| | | | | | | Presented By OurCrowd | | | | Axios Markets | | By Kate Marino ·Nov 01, 2021 | | ☀️ Good morning, and welcome to November! 🎃 I hope those of you with little trick-or-treaters had a blast. - Start your day with this: Hands down the best Halloween costumes of 2021. 🐶

⏳ Today's Smart Brevity count is 1,162 words, 4.5 minutes. | | | | | | 1 big thing: Double-digit inflation in Brazil |  | | | Illustration: Annelise Capossela/Axios | | | | In the worldwide campaign to prevent runaway inflation, Brazil appears to be losing. Driving the news: The nation's central bank just raised its key overnight interest rate by 1.5 percentage points — and expects to do so again in December. That would take it to an eye-popping 9.25%. - Here's why: Inflation there is running hot, at a rate of over 10% this year.

Why it matters: Brazil is the largest economy in Latin America. And the origins and implications of its financial plight mirror those of many of its neighbors. - Amid rising prices across the region — though not to the same degree as Brazil — countries like Chile, Mexico and Peru have all hiked interest rates numerous times this year.

What's happening: As in most countries around the world, Brazil's energy and food commodity costs are up substantially. On top of that, extreme drought has jacked up the price of widely used hydropower. - A weak currency makes imports increasingly expensive (the Brazilian real has declined 14% against the dollar since June).

- And most critically, the government's social spending plans are expected to bust through a once-sacrosanct fiscal spending cap. That'll add fuel to the fire of rising prices and put more pressure on the central bank to offset with even higher rates, Jason DeVito, emerging markets portfolio manager at Federated Hermes, tells Axios.

State of play: The Brazilian government's pandemic assistance program is about to end — but many of its citizens remain in poverty. - As such, President Jair Bolsonaro recently announced a plan to expand the pandemic-era program — but how it will be paid for has led to government chaos, including the resignations of four high-ranking officials in the Ministry of Economy.

By the numbers: Markets are nervous. Alongside the real's tumble, Brazil's benchmark stock index is down 10% since Oct. 18, around the time Bolsonaro pledged the new round of spending. - "Once that spending cap breaks, it means the fiscal anchor is gone. It's like a dam breaking," says Pradeep Kumar, emerging markets portfolio manager at PGIM Fixed Income.

- Given the higher interest rate backdrop, Brazilian bank Itau Unibanco last week cut the country's 2022 GDP forecast to negative 0.5%.

Where it stands: Bolsonaro — the right-wing populist — is up for election next year. - The left-wing former president Luiz Inácio Lula da Silva is hinting at a run — and both men are expected to promise even more sweeping spending to bolster their popularity, Kumar says.

The bottom line: This and other elections across South America over the next year will show the degree to which voters gravitate to promises of more government spending — and put central bankers on high alert. |     | | | | | | 2. Catch up quick | | Barclays CEO Jes Staley is stepping down after U.K. financial regulators found that he had a commercial relationship with Jeffrey Epstein. (Axios) China's manufacturing production contracted more than expected in October, while prices continue to rise, leading economists to warn of signs of stagflation. (CNBC) Coca-Cola is expected to buy the 70% of BodyArmor that it doesn't already own, in a deal valuing the sports drink brand at $8 billion. BodyArmor founders and investors include professional athletes and the estate of Kobe Bryant. (WSJ) American Airlines canceled at least 1,200 flights, or 12% of its schedule, this weekend. The airline blamed weather problems and staffing shortages for the disruptions. (NYT) |     | | | | | | 3. A fresh chart showing wages are ⬆️ |  Data: Employment Cost Index, via U.S. Bureau of Labor Statistics; Chart: Axios Visuals One of the government's most reliable gauges of wage growth, the Employment Cost Index, surged during the third quarter. Why it matters: Higher pay is good for workers. And when it comes to lower-income sectors it tends to circulate back into the economy. - But increasing labor costs can also weigh on corporate profits, which we've been hearing a lot about throughout this Q3 earnings season (more on that below).

Details: On average, wages and salaries grew 1.5% during Q3 alone — a figure which, if annualized, would amount to 6%. Go deeper: The aircraft manufacturing industry saw the biggest jump, at 7%. - That dovetails with recent upticks in new orders for both defense and nondefense aircraft and parts, as cataloged by the Census Bureau.

- Retail, finance and nursing and residential care facilities also grew faster than the average.

