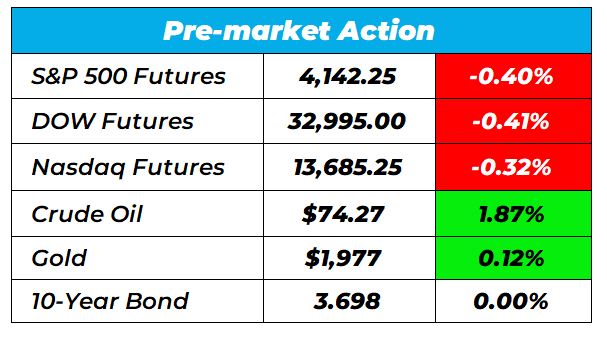

| Good morning Wake-up Watchlisters! While you're sipping coffee you'll see stock futures dipped again on Wednesday, continuing a downward trend on Wall Street after significant losses on Tuesday, with both the S&P 500 and Nasdaq 100 declining over 1%. Progress in US debt negotiations was limited, raising concerns about a potential default in the world's largest economy. Stocks are currently facing multiple challenges, including apprehension regarding the US debt ceiling, China's economic recovery, and worries about persistent inflation that may lead to prolonged higher interest rates. With the markets down, it's crucial to focus on value stocks that have a chance to go up and withstand headwinds. Right now our Head Fundamental Tactician Karim Rahemtulla is pounding the table on "The Last Great Value Stock." It's currently trading at under $2, and it recently got a huge upgrade from Jefferies analyst Chloe Lemarie to over 20% the current price. To top it off, its gains are already 100% above where they were last September. Click here to unlock "The Last Great Value Stock." Here's a look at the top-moving stocks this morning. Palo Alto Networks (Nasdaq: PANW) Palo Alto Networks is up 4.88% premarket after the security software maker reported quarterly earnings of $1.10 per share, surpassing the Zacks Consensus Estimate of $0.92 per share and showing significant growth compared to the previous year's earnings of $0.60 per share. This represents an earnings surprise of 19.57%. In the previous quarter, the company exceeded expectations by delivering earnings of $1.05 per share compared to the estimated $0.78 per share, resulting in a surprise of 34.62%. In The War Room, our Lead Trading Tactician Bryan Bottarelli noticed PANW had rallied 13%, 11% and 11% over its last three earnings reports. So he got positioned on the stock yesterday and closed for a winning trade in less than 1 trading day. Click here to learn more about how overnight trading works. Agilent Technologies (NYSE: A) Agilent Technologies is down 9.09% premarket after the scientific instrument maker reported quarterly earnings of $1.27 per share, meeting the Zacks Consensus Estimate and showing a slight increase compared to the previous year's earnings of $1.13 per share. In the previous quarter, the company exceeded expectations by delivering earnings of $1.37 per share compared to the estimated $1.31 per share, resulting in a surprise of 4.58%. While several stocks are down right now, it's vital to adjust and focus on a smaller group of stocks that actually have a chance of doing well. Our Lead Technical Tactician Nate Bear mentioned one of those stocks in yesterday's Trade of the Day. Click here to see how you could trade alongside Nate as part of his mission to turn a $37,000 into $1 million in verified trading profits. |

No comments:

Post a Comment