| | | | | | | Presented By Northern Trust | | | | Pro Rata | | By Dan Primack ·Dec 21, 2020 | | 🎧 Axios Re:Cap speaks with Nicholas Kristof about his investigation of Pornhub, the aftermath and what comes next. Listen via Apple, Spotify or Axios. 🎬 That's a wrap: Today at 12:30pm ET, please join me and Axios Today host Niala Boodhoo for a year-end show from Axios Virtual Events, spotlighting some of the best of 2020. Register here. | | | | | | Top of the Morning |  | | | Illustration: Eniola Odetunde/Axios | | | | Congress will head home this week after finally agreeing to an economic stimulus that it should have agreed to several vacations ago. Why it matters: There's all sorts of stuff in here that will help economically crushed businesses and individuals, including many whose economic hardship was legislatively designed to worsen at year-end. The big caveat: The legislative text hasn't been released, as of this writing at 9am ET. That's right, for a $900 billion spending package that is expected to be voted on imminently. So don't be surprised to see all sorts of infuriating provisions that no one had time to find and excise before the final vote. What's in the bill: - $284 billion in reauthorized PPP loans, including for businesses and nonprofits that participated in the initial tranche. No specifics yet on how qualifications may differ, although early drafts included a lower employee threshold and at least a 20% quarterly revenue decline. If only we had the text...

- $15 billion for airlines, in exchange for calling back over 32,000 furloughed workers.

- $25 billion in rental assistance, plus an extension of the eviction moratorium.

- $300 per week in enhanced unemployment insurance for 11 weeks.

- $600 checks to individual taxpayers, although no word yet if income requirements are the same as in the spring.

- Tax credits for employers offering paid sick leave.

- Business meal tax deductions, otherwise known as the "three martini lunch" provision that had been pushed by President Trump.

- A watered-down version of Sen. Pat Toomey's (R-Pa.) last-minute attempt to handcuff future Fed lending programs.

What's not in the bill: - Local and state aid.

- Coronavirus-related liability protections for businesses and schools.

What's next: All eyes on Georgia. - Democrats view this stimulus as an opening salvo, believing they'll have more leverage with President Biden. The trouble, though, is that Trump was more than willing to go big here — particularly on the individual checks — but was held back by Senate Republicans.

- In other words, Democrat control of the Senate is more crucial to future stimulus than is Democrat control of the White House.

|     | | | | | | The BFD |  | | | Illustration: Eniola Odetunde/Axios | | | | Lockheed Martin (NYSE: LMT) agreed to buy Aerojet Rocketdyne (NYSE: AJRD) for $4.4 billion in cash (including assumed debt). - Why it's the BFD: This reflects how legacy defense companies are racing to keep up with Elon Musk and Jeff Bezos in space, a dynamic that also helped drive Raytheon's merger effort with United Technologies Corp. Plus, this is the exact type of company that will be seeking Space Force bids, maybe getting cool branding logos on the Guardian outfits.

- Details: Lockheed will pay $56 per share (33% premium over Friday's closing price), which will be reduced to $51 after payment of a pre-closing dividend.

- Flashback: Aerojet in 2015 offered to pay $2 billion to buy a rocket launch joint venture between Boeing and Lockheed, but was rebuffed by Boeing.

- The bottom line: "The acquisition signals Lockheed's continued interest in the areas of hypersonic weapons and space — two major technology development priorities for the Defense Department and two areas of increased investment in recent years. In particular, the acquisition would add 'substantial expertise' to Lockheed in the area of propulsion, as Aerojet's engines are already part of its supply chain across the company's space, aeronautics and missile and fire control business units." — Valerie Insinna, DefenseNews

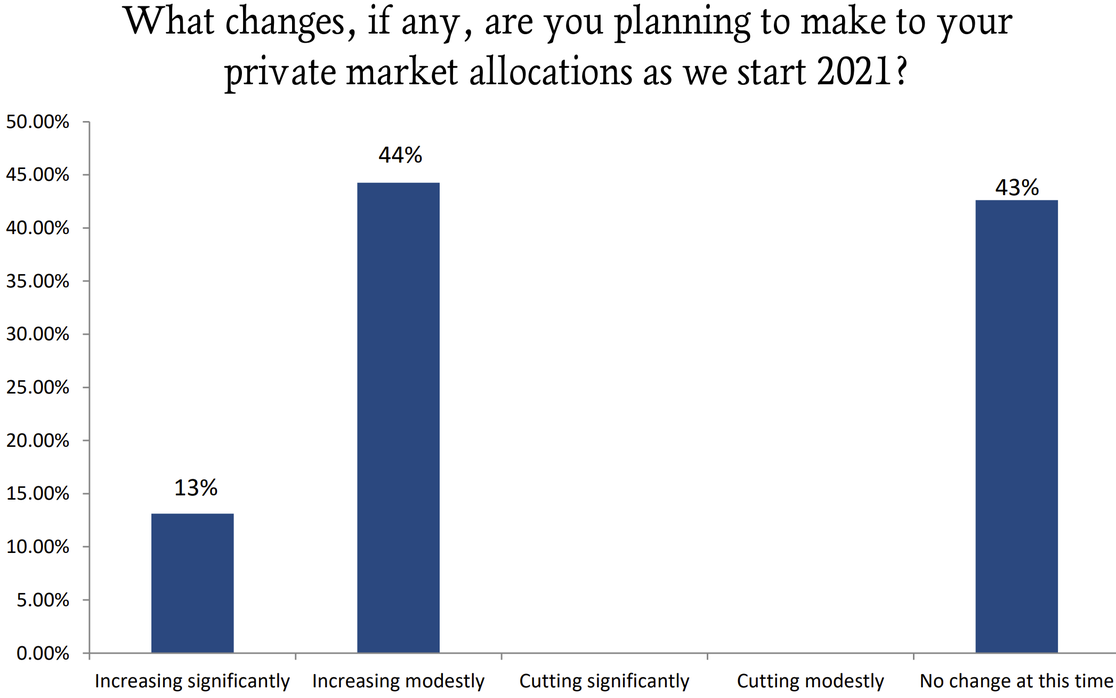

|     | | | | | | Venture Capital Deals | | • OneTrust, an Atlanta-based data protection and privacy policy software company, raised $300 million in Series C funding at a $5.1 billion valuation. TCV led, and was joined by insiders Coatue and Insight Partners. http://axios.link/t91Y • Creditas, a Brazilian consumer lending startup, raised $255 million in Series E funding at a $1.75 billion post-money valuation. Backers include LGT Lightstone, Tarsadia Capital, Wellington Management, e.ventures, and Sunley House Capital and insiders SoftBank Vision Fund, SoftBank Latin America Fund, VEF, Kaszek Ventures and Amadeus Capital Partners. http://axios.link/VN1X • Bolt, a San Francisco-based checkout platform, raised $75 million. General Atlantic and WestCap co-led and were joined by return backers Activant Capital and Tribe Capital. www.bolt.com • Trigo, an Israeli developer of self-checkout technologies, raised $60 million in Series B funding. 83North led and was joined by return backers Vertex Ventures Israel, Hetz Ventures, Red Dot Capital Partners, Tesco, and Morag Investments. www.trigo.tech • Very Good Security, a San Francisco-based data security and compliance company, raised $60 million in Series C funding. Vertex Ventures US led and was joined by insiders Andreessen Horowitz and Goldman Sachs Growth. www.verygoodsecurity.com • Apartment List, a San Francisco-based apartment rental marketplace, raised $50 million in new funding led by Janus Henderson Investors at around a $600 million valuation. http://axios.link/BnCM • QuantalRF, a Swiss RF semiconductor startup, raised around $19 million co-led by Metellus and Dara Capital. http://axios.link/qvNd • Group14 Technologies, a Woodinville, Wash.-based provider of silicon-carbon composites for the lithium-ion markets, raised $17 million in Series B funding. SK Materials led and was joined by return backer OVP Venture Partners. http://axios.link/aFaj • Dash Systems, a Los Angeles-based developer of hardware and software for precision airdrops, raised $8 million in seed funding. 8VC led, and was joined by Tusk Venture Partners, Loup Ventures, Trust Ventures, Perot Jain, and MiLA Capital. http://axios.link/M8Ld • Skuad, a Singapore-based digital payroll platform for remote teams, raised $4 million in seed funding co-led by Beenext and Anthemis Group. http://axios.link/0UuJ • Tap Network, a New York-based loyalty rewards-as-a-service startup, raised $4 million from backers like Revelis Capital, Nima Capital, the Forbes family office, Warner Music Group and Access Industries. http://axios.link/7UNz • WorkWhile, a San Francisco-based labor management platform for hourly work, raised $3.5 million in seed funding led by Khosla Ventures. http://axios.link/iKbV • Tradefeedr, a London-based data-sharing platform for collaborative analytics in capital markets, raised $3 million led by IPGL. http://axios.link/tlG3 |     | | | | | | A message from Northern Trust | | How to relocate with taxes in mind | | |  | | | | Relocation is top-of-mind for many people this year because of potential tax savings and remote working becoming the norm. But before relocating, consider the broader impact of the move and understand the requirements to establish residency. The tax factors to consider. | | | | | | Private Equity Deals | | • Thoma Bravo agreed to buy RealPage (Nasdaq: RP), a Richardson, Texas-based provider of software and data analytics to the real estate industry, for $10.2 billion (including debt), or $88.75 per share (30.8% premium over Friday's closing price). http://axios.link/XzSo ⛽ Aegis Hedging, a The Woodlands, Texas-based portfolio company of Trilantic North America, acquired Risked Revenue Energy Associates, a Houston-based commodity trading adviser. www.aegis-hedging.com 🚑 Amulet Capital Partners invested in SSI Strategy Holdings, a Parsippany, N.J.-based life sciences consultancy. www.ssistrategy.com • BlueHalo, a portfolio company of Arlington Capital Partners, acquired Base2 and Fortego, a pair of Maryland-based providers of cyber and signals intelligence solutions to the national security market. www.bluehalo.com • CapVest agreed to buy Inspired Pet Nutrition, a British pet food maker, from L Catterton. www.ipn.co.uk • Core Industrial Partners acquired Dahlquist Machine, a Ham Lake, Minn.-based provider of machined components for the medical and instrumentation markets. www.dahlquistmachine.com • CriticalPoint Capital acquired the Farm Supply Distribution unit of Southern States Cooperative and will rename the business Agway Farm & Home. www.agway.com • Crown Products, a portfolio company of WILsquare Capital, acquired Jer-And, St. Louis-based distributor of flooring and flooring installation solutions. www.jer-and.com 🚑 Elsan, a French hospital group backed by KKR, Ardian and CVC Capital Partners, agreed to buy C2S, a French group of 17 general medicine clinics, from Eurazeo for €400 million. http://axios.link/7XJ1 • HGGC agreed to buy Specialist Risk Group, a London-based specialist insurance broker, from Pollen Street Capital. www.specialistrisk.com ⛽ Global Infrastructure Partners Australia agreed to buy a 26.25% stake in Shell's Queensland Curtis LNG (QCLNG) facilities for A$2.5 billion. http://axios.link/elT3 • Morgan Stanley Infrastructure Partners offered to buy Tele Columbus, a listed German fiber network operator, for just over €400 million. http://axios.link/Djbt 🚑 Nordic Capital and Astorg agreed to buy Cytel, a Waltham, Mass.-based provider of statistical software for clinical trial design and biometrics execution from New Mountain Capital. www.cytel.com |     | | | | | | Public Offerings | | • ACV Auctions, a Buffalo, N.Y.-based wholesale auto auction site, filed confidential IPO papers with the SEC, Axios has learned. The company has raised $350 million in VC funding, most recently led by Durable Capital Partners at a $1.7 billion valuation. • Bumble, a dating app, filed confidential IPO papers with the SEC and plans to list in February, per Bloomberg. Backers include Lead Edge Capital, Greycroft and Accel. http://axios.link/Cp4Q 🚑 Cullinan Oncology, a Cambridge, Mass.