Good morning. Anyone here a 1989 baby? If so, according to Derek Guy, you are now as old as George Costanza is during season 1 of Seinfeld, which premiered in...1989. That also means Taylor Swift, Daniel Radcliffe, and Joe Jonas are all George Costanza's age. If it makes you feel weird that you're the same age as George, just convince yourself it's not true. As he once said, "It's not a lie if you believe it." —Neal Freyman, Matty Merritt, Abby Rubenstein | | | |  | Nasdaq | 10,970.99 | | |  | S&P | 3,830.60 | | |  | Dow | 31,839.11 | | |  | 10-Year | 4.006% | | |  | Bitcoin | $20,755.79 | | |  | Meta | $129.82 | | | | *Stock data as of market close, cryptocurrency data as of 2:00am ET. Here's what these numbers mean. | - Markets: Plunging tech stocks dragged the market down with them yesterday, snapping a three-day winning streak. Up next for the economy: The third-quarter GDP report drops today, which is sure to set off another frantic round of investors' favorite game, "try to read Jerome Powell's mind."

| | | | TECH Tech giants are in their dial-up era | Grant Thomas American heavyweights that were once considered unstoppable are, for the first time in years, looking a little washed up. We're not talking about Tom Brady and Aaron Rodgers. This is about America's internet giants, which are slumping hard in this era of higher interest rates, lower advertising budgets, and widespread economic uncertainty. Yesterday, Meta became the latest Big Tech company to post rough financial results for the prior quarter. It recorded its second straight quarter of declining revenue and provided a gloomy outlook for Q4. Come to think of it, maybe Meta shouldn't even be considered "Big Tech" anymore. Since its share price peaked in September 2021, the company lost nearly two-thirds of its value…before diving another ~20% in after-hours trading yesterday. What went wrong? Younger people are fleeing Facebook, and investors aren't confident CEO Mark Zuckerberg can reinvent the company as a metaverse platform. "Meta has drifted into the land of excess—too many people, too many ideas, too little urgency," a prominent shareholder wrote this week in a scathing letter. Meta's metaverse unit, Reality Labs, has lost $9.4 billion so far this year. While Meta may be the poster child for Big Tech's struggles, it's not the only company that needs a checkup. - Google parent Alphabet posted its slowest revenue growth since 2013 (outside of one early pandemic quarter), and YouTube ad sales actually fell in Q3. It's "a tough time in the ad market," CEO Sundar Pichai acknowledged. Sure is—yesterday, Alphabet shares had their worst day since March 2020.

- Cool-as-a-cucumber Microsoft also had its worst day since March 2020 after giving a disappointing forecast. Its push to dominate the metaverse is also faltering, per the WSJ.

Big picture: Tech giants scored record profits during Covid, when interest rates were near zero, stimmies were flowing, and everyone was stuck inside with only the internet to entertain themselves. But now that those days are over, we're going to find out which companies can sail without the wind at their back.—NF | | TOGETHER WITH FIDELITY INVESTMENTS | | To buy, spend, or sell? That's the big question on the minds of crypto holders and the crypto-curious everywhere—and it's why you should tune in to this week's episode of Fresh Invest, our investing podcast sponsored by Fidelity Investments and powered by Morning Brew.

We're talkin' how investors like you can add crypto to your portfolio and whether it makes sense to *actually* use it. Plus, we get into how government regulations will impact individual portfolios and, of course, how this asset class could impact your taxes.

After you listen to this episode, take a short quiz to test your knowledge on the entire season for a chance to win one of 10 $500 prizes from Morning Brew.* | | Michael M. Santiago/Getty Images  Wait—there was a successful IPO? Shares of autonomous vehicle company Mobileye jumped more than 37% in their first day of trading, a rare bright spot in what's on track to be the worst IPO year in decades. Well, it's not technically Mobileye's first day of trading: It was listed until 2017, when it was bought by Intel for $15.3 billion. Now, five years later, it's been spun off, but only at a minimally higher valuation (less than $17 billion, at its IPO price) and for much lower than initial expectations. Wait—there was a successful IPO? Shares of autonomous vehicle company Mobileye jumped more than 37% in their first day of trading, a rare bright spot in what's on track to be the worst IPO year in decades. Well, it's not technically Mobileye's first day of trading: It was listed until 2017, when it was bought by Intel for $15.3 billion. Now, five years later, it's been spun off, but only at a minimally higher valuation (less than $17 billion, at its IPO price) and for much lower than initial expectations.

