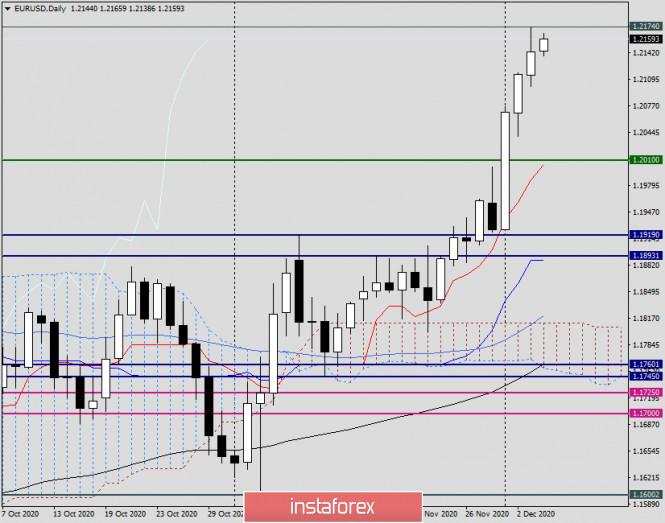

| Analysis and forecast for EUR/USD on December 4, 2020 2020-12-04 Traditionally, the most important data on the US labor market is released on the first Friday of the new month. Today's Friday will not be an exception, and at 14:30 London time, American labor reports will be issued. According to the consensus forecast, it is expected that the unemployment rate will drop to 6.8% (previous rate 6.9%), change in the number employed in non-agricultural sectors of the economy will be $ 469 thousand (the previous figure is 638 thousand) and the increase in the average hourly wage will remain the same as 0.1%, which was shown a month earlier. These expectations cannot be considered too high, but rather the opposite. The only question is whether unemployment will decrease by 0.1%. This will become known after the release of labor statistics, which will show the pace at which the world's leading economy is recovering from the consequences of the COVID-19 pandemic. However, given that the daily number of coronavirus infections in the United States remains at a fairly high level, conclusions about the recovery of the American economy or its absence may be premature. If we develop the topic of COVID-19, the World Health Organization (WHO) has slightly changed its rhetoric. Let me remind you that while the WHO previously considered vaccination to be the only way to combat coronavirus, it now recommends more thorough contact tracking of infected people, stricter compliance with quarantine measures, and more extensive testing of the population. In principle, there is nothing radically new in this statement, and vaccination is still the main factor in the fight against the COVID-19 pandemic. Daily

