| Trading plan for the EUR/USD pair on December 21. A new strain of coronavirus has spread in the UK. 2020-12-21

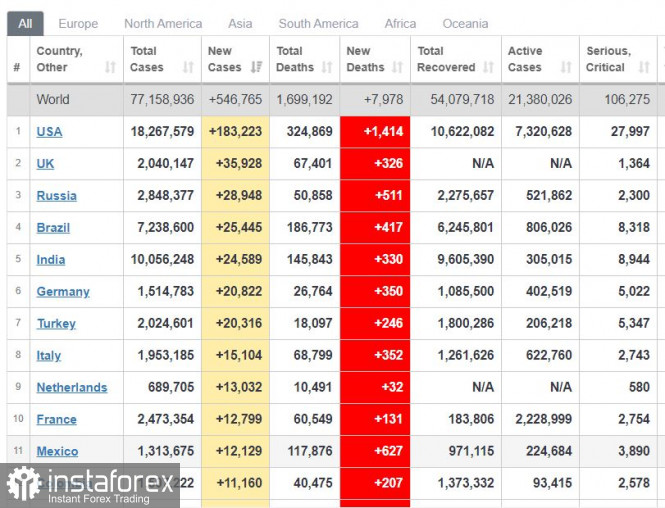

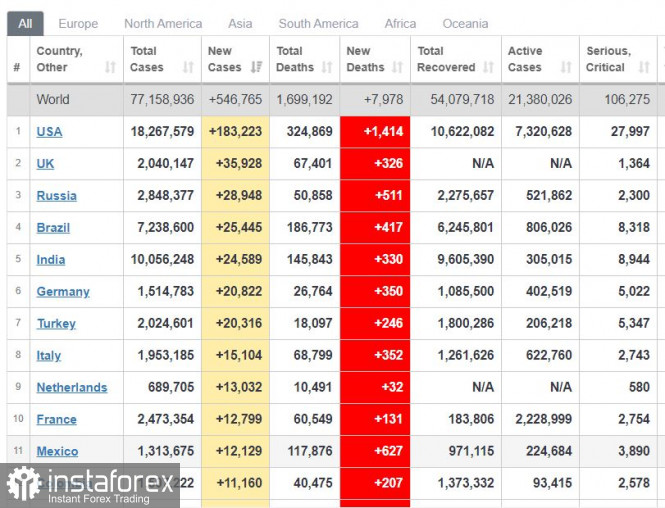

The latest data indicated that global COVID-19 incidence has decreased to 543,000, which is almost 200,000 below the record peak. This seems to be great news, however, in the UK, a new strain of coronavirus was discovered, and according to initial studies, it is much more contagious than the current COVID-19. Authorities have canceled flights because of this, and the EU will hold an urgent meeting today to discuss actions for this new virus. The news also led to the sharp plunge of the euro and the pound this morning, but now the market is calming down.