But another autonomous vehicle company, Argo AI, is shutting down. Ford revealed that the company, which it backed alongside Volkswagen, will be winding down after it took a $2.7 billion loss on the investment. Ford CFO John Lawler said that "profitable, fully autonomous vehicles at scale are still a long way off." It wasn't the only bad news: While reporting its earnings yesterday, the automaker also said it continues to face supply chain problems. But another autonomous vehicle company, Argo AI, is shutting down. Ford revealed that the company, which it backed alongside Volkswagen, will be winding down after it took a $2.7 billion loss on the investment. Ford CFO John Lawler said that "profitable, fully autonomous vehicles at scale are still a long way off." It wasn't the only bad news: While reporting its earnings yesterday, the automaker also said it continues to face supply chain problems.

Elon Musk has entered the building. Twitter headquarters that is: Musk posted a video of himself walking in while carrying a sink ("Let that sink in," he joked), and changed his Twitter bio to say "Chief Twit" ahead of his expected $44 billion purchase of the social media company. Musk must close the deal to take the company private by 5pm Friday or face litigation, and it looks like things are nearing their conclusion. Over at another Musk business, Tesla is said to be facing a criminal investigation over claims about its self-driving feature. Elon Musk has entered the building. Twitter headquarters that is: Musk posted a video of himself walking in while carrying a sink ("Let that sink in," he joked), and changed his Twitter bio to say "Chief Twit" ahead of his expected $44 billion purchase of the social media company. Musk must close the deal to take the company private by 5pm Friday or face litigation, and it looks like things are nearing their conclusion. Over at another Musk business, Tesla is said to be facing a criminal investigation over claims about its self-driving feature.

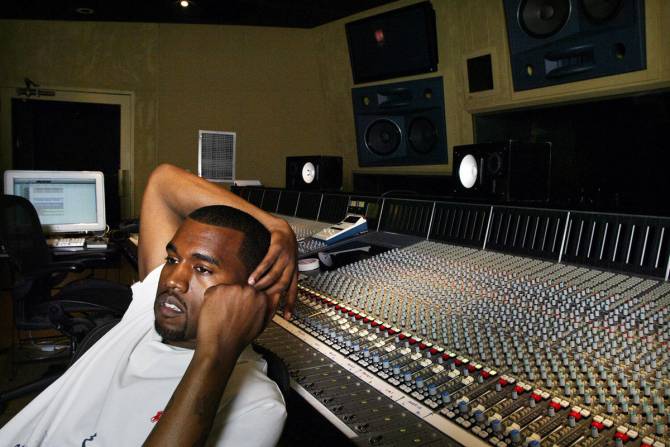

| | MUSIC Spotify denounces Ye, but keeps him on the playlist | Ye in 2005 working on 'Late Registration.' J.Emilio Flores/Getty Images After most brands fled from Kanye West (who now goes by Ye) due to his antisemitic comments, his music—and the cash that comes with it—may be his final tether to the spotlight. Spotify CEO Daniel Ek told Reuters yesterday that Ye's music will remain on the platform because it doesn't violate the company's hate speech policy. The streamer is an outlier as a corporate boycott of the artist by the likes of CAA, Balenciaga, and Adidas grows. Even brands that haven't partnered with Ye are joining in—Sketchers said it had no intention of working with the rapper after he showed up unannounced at the company's headquarters yesterday (executives escorted him out). But his music is another story. Despite his more recent albums' mediocre reception, Ye's early songs are still valuable to streamers. Ye is currently the 19th most popular artist on Spotify, where he has 51 million monthly listeners. Ek hot-potatoed the blame: He said the responsibility to pull the music falls on Ye's former record label, Def Jam. Def Jam ended its partnership with Ye in 2021, but The Life of Pablo still pays for the office pizza parties. Ye's music catalog brings in roughly $13.25 million per year, with $5 million of that going directly to Ye, per Billboard. Last month, Billboard said that Ye was considering selling that catalog for nearly $175 million (though at the time he denied it).—MM | | TECH Earthquake about to hit? There's an app for that | UC Berkeley Around 18 seconds before a 5.1-magnitude earthquake struck near San Jose on Tuesday, 95,000 people got an alert on their smartphones warning them it was coming. The heads-up came courtesy of MyShake, an app developed by scientists at UC Berkeley's Seismology Lab. The most recent warning was right before the quake, but the hope in the future is to give you enough time to make like the Boy Scouts and prepare. How does it work? MyShake uses the sensors in your phone to detect movement and then filters it through an artificial neural network to determine if it matches the model for an earthquake. And unlike some other smartphone emergency systems that might mistake a roller coaster for a car crash, MyShake's algorithm is really good at figuring out which motion fits the model, according to the scientists behind it. So far, MyShake can only warn you that the ground is about to start shaking if you're in California, Oregon, or Washington, but it's gathering data to expand and has been downloaded 1.6 million times. What's next? The app's creators want to turn it into a global network, available in countries that don't have the traditional (and very expensive) equipment used to detect quakes.—AR | | | Way day, way day  . Today's the *last day* of Wayfair's big sale, featuring massive deals for your entire home. Get furniture, rugs, kitchen must-haves, and way more, all for up to 80% off. Wayfair has everything you need to bring that cozy-home feeling to life. Start shopping now. . Today's the *last day* of Wayfair's big sale, featuring massive deals for your entire home. Get furniture, rugs, kitchen must-haves, and way more, all for up to 80% off. Wayfair has everything you need to bring that cozy-home feeling to life. Start shopping now. | | Mike Ehrmann/Getty Images Stat: When the Phillies and the Astros face off on Friday to determine the fate of the global economy, it'll be the first World Series without any US-born Black players since 1950, according to the AP. "It is somewhat startling that two cities that have high African American populations, there's not a single Black player," said Bob Kendrick, president of the Negro Leagues Baseball Museum, noting it shows there's work to be done to help Black kids with baseball dreams advance in the sport. Quote: "We have no choice." It might be time to throw your Lightning cables in the drawer with the tangle of other cords you never use. Apple will soon make the switch to USB-C, Greg Joswiak, its head of marketing, confirmed Tuesday. As Joswiak pointed out, Apple has to change it up because the EU on Monday approved the final version of a law requiring all phones and tablets to support USB-C charging by 2024. It's likely Apple will use the new charging cables for all iPhones, not just those in the EU, though the executive was coy on this point. Read: Why this could be the year for orange college football teams. (FiveThirtyEight) | | - A Michigan jury convicted three men of helping with an attempt to kidnap the state's governor, Gretchen Whitmer.