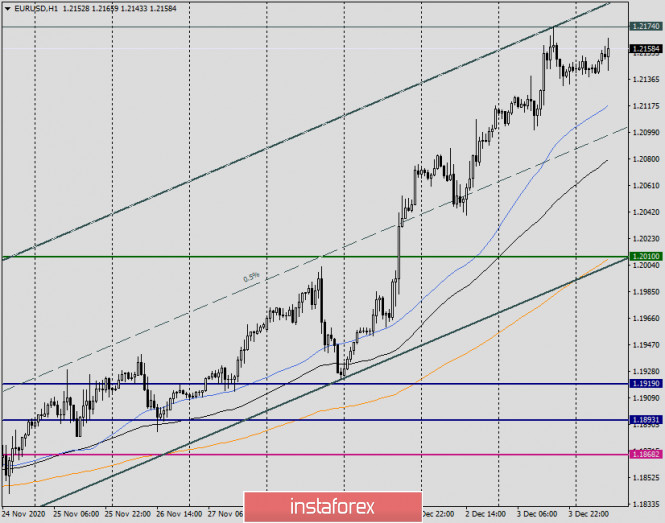

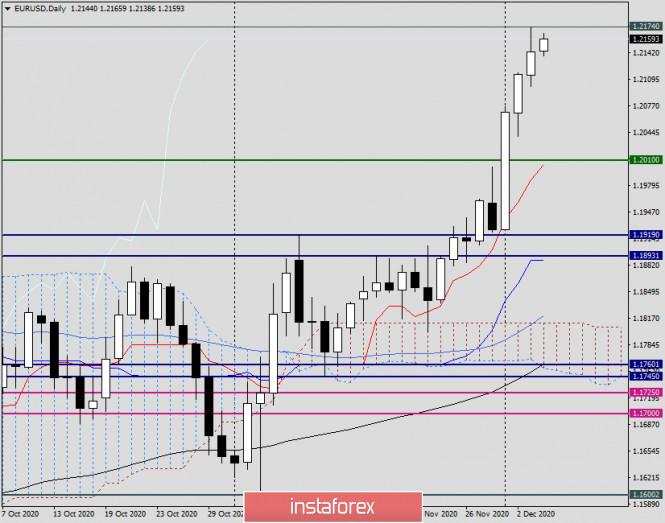

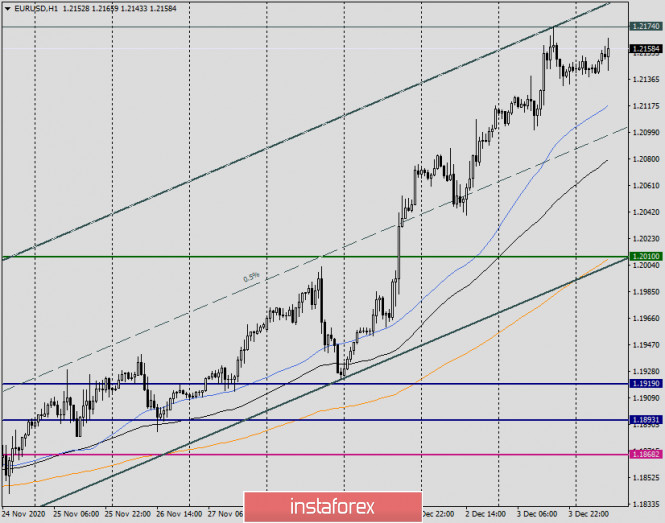

As for market sentiment, the global financial markets are still dominated by cautious optimism based on the imminent introduction of tested vaccines, as well as expectations of the adoption of a stimulus package for the world's leading economy. Yesterday, as expected, the main currency pair continued to grow. During the trading on Thursday, the quote rose to 1.2174, and trading on December 3 ended at 1.2143. Naturally, today's trading will be influenced by macroeconomic reports from the United States. However, given the market sentiment, which is clearly not in favor of the US dollar, I would venture to assume that we will not see a fundamental change, and the US currency will end the week with losses across a wide range of markets. At the same time, we cannot exclude corrective rollbacks to 1.2100, 1.2080, 1.2060, 1.2030, and 1.2010. Near all these levels, you should consider buying a pair, especially if signals appear near the indicated marks to open long positions on the four-hour and hourly charts. H1

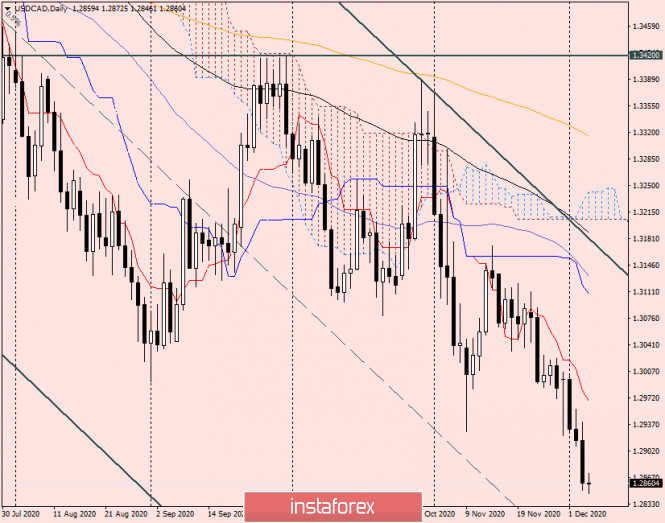

But looking at the hourly timeframe, the earliest and most aggressive purchases can be tried near 1.2220. As you can see, there is a simple moving average of 50, and the average line (dotted) of the ascending channel is slightly lower. At the same time, I would not rule out the possibility of profitable sales today. First, labor data from the US may be strong and support the US dollar. Secondly, on the last trading day of the week, profit-taking is possible, which will cause the US currency to adjust to its previous decline. We will try to outline the results of weekly trades, as well as recommendations for opening new positions, on Monday. Analysis and forecast for USD/CAD on December 4, 2020 2020-12-04 The North American dollar currency pair is in a downward trend. The Canadian dollar shows a noticeable strengthening against its namesake from the United States. This dynamic is due to the optimism that prevails in the market. Investors are waiting for the imminent start of large-scale vaccination of the population against the COVID-19 pandemic, as well as the adoption of a new package of fiscal incentives in the United States to counter the coronavirus pandemic. I would like to note that today will be very important for the USD/CAD currency pair since, in addition to the US labor reports, which will be released at 14:30 (London time), data on the Canadian labor market will also be presented at the same time. In this regard, we should expect increased volatility and sharp multidirectional movements from USD/CAD. In principle, everything will depend on specific indicators. Daily