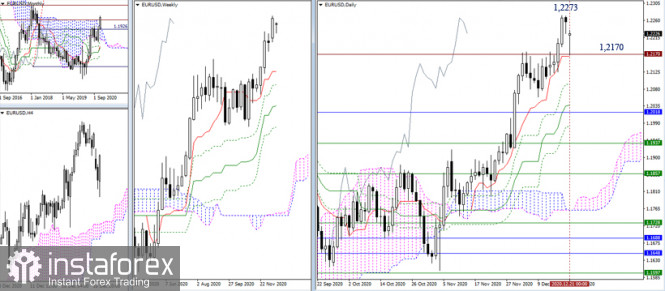

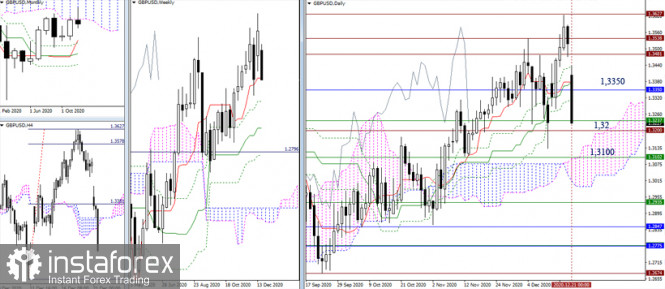

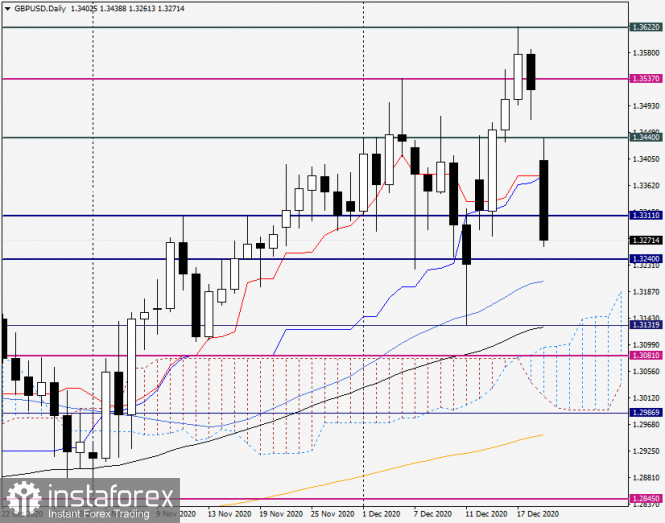

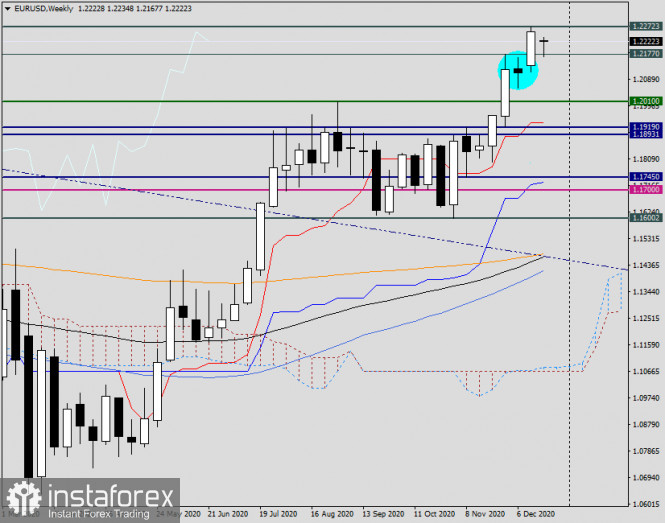

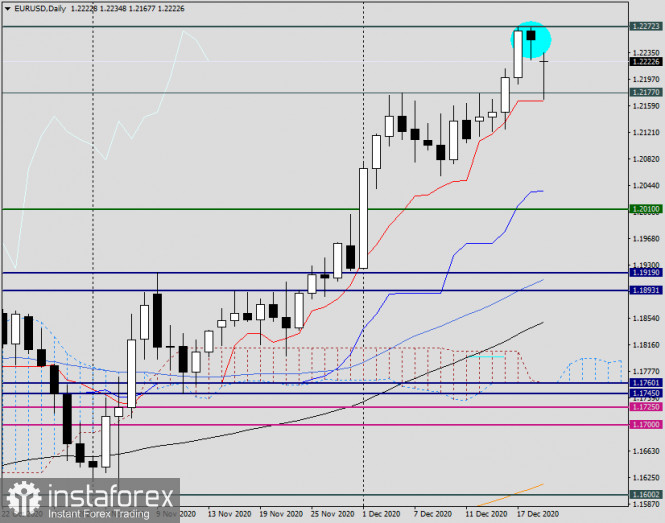

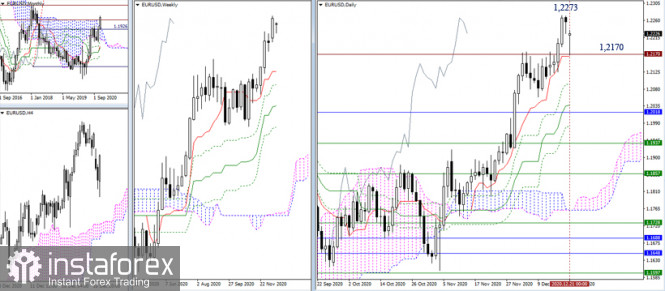

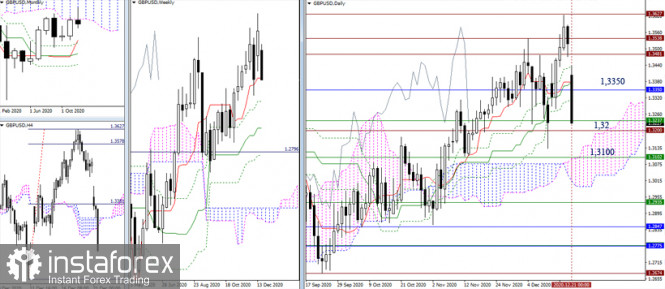

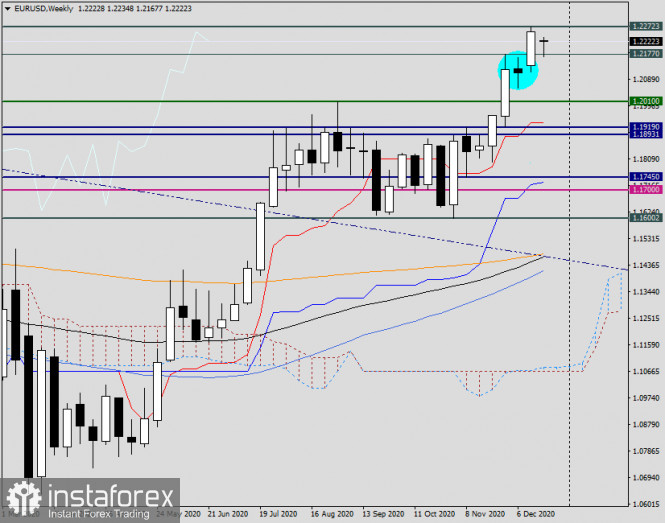

EUR / USD: the euro collapsed this morning, but the bullish trend has not changed yet. Open long positions from 1.2275. Open short positions from 1.2058. Technical recommendations for EUR/USD and GBP/USD on 12/21/20 2020-12-21 EUR/USD  The fundamental data intervened with the current technical outlook. As a result, the pair opened the new trading week with a large downward gap, supported by an important line of 1.210. As the situation develops further, it will be important to know the result of the current interaction. If the pair closes the gap and rallies to the previous week's high (1.2273), then the bulls will have an opportunity to continue the upward movement. But if they do not manage to cope with the situation, then closing at 1.2170 will have far-reaching plans. In this regard, the bulls will lose the support of the daily short-term, which will lead to the bears striving to implement a weekly correction.  Currently, there is a struggle in the smaller time frame to reach the key level – weekly long-term trend (1.2197). If they don't conquer the area of 1.2197-70, the current balance of power will change, which will open up new prospects for the bears. For the bulls, two pivot points: 1.2251 (central pivot level) and 1.2273 (last week's high extreme) are important today. GBP/USD  Today, the bears are using the opportunity of news noise to return to their previous positions within the day, blocking all the bulls' achievements last week. Now, the bears have quite successfully left the monthly cloud and are testing the support of the weekly short-term trend (1.3239), strengthened by the historical limit of 1.32. If it consolidates below, new opportunities are possible. However, the situation may persist again in case of slowdown.  All the pivot points were left far behind in the smaller time frame and this favors the bears. The downward trend is also in its active phase. The support levels of 1.3239 - 1.32 - 1.31 can be noted in the bigger time frame. On the other hand, the key resistances in the one-hour chart are now located at 1.3459 (weekly long-term trend) and 1.3526 (central pivot level). Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120) Technical analysis for EUR/USD pair for the week of December 21-26, 2020 2020-12-21 Trend analysis The price from the level of 1.2254 (closing of the last weekly candle) may make a downward pullback to the support level of 1. 2177 (yellow bold line) this week. After that, it will further rise to the target of 1.2462 – historical resistance level (blue dashed line). Upon reaching this level, the upward movement will continue to the target of 1.2554 (blue dotted line) – upper fractal (weekly candle from 02/11/2018).

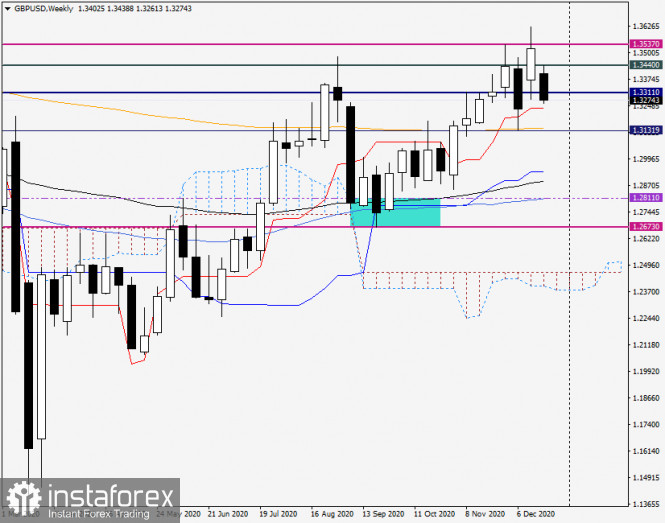

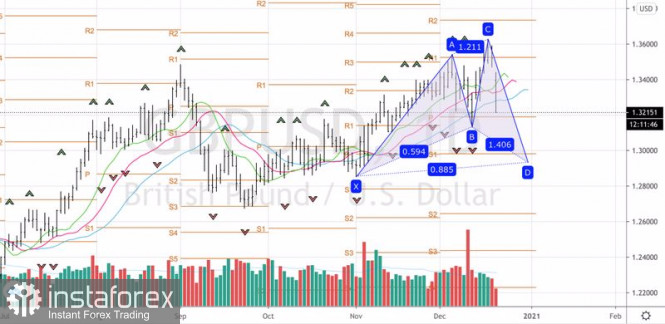

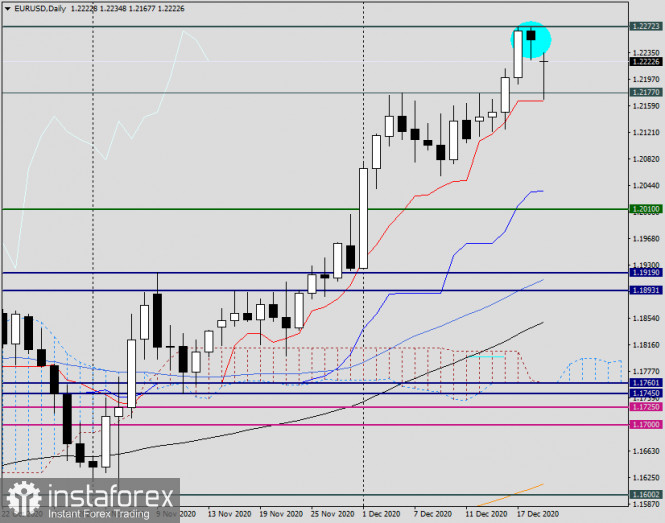

Figure 1 (weekly chart) Comprehensive analysis: - indicator analysis - up; - Fibonacci levels - up; - volumes - up; - candlestick analysis - up; - trend analysis - up; - Bollinger lines - up; - monthly chart - up. An upward movement can be concluded based on comprehensive analysis. The overall result of the candlestick calculation on the weekly chart: the price is likely to have an upward trend this week, with a lower shadow in the weekly white candlestick (Monday - down) and without an upper shadow (Friday - up). The first upper target is 1.2462 – the historical resistance level (blue dashed line). Upon reaching this level, the upward movement will continue to the target of 1.2554 (blue dotted line) – upper fractal (weekly candle from 02/11/2018). An alternative scenario: the price from the level of 1.2254 (closing of the last weekly candle) may decline to the target of 1.2186 – support level (yellow bold line). After reaching this level, it can rise to the target of 1.2462 – historical resistance level (blue dashed line). Technical analysis for GBP/USD pair for the week of December 21-26, 2020 2020-12-21 Trend analysis The price from the level of 1.3519 (closing of the last weekly candle) will decline to the target of 1.3208 – 13th average EMA (yellow thin line) this week. If this line is tested, upward movement can continue to the target of 1.3623 – the upper fractal (weekly candle from 12/13/20). Upon reaching this level, further growth can be expected to the target of 1.3675 – the pullback level of 76.4% (blue dotted line).

