2008 Fears Are Mounting

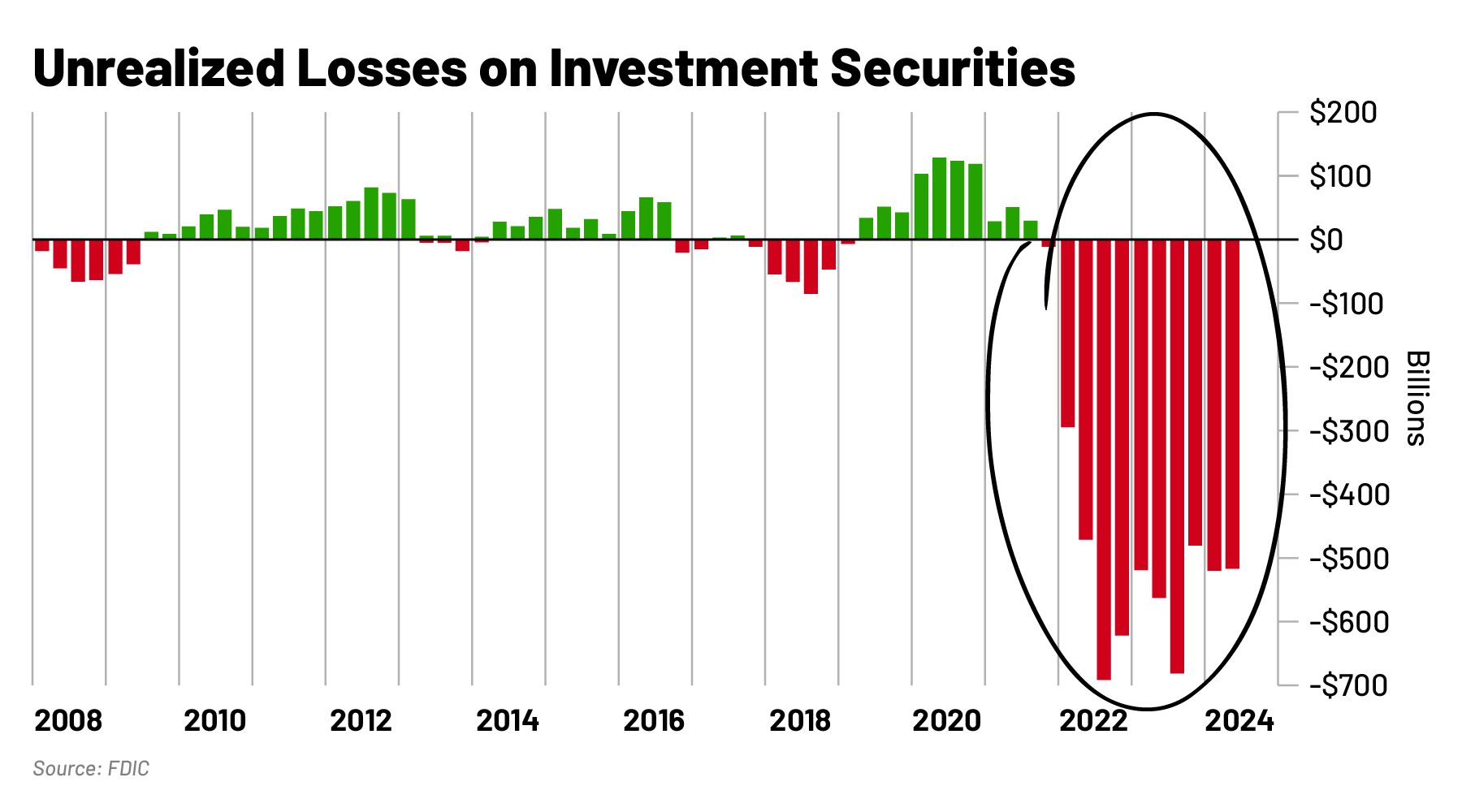

In spite of record stock gains, the ghosts of 2008 are rattling their chains this week. And as I explain here, our country's current financial position has more in common with the Great Recession than you may think – especially when it comes to U.S. stocks. The FDIC recently released new data showing that unrealized losses on investment securities for US banks reached $512.9 billion in Q2 2024:  This is 7 times higher than at the peak in 2008. Meaning that should those banks be forced to suddenly realize those losses – and sell billions worth of losing investments... They'd be in dire straits, the likes of which we haven't seen since the Great Recession. So you can see why I take a few minutes here to talk through what our EXACT strategy would be in the Power Gauge should we see a "repeat" of the financial crisis. Now, please understand... It took more – much more – than unrealized losses to create the perfect storm banks suffered in 2008. That's simply not the specific kind of market event I see hitting U.S. stocks in the next 90 days. (Here's the storm I DO see coming.) However, as millions of investors celebrate the rate cut as a "cure-all" to all of our market woes, this is a stock warning you must hear... We are not out of the woods yet. In the aftermath of 2008, every investor in America promised themselves they'd be smarter next time. That they'd act faster. That they'd see the signs – and have a plan in place to protect themselves. If you made yourself this same promise, you must see my stock warning before tomorrow. Regards, Marc Chaikin

Founder, Chaikin Analytics P.S. Because you follow my work, you're the first to know... The full, unedited replay comes offline tomorrow. So, if you still haven't seen my prediction for exactly what's coming to U.S. stocks before the end of this tumultuous election year... Please click here to watch before this disappears for good. |

No comments:

Post a Comment