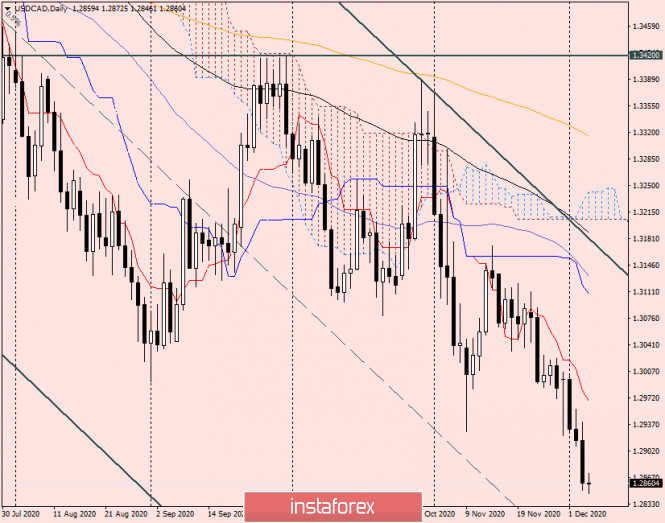

On the daily chart, the pair moves in a descending channel with parameters: 1.4667-1.3388 (resistance line) and 1.3314 (support line). In this case, the trend will change only if the resistance line of the descending channel is broken, which is also a downward trend line. However, this line is far enough away from current prices, and for it to break through, market sentiment must radically change in favor of the US currency. However, at the moment, such changes are not visible, which means that with a high probability the pair will continue to move in a southerly direction. However, as noted above, do not write off labor statistics from the United States and Canada. For today, the main target at the top will be 1.2965, where the red line of the Tenkan indicator Ichimoku passes. If the pair maintains the downward trend, it risks falling to the area of 1.2740, where the middle line (dotted) of the descending channel passes. H4