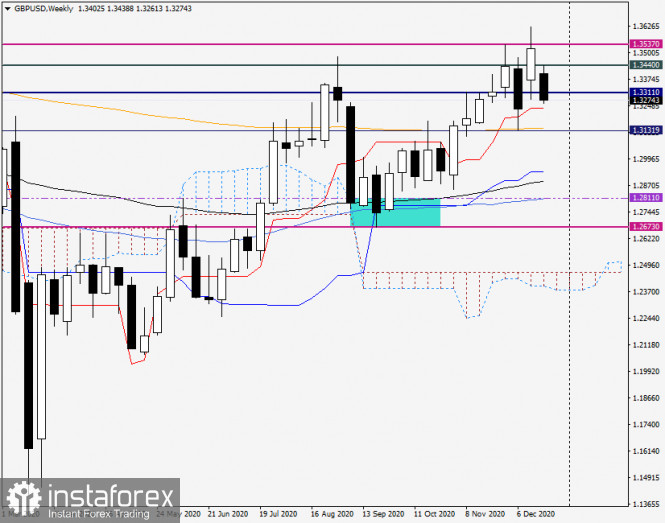

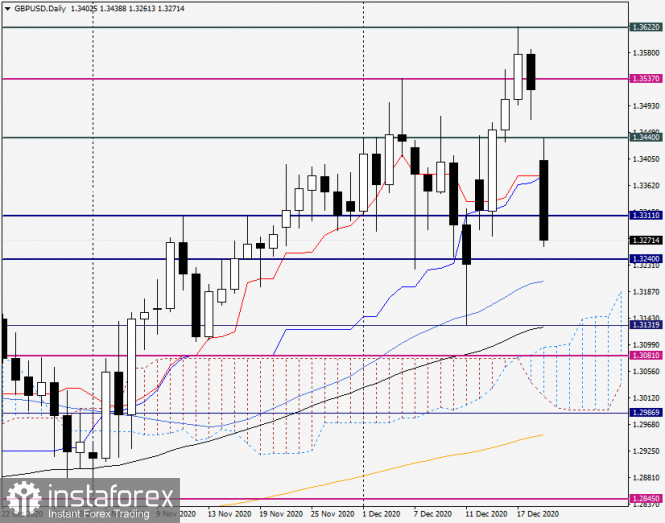

Figure 1 (weekly chart) Comprehensive analysis: - indicator analysis - up; - Fibonacci levels - up; - volumes - up; - candlestick analysis - up; - trend analysis - up - Bollinger lines - up; - monthly chart - up. An upward movement can be concluded based on comprehensive analysis. The overall result of the candlestick calculation on the weekly chart: the price is likely to have an upward trend this week, with the first lower shadow of the weekly white candlestick (Monday - down) and without the second upper shadow (Friday - up). The first downward target is 1.3208 – 13th average EMA (yellow thin line). In case of testing this line, upward movement can continue to the target of 1.3623 – the upper fractal (weekly candle from 12/13/20). Upon reaching this level, further growth can be expected to the target of 1.3675 – the pullback level of 76.4% (blue dotted line). An alternative scenario: the price from the level of 1.3519 (closing of the last weekly candle) can decline to the first target of 1.3208 – 13th average EMA (yellow thin line). After testing this line, it is expected to further decline to the target of 1.3111 – support line (white thick line). From this line, upward movement is possible. Technical analysis of GBP/USD for December 21, 2020 2020-12-21  Overview : On the one-hour chart, the GBP/USD pair continues moving in a bearish trend from the resistance area of of 1.3624 - 1.3311. The GBP/USD pair is trading below 1.3321, crashing by over 413 pips (from the top of 1.3624 to 1.3211 levels) as the UK faces supply chain issues amid travel bans imposed to stop the spread of the new Coronavirus (Covid-19) strain. Currently, the price is in a bearish channel. This is confirmed by the RSI indicator signaling that we are still in a bullish trending market. The Relative Strength Index is nearing the 20 level, oversold conditions. The bias remains bearish in the nearest term testing 1.3181 and 1.3134. Immediate resistance is seen around 1.3321 levels, which coincides with the weekly pivot. Moreover, the moving average (100) starts signaling a downward trend; therefore, the market is indicating a bearish opportunity below 1.3321. the GBP/USD pair has fallen sharply, piercing through the 100 Simple Moving Averages on the four-hour chart and hitting the 100 SMA. So it will be good to sell at 1.3321 with the first target of 1.3181. It will also call for a downtrend in order to continue towards 1.3134. The strong weekly support is seen at 1.3080. However, if a breakout happens at the resistance level of 1.3379, then this scenario may be invalidated. Forecast - If the pair fails to pass through the level of 1.3221, the market will indicate a bearish opportunity below the strong resistance level of 1.3221. In this regard, sell deals are recommended lower than the 1.3221 level with the first target at 1.3181. It is possible that the pair will turn downwards continuing the development of the bearish trend to the level 1.3134 (double bottom), probably next objective 1.3080. Notwithstanding, stop loss has always been in consideration thus it will be useful to set it above the last double top at the level of 1.3379 (notice that the major resistance today has set at 1.3379).

Daily key levels : - Resistance 3 : 1.3516

- Major resistance: 1.3437

- Minor resistance: 1.3379

- Pivot point: 1.3321

- Minor support: 1.3180

- Major support: 1.3134

- Support 3 : 1.3080

Analysis and forecast for GBP/USD on December 21, 2020 2020-12-21 Following the results of the last five-day trading session, the British pound became the leader among all major currencies that strengthened against the US dollar. The growth of the GBP/USD currency pair at the auction on December 14-18 was 2.10%. Now to the events that have had and will still have an impact on the price dynamics of the British pound. As you know, by the end of this year, the UK must leave the European Union, and this will most likely happen without signing a trade agreement or the so-called Brexit deal. The main stumbling block is still the issue of fishing. The waters in which European and British fishermen have fished (and still do) will be protected from the beginning of next year by ships of the British Navy, to protect the fishing of their recent European partners in the designated waters, which are rightfully British. The problem is different. There is too much fish for British domestic consumption and it will have to be exported. And where, if not to Europe? However, the EU authorities intend to impose such duties on British fish that it simply will not be competitive, and residents of European countries are unlikely to be willing to buy it. It is first and foremost about the cod species of fish. So it will turn out: "I myself will not give it to others." In this regard, it is worth noting that the British budget does not count a significant amount of funds from fishing. London understands all this, and also understands that prices for European goods will rise significantly from the new year. It is not for nothing that British Prime Minister Boris Johnson in his recent speech called on the citizens of the United Kingdom to stock up on European cheeses and other products, as well as medicines since from next year the entire range of goods and services from Europe will become much more expensive for the British. And then, as if by order, there was another opportunity. Just before the end of the time allotted for the conclusion of a trade agreement between London and Brussels, a new strain of COVID-19 was discovered in the UK, which is much more dangerous in terms of infection than the usual strain. Here, somehow everything "miraculously" coincided with the withdrawal of the United Kingdom from the European Union. It is not enough to believe that this is a mere coincidence. EU countries have already surrounded the UK with a cordon sanitaire and cut off from mainland Europe. Several European countries have already stopped transport links with the UK, and this primarily applies to countries with the first and second European economies, Germany and France, respectively. And it's also hardly a coincidence. By the way, a new strain of coronavirus, in addition to the UK, was detected in the Netherlands, Denmark, and Italy. In the UK itself, the situation is close to panic, residents of London began to leave the city in a hurry, as the strictest quarantine regime came into force on Sunday, and all easing on the occasion of the Christmas holidays had to be canceled. Here's the deal. Needless to say, you will not envy the British, but with the "light hand" of former Prime Minister Cameron, as a result of the vote, they chose this path for themselves, namely secession from the European Union. Weekly

Despite the lead in growth against the US dollar, the situation for the pound is extremely difficult and largely uncertain. Reports of a new strain of COVID-19 could not pass without a trace, and the beginning of the week opened for the pound/dollar pair with a bearish gap. The complexity of the position of the British currency is also indicated by prices. If the last trading week ended at 1.3519, the GBP/USD pair is trading near 1.3280. The difference is significant and such price jumps do not occur. As you know, in times of aggravation or deterioration of the situation with the spread of coronavirus, the US dollar is used by investors as a safe asset. This is exactly what is happening now. Daily