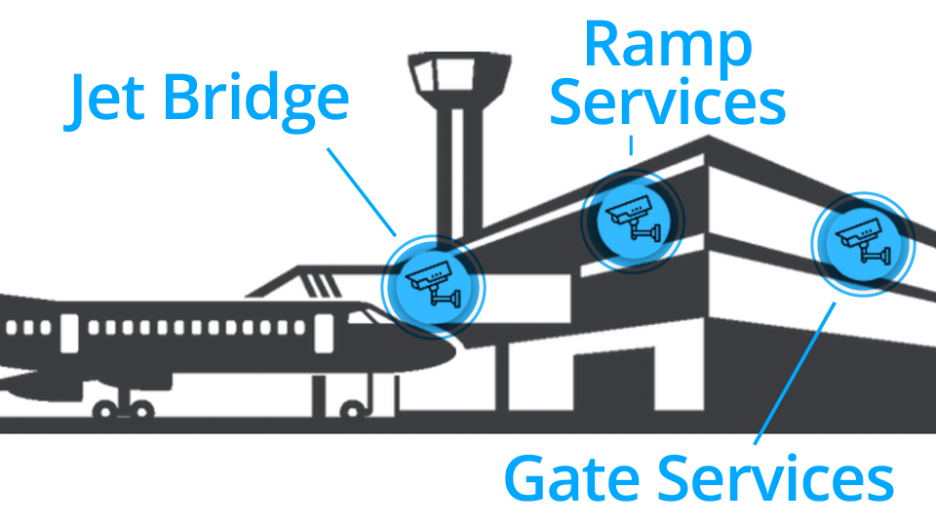

|     | | | | | | A message from OurCrowd | | The delay-reducing solution designed to save airlines billions | | |  | | | | OurCrowd offers an opportunity to invest in IntellAct, the machine learning solution that helps reduce costly airline turnaround delays. IntellAct has already been deployed in major international airlines, streamlining travel for 100M+ passengers a year. See the possibility of IntellAct. | | | | | | 4. Big Tech's reshuffle |  Data: FactSet; Chart: Jared Whalen/Axios Last week may go down in the Big Tech history books. - Tesla displaced Facebook — which unveiled a new name, Meta Platforms — in the S&P 500's top five companies by market cap. And Microsoft overtook Apple as the world's most valuable company, for the first time in over a year.

Catch up quick: Earnings reports for Big Tech's top five broke across a few dominant themes. - Cloud and services outperformed, driving Alphabet and Microsoft to new heights. But supply chain and labor costs dragged down Apple and Amazon's physical businesses, weighing on their stock prices after pre-earnings bumps.

Why it matters: These trends set the tone for the next few quarters, as many of the dynamics are unlikely to change in the short term. - As these giants go, so goes the market. The five largest companies in the S&P — Microsoft, Apple, Alphabet, Amazon, and now Tesla — make up 23.4% of the index as of Friday (as recently as year-end 2019, the top five S&P constituents were just 17% of the index).

What they're saying: "It's really a story of two different types of companies," says Tony Roth, CIO at Wilmington Trust. - "Service providers' input costs are not rising significantly. … On the other hand, [for Apple and Amazon], it's all stuff and people. And stuff and people bring lots of challenges as it relates to price pressure," he says.

Reality check: Last week's tech stock laggards still made unfathomable sums of money. And the supply chain problems may start to iron themselves out sometime next year. The bottom line: That kept valuations from falling further — and helped the S&P and Nasdaq surge to new record highs by Friday's close. |     | | |  | | | | If you like this newsletter, your friends may, too! Refer your friends and get free Axios swag when they sign up. | | | | | | | | 5. What we're watching this week |  | | | Illustration: Eniola Odetunde/Axios | | | | Jerome Powell takes the stage again Wednesday afternoon for the Federal Open Market Committee's press conference. The big picture: There will be details of the upcoming taper, of course (boring!) — but we all want to hear more about the Fed's evolving views on rate liftoff. - Over the last month or two as inflation trends have gotten a little stickier, markets like short-term Treasuries and fed funds futures have begun pricing in a rate hike next year.

Powell may (or may not) wish he had an inkling of Friday's employment numbers when he addresses the nation — as those figures will show whether the persistent labor gridlock is starting to loosen. By the numbers: Consensus estimates are for 437,500 new jobs created in October, according to FactSet, up from 194,000 the month before. - The last jobs report, for September, showed that labor force participation ticked down — at a time when only half the pandemic-induced reduction to the labor force has been recouped.

- I'll be zeroing in on the participation rate for women, which has cratered compared to men, likely due to care-taking responsibilities.

|     | | | | | | A message from OurCrowd | | This software-only solution reduces costly airline delays | | |  | | | | Existing airport CCTV systems capture valuable data. IntellAct processes it with machine learning to find the causes of costly ground delays. IntellAct aims to reduce overall turnaround time by 15%, saving the airline industry billions annually. See the possibility of IntellAct. | | | | 📫 Thanks for reading. If this email was forwarded to you, click here to sign up for Markets or any of Axios' other free newsletters. |  | | It'll help you deliver employee communications more effectively. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment