| Mother nature is giving Europe an economic reprieve as the bloc heads into winter with far less Russian gas flowing, Ben and Andrew write. Driving the news: European power and gas prices have eased well off record levels amid mild fall weather, which eases demand. - That's helping countries fill up their gas storage levels, with the average now over 90%, per EU data and other sources.

- Prices that smashed records after Russia's invasion of Ukraine have backed off too thanks to a combination of weather, alternative supplies, conservation and more.

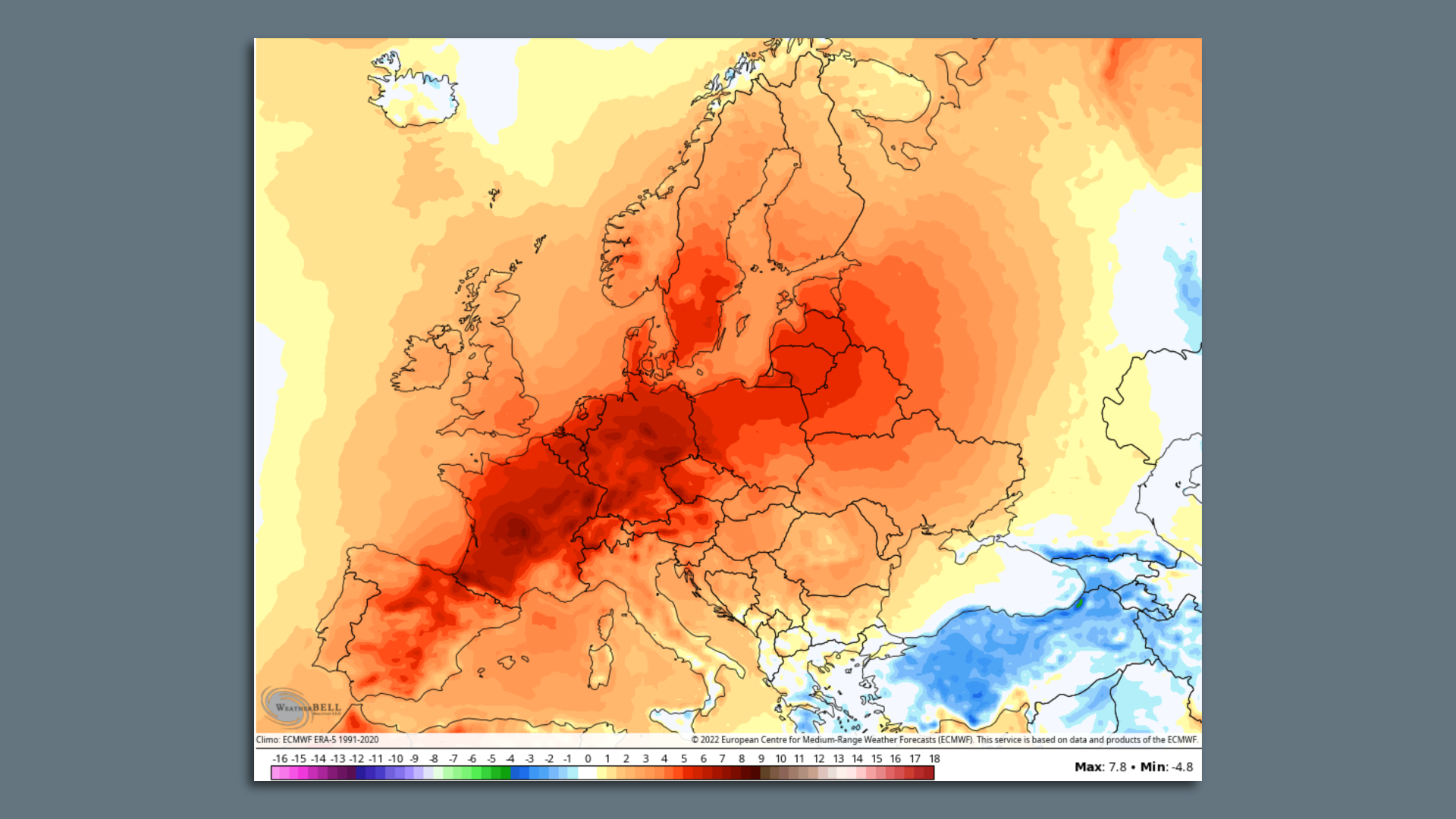

Zoom in: Power prices in Germany, France and several other large economies are down by well over 70% from August peaks, per Rystad Energy. - October has been unusually warm across the continent, with monthly temperatures on track to rank among the warmest on record.

- The forecast for Paris, for example, calls for temperatures to reach the mid-70s°F this week, about 20°F above average, and severe thunderstorms have struck England and France in recent days. Such storms are more typically seen there during the summer.

On the supply front, LNG imports "continued to be very strong in October...with high utilization across European LNG regasification terminals," Rystad said in a note. Why it matters: The weather and price trends are both economically and geopolitically important as the bloc looks to break ties with Russian fuels. Record gas prices have been crushing to a number of European industries, hurt consumers, and prompted governments to unveil expensive support packages. What they're saying: "Europe is in a comfortable place concerning supplies now," Wood Mackenzie analyst Graham Freedman tells Bloomberg. "The risks of blackouts and rationing are receding. But the real test will be when we have cold weather," Freedman said. What we're watching: Where temperatures head this winter. A recently issued winter outlook for Europe shows a milder-than-usual season is likely, but that's the average. There are still likely to be significant cold outbreaks. Yes, but: "Nations such as Germany and Italy have not dodged a bullet, merely deferred it. With 80 per cent of Russian gas supplies now offline, they may struggle to repeat their storage feat next winter," a Financial Times op-ed warns. It calls for stronger conservation efforts, noting that Chinese LNG demand could rebound, boosting competition for supplies and that Russia could cut gas shipments to Europe completely. |

No comments:

Post a Comment