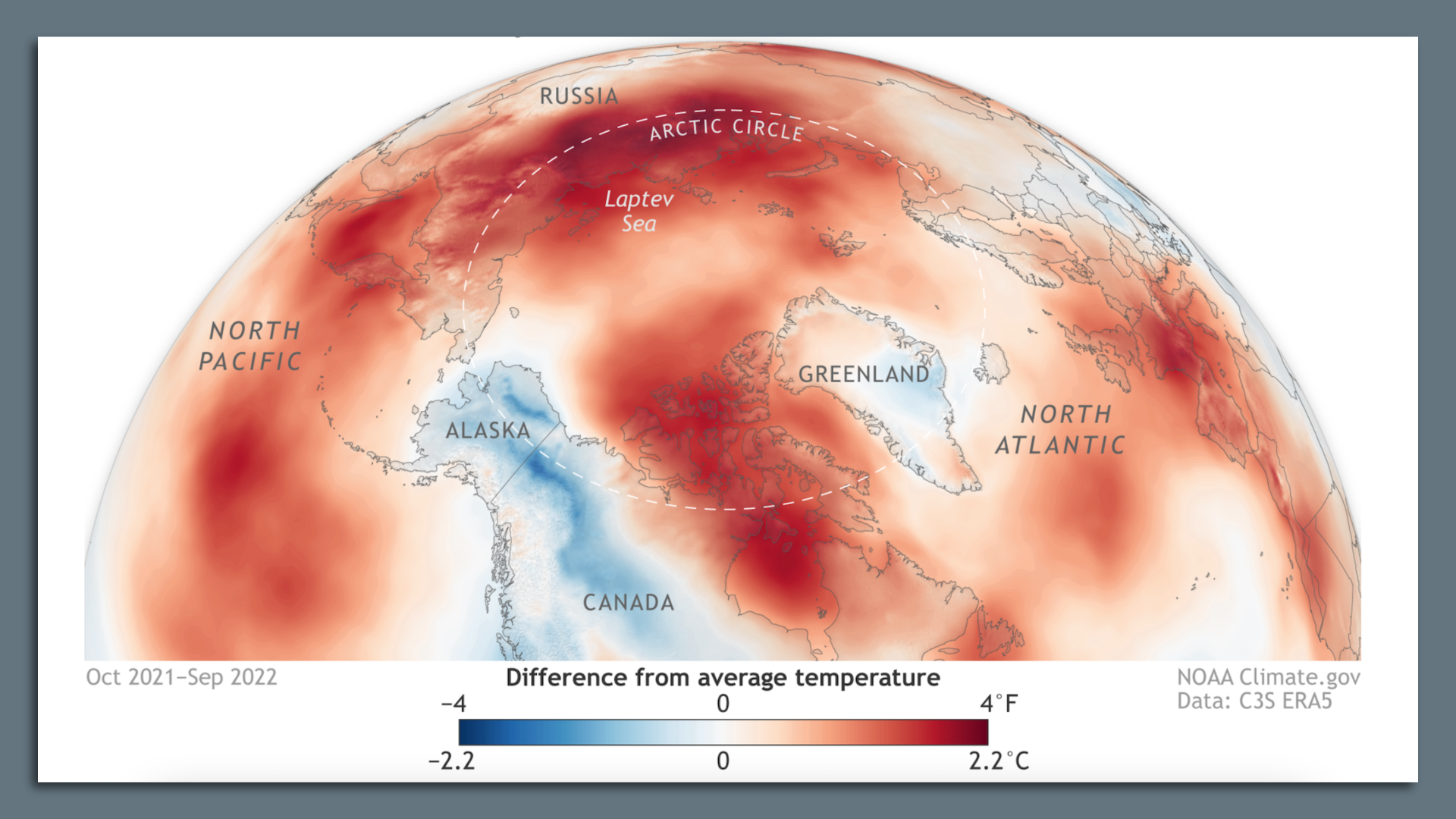

| | | | | | | | | | | Axios Generate | | By Ben Geman and Andrew Freedman · Dec 14, 2022 | | 🐪 Hi Wednesday! Today's newsletter has a Smart Brevity count of 1,294 words, 5 minutes. 👀 Attention Hill staffers: Axios Pro: Policy is our radical new approach to policy reporting. Sign up to secure heavily discounted pricing for your office. 🎶 This week marks 30 years since rap pioneer Dr. Dre released his debut solo album "The Chronic," which provides today's intro tune... | | | | | | 1 big thing: The Arctic is warmer and riskier |  | | | Map showing temperature departures from the 1991-2020 average during Oct. 2021-Sept. 2022. Image: NOAA | | | | Rapid Arctic warming is causing compounding and sweeping changes throughout the region, with Arctic residents facing increasingly perilous conditions, a comprehensive new report finds, Andrew writes. Why it matters: The Arctic is a sentinel for the Northern Hemisphere's climate stability, and it is flashing red. The big picture: The peer-reviewed 2022 Arctic Report Card was released yesterday at a scientific meeting in Chicago, and is the work of 147 scientists from 11 countries. - The new data highlights the cascading changes throughout Arctic ecosystems.