- Clorox recalled 37 million bottles of Pine-Sol that could contain bacteria dangerous to people with compromised immune systems.

- Germany plans to legalize recreational marijuana, which would make it the second country in the EU to do so, after Malta.

- Thai business mogul Jakapong "Anne" Jakrajutatip, a media magnate and transgender rights advocate, purchased the Miss Universe Organization for $20 million, becoming the first woman to own the beauty pageant franchise.

- Bali has joined the ranks of places looking to lure white-collar types to work from the beach. It unveiled a new visa that lets foreigners with $130k in the bank stay for 10 years.

| | Let the computer do the heavy lifting: The best AI tools to help you get stuff done. Schools have been teaching reading the wrong way for decades: A new podcast examines why. It's never too early to start planning fantasy vacations: Here's a list of the top 25 travel destinations for 2023. ICYMI: Purchase any mouse pad and receive a FREE matching Digital Guide + Dictionary. You can take your Excel expertise off the charts—but the offer ends tomorrow. Add both to cart and see the promotion at checkout. | | Brew Mini: Don't ghost today's Mini crossword. Play it here. Three headlines and a lie Three of these headlines are real and one is faker than successfully handing out granola to trick-or-treaters. Can you spot the fake? - A Chicago museum kicked out a woman it thought was a soup-throwing climate protester. She was actually the museum president

- Marijuana company sued for not making customers high enough

- A Kentucky man posed as a dead body on TikTok for 321 days. Now he's going to be on CSI

- Hobby Lobby founder gives away company, says he 'chose God'

If you love Three Headlines and a Lie, play along on The Refresh from Insider and dive deeper into these weird headlines. | |  Join Money With Katie to discuss investing topics like the relationship between risk and returns, diversification beyond the S&P, and the (free) tools that can help you level up your portfolio. Listen or watch here. Join Money With Katie to discuss investing topics like the relationship between risk and returns, diversification beyond the S&P, and the (free) tools that can help you level up your portfolio. Listen or watch here.

On Imposters: the definitive mental health toolkit, and ways to feel supported while building a business. Listen here. On Imposters: the definitive mental health toolkit, and ways to feel supported while building a business. Listen here.

ICYMI: Sidekick dropped its list of the most innovative and creative entrepreneurs you need on your radar. Check it out. ICYMI: Sidekick dropped its list of the most innovative and creative entrepreneurs you need on your radar. Check it out.

Join the CMO of everyone's first stop on cheat day, Magnolia Bakery, at our Marketing Brew Summit: The Brief, as we discuss how to rebrand. Join the CMO of everyone's first stop on cheat day, Magnolia Bakery, at our Marketing Brew Summit: The Brief, as we discuss how to rebrand.

| | | We made up the soup-thrower headline. | | | ✢ A Note From Fidelity Investments Investing involves risk, including risk of loss. Morning Brew and Fidelity Investments are independent entities and are not legally affiliated. Fidelity Brokerage Services LLC, Member NYSE, SIPC. Submitting your completed board does not guarantee a prize from Morning Brew. See sweepstakes rules for more details. | | |

No comments:

Post a Comment