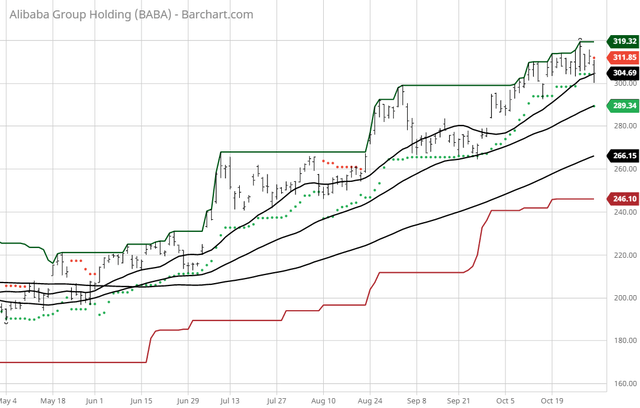

The Barchart Chart of the Day belongs to the Internet commerce company Alibaba (NYSE:BABA). I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent prices appreciation. Since the Trend Spotter signaled a buy on 8/21 the stock gained 14.63%. Alibaba Group Holding Limited, through its subsidiaries, provides online and mobile commerce businesses in the People's Republic of China and internationally. It operates through four segments: Core Commerce, Cloud Computing, Digital Media and Entertainment, and Innovation Initiatives and Others. The company operates Taobao Marketplace, a mobile commerce destination; Tmall, a third-party online and mobile commerce platform for brands and retailers; Alibaba Health Internet platforms for pharmaceutical and healthcare products; Alimama, a monetization platform; 1688.com and Alibaba.com, which are online wholesale marketplaces; AliExpress, a retail marketplace; Lazada, an e-commerce platform; and Tmall Global, an import e-commerce platform. It also operates Lingshoutong, a digital sourcing platform; Cainiao Network logistic services platform; Ele.me, a delivery and local services platform; Koubei, a restaurant and local services guide platform; and Fliggy, an online travel platform. In addition, the company offers pay-for-performance and display marketing services; and Taobao Ad Network and Exchange, a real-time bidding online marketing exchange. Further, it provides elastic computing, database, storage, virtualization network, large-scale computing, security, management and application, big data analytics, and Internet of Things and other services for enterprises; payment and escrow services; and movies, television series, variety shows, animations, and other video content. Additionally, the company operates Youku, an online video platform; Alibaba Pictures and other content platforms that provide online videos, films, live events, news feeds, literature, music, and others; Amap, a mobile digital map, navigation, and real-time traffic information app; DingTalk, a business efficiency app; and Tmall Genie, an AI-powered smart speaker. The company was founded in 1999 and is based in Hangzhou, the People's Republic of China.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. Barchart technical indicators: - 100% technical buy signal

- 76.80+ Weighted Alpha

- 71.58% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 11 new highs and up 3.62% in the last month

- Relative Strength Index 54.01%

- Technical support level at 309.12

- Recently traded at 305.12 with a 50 day moving average of 289.51%.

Fundamental factors: - Market Cap $345 billion

- P/E 48.34

- Revenue expected to grow 37.40% this year and another 26.40% next year

- Earnings estimated to increase 23.80% this year, an additional 27.00% next year and continue to compound at an annual rate of 3.65% for the next 5 years

- Wall Street analysts issued 18 strong buy, 29 buy and 1 hold recommendation on the stock

- The individual investors following the stock on Motley Fool voted 1,158 to 63 that the stock will beat the market

- 394,820 investors are monitoring the stock on Seeking Alpha

The #1 strategy that could have sent you 20 years with no losing years… Trophy Trades have already proven to have the potential to earn you as much as $13.5 million dollars… But it’s never been released to the public before - now that changes for you

More on this symbol: |

Post a Comment

0Comments