- For example, snow cover is melting earlier in spring, allowing for the Arctic fire season to get an earlier, more destructive start and affect new areas.

- There is a "blending of the seasons" in the Arctic as the timing of certain events shifts, which affects residents who may face thinner lake and sea ice cover when they venture out to hunt or travel, lead author Matthew Druckenmiller told Andrew in an interview from the meeting in Chicago.

- "The rules for survival are changing in the Arctic," he said.

By the numbers: The report finds for the first time that the entire Arctic region is becoming wetter, with the heaviest one-day and five-day precipitation events also increasing at a statistically significant rate throughout the Far North. - For example, Utqiagvik, Alaska, the northernmost community in the U.S., saw its heaviest precipitation fall in a single day, with 1.42 inches on July 26.

- The increasingly open and milder Arctic Ocean waters are adding more moisture to the air, and a warmer atmosphere can also hold more water vapor.

- Overall, this past year (Oct. 2021-Sept. 2022) was the sixth-warmest on record in the Arctic since 1900, and the past seven years have been the seven warmest.

Between the lines: Alaska and other parts of the Arctic should expect seemingly freak events to occur more frequently as climate change continues, Druckenmiller said. - Such occurrences in 2022 included a storm in Fairbanks that encased the city in 1.4 inches of ice, wreaking havoc on transportation and a record September melt spike on the Greenland Ice Sheet.

- Even more damaging was a hybrid storm that evolved from Typhoon Merbok in the Pacific in September and gathered intensity over record-warm waters.

- When it slammed into western Alaska, storm surge flooding devastated coastal communities.

What's next: "These continuously record-breaking years are turning the accelerated rate of climate change in the Arctic into 'a new normal' rate of change," said Sue Natali, an Arctic research scientist who was not involved in the report. - "This is especially concerning because it's causing increasingly severe climate hazards for the people of the Arctic and globally."

|     | | | | | | Bonus: A Russia-sized gap threatens Arctic science |  | | | Aerial picture showing a wildfire in Sakha, Siberia, in 2021. Photo: Dimitar Dilkoff/AFP via Getty Images | | | | Cooperation with Russian researchers remains frozen, though scientists are hopeful they can eventually resume vital collaborations, Andrew writes. The big picture: The seven non-Russian Arctic nations closed off their research institutions in response to Russia's unprovoked invasion of Ukraine. - For now, remote sensing and internationally shared ground observations are allowing insights to continue to flow.

Yes, but: But the longer this goes on, the greater the chances that significant trends will be missed, with the biggest concerns related to studies of permafrost thaw and wildfire research. - Some Russian scientists, for example, are having trouble importing equipment to keep observatories functioning, Natali said.

|     | | | | | | 2. Biden seeks African EV "value chain" |  | | | Illustration: Megan Robinson/Axios | | | | The Biden administration signaled it may invest in African battery mineral development for electric vehicles, Axios' Jael Holzman writes. Driving the news: The State Department yesterday signed a memorandum of understanding with the Democratic Republic of the Congo and Zambia to develop an "electric vehicle value chain." - At a signing ceremony, Secretary of State Antony Blinken talked about battery metals and said the U.S. was "exploring financing and support mechanisms for investment in African electric vehicle value chains."

- The DRC and Zambia are both rich in cobalt, a mineral used in EV batteries.