-based developer of cancer drugs, filed for a $100 million IPO. The pre-revenue company plans to list on the Nasdaq (CGEM) and raised around $380 million in VC funding from MPM Capital, F2 Ventures, Cowen Healthcare, Foresite Capital, OrbiMed, Schooner Capital and UBS Oncology Fund. http://axios.link/YgLB 🚑 Gracell, a Chinese developer of CAR-T cell therapies for cancer, filed for a $100 million IPO. The pre-revenue company plans to list on the Nasdaq (GRCL) and raised $195 million from firms like Temasek (17.7% pre-IPO stake), OrbiMed (14%), Lilly Asia Ventures (9.2%), Kington Capital (8.4%), Wellington Management and Vivo Capital. http://axios.link/PYUl |     | | | | | | SPAC Stuff |  | | | Illustration: Sarah Grillo/Axios | | | | • SoftBank later today will file to raise between $500 million and $600 million via an IPO of its first SPAC, Axios has learned. The firm is said to be prepping at least two additional SPACs. http://axios.link/9vLq • Bright Lights Acquisition, a SPAC led by Michael Mahan (former CEO of Dick Clark Productions), filed for a $200 million IPO. http://axios.link/qLdT • Global Synergy Acquisition, a tech services-focused SPAC, filed for a $225 million IPO. http://axios.link/mW8Y • Prospector Capital Corp., a tech-focused SPAC led by former Qualcomm execs Derek Aberle and Steve Altman, filed for a $250 million IPO. http://axios.link/AfaB • Rotor Acquisition, a SPAC led by Brian Finn (Nyca Partners), filed for a $200 million IPO. http://axios.link/EO7u • VectoIQ Acquisition II, a smart transportation-focused SPAC led by former GM execs, filed for a $300 million IPO. http://axios.link/Y4Y0 |     | | | | | | Liquidity Events | | • Rent-A-Center (Nasdaq: RCII) agreed to acquire Acima Holdings, a provider of virtual lease-to-own solutions, for $1.65 billion in cash and stock. Sellers include Aries Capital Partners and Arklow Holdings. http://axios.link/lQyq |     | | | | | | More M&A | | • Cognizant (Nasdaq: CTSH) acquired Inawisdom, a London-based business consultancy focused on AI and machine learning. www.cognizant.com 🚑 Servier agreed to buy the cancer business of Cambridge, Mass.-based Agios Pharmaceuticals (Nasdaq: AGIO) for $1.8 upfront in cash and up to $200 million in milestone-based earnouts. http://axios.link/UDMl |     | | | | | | Fundraising | | • Hambro Perks acquired Ombu, a British VC group focused on environmental tech that has seven portfolio companies. http://axios.link/QkZK • Qumra Capital, an Israeli growth equity firm, $260 million for its third fund. http://axios.link/FsgZ |     | | | | | | It's Personnel | | 🚑 Abingworth, a London-based life sciences VC firm, promoted Bali Muralidhar to managing partner. www.abingworth.com |     | | | | | | Final Numbers: Fundraising forecast | | Source: Eaton Partners Pulse Report. Data via online survey of 61 institutional investors 11/30/20-12/10/20. |     | | | | | | A message from Northern Trust | | The wealth planning trifecta | | |  | | | | The trifecta of low interest rates, high exemption amounts and uncertain tax policy future make it a good time to revisit your wealth plan to prepare for an uncertain future. Learn how to take advantage of this window of opportunity from Northern Trust's The Wealth Planning Trifecta report. | | | | ✔️ Thanks for reading Axios Pro Rata! Please ask your friends, colleagues and astronauts to sign up. | | | | Axios thanks our partners for supporting our newsletters.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment