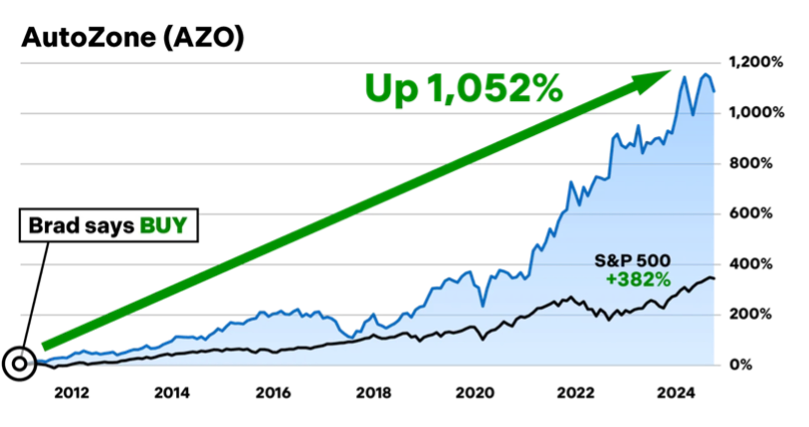

Dear Reader, All three major indexes notched record highs this week... And with valuations for stocks stretching higher and higher by the week, many folks are wondering: "Are we about to see a major pullback in stocks?" Well, I'm still forecasting a strong market through the end of the year. But if you're worried about putting new money to work in richly valued stocks right now, I recommend you watch this new interview with my colleague, investor and former Presidential economic advisor, Brad Thomas. You see, Brad is well known in the world of independent financial research for recommending some of the market's biggest winners in the aftermath of the Financial Crisis. Like when he AutoZone back then which has risen 1,052% – about triple the return of the overall market...

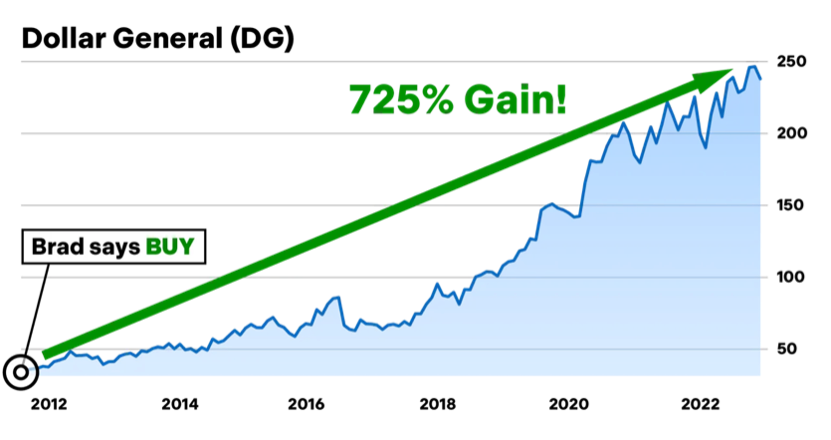

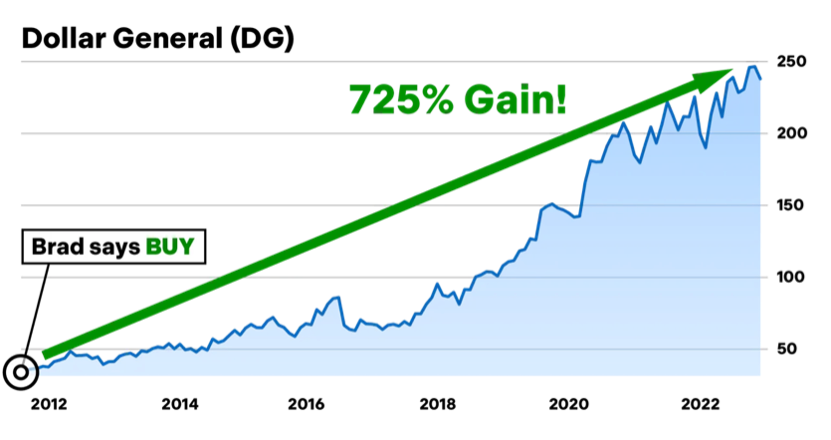

He also highlighted Dollar General before it was widely known – ahead of gains as high as 725% for anyone who held over the years...