Why it matters: The U.S. may challenge China's financing of global resource production for electric vehicles and fossil-free energy sources. Go deeper: Biden's team is looking at funding roughly a dozen mineral projects around the world for the energy transition, Under Secretary of State Jose Fernandez told Jael recently. |     | | | | | | A message from Chevron | | The Human Energy Newsletter: energy insights, delivered | | |  | | | | Staying informed on the future of energy is as easy as a click. Subscribe to Chevron's Human Energy Newsletter and be the first to receive our recently release methane report, energy sector news and powerful insights so you can stay ahead of energy trends. Subscribe now. | | | | | | 3. An oil market warning and more petro notes |  | | | Illustration: Annelise Capossela/Axios | | | | Another oil price rally "cannot be ruled out" amid still unfolding sanctions on Russian barrels and the new G7 price capping policy, the International Energy Agency said, Ben writes. The big picture: "While lower oil prices come as a welcome relief to consumers faced by surging inflation, the full impact of embargoes on Russian crude and product supplies remains to be seen," IEA said in its monthly analysis. - Despite the seasonal demand slowdown and economic headwinds, "recent oil consumption data have surprised to the upside."

- Combined Russian crude and oil products exports actually grew last month, but a drop looms as policies to curb Putin regime revenues take hold. Bloomberg has more.

👀 Elsewhere on our petro radar, Reuters reports that banking giant HSBC will "stop funding new oil and gas fields and expect more information from energy clients over their plans to cut carbon emissions." |     | | | | | | 4. The economic case for more methane capture |  Data: S&P Global Commodity Insights; Chart: Madison Dong/Axios Visuals Higher natural gas prices mean large volumes released along the oil-and-gas value chain could be economically captured, a new analysis finds, Ben writes. Why it matters: Methane is a powerful planet-warming gas that's currently directly released or flared at wells and related infrastructure. The big picture: Over 70% of the gas lost in key regions can be economically captured, which would boost supply by roughly 80 billion cubic meters and avoid significant emissions, S&P Global Commodity Insights found. Zoom in: It's possible to add 40 billion cubic meters — akin to France's annual demand — to global markets over just the next two-to-three years alone, S&P said in a summary. - Capturing this gas would cut CO2-equivalent emissions by an amount akin to Germany's total annual emissions, it said.

- Projected 10-year revenues from capture projects deployed next year are 140%-240% higher than under gas price forecasts before Russia's attack on Ukraine.

Yes, but: The analysis takes stock of barriers to capturing and commercializing this gas in various regions. They include export capacity limits, capital constraints and other financial barriers in Nigeria, North Africa and elsewhere, and geopolitical and security risks. Check it out |     | | | | | | 5. 🏃🏽♀️Catch up fast on tech: CO2 removal, battery metals, fusion | | The Energy Department is moving ahead with a multibillion-dollar program to demonstrate and help commercialize direct air capture tech at scale, Ben writes. Driving the news: It published a "funding opportunity announcement" for the first $1.2 billion of $3.5 billion in the bipartisan infrastructure to establish four regional DAC "hubs." Why it matters: DAC and other carbon removal technologies, if they can scale, can complement (not replace!) low-carbon energy to help fight climate change. Elsewhere on our tech radar... 🔋 Panasonic has a multiyear deal to supply batteries to the luxury EV startup Lucid Motors, the companies said yesterday, the latest sign of mobility companies looking to lock-up supplies. 🔋 BHP-backed Lifezone, a nickel producer and refiner, announced a SPAC merger with GoGreen Investments, giving it a valuation of about $1 billion, the companies say, our colleagues at Axios Pro Climate Deals reported. Sign up ⚡ Siemens eMobility is establishing a manufacturing hub in Carrollton, Texas, to meet the rapidly growing U.S. demand for electric vehicle (EV) chargers, Axios' Joan Muller scooped yesterday. Go deeper ⚛️ ICYMI: Axios' Alison Snyder unpacked yesterday's big fusion news. |     | | | | | | 6. Charted: Tesla's big slide |  Chart: Axios Visuals Tesla shares slid anew yesterday, the latest drop in a decline that has continued since CEO Elon Musk bought Twitter in October, Ben writes. The big picture: Shares are trading at their lowest levels in over two years. Per Bloomberg, the slide reflects signs of waning demand in China and investor concern that Musk's involvement with Twitter is a liability. Musk tweeted last night that he'll "make sure Tesla shareholders benefit from Twitter long-term," but didn't elaborate. |     | | | | | | A message from Chevron | | The Human Energy Newsletter: energy insights, delivered | | |  | | | | Staying informed on the future of energy is as easy as a click. Subscribe to Chevron's Human Energy Newsletter and be the first to receive our recently release methane report, energy sector news and powerful insights so you can stay ahead of energy trends. Subscribe now. | | | | 📬 Did a friend send you this newsletter? Welcome, please sign up. 🙏 Thanks to Mickey Meece and David Nather for edits to today's newsletter. We'll see you back here tomorrow! |  | | Your personal policy analyst is here. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment