| Trading Breakouts: Riding the Hype in This Insane Market - Analyzing the current market conditions…

- My favorite pattern for long-biased traders…

- And what you can learn from my top students…

Recommended Link

Dear Penny Stock Millionaire, The hot market keeps going — and I’m not the only one trading breakouts in this insanity. Of course, the market will continue to change and my students and I will continue to adapt. It’s all part of a cycle that you need to be prepared for as a trader. Right now, I’m having one of the best trading years that I’ve had in a long time. As of June 30, I’m up over $500K — nearly $300K came from June alone. This is one of the greatest markets I’ve seen in a long time. I don’t see it slowing down anytime soon. The pandemic poses a threat to the economy ... There’s a number of social movements throughout America ... So the penny stock market still has huge potential… That’s why I want to dedicate this post to the patterns that work for me, as well as some highlights from Trading Challenge students. They’re prepared for this madness because they study their butts off, year after year. So, let’s dig into trading breakouts, my favorite patterns, and some student highlights. Current Market Conditions: Trading Breakouts Trading breakouts isn’t my only pattern or strategy right now. But they help make my patterns more effective. My win percentage in June is high because the patterns I play work for me. That’s because I mostly long penny stocks. I used to short sell. And there’s nothing wrong with short selling. But a lot of my haters don’t like my conservative approach to shorting. In fact, the shorts are often why penny stocks break out so much … And aggressive short sellers can get squeezed hard. Too many newbies short anything they think it’s up too much. The problem is that no one knows how high these can go. And as soon as they’re wrong, they keep adding to their positions. Too often it ends in disaster and blown-up accounts. The losses can be devastating. Not worth it if you ask me. There are so many long opportunities in this market — I’m taking advantage of them whenever possible. Recent Trading Breakouts I’ve been trading breakouts — mainly caused by short squeezes — recently. It’s been awesome. I want to show you a few of my favorite plays — most of which I underestimated. That’s OK. What’s great about the way my students and I trade — we’re not swinging for home runs. Instead, we aim for singles and consistency. Over time they add up. I’ve made over $5.5 million in trading profits. And as you grow as a trader, you can potentially scale up. You can apply more knowledge and experience to your trades. Now let’s look at a few examples of trading breakouts from June. Genius Brands International, Inc. (NASDAQ: GNUS)

GNUS chart: 1-year, daily candles — courtesy of StocksToTrade.com This is an awesome trading breakout. GNUS went from under $1 to almost $12 per share over the course of a few weeks. The best part? As these daily breakouts keep going, they provide more opportunities. There’s no need to hold and hope. I just play them as they break out every day. I was actually trading this stock when it was under $1 per share during its breakout back in May. And it continued to shock me as it squeezed more shorts every day. This stock had a great catalyst — news the company was launching a TV network. Who knows if it’s legit. I honestly don’t care. I care about trading breakouts with the right setups, catalysts, and volume. eMagin Corporation (NYSE: EMAN)

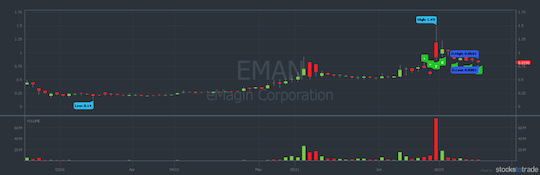

EMAN chart: 1-year, daily candles — courtesy of StocksToTrade.com EMAN was another great breakout ticker that just kept going. Every week it seemed to have consolidation periods before the next inevitable breakout. Again, I don’t buy before the breakout and hope. I wait for the breakout to happen, then play my patterns. I’ll get into my favorite patterns in a bit. But it’s important that you understand to not hold and hope. Remember, these are often scammy companies that make money through toxic financings at the expense of traders and investors. That’s I trade these companies. Usually, I’m in and out of trades in a matter of minutes. Let’s talk about one of my favorite patterns ever — the morning panic dip buy… Recommended Link

Morning Panic The morning panic pattern is one of my favorites. A lot of my top students love it, too. I love having truly dedicated students learning the patterns I trade and teach. It’s important to me that I can help students learn slowly and consistently. Including the morning panic pattern. Trading breakouts is a regular thing in this crazy market. A morning panic is when a stock drops massively right at the market open. The stock may have considerably gapped up in premarket trading. Those who have been in the stock for days or weeks from a low price want to take profits. The selling at the open often creates a considerable price drop. This can be a great place to buy. Sometimes, the stock spikes at the open, then has a big pullback. This can be another good place to get in. But it may not be as much of a panic as a regular dip buy. In my experience, the morning panic has a massive drop. So I look to buy into massive selling for on a large gap-up stock. Then I sell on the way back up. If it doesn’t work, I’m out. I cut losses quickly. That’s rule #1. Let’s look at some of my recent morning panic trades... Morning Panic Examples June was full of morning panics. I had trades with profits of $2,000 and others where I made over $10,000. It all depends on the size of the panic and how fast they bounce back. I’ve learned how to use technical indicators like Level 2, available StocksToTrade, to find where stocks should begin to turn. Sometimes I’m wrong morning panics — it’s part of the game. Anyone who tells you they don’t take losses in the market is a liar. But I constantly work to improve. Now check out some of the best morning panics from June... Innovation Pharmaceuticals (OTC: IPIX)

