| | | | | | | Presented By OurCrowd | | | | Axios Markets | | By Emily Peck and Matt Phillips · Jun 02, 2022 | | ☕️ Good morning! It's Emily, and I'm sitting down for my first cup of coffee. I've always believed that I need coffee to live, in some vague metaphoric sense. But then yesterday, Axios' Tina Reed reported on a study that found coffee drinkers are less likely to die (at least for some amount of time). - Today, Kate Marino checks in on the Infowars bankruptcy, I take a look back on Sheryl Sandberg's legacy of corporate feminism and Matt has an update on the latest from the manufacturing sector. It's all happening!

Today's newsletter, edited by Kate, is 1,151 words, 4.5 minutes. | | | | | | 1 big thing: Infowars' bankruptcy law shell game |  | | | Illustration: Annelise Capossela/Axios | | | | The Texas bankruptcy of entities linked to conspiracy theorist Alex Jones' Infowars empire could set a new precedent for how companies can — or can't — wield the bankruptcy court against their litigation foes, Axios' Kate Marino writes. Context: It's not uncommon for companies to file for bankruptcy as a way to consolidate and settle onerous litigation damages (think Purdue Pharma's opioid liabilities, and the wildfire-related claims against PG&E). Why it matters: Still, Infowars' April bankruptcy — filed by three corporate entities related to Alex Jones and the publication — seeks to use a new section of the law in a way that could break through previously understood boundaries of what the bankruptcy code is intended to accomplish. - The litigation that Jones seeks to deal with is particularly timely and controversial. The claims are being brought by Sandy Hook families against Jones for his calling America's most deadly school shooting a hoax — putting the families on the receiving end of harassment by Jones' followers.

The impact: The Justice Department is seeking to dismiss the bankruptcy case altogether. In April, its bankruptcy watchdog wrote that "the strategy employed here ... is a novel and dangerous tactic that is abusive and undermines the integrity of the bankruptcy system." Meanwhile, the key claimants are in the process of dismissing the bankrupt entities from their lawsuits, with the goal of freeing themselves from the bankruptcy case so they can continue to seek damages from Jones himself. State of play: Jones was found liable in multiple defamation lawsuits brought by the Sandy Hook families against him and his companies. The damages trial was set to go forward when the three small Jones-affiliated companies filed for Chapter 11 bankruptcy, using a relatively new "subchapter" meant to help struggling small businesses reorganize rather than face liquidation. - This is where it gets technical ... The so-called subchapter V offers a streamlined process. There are no creditors committees with reams of costly advisers, and — crucially — creditors (in this case, the Sandy Hook claimants) don't get to vote to accept or reject the bankruptcy deal.

So how's this different from Purdue, PG&E, and the like? - First off, those others didn't use subchapter V. Jones chose to hive off some smaller entities and file those for bankruptcy, rather than filing personally or putting the main operating company that holds his business in bankruptcy. As such, he utilized the new small-biz subchapter and the lack of creditor rights that comes with it.

- Purdue and PG&E may have used the bankruptcy process as a way to deal with sprawling litigation claims — but in regular Chapter 11, they ultimately had to come to a deal that claimants would vote to accept.

- And critics of Jones' strategy point out another wrinkle: The law requires the companies that file for bankruptcy to be "engaged in business activities" — which the bankrupt Infowars entities arguably are not.