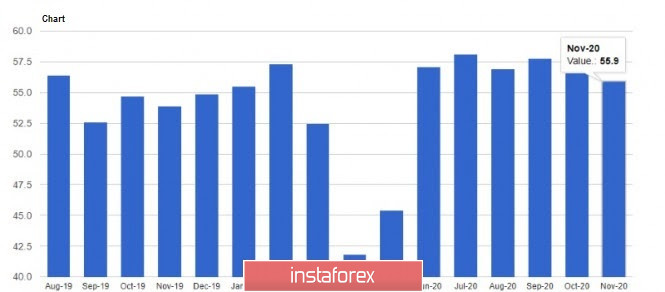

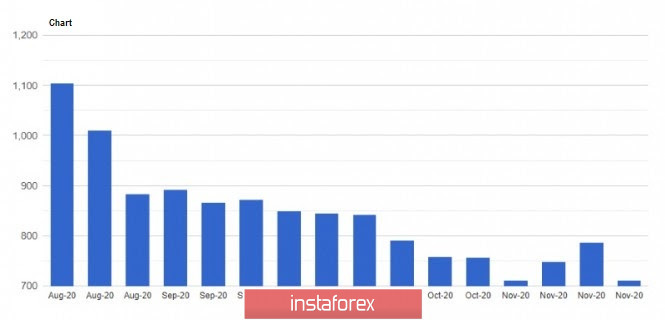

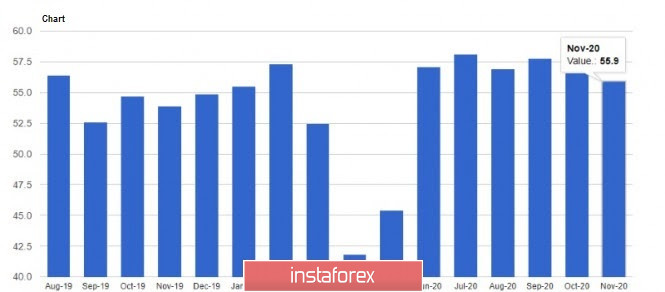

On this timeframe, we can see that the pair has broken through the support level of 1.2925 and is already fixed under this broken mark. Given that the 50 simple and 89 exponential moving averages are slightly higher, we will define the zone for potential sales as 1.2925-1.2975. If we consider opening sales at more attractive prices, then of course short positions should be considered when the pair tries to return above the most important psychological and technical level of 1.3000. Given that the orange 200 exponentials are located slightly higher, the area for sales can be considered 1.3000-1.3070. However, for such a significant growth of the pair, labor data from the United States should be very good, and labor reports from Canada should disappoint market participants. In any case, the main trading recommendation for USD/CAD is sales that should be considered starting from 1.2900 and higher, from the prices that were already indicated earlier in this review. Purchases look riskier since they are against the current downward trend, and trading against the trend is always uncomfortable and such positioning carries increased risks. In this regard, I recommend refraining from purchases in the current situation. At least until there are clear signals to open long positions on USD/CAD. EUR/USD: Pfizer halves its target COVID-19 vaccine supply. The US dollar continues to decline amid a slowdown in the US economy. 2020-12-04 The news that the United States will be pumping money early next year put pressure on the US dollar. Yesterday, President-elect Joe Biden backed the adoption of the $ 900 billion worth of stimulus package that was discussed recently in the Congress. However, in his statement, Biden said this is only the beginning of a long journey, and 900 billion is clearly not enough to revive the economy. Last financial year, over $ 3 trillion was used for the economy.  But in spite of this news, the European currency did not grow, mainly because of weak data on the euro area's service sector. According to IHS Markit, the EU's Service PMI fell to 41.7 points in November, but is better than its preliminary figure which is 41.3 points. Back in October, the index was 46.9 points. This did not come as a surprise and did not greatly affect the euro, as everyone already knew that business activity has been affected by new quarantine restrictions designed to contain the second outbreak of COVID-19. On the topic of COVID-19, Pfizer was reported to have halved its target vaccine supply after encountering problems in its raw materials. The company said the materials it used in the earlier-produced vaccines do not meet the standards, thus, it will purchase a new one, which shifts the planned terms and volumes of supplies. Meanwhile, the number of cases and deaths (from coronavirus) in the US has reached new highs, which once again indicates the likelihood of imposing tighter restrictions by the authorities. If such a decision is made, the US dollar may decline even more. As for economic reports, data on jobless claims decreased in the US last week, which indicates a better state of the labor market after a strong increase in applications a week earlier. According to the US Department of Labor, initial jobless claims for the week of November 21-28 fell by 75,000, amounting to 712,000.  Meanwhile, employment data in the US non-agricultural sector will be published today, and experts project it to come out worse than the previous month's value. They forecast a 480,000 increase in the number of employees, but if the report comes out lower, the pressure on the US dollar will return, which may lead to the continued rise of the euro towards new highs. At the moment, the technical picture of the EUR / USD pair shows the bulls are clearly aiming for a continued growth towards 1.2200, a breakout of which will definitely give confidence to new buyers, which will push the euro even higher towards 1.2260 and 1.2340. But if the pressure on the pair returns, the quote may collapse to 1.2080 and 1.2040.  Another report that put pressure on the US dollar yesterday was the signs of a slowdown in the US economy. The report published by the Institute for Supply Management (ISM) said Service PMI continued to rise in November, but at a slower pace. The index fell to 55.9 points in November, after recording 56.6 points in October. Nonetheless, index values above 50 indicate an increase in activity. S&P also published economic forecasts for the US yesterday, saying the US economy has recovered 2/3 of the losses it suffered during the COVID-19 crisis, but now there are signs of weakness. Therefore, real GDP is projected to contract by 3.9% this year, and will not return to pre-crisis levels until the 3rd quarter of 2021. As for the unemployment rate, it will not return to pre-crisis levels until 2023. The risk of another recession in the US is estimated at 25% -30%. Such reduced the confidence of dollar bulls, however, a very active growth in the European currency is also not good for the European Union, according to the European Central Bank. The central bank said a massive rise in the euro will harm the economy no less than a partial lockdown. Trading idea for the GBP/USD pair 2020-12-04  Pound bulls were in luck yesterday, especially those who followed our earlier trading strategy, which was to set up long positions in the GBP/USD pair, in order to raise the quote to 1.35. Plan:  Results:  This simple trend, based on impulse trading and an understanding of target stops, yielded 7,000 pips! Since October, we have already recommended working on the pound exclusively up to 1.35. Now, the pair has reached our target, bringing plenty of profit from the market. Huge congratulations to those who took up this strategy! EUR/USD analysis for December 04 2020 - Strong upside breakout and potential for test of 1.2400 2020-12-04 ECB policymakers open to 12-month PEPP extension - report The report says that ECB policymakers would likely agree to extend PEPP by a full year if that is proposed at the meeting next week. Adding that several members of the governing council would support such a proposal, even those who have a personal preference for a six-months extension. That said, the sources also reveal that there might still be a possibility of dissent as there is concern that such extending the program to the middle of 2022 would reveal unwarranted assumptions about the post-pandemic economy. There is also a suggestion that they could go with a 12-month extension with the option to reduce it again if the recovery proves stronger than expected. Further Development

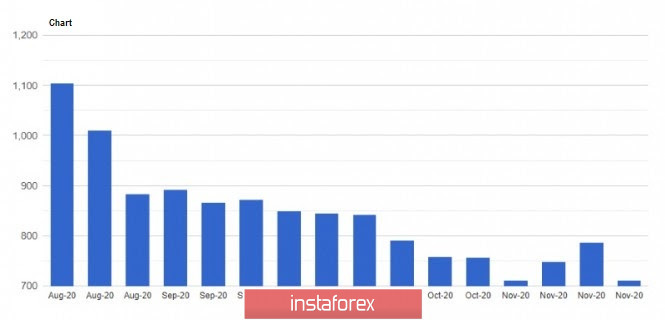

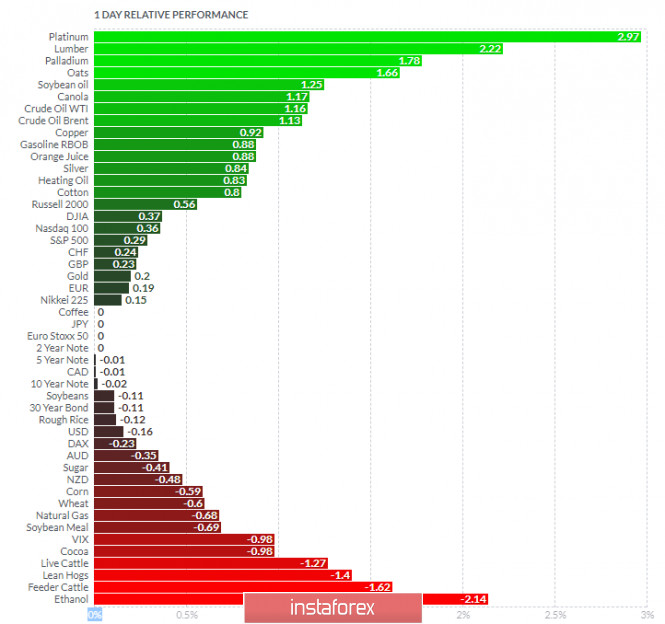

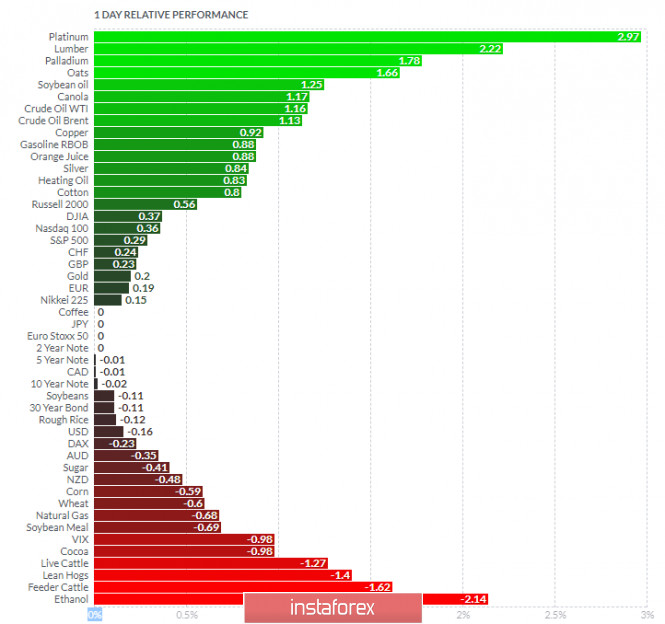

Analyzing the current trading chart of EUR/USD, I found that this week is the breakout week of the multi week balance in the background, which is strong sign of the upside continuation of the trend. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Platinum and Lumber today and on the bottom Ethanol and Feeder Cattle. EUR is positive on the list today. Key Levels: Resistance: 1,2400 Support level: 1,2000 Analysis of Gold for December 04,.2020 - Potential completion of the bigger ABC correction with target at $1.960 2020-12-04  China policymakers reportedly comfortable with yuan appreciation for now PBOC might take action if further rise is rapid, were to hurt country's exports - Otherwise, would not intervene as there hasn't been any shocks from big capital inflows or outflows due to currency movement