IPIX chart: 5-day, 1-minute candles — courtesy of StocksToTrade.com This was one of the most classic morning panics I’ve seen in a while. I got into this trade at right near the bottom at 36 cents per share and got out around 39 cents for $2,618. Compare the next few trades and try to find the similarities… Vystar Corporation (OTC: VYST)

VYST chart: 5-day, 1-minute candles — courtesy of StocksToTrade.com VYST panicked pretty hard at the open but definitely didn’t bounce as much as I wanted. I got in at $0.037 and out at 4 cents per share, making $1,125 in profits in minutes. Once you learn these patterns, you see them repeat again and again. But you gotta follow rules and stay disciplined. Digital Locations, Inc. (OTC: DLOC)

DLOC chart: 5-day, 1-minute candles — courtesy of StocksToTrade.com This is one of the craziest OTC runners I’ve seen in a long time. What I don’t show you on the chart is the day before. In the matter of one day — the day before — it went from $0.0057 to 19 per share. It was over a move of over 3,000% in about 30 minutes. I haven’t seen these kinds of OTC moves in a long time, but I’m excited they’re popping up again. Another sign of this INSANE market. Of course, those trades are risky, which is why I took a small position size on the first day I played it. And I wouldn’t have found the stock without StocksToTrade’s Breaking News chat. I played this stock because of the massive dip off of the 35-cent high. After it started really tanking, I bought 25,000 shares around 21 cents and sold around 27 cents for $1,548. Again, I can find the bottom of the move because I’ve studied these patterns for 20+ years. And I teach my students through thousands of video lessons. Now the key question ... did you notice the pattern in these trades? The answer: I aimed for singles on every trade. Sometimes these plays continue to run. But some completely fail. I’d rather consistently hit singles than swing for home runs and miss. Recommended Link

The 2020 Gold Portfolio [FREE]

The new gold bull market is here. The bad news is there’s still a TON of junk out there... Gold bugs are shouting from the rooftops in excitement, but that doesn’t mean you rush out and just buy any gold stock. That’s why we laid out The 2020 Ultimate Gold Portfolio – to dissect the treasure from the trash. And it’s yours - absolutely free. Out of the hundreds of publicly available gold plays in the market today, we’ve hand-selected 5 lucrative gold stocks you can buy right now. | |

Trading Breakouts: Student Highlights My students report killing it in June, too, and they deserve some recognition. They’ve worked their butts off for years. They’re putting their knowledge to use in this wild market. Matt Monaco and Jack Kellogg report exceptional trades in June... Matt’s now up nearly $200K. Most of his gains are from 2020. He just graduated from college. When he first found me, he was struggling with consistency. It took him three years to work his butt off and hit his stride. But now he’s nailing play after play. Jack’s another top student. He’s now up over $600K in career trading profits. Almost $400K is from 2020 alone. These two are living proof that studying, discipline, and dedication really matter. Catch up with these two if you don’t know who these traders are. Here’s my recent post on Matt and here’s my post on Jack. I’m so proud. Now, let’s go over a few of their trades from June 2020. Matthew Monaco Matt’s primarily a long-biased trader like me. While he’s trading listed stocks pretty well now, he specializes in trading breakouts in OTCs. One company Matt traded in June is Transportation and Logistics Systems, Inc. (OTCPK: TLSS). Check it out:

TLSS chart: 1-year, daily candles — courtesy of StocksToTrade.com This OTC runner broke for weeks, and Matt was on top of all the breakouts. Matt’s on track to have a killer 2020 if he stays disciplined and follows my rules. Jack Kellogg Jack’s primarily short biased. I like to mess around with Jack for being a short seller in a market where everything seems to be a long … but he’s still killing it! One of Jack’s favorite patterns is the OTC first red day. It’s popped up a lot of recently. Remember, when a stock runs 100% or more, it’s likely to come back down. And when they run hard, they can come down just as hard. One example from Jack’s first red day trade is on Indivior PLC (OTCPK: INVVY). It was a massive runner in mid-June. Jack caught the first red day after preparing for its crash. Here’s the chart:

INVVY chart: 1-year, daily candles — courtesy of StocksToTrade.com The first red day that Jack played was actually on June 18. You can check out his verified trade on Profit.ly, where he made almost $3,000. I’m so proud Matt, Jack, and all my students nailing plays in this market. Trading Breakouts: Conclusion This market is full of opportunity. With so much economic uncertainty in the U.S., these market conditions could continue ... I hope they do. I also hope you learn more about trading breakouts. My favorite pattern actually happens after the breakout and can be a great way to take advantage of a large price drop. My students like Matt and Jack might not play the same patterns as me. But they’ve studied all my lessons over the years. They’ve worked and studied their butts off for years to become self-sufficient. Here’s a video where I talk with them and another student, Kyle Williams. You can follow these traders on the TWIST (This Week In SteadyTrade) podcast every week. I hope these traders inspire you to study every day. I’m curious … What inspires you to be successful in the stock market? Talk to you tomorrow, Tim Sykes

Editor, Penny Stock Millionaires P.S. In case you missed it earlier... Government advisor Jim Rickards made a shocking election prediction.

One that’s going to blow your mind! During the event Jim also reveals his top investment pick to take advantage of the upcoming volatility… And Nomi Prins reveals an exciting opportunity. One that could hand you 3X your money over the next three months. But you must hurry, time is running out… Because the rebroadcast is coming down Tuesday at midnight. Click here to watch the video before it comes down. |

Post a Comment

0Comments