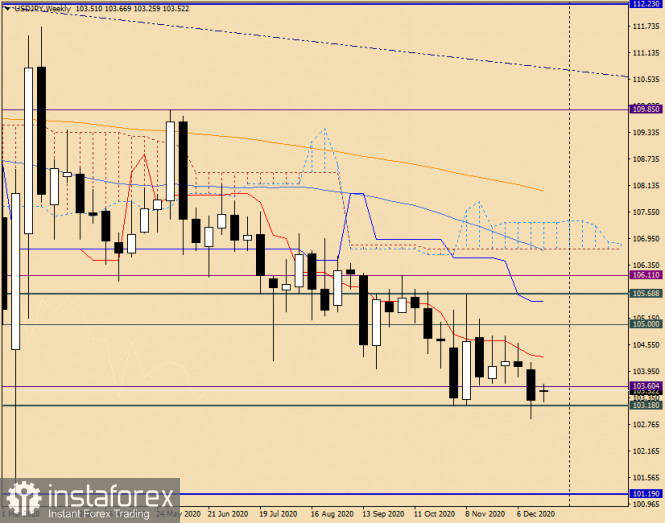

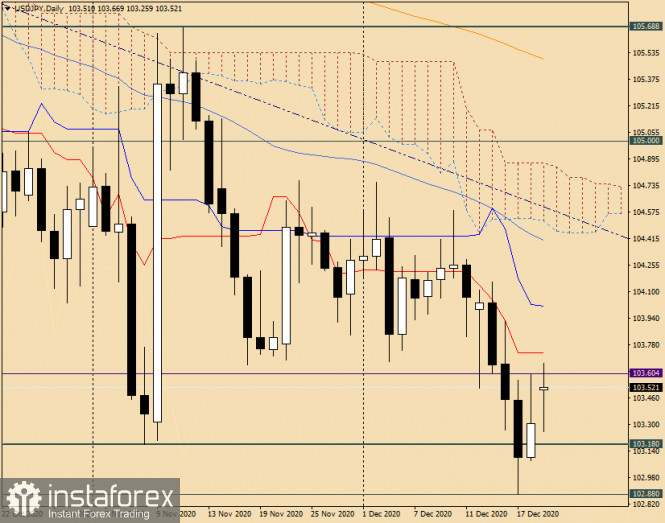

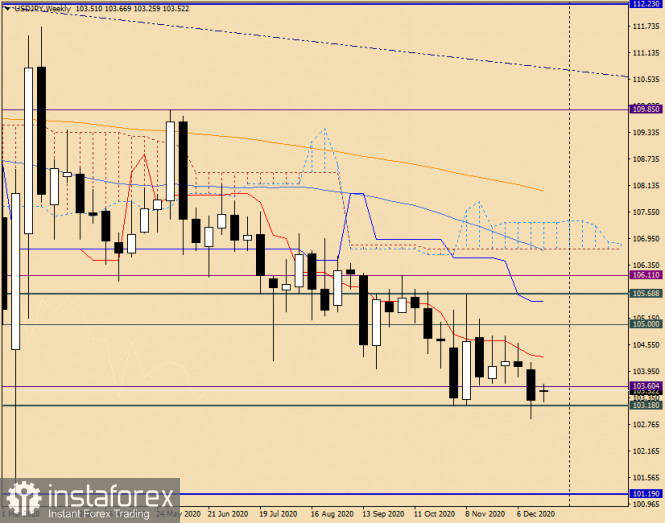

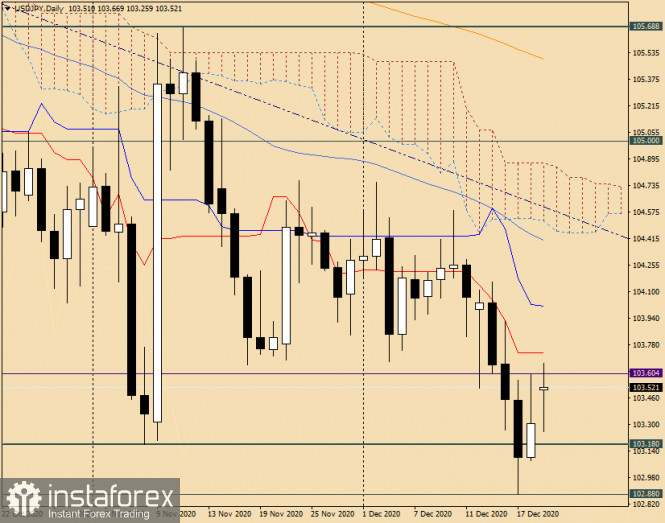

On the daily chart, the price gap is particularly clear, as a result of the fall, the pair is already trading below the Tenkan and Kijun lines of the Ichimoku indicator. If trading ends under these lines, it will be possible to try selling the British currency on a pullback to them. In truth, given the current situation, buying pounds is risky or even dangerous. At least, if you open long positions, then from the depth, after a decline to the levels of 1.3200 and (or) 1.3145. However, sales do not look particularly attractive. For those who are bearish and want to sell the GBP/USD pair, I recommend waiting for a pullback to the price zone of 1.3400-1.3430 and from there consider opening short positions. It's not a bad idea to be patient and stay out of the market for now. The current situation is quite difficult for making trading decisions. Perhaps it makes sense to wait a bit and see what will be the reaction of market participants. Analysis and forecast for USD/JPY on December 21, 2020 2020-12-21 Well, it's time to consider a rather interesting and much-loved currency pair USD/JPY. It is characteristic that both currencies, depending on the situation, are used by market participants as protective assets. Recently, investors prefer the Japanese yen, however, the technical picture for this instrument can not be called completely unambiguous. Before proceeding to the USD/JPY price charts, it is worth noting that the Central Banks of Japan and the United States continue to pursue a fairly soft monetary policy, aimed primarily at restoring their economies from the effects of COVID-19. Thus, market participants keep waiting for the adoption by the US Congress of a new package of fiscal incentives for $ 900 billion, however, the adoption of this bill is still being postponed, because Democrats and Republicans can not find all the necessary compromises for the adoption of this program. It should be noted here that this factor puts pressure on the US dollar in a pair with the Japanese yen. Weekly

Turning to the technical nuances of USD/JPY, first of all, it is necessary to note the strength of support at the level of 103.18. It is significant that this mark was tested for a breakdown in November, but resisted, after which the price rebounded to 105.68. Here, the further upward movement lost its strength and the quote again turned to decline. And here at the auction of the last five days, the bears on the instrument again tried to break through the support at 103.18 - and again failed. During the pressure, this level was only punctured, but not broken, as the closing price of weekly trading was above 103.18 and was fixed at 103.30. At the same time, the lows of the weekly session, shown at 102.88, allow us to hope that the barrier in the form of the support level of 103.18 is quite capable of overcoming. This assumption is supported by the last weekly candle, which has a fairly full bearish body and not so long lower shadow to consider the last candle a reversal. So, the key support zone in the current situation is 103.18-102.88. If the designated area is overcome and this week's trading ends at 102.88, the road will open to the next significant support level of 101.20, where the March lows of the outgoing year were shown. To change the market sentiment for this currency pair in favor of the US dollar, players on the exchange rate increase need to return the quote above the red line of the Tenkan indicator Ichimoku and especially above the psychological level of 105.00 and fix trading above this mark. To further indicate a change in sentiment, a breakout of the sellers' resistance at 105.86 is needed. Daily

Although the candle for December 17 closed below the support level of 103.18, it was not enough for the breakdown of this mark to be true. As you can see, the very next day, the USD/JPY bulls started up and made attempts to seize the initiative. And everything would be fine, but the very long upper shadow of the Friday bullish candle, which exceeds the size of the body itself, indicates a lack of strength in the bulls on the instrument. The highs of December 18 at 103.60 and the Tenkan line at 103.73 represent serious resistance to change the trend. In my opinion, if the USD/JPY bulls manage to overcome both of these levels, we can expect a subsequent rise in the price zone of 104.00-104.15. In the event of continued bearish pressure and an alternate breakdown of 103.18, 103.00, and 102.88, the downward scenario for this currency pair will continue to remain relevant. According to the trading recommendations, I will give preference to sales, which are better to open after corrective pullbacks up and attempts to overcome the price zone of 103.60-103.80. If there are reversal patterns of candle analysis, a signal will be received to open sales transactions. By the same tactic, it is worth observing the price behavior in the area of 104.00-104.15, and after the appearance of bearish patterns of Japanese candlesticks on the daily, four-hour, and hourly charts, open deals for sale. this week we will return to the consideration of the USD/JPY currency pair, and if necessary, we will make adjustments to this trading plan. Analysis and trading recommendations for USD/CHF 12/21/20 2020-12-21 Good day! Today, I would like to consider another major currency pair - the dollar/franc. Since both currencies are used by market participants depending on the situation as safe-haven currencies, we will take a closer look at the technical picture for this instrument, and taking into account the end of weekly trading on Friday, we will start with the corresponding timeframe. Weekly

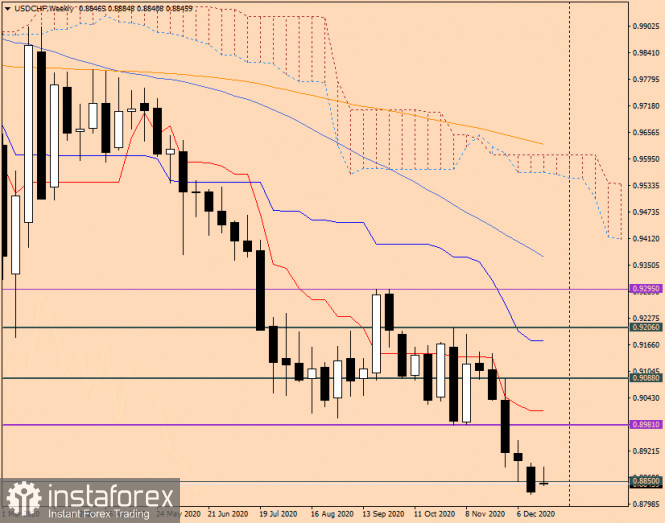

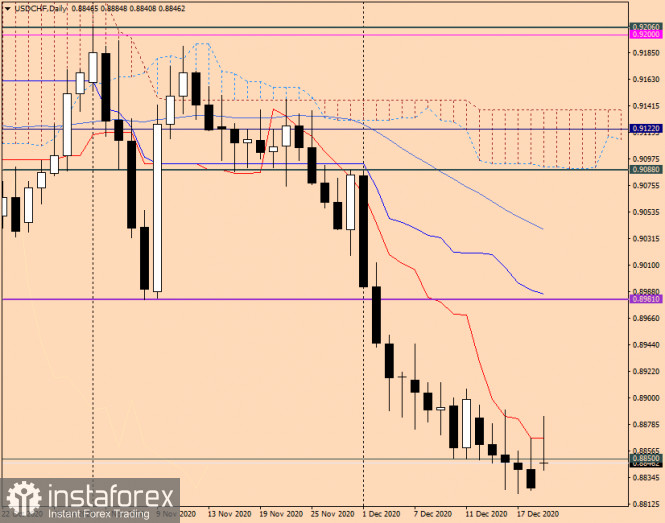

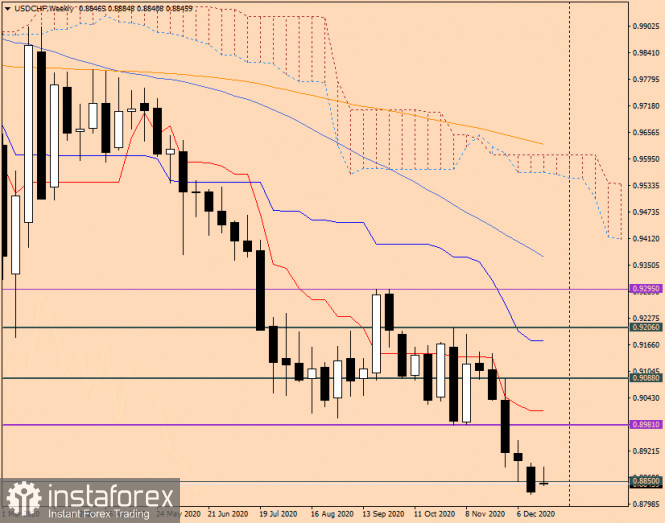

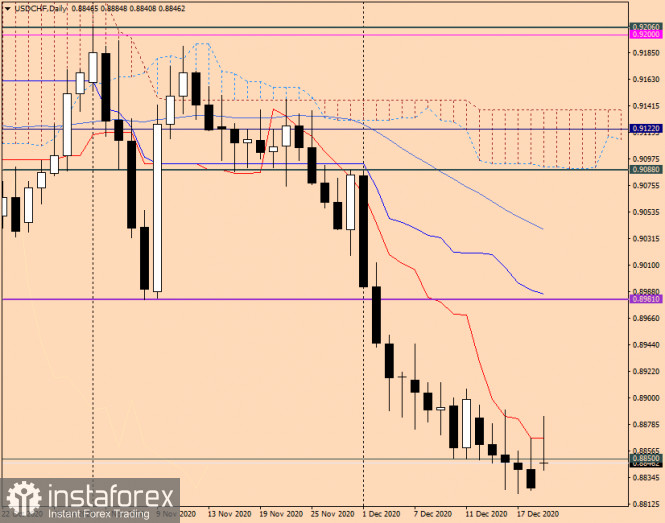

At the end of trading last December 14 - 18, the Swiss franc strengthened against the US dollar by 0.61%. Based on the weekly chart of USD/CHF, you should pay attention to two important points. First, the strong support of 0.8981 was broken the week before last. Second, last week's trading ended below the previous lows of 0.8850. Both of these factors allow us to count on the subsequent movement of the quote in a downward direction. I would also like to draw your attention to the fact that the doji candle, which could be considered as a reversal candle, was ignored by the market participants who did not want to work out this signal. In my opinion, this indicates the strength of bearish sentiment for the USD/CHF and with a high degree of probability suggests a further decline in the quote. But the trading of the starting week opened with a price gap in favor of the US currency across a wide range of the market. I believe that such a reaction of market participants became possible due to the discovery of a new strain of coronavirus infection in the UK, Germany, France, Italy and Australia. As you know, in times of aggravation of the epidemiological situation, it is the US dollar that investors give their preference as a safe haven currency. If the trading of the week that has begun is held under the dollar sign, and the pair of USD/CHF ends trading with growth, then the breakdown of support at 0.8850 will have to be recognized as false and it will be possible to count on a change in the trend. In this case, the growth of the dollar/franc pair to the levels of 0.8900, 0.8945, 0.9000 and higher is not excluded towards the red Tenkan Line, which passes at 0.9013. If the situation stabilizes and the US dollar returns to its previous weakening, the USD/CHF pair will have every chance to update the previous lows of 0.8821 and end the week trading under the important mark of 0.8800. Daily

As you can see on the daily chart, at the time of writing, the pair was already rising to 0.8885, but could not continue the rise and stalled at the Daily Tenkan Line. As of this moment, today's candle has a fairly long upper shadow and much will be answered by the closing price of today's trading relative to the Tenkan Line. Closing today's session above this line will create prerequisites for further growth, which we will consider corrective for the time being. However, Friday's candle in the form of an inverted bear hammer can be interpreted as a reversal signal. But whether it will be worked out by the market will become clear in the course of further development of the situation in the Forex currency market. Based on the current situation, the probability remains for both effective purchases and profitable sales. The only thing I would like to pay attention to is that you should not set high prices now, because the situation is far from obvious. I propose to consider purchases after the pair rises above 0.8885 and (or) 0.8900, with mandatory consolidation above the last mark. If bearish candlestick patterns appear near the indicated prices on the four-hour and/or hourly charts, this will be the basis for opening short positions on USD/CHF. That's all for now. Have a successful bidding! Analysis and forecast for EUR/USD on December 21, 2020 2020-12-21 The next trading week has ended on the foreign exchange market, and Christmas and New Year holidays are ahead, which will acquire a special flavor that was not typical before in the context of the COVID-19 pandemic. However, let's talk about everything in order. At the auction on December 14-18, the US dollar showed a decline against all major competitors, except the Canadian dollar. In particular, the US dollar fell by 1.12% against the single European currency and judging by the price charts of this instrument, this is far from the limit. In general, the mood on the global financial markets can be characterized as moderately positive, in which there is a tendency of investors to risk operations. However, the inability of the US Congress to agree on a new package of support measures against the COVID-19 pandemic for $ 900 billion, an open question regarding the conclusion of a deal to leave the UK from the European Union cool the appetite for risks, nevertheless, the demand for defensive assets, in particular for the US dollar has declined significantly recently. Last week, it became known that French President Emmanuel Macron was among those infected with the coronavirus and was forced to leave for seven-day isolation, which the French leader holds at his residence in Versailles. Macron continues to remotely perform his duties, urging the French to strictly comply with the protection measures recommended by the authorities. In many European countries, restrictions are being tightened on the eve of the Christmas holidays. People are encouraged to stay at home as much as possible, and in the case of going to visit, be sure to use protective masks and avoid too crowded companies. But Christmas in Europe is one of the biggest holidays, and it is unlikely that everyone will stay at home. It is possible that after the Christmas celebrations, the situation with COVID-19 infection in Europe will worsen even more. In principle, the same can be assumed for the United States of America. In this regard, it cannot be ruled out that the beginning of 2021, due to a possible surge in coronavirus infection, will be extremely negative. On the other hand, the promises of the authorities of many countries to start mass vaccination of the population leave hope that the number of infected people will significantly decrease, and this also adds to optimism on global trading platforms. In general, in the author's personal opinion, the Christmas holidays will largely indicate the immediate dynamics of the COVID-19 pandemic. Weekly

