| | Andy Snyder

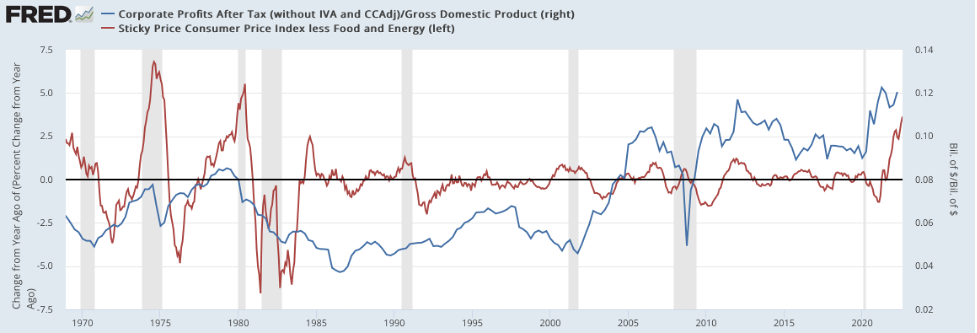

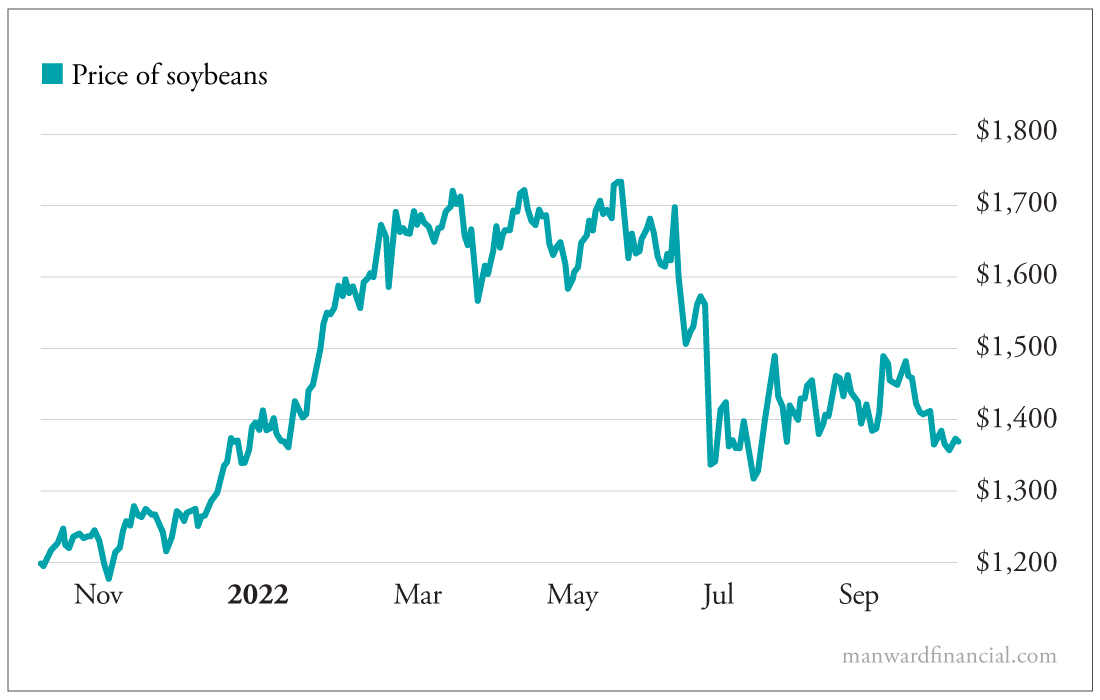

Founder | There's an opportunity growing in this nasty market. With each tick lower, it gets bigger. You know we're not in "buy the dip" mode. The world has gotten itself into quite a financial pickle - one that could flatline markets for the next few years. But not every company is suffering. Some are taking full advantage of this high-inflation market. We'll see which ones they are as some pivotal earnings reports come out over the next few weeks. [Is It Crazy to Want a Carefree Retirement? Watch Bestselling Financial Author and World-Famous Income Expert Marc Lichtenfeld Show You How...] Truth Hurts You've probably heard the term "greedflation." It's a certain progressive politician's favorite way of dismissing the upward pressure on prices. It's not his fault for printing too much cash and using it to buy votes. No way. Instead, inflation is the greedy man's way of making more. It's a bogus idea. But there's truth in even the craziest conspiracies. Take a look at the chart below. It shows the inflation rate (in the form of CPI) and corporate profits. It also shows quite an opportunity... Look back to the 1970s. Inflation, as you know, soared. Companies made more money too. But profits hardly kept up with rising prices. In fact, for nearly the entire period covered in the chart, inflation chipped away at profits. That changed in the early 2000s... when the deflationary effect of the internet muscled its way into the economy. With monstrous outlets offering global price discovery (think Amazon and eBay), the prices of goods stayed flat. For the first time in ages, profits soared faster than prices. Despite so many fears to the contrary, the trend has not changed. Over the last year, we've heard a familiar refrain from CEOs: "We raised prices, and customers didn't complain." That's what happens when there's $5 trillion in free money floating around. But as we enter a critical earnings season, most pundits believe the trend is about to change. They believe inflation is about to slash corporate profit margins. They're right, mostly... but not entirely. Let's think back to our days in Econ 101. You may recall the notion that prices are "sticky." It's why profits continued to rise in the '70s despite hugely volatile inflation. Prices tend to rise quickly, and they rarely fall. Once a box of cereal sells for $4... it rarely goes back to $3. Look at this chart... Companies that were forced to raise their prices when lumber soared are seeing quite a nice profit margin today. Same thing with soybeans. Prices there have fallen by 25%. It's all good news for the companies that raised their prices "without a complaint from customers." Settling Out We met with a local business owner recently. He's in the commodity game and doesn't have much control over his prices. "When costs were soaring, we couldn't raise prices fast enough," he told us. "We were swamped with business, but the profits weren't there." "Now, though," he continued, "our prices are still high, but costs are down. We're finally making money. It's contrary to what everyone is saying." It's a trend that's likely to be much in evidence over the next few weeks. Earnings expectations are bleak. Many are overdone to the downside. In fact, there's blood in the streets. But for companies that depend on the commodities markets for their spreads... it's time to buy. Profit margins are thick... thicker than they have been in 18 months. Short-term traders will have a nice opportunity as the numbers bear out our idea. Be well, Andy Editor's Note: It's not just the commodities market that's giving investors a solid chance for profits... Andy's uncovered an exciting tech breakthrough that could be 20X bigger than the internet boom. He calls it "XRI," and it could spark the greatest wealth creation event of this decade. To get all the details, click here now. Want more content like this? | | | | | Andy Snyder | Founder Andy Snyder is the founder of Manward Press, the nation's premier source of unfiltered, unorthodox views on money and what it means for a free society. An American author, investor and serial entrepreneur, Andy cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. He's been a keynote speaker and panelist at events all over the world, from four-star ballrooms to Capitol hearing rooms. | | | |

No comments:

Post a Comment