| We'll Miss You... Unless You CLICK HERE Clicking on links is the only way to let us know you're reading. It's simple: If you don't click any links, you'll soon lose access to Manward Financial Digest. Please CLICK HERE to ensure your subscription continues uninterrupted. | | |  | | Andy Snyder

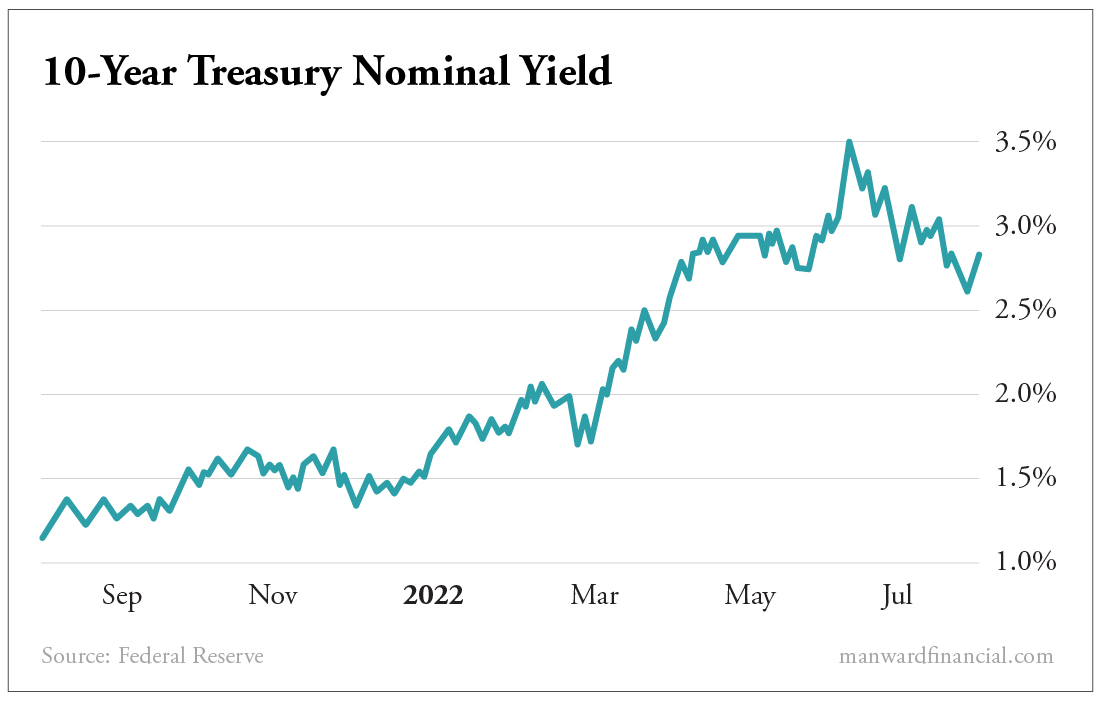

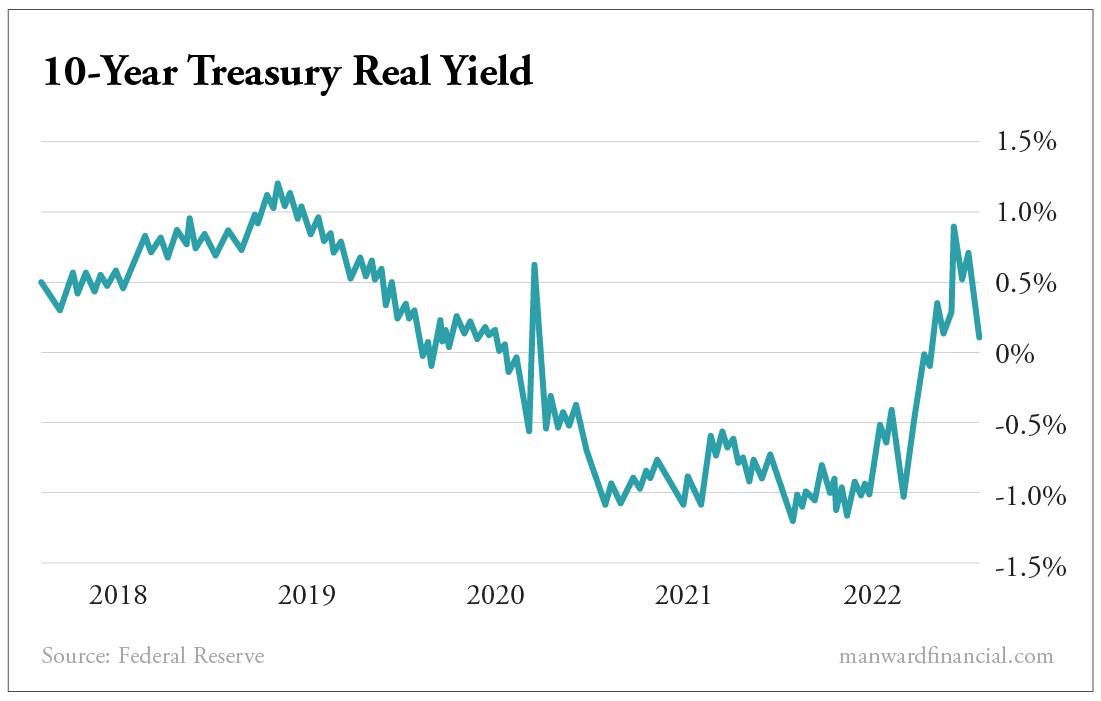

Founder | The market is making a big mistake, and one savvy company is eager to take advantage of it. It brings us back to an old friend... and a big opportunity. It's as if the house blew up with our hero in it. There's no way he could have survived, we figure. The fire is too hot, and the carnage is too great. Roll the credits, he's a goner. But... wait. There he is. And he saved the dog too! Buybacks are back. [Wall Street FEEDING FRENZY on 5G SuperStock! Find Out Here.] Free Money Apple (AAPL) announced on Monday that it is diving into the bond market to borrow another $5.5 billion. It doesn't need the cash. It's got more than $200 billion on its books. But the opportunity is too grand to pass up. It'll borrow the cash at ultra-cheap rates and hand it right back to shareholders in the form of dividends and share buybacks. That's the luxury of having a top-rated credit score. A AAA bond rating gets a company deals its investors would have no shot at getting on their own. It's the same sort of interest rate arbitrage that pushed the stock market to record highs and stirred the bubble that made Jay Powell's hair turn gray. "But wait a second, Andy," we can hear our savvy readers saying. "Hasn't the Fed raised rates to stop this sort of thing from happening?" This is where the news isn't so good. It's part of the market's big mistake... and our big opportunity. Troubling Charts If you've been tracking interest rates, you know the yield on the 10-year Treasury has slipped in recent weeks. Despite the Federal Reserve raising its key lending rate by 250 basis points (one of the most aggressive pushes... ever), the benchmark Treasury has risen by only about 100 points this year. There are all sorts of reasons for this odd trend - the current recession being near the top of the list. But it's the situation with real yields that tells the whole story. They've plunged... and virtually nobody (but Apple?) has caught on. This chart will drive the Fed insane. After spending years in negative territory before going positive this spring, real yields (the figure we get when we subtract inflation from the printed - or nominal - yield) almost crossed back under the breakeven line once again on Monday... the same day Apple made its announcement. It shows that - despite immense pressure from the Federal Reserve - money remains dirt cheap... and is actually getting cheaper. And when money is dirt cheap, stock prices surge. Soaring Stocks With real rates flirting with negative territory, money has no choice but to chase speculative action. That's why stocks soared in July. Real yields plunged. But here's the thing. It's what everybody is missing. The "real" real yield is much, much lower than the figure in that chart. Get this... the inflation figure used in the calculation above is just 2.8% - a fraction of today's rate. It's that low because it represents the market's expected rate of price increases over the next 10 years. It's a big vote of confidence for the Federal Reserve. It shows the market believes inflation pressure will return to normal relatively soon... and will average just above long-term highs for the full decade. It's insanely wrong. Riddle me this... How do we get from 9% inflation to an average of 2.3%? A couple of things would have to happen. First, we would have to see a quick dip in today's inflation rate - an unlikely scenario given the rash of recent bullish earnings reports. Second... to get an average of 2.3% after more than a year of price hikes running close to double digits, we would have to see a sustained run below 2.3%. It's simple math. And it's not going to happen. This is key. The number being used to calculate real yields is way too small. Most likely, we should be subtracting 4% or even 5% from today's nominal 10-year yield to calculate the true return we'd see on our money. And if that's the case, real yields are actually lower (far lower!) than they were at the height of the speculative bull market. Again, it's hellish news for Powell and the Fed. And until they figure out what to do about it, it's grand news for investors in speculative assets like stocks, crypto and everything else that has soared over the past five years. Apple figured it out. It's borrowing like crazy to take advantage of it. This math changes the game. If the Fed wants to stop it... it's got some market crashing to do. We'll have more on what it all means and how to trade it later this week during our "town hall" meeting with Alpha Money Flow and Venture Fortunes subscribers. Be well, Andy Want more content like this? | | | | | Andy Snyder | Founder Andy Snyder is the founder of Manward Press, the nation's premier source of unfiltered, unorthodox views on money and what it means for a free society. An American author, investor and serial entrepreneur, Andy cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. He's been a keynote speaker and panelist at events all over the world, from four-star ballrooms to Capitol hearing rooms. | | | |

No comments:

Post a Comment