- Some policy advisers see the yuan strengthening to 6.40 per dollar next year

- The yuan is still within a normal range and there is no big deal if it rises further

The above narrative suggests that China still has some room for tolerance to allow the yuan to strengthen further, although they will surely be aware of any major or rapid acceleration should the dollar meltdown go too far, too fast. A drop in USD/CNY to 6.40 would mean another 2% drop from current levels. Since peaking in late May, the pair has already fallen by roughly 9%.

Further Development

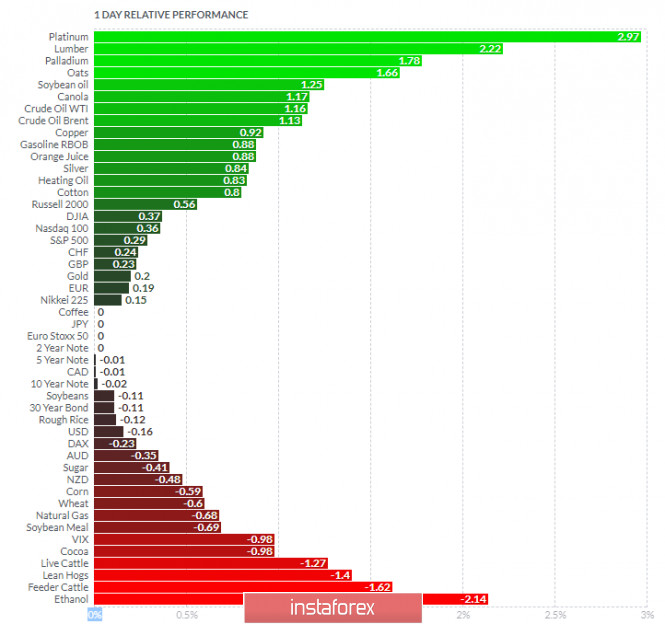

Analyzing the current trading chart of Gold, I found that there is potential for the completion of the downside correction ABC major in the background, which is strong sign for potential upside continuation. 1-Day relative strength performance Finviz Based on the graph above I found that on the top of the list we got Platinum and Lumber today and on the bottom Ethanol and Feeder Cattle. Gold is positive today on the list... Key Levels: Resistance: $1,950 and $1,960 Support level:$1,767

Author's today's articles: Ivan Aleksandrov  Ivan Aleksandrov Ivan Aleksandrov Pavel Vlasov  No data No data Andrey Shevchenko  Andrey Shevchenko Andrey Shevchenko Petar Jacimovic  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work" Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

A Zotova, Aleksey Almazov, Alexander Dneprovskiy, Alexandr Davidov, Alexandros Yfantis, Andrey Shevchenko, Arief Makmur, Dean Leo, Evgeny Klimov, Fedor Pavlov, Grigory Sokolov, I Belozerov, Igor Kovalyov, Irina Manzenko, Ivan Aleksandrov, l Kolesnikova, Maxim Magdalinin, Mihail Makarov, Mohamed Samy, Mourad El Keddani, Oleg Khmelevskiy, Oscar Ton, Pavel Vlasov, Petar Jacimovic, R Agafonov, S Doronina, Sebastian Seliga, Sergey Belyaev, Sergey Mityukov, Stanislav Polyanskiy, T Strelkova, Torben Melsted, V Isakov, Viktor Vasilevsky, Vladislav Tukhmenev, Vyacheslav Ognev, Yuriy Zaycev, Zhizhko Nadezhda

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

China policymakers reportedly comfortable with yuan appreciation for now

China policymakers reportedly comfortable with yuan appreciation for now

Ivan Aleksandrov

Ivan Aleksandrov  No data

No data  Andrey Shevchenko

Andrey Shevchenko  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

No comments:

Post a Comment