According to the results of the last five days of trading, the main currency pair of the Forex market showed quite impressive growth. Weekly highs were shown at 1.2272, and the session ended on December 14-18 at 1.2254. As previously suggested, in the event of a breakout of the resistance of sellers in the area of prices 1.2000-1.2010, the road opens to the February 2018 highs at 1.2555. Naturally, if this happens, it will not happen in one or two days, especially since no one has canceled corrective pullbacks in the market, and they are likely to take place. The bullish mood of the pair can also be judged by the fact that the market ignored the reversal model of the candle analysis "hanged", which is circled on the chart and was formed a week earlier. Given the fact that this model has been absorbed by strong growth, the pair is not going to change direction yet and will most likely continue to move in a northerly direction. In the case of the latest highs at 1.2272, we can expect the price to rise to the technical zone of 1.2300-1.2340, which is not easy to pass. If we define more distant growth targets, then this is the price area of 1.2380-1.2420. Daily

On the last trading day of last week, the daily chart of EUR/USD also showed a reversal candle model "hanged", which is also called "gallows". In principle, this is a reason to conduct a corrective pullback, however, the market will take advantage of this opportunity or continue to move the price up. To break this pattern, euro bulls need to form a large bullish candle with a closing price above the highs of December 17-18 at 1.2272. The fact that this mark held back further strengthening of the quote for two consecutive trading days indicates its strength. However, nothing is impossible in the market, and given the rather strong upward trend in EUR/USD, it is quite possible to assume the scrapping of this model and the further rise of the quote to the prices indicated above. Based on all of the above, the main trading recommendation for the euro/dollar continues to be trend positions, that is, purchases. I consider it appropriate to consider opening long positions after corrective pullbacks to 1.2245, 1.2205, and 1.2180. If there are no such pullbacks and there is a true breakdown of the resistance of 1.2272, then on the rollback to this broken mark, you can also think about opening purchases. In tomorrow's article on EUR/USD, we will analyze the lower timeframes and, if necessary, adjust these trading recommendations. GBP/USD. Today's main outsider is the pound 2020-12-21 The pound is the main outsider in the currency market today, which is actively losing its positions throughout the market. This is caused not only by the new strain of COVID-19, but also by another failure in negotiations around the Brexit prospects. The combination of these fundamental factors put the strongest pressure on the British currency. The new trading week began for GBP/USD traders with both a downward gap and a rally. Overall, the pair has lost almost 300 pips so far, relative to Friday's high. And judging by the dynamics of the downward movement, the pair will be at the bottom of the 32nd figure today, although it tested the limits of the 36th price level last Friday. Such a mood change is quite justified, given the current fundamental picture. Let's start with the Brexit issue. Yesterday, the next deadline for concluding a trade deal was disrupted: the parties could not come to a compromise solution on the key (and in fact, the only remaining) issue regarding the rules of fishing. Although the negotiators agreed to extend the negotiation process, yesterday's deadline was particularly important in the context of future prospects. The fact is that last week, the EU expressed its readiness to organize an extraordinary plenary session before this year ends (this is not a quick process, especially amid quarantine restrictions) if a compromise is reached before 00:00 on Sunday. However, after it became known that the parties could not agree before the designated deadline, the European Parliament said that deputies will not be able to approve the deal this year, even if the negotiators compromise this week.

To simply put, London and Brussels will not have time to ratify the deal before the end of the transition period. Now, politicians need to think not only about how to reach a compromise on key points of the deal, but also how to get out from the legal impasse in which they are in. Some MEPs say that if the agreement is reached before the end of the year, it can be applied under a "special temporary procedure" from January 1, while the European Parliament will ratify the deal in the second half of next month. A separate meeting on this issue will be held today, where various options for breaking the deadlock will be discussed. However, legal maneuvers may not be useful, since the parties still cannot resolve the most complex and controversial issue on fisheries. According to Reuters' news agency sources in the UK government, London will not agree to a deal that "leaves the country in control of its own laws or waters". Downing Street confirmed that negotiations are continuing, but if Brussels does not change its position, then the country will leave the EU on the terms of the World Trade Organization on December 31. An unnamed source of journalists noted that Boris Johnson is not bluffing and is seriously ready to take such a risky step for the country. However, it is still a rhetorical question whether the British Prime Minister is bluffing or is he really ready to leave Britain on WTO terms. In fact, negotiations was stalled, although there are only 10 days left until the end of the transition period. At the same time, the European Parliament will not have time to ratify the deal in any case, even if the parties can unravel the tangle of controversial issues. All these circumstances put a lot of pressure on the pound, especially amid the panic about a new strain of COVID-19. Britain's Ministry of Health has already reported that the situation with the mutated strain is actually out of control, as it spreads too quickly. According to preliminary estimates, it is 70% more infectious than usual, so quarantine measures in those regions of England where it was detected did not bring any results. The number of cases of coronavirus in the country on Sunday rose by almost 36,000, which was twice the value a week ago. In this regard, flights to the UK were canceled by France, Austria, the Netherlands, Bulgaria, Germany, Ireland, Sweden, Turkey, Saudi Arabia, Israel, Iran, El Salvador and Colombia. Brussels, in turn, is also expected to completely isolate the EU from this country today. Meanwhile, Downing Street will analyze the current situation today. On the one hand, the Ministry of Health and the Ministry of Transport urged carriers to cancel trips to British ports, which are located in the south of the country (the focus of the new coronavirus was discovered there). On the other hand, many British companies are now actively accumulating inventories, considering the possible implementation of a no-deal Brexit from January 1, 2021. At the same time, Boris Johnson refuses to initiate the issue of extending the transition period, although the Scots, represented by the First Minister of Scotland, Nicola Sturgeon, officially asked him to do so. Moreover, it became known that the British authorities decided yesterday to introduce the most tightened restrictive measures on the movement of residents of London and almost the entire Southeast of England. Experts believe that Johnson will have to introduce a nationwide lockdown in the near future, due to his late reaction to the threat of a new COVID-19 strain.