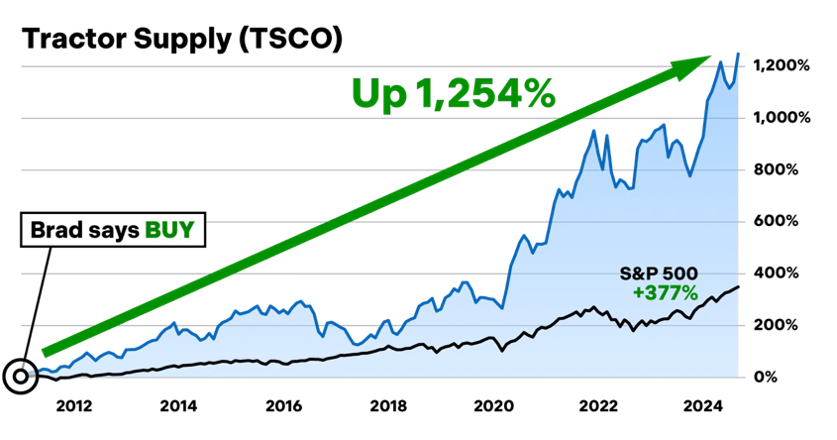

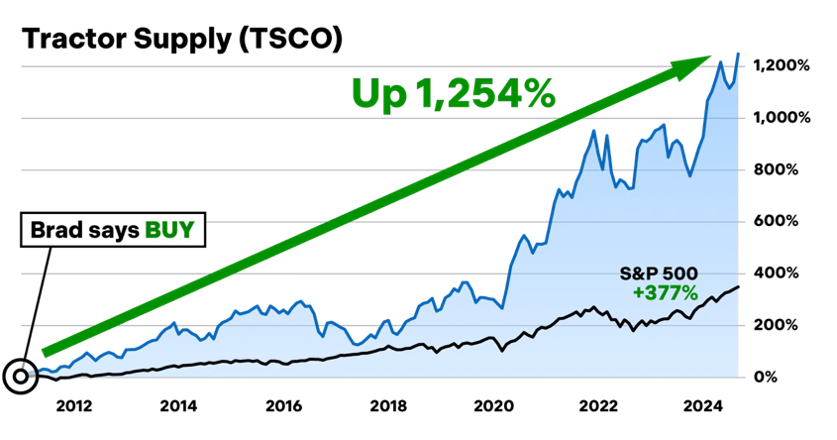

And there was Tractor Supply, which has gained as much as 1,254%, or nearly 4 times the S&P 500 Index...

Today, Brad says it doesn't matter what you're hearing about the market or valuations... That's because he says there's a 2009-like moment happening right now – except maybe even better – in a very specific group of stocks that he's excited about. And frankly, I couldn't agree more... It's an opportunity we've been very excited about at Chaikin Analytics for months – one group of stocks that we believe will wildly outperform everything else... not just for months, but for years to come. In fact, we recently released a brand-new research service specifically to take advantage of the same strategy in the markets. But Brad is taking a very different approach. While I rely on the Power Gauge... He's going to the source: tapping the long list of multi-millionaires and billionaires he's acquired over his career to help him uncover the best opportunities in this group that he believes will outperform all the others. It's the same group of stocks that I personally look at first every time I open the Power Gauge... And it's hands-down my No. 1 favorite strategy. But again, he'll be approaching it in a totally different way. The last time Brad publicly did something like this was in 2016... When he used this same group of stocks to build a model portfolio for his readers that recorded 44% annualized gains over five years... nearly triple what you would have seen in the S&P 500 over the same period. But today, Brad thinks the timing is even better today to get into these companies than in 2016, with potentially much higher gains. In short – all the stars are starting to align for this opportunity, so please don't miss it... Click here to watch Brad's new presentation. Regards, Marc Chaikin

Founder, Chaikin Analytics |

No comments:

Post a Comment