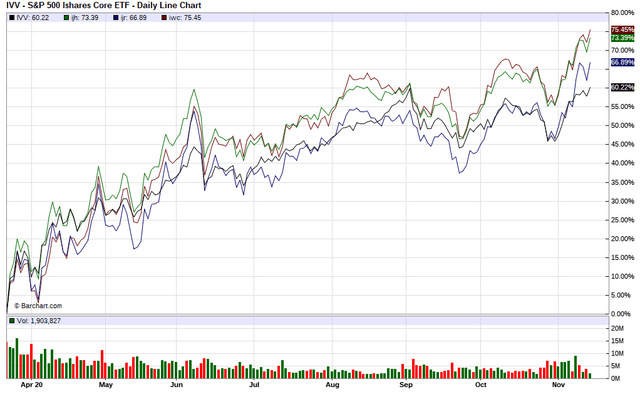

Today's Barchart Chart of the Day is a little different. Instead of finding a stock with the best upward price appreciation, I thought it might be time to revisit the old saying that "In the long run Small Caps outperform Large Caps". When I began investing almost almost every broker would pull out a charts prepared by Ibbotson that showed that since the Great Depression Small Caps always out performed Large Caps and every broker repeated that like it was proven fact. I decided to see if that dogma was still true. I decided to compare the returns of the S&P 500 Large Cap ETF (NYSEARCA:IVV), the S&P 400 Mid Cap ETF (NYSEARCA:IJH), the S&P 600 Small Cap ETF (NYSEARCA:IJR) and the Micro Cap ETF (NYSEARCA:IWC) from the most recent Market bottom at 3/23 till today and the dogma still seems to hold true.

As you can see over that period the IVV returned 60.22% while the IJH returned 73.29%, the IJR 66.89% and the IWC returned 75.45%. Additional information: S&P 500 ETF (IVV) - 100% technical buy signals

- 3 new highs and up 2.10% in the last month

- 19.90+ Weighted Alpha

- 15.42% gain in the last year

S&P Mid Cap 400 ETF (IJH) - 100% technical buy signals

- 7 new highs and up 6.11% in the last month

- 14.70+ Weighted Alpha

- 6.11% gain in the last year

S&P 600 Small Cap ETF (IJR) - 100% technical buy signals

- 8 new highs and up 8.07% in the last month

- 11.60+ Weighted Alpha

- 1.48% gain in the last year

Micro Cap ETF (IWC) - 100% technical buy signals

- 4 new highs and up 4.74% in the last month

- 21.90+ Weighted Alpha

- 12.80% gain in the last year

|

No comments:

Post a Comment