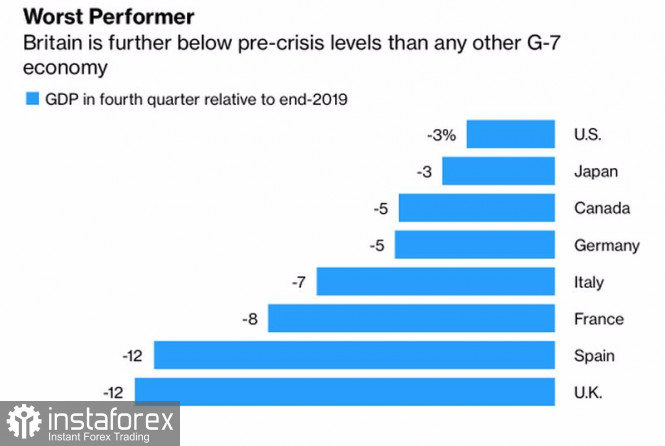

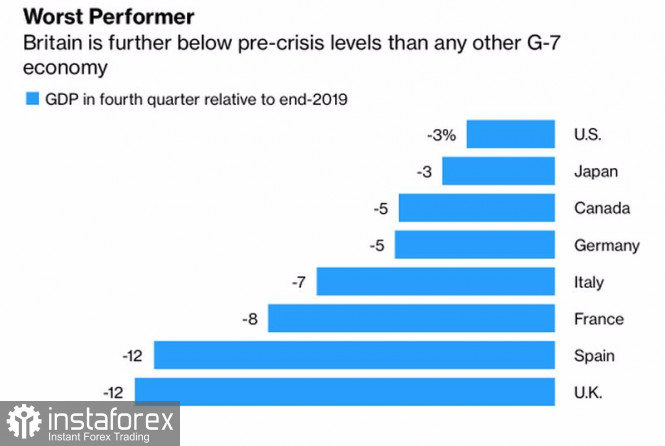

As a result, the pound's fundamental background is quite gloomy. Even if Mr. Johnson decides to extend the transition period, it will happen at the last moment, that is, by the end of this week or even at the beginning of the next. In regards to the situation with the mutated coronavirus, there are more questions than answers. At the moment, scientists have not been able to provide detailed information on the new strain. Therefore, the "coronavirus factor" will put additional pressure on the British currency in the next few days. Given all of the above, we can conclude that the GBP/USD pair remains bearish in the short term. Most likely, the pair will reach the base of the 32nd figure (the lower line of the Bollinger Bands indicator on the daily chart) before this day ends, while the main target of the decline is located below, which is at the level of 1.3110 (upper limit of the Kumo cloud on the same time frame). GBP/USD bulls believe in futile Brexit. Pound sank amid failed negotiations and new COVID strain 2020-12-21 The pound sterling plummeted after London and Brussels failed to find a common language on the weekend of December 19-20, the European Parliament said that it would not be able to ratify the deal in 2020, as a critical deadline was missed, and a new strain of COVID-19 was discovered in the UK, which forced Boris Johnson to introduce additional restrictions. The markets until recently flattered themselves with hopes of concluding a Brexit deal on the falling flag, but as soon as they lost their illusions, the bears on GBP/USD rushed to the attack. Fisheries are a stumbling block on the road to consensus. European fishermen earn about €650 billion a year in British waters, and Brussels was ready to unfasten 15-18% of this amount, subject to maintaining access for 8 years. London wanted 80%, and realizing that things would not get off the ground, the EU made a new proposal of 25% and 6 years. Boris Johnson said that he needed clarification, the deal was not reached, the European Parliament announced the impossibility of ratifying it before January 1, sterling went to the bottom. The British Prime Minister is not satisfied not only with fishing, but also with the European Aid Mechanism, which allegedly allows EU countries to receive more subsidies than the UK, which violates the rules of the level playing field. There is practically no time left, and the negotiators are still so far from each other that Cabinet member Michael Gove begins to talk about "side deals" like the United States and Britain. Say, if a comprehensive trade agreement cannot be reached, then why not break everything up into small agreements? How can such conversations make investors feel any other than disappointment? The situation for the GBP/USD bulls is aggravated by the discovery of a new strain of COVID-19, which is spreading 70% faster than the previous ones. And although there is no evidence of a higher mortality rate caused by it, and the vaccine is likely to help against all existing infections, Boris Johnson was forced to introduce new restrictions in London and the south-east of England. Due to the pandemic and Brexit, the British economy is showing worse results than large developed countries, how can the pound grow in such conditions? Depth of recession in major developed countries of the world:

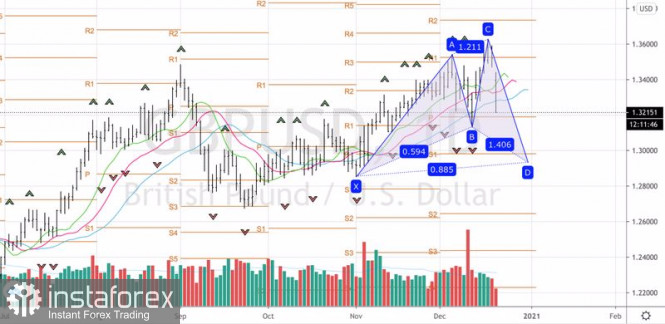

Things are going badly, but they could go even worse if the decades-old regime of free movement of goods, services, people, and capital remains a thing of the past. Mutual import duties of the UK and the EU and the risks of a double recession of the British economy will increase the likelihood of monetary expansion of the Bank of England, including a reduction in the repo rate below zero. It seems that the markets are beginning to believe that the worst can not be avoided. But is it so? Technically, a break of support at 1.318-1.3185 is fraught with the activation of the Shark pattern and the continuation of the peak to the target at 88.6%, which corresponds to the mark of 1.293. Purchases of GBP/USD will become relevant from the area of 1.293-1.2975 or in the case of a return of the pair above 1.333-1.3335. In the meantime, you should give preference to short-term sales or stay "out of the market". GBP/USD daily chart:

Gold and silver surged last week due to three events 2020-12-21

There were three events that gave profound impact to US stocks, gold, silver and the US dollar last week. First is the emergence of Pfizer's COVID-19 vaccine, which gave investors optimism that soon, the world will finally escape the clutches of the coronavirus. The second was the news that the bipartisan group that proposed revising the $ 908 billion bailout package split the package into two separate bills. The first bill allocates about $ 748 billion, and covered the areas that both the House of Representatives and the Senate agreed on, thereby making this smaller bill more acceptable to both Democrats and Republicans. This means that the Congress may adopt this package at the end of this year. The second bill, which provides $ 160 billion in bailout, responds to the two major issues that were the cause of deadlock in the earlier negotiations. These were the funds for state and municipal assistance and the liability insurance of enterprises. Meanwhile, the last event was the FOMC meeting, during which the Fed decided to stick to its current monetary policy. Interest rates will remain near zero, at least until early 2023. This decision led to the sharp decline of the US dollar last week. Together, these three events provided strong support to gold and silver, and pushed them to higher price levels.

But this week, their quotes may turn down, especially if the US does not adopt a new stimulus package. If a bill is not signed, millions of Americans will suffer, since the program of unemployment benefits will expire the day after Christmas, and the deadline of the eviction moratorium is on December 31. EUR/USD analysis for December 21 2020 - Potetnial for the upside continuation towards 1.2272 2020-12-21 Reminder: UK PM Johnson to chair emergency crisis meeting later today This is in response to the crisis and chaos faced by the UK amid European countries closing its borders to the UK due to the new virus strain As Eamonn pointed out earlier, this is to discuss: - The announcement by many countries to impose bans on flights from the UK in an attempt to stop the new strain of coronavirus landing

- Also to be addressed are freight issues, with a warning of an imminent shortage of some fresh foods

- The Port of Dover ferry terminal and Eurotunnel have both closed following French travel restrictions

As things stand, most European countries are keeping the travel bans but they are to be temporary in order to sort out procedural and safety protocol before allowing for accompanied freight and trade to resume in the coming day(s). Technical analysis:

EUR has been trading downwards during the Asia session and first half of Europe session but I see potential exhaustion and further upside movement. The trend is still bullish and the support at the price of 1,2170 looks like the nice pivot level for further rise. Support level: 1,2,170 Resistance levels: 1,2240 and 1,2270 Analysis of Gold for December 21,.2020 - Potential for the upside continuation towards $1.954 2020-12-21 UK December CBI retailing reported sales -3 vs 0 expected Prior -25 - Total distributive reported sales -2

- Prior -21

UK retail sales is seen picking up ahead of the Christmas period, with CBI noting that: "It says something about the challenges the retail sector has faced during 2020 that stable volumes in the run-up to Christmas were seen as a good result for the time of the year. The new year looks set for an unpromising start, with retailers anticipating a sharp fall in sales in January." Of note, the outlook reading is seen at -33 and the thing to note about this survey is that it came before tougher lockdown restrictions were announced for London and southern England over the weekend by the government. The readings here are an indicator of short-term trends in the retail and wholesale sector of the UK economy.

Technical analysis:

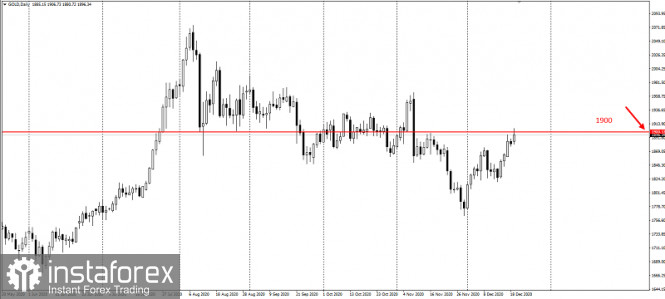

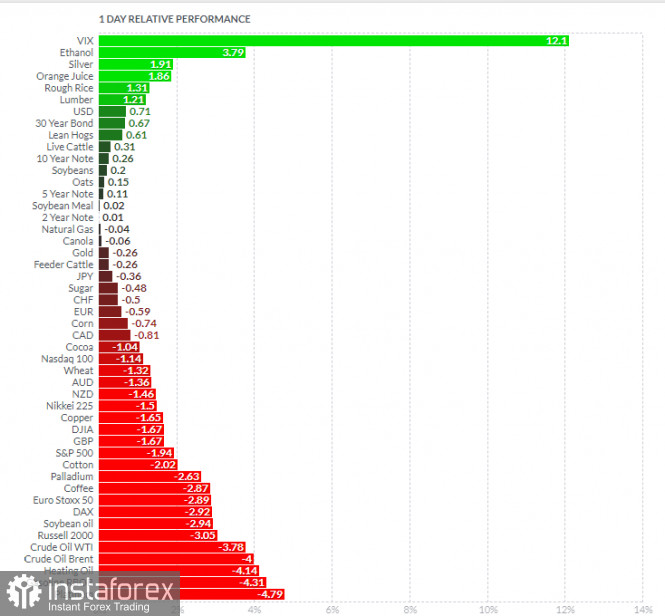

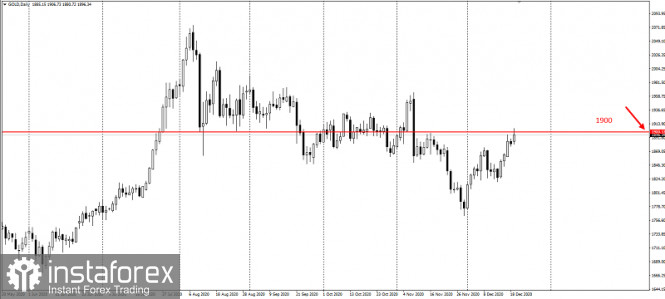

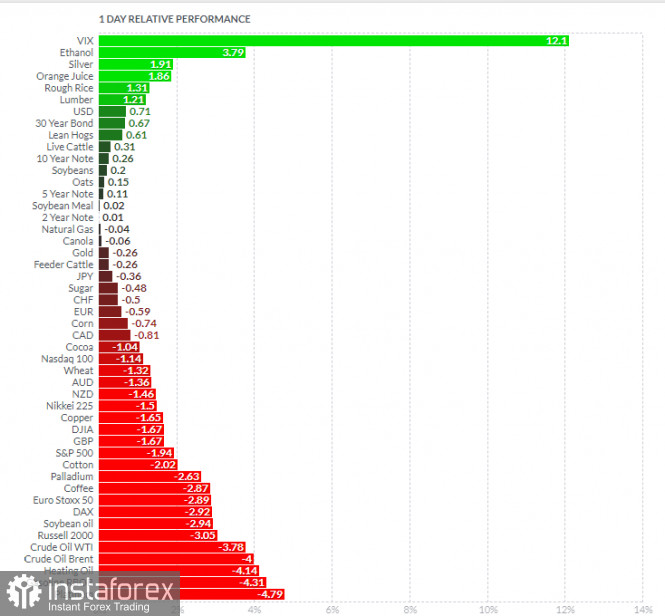

Gold has been trading downwards during the Asia session and first half of Europe session but I see potential exhaustion and further upside movement. The trend is still bullish and the support at the price of #1,872 looks like the nice pivot level for further rise (previous swing high on daily). My advice is to watch for buying opportunities on the dips with the upside target at $1,950. Additionally, there is the rising trend line.... Finviz Relative Strength >

On the top of the list wr got VIX and Ethanol and on the bottom Platinum and Gasoline... Support level: $1,872 Resistance levels: $1,954

Author's today's articles: Mihail Makarov  - - Zhizhko Nadezhda  Graduated from Irkutsk State University. Having acquainted with Forex market in 2008, followed the courses in the International Academy of Stock Exchange Trading. The agenda was so exiting that she moved to St. Petersburg in order to get professional education. Obtained a diploma of the retraining course on the discipline Exchange market and stock market issues, defended the graduation paper with distinction on the subject "Modern technical indicators as the basis of the trading system". At the moment obtains a master degree in International Banking Institute on specialty Financial markets and investments. Apart from trading is occupied with development of trading systems and formalization of the working strategies using Ichimoku indicator. At the moment is working on the book dedicated to the peculiarities of Ichimoku indicator and its operating methods. Interests: yoga, literature, travelling and photograph. "You can only get smarter by playing a smarter opponent" Basics of Chess play, 1883 "Successful people change by themselves, the others are changed by life" Jim Rohn Graduated from Irkutsk State University. Having acquainted with Forex market in 2008, followed the courses in the International Academy of Stock Exchange Trading. The agenda was so exiting that she moved to St. Petersburg in order to get professional education. Obtained a diploma of the retraining course on the discipline Exchange market and stock market issues, defended the graduation paper with distinction on the subject "Modern technical indicators as the basis of the trading system". At the moment obtains a master degree in International Banking Institute on specialty Financial markets and investments. Apart from trading is occupied with development of trading systems and formalization of the working strategies using Ichimoku indicator. At the moment is working on the book dedicated to the peculiarities of Ichimoku indicator and its operating methods. Interests: yoga, literature, travelling and photograph. "You can only get smarter by playing a smarter opponent" Basics of Chess play, 1883 "Successful people change by themselves, the others are changed by life" Jim Rohn Sergey Belyaev  Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis. Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis. Mourad El Keddani  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Languages: Arabic, English, French and Dutch.

Interests: Algorithm, Graphics, Social work, Psychology and Philosophy. Ivan Aleksandrov  Ivan Aleksandrov Ivan Aleksandrov Irina Manzenko  Irina Manzenko Irina Manzenko Igor Kovalyov  Igor Kovalyov was born on September 24, 1985. Igor graduated from Krasnoyarsk State University with a degree in Philology and Journalism. He has a wide experience as a newspaper and information agency correspondent. He got interested in financial markets in 2001. He also graduated from Moscow State University of Economics, Statistics, and Informatics (MESI) with a degree in Global Economics and then served as an analyst in an investment company. He has been working at InstaForex since 2014. Igor Kovalyov was born on September 24, 1985. Igor graduated from Krasnoyarsk State University with a degree in Philology and Journalism. He has a wide experience as a newspaper and information agency correspondent. He got interested in financial markets in 2001. He also graduated from Moscow State University of Economics, Statistics, and Informatics (MESI) with a degree in Global Economics and then served as an analyst in an investment company. He has been working at InstaForex since 2014. Andrey Shevchenko  Andrey Shevchenko Andrey Shevchenko Petar Jacimovic  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work" Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

A Zotova, Aleksey Almazov, Alexander Dneprovskiy, Alexandr Davidov, Alexandros Yfantis, Andrey Shevchenko, Arief Makmur, Dean Leo, Evgeny Klimov, Fedor Pavlov, Grigory Sokolov, I Belozerov, Igor Kovalyov, Irina Manzenko, Ivan Aleksandrov, l Kolesnikova, Maxim Magdalinin, Mihail Makarov, Mohamed Samy, Mourad El Keddani, Oleg Khmelevskiy, Oscar Ton, Pavel Vlasov, Petar Jacimovic, R Agafonov, S Doronina, Sebastian Seliga, Sergey Belyaev, Sergey Mityukov, Stanislav Polyanskiy, T Strelkova, Torben Melsted, V Isakov, Viktor Vasilevsky, Vladislav Tukhmenev, Vyacheslav Ognev, Yuriy Zaycev, Zhizhko Nadezhda

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

-

-  Graduated from Irkutsk State University. Having acquainted with Forex market in 2008, followed the courses in the International Academy of Stock Exchange Trading. The agenda was so exiting that she moved to St. Petersburg in order to get professional education. Obtained a diploma of the retraining course on the discipline Exchange market and stock market issues, defended the graduation paper with distinction on the subject "Modern technical indicators as the basis of the trading system". At the moment obtains a master degree in International Banking Institute on specialty Financial markets and investments. Apart from trading is occupied with development of trading systems and formalization of the working strategies using Ichimoku indicator. At the moment is working on the book dedicated to the peculiarities of Ichimoku indicator and its operating methods. Interests: yoga, literature, travelling and photograph. "You can only get smarter by playing a smarter opponent" Basics of Chess play, 1883 "Successful people change by themselves, the others are changed by life" Jim Rohn

Graduated from Irkutsk State University. Having acquainted with Forex market in 2008, followed the courses in the International Academy of Stock Exchange Trading. The agenda was so exiting that she moved to St. Petersburg in order to get professional education. Obtained a diploma of the retraining course on the discipline Exchange market and stock market issues, defended the graduation paper with distinction on the subject "Modern technical indicators as the basis of the trading system". At the moment obtains a master degree in International Banking Institute on specialty Financial markets and investments. Apart from trading is occupied with development of trading systems and formalization of the working strategies using Ichimoku indicator. At the moment is working on the book dedicated to the peculiarities of Ichimoku indicator and its operating methods. Interests: yoga, literature, travelling and photograph. "You can only get smarter by playing a smarter opponent" Basics of Chess play, 1883 "Successful people change by themselves, the others are changed by life" Jim Rohn  Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis.

Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis.  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). Ivan Aleksandrov

Ivan Aleksandrov  Irina Manzenko

Irina Manzenko  Igor Kovalyov was born on September 24, 1985. Igor graduated from Krasnoyarsk State University with a degree in Philology and Journalism. He has a wide experience as a newspaper and information agency correspondent. He got interested in financial markets in 2001. He also graduated from Moscow State University of Economics, Statistics, and Informatics (MESI) with a degree in Global Economics and then served as an analyst in an investment company. He has been working at InstaForex since 2014.

Igor Kovalyov was born on September 24, 1985. Igor graduated from Krasnoyarsk State University with a degree in Philology and Journalism. He has a wide experience as a newspaper and information agency correspondent. He got interested in financial markets in 2001. He also graduated from Moscow State University of Economics, Statistics, and Informatics (MESI) with a degree in Global Economics and then served as an analyst in an investment company. He has been working at InstaForex since 2014.  Andrey Shevchenko

Andrey Shevchenko  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

No comments:

Post a Comment