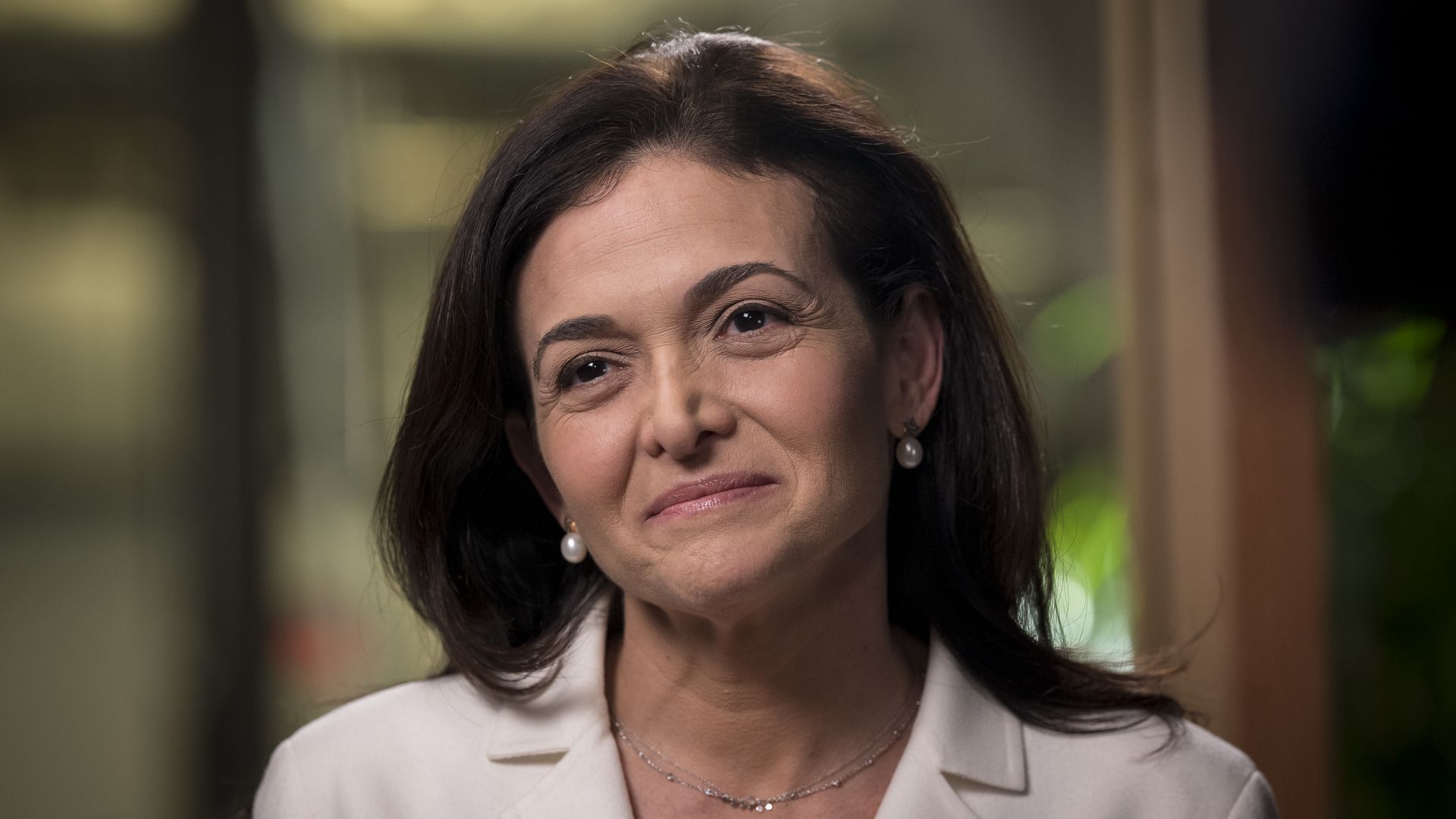

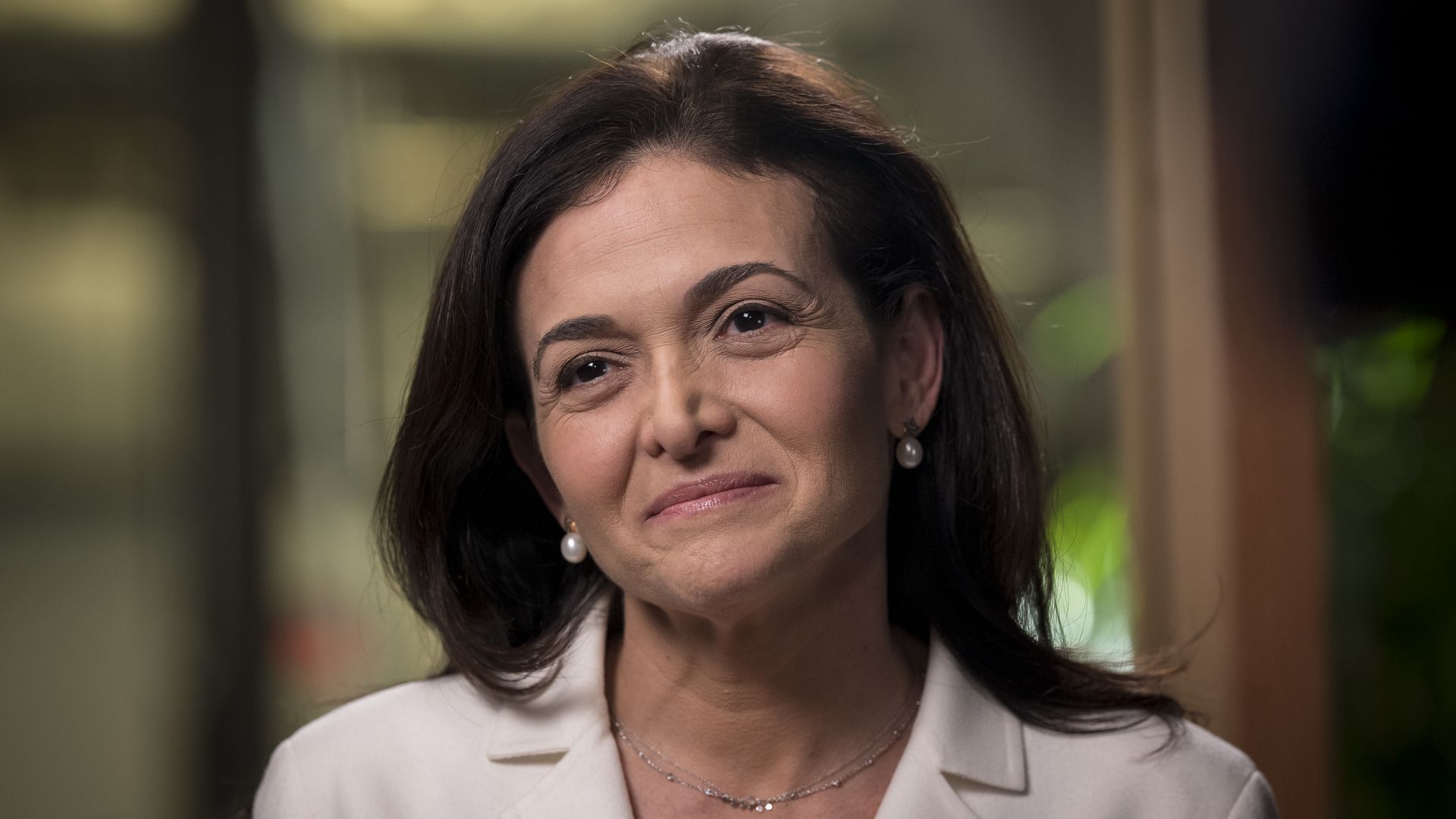

Read the full story. |     | | | | | | 2. Catch up quick | | 🛢 Saudi Arabia is reportedly poised to pump more oil. (FT) ⚠️ Russia misses a key payment as it teeters on default. (Reuters) 💸 Biden cancels student debt for borrowers defrauded by Corinthian College. (Axios) |     | | | | | | 3. End of an era |  | | | Sandberg in 2019. Photo: Bloomberg via Getty Images | | | | Sheryl Sandberg's departure from Facebook marks the end of an era for a certain kind of corporate feminism, which the 52-year-old didn't invent but absolutely launched into the stratosphere with her 2014 book "Lean In," Emily writes. Why it matters: This is a moment worth marking. Sandberg started a conversation about women in the workplace more than a decade ago that's ongoing and felt impactful — many more employers offer the kind of benefits, like paid leave, she pushed — yet in so many ways, the situation for women in the workplace hasn't much changed. - The pandemic highlighted the fact that women with families could "Lean In" all they wanted, but without reliable child care, there was only so far they could go.

- One of Sandberg's key data points: The number of women in the C-suite has increased over the years, but still only 6.4% of CEOs at S&P 500 companies are women.

Driving the news: In a Facebook post yesterday, Sandberg said she was stepping down from her role as chief operating officer at the company after 14 years. Flashback: Back in 2010, Sandberg electrified many women with a Ted Talk called "Why we have too few women leaders." - Her advice — to take a seat at the table, to be ambitious — set the stage for what you might call the Girl Boss era, a time when merely being a woman CEO was considered progress. (Theranos founder Elizabeth Holmes killed that notion with fire.)

Context: Sandberg's caught a lot of flak for her book since it came out. Some argued it missed systemic issues that women can't simply solve by sitting at the table. - She's acknowledged the criticism and made many of these issues a focus at her Lean In Foundation, a women's advocacy group, broadening out her lens to keep pace with the times — issuing reports focused on women of color, for example.

Keep reading. Go deeper: Axios interview: Sheryl Sandberg on her future |     | | | | | | A message from OurCrowd | | Explore the exclusive world of private market investing | | |  | | | | At OurCrowd, you can discover innovative tech startups that are unavailable in the public market. OurCrowd has vetted over 16,000 startups and selected the top~ 2% to offer its members for investment. Experience private market potential. | | | | | | 4. Factory sector shrugs off rate hikes |  Data: FactSet; Chart: Axios Visuals American factories are still in expansion mode, as clients continue to backfill giant holes in their inventories left by COVID-related supply chain snarls, Matt writes. Why it matters: A manufacturing sector in strong health means a recession is not imminent, despite the Fed's efforts to slow the economy with rate hikes this year. Driving the news: The Institute for Supply Management Purchasing Managers' Index for May was stronger than expected, the group reported yesterday. - The index, one of the most closely watched leading indicators of the health of the U.S. economy, came in at 56.1, besting Wall Street economists' expectations of around 54.5.

- Any number above 50 indicates expansion, while numbers below 50 show shrinkage.

Yes, but: Manufacturing employment actually contracted in May, the data show, with the ISM's manufacturing employment subindex slipping to 49.6, suggesting the Fed's efforts to tap the economic brakes are having some impact. |     | | |  | | | | If you like this newsletter, your friends may, too! Refer your friends and get free Axios swag when they sign up. | | | | | | | | 5. New "quits" hot spots |  Data: FRED; Chart: Axios Visuals The quitting bonanza among leisure and hospitality workers that helped define the "Great Resignation" is starting to cool. It's heating up in other industries, Axios' Courtenay Brown writes. What's going on: The new quitting hot spots are both tied to the housing market, where job openings rose to or near record highs. By the numbers: The quits rate in the real estate sector surged more than any other industry, from 1.9% to 3.5% in April, the highest in 18 years. - In March, construction was the industry that saw the biggest jump in quitters, by a full percentage point, to a record 3.3% (before backing off in April).

- The leisure and hospitality sector quits rate is still historically high, but it fell to 5.7% from 5.2% in March — the biggest monthly drop since March 2020.

The bottom line: "There are indications that the epicenters of quitting are shifting," Indeed's Nick Bunker says. |     | | | | | | A message from OurCrowd | | The unicorns — startups valued at $1B — are out there | | |  | | | | Looking for the next unicorn? OurCrowd has invested in 300+ companies to date, 21 of them unicorns with at least a $1B valuation. With a total of $1.8B investment dollars committed, 51 OurCrowd investment companies have already had IPO-exits or been acquired. Search for your unicorn at OurCrowd. | | |  | It's called Smart Brevity®. Over 200 orgs use it — in a tool called Axios HQ — to drive productivity with clearer workplace communications. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment