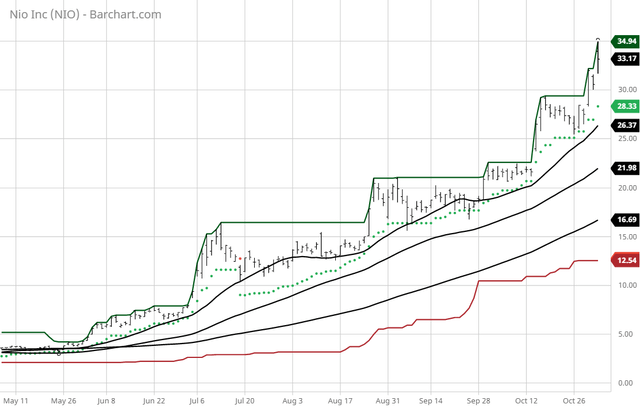

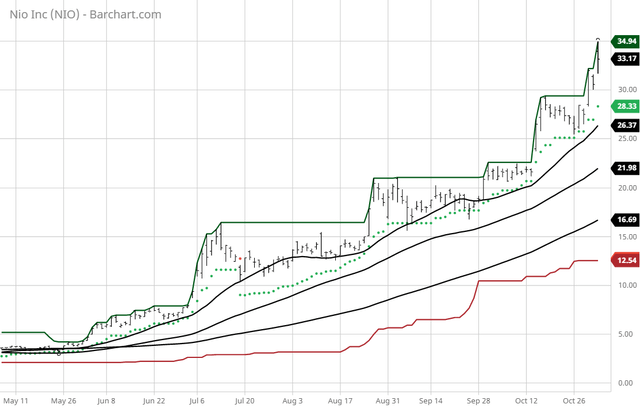

The Barchart Chart of the Day belongs to the Chinese electric car maker Nio (NYSE:NIO). I found the stock by sorting Barchart's New All-Time High list first by the most frequent number of new highs in the last month, then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 7/20 the stock gained 158.91%. NIO Limited designs, manufactures, and sells electric vehicles in the People's Republic of China, Hong Kong, the United States, the United Kingdom, and Germany. The company offers five, six, and seven-seater electric SUVs. It is also involved in the provision of energy and service packages to its users; marketing, design, and technology development activities; manufacture of e-powertrains, battery packs, and components; and sales and after sales management activities. In addition, the company offers charging solutions, including Power Home, a home charging solution; Power Swap, a battery swapping service; Power Mobile, a mobile charging service through charging trucks; Public Charger, a public fast charging solution; and Power Express, a 24-hour on-demand pick-up and drop-off charging service. Further, it provides value-added services, such as statutory and third-party liability insurance, and vehicle damage insurance through third-party insurers; repair and routine maintenance services; courtesy car services during lengthy repairs and maintenance; and roadside assistance, as well as data packages. NIO Limited has a strategic collaboration with Mobileye N.V. for the development of automated and autonomous vehicles; and collaboration agreements with various manufacturers for the manufacture of ES8, a six or seven-seater high-performance electric SUV. The company was formerly known as NextEV Inc. and changed its name to NIO Limited in July 2017. NIO Limited was founded in 2014 and is headquartered in Shanghai, China.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. Barchart technical indicators: - 100% technical buy signal

- 627.60+ Weighted Alpha

- 2,083.00% gain in the last year

- Trend spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 8 new highs and up 56.71% in the last month

- Relative Strength index 72.97%

- Technical support level at 29.88

- Recently traded at 33.06 with a 50 day moving average of 21.98

Fundamental factors: - Market Cap $31.38 billion

- Revenue expected to grow 100.80% this year and another 79.30% next year

- Earnings estimated to increase 52.00% this year and an additional 33.60% next year

- Wall Street analysts issued 2 strong buy and 2 hold recommendations on the stock

- The individual investors monitoring the stock on Motley Fool voted 189 to 24 for the stock to beat the market

- 80,890 investors are monitoring the stock on Seeking Alpha

The #1 strategy that could have sent you 20 years with no losing years… Trophy Trades have already proven to have the potential to earn you as much as $13.5 million dollars… But it’s never been released to the public before - now that changes for you

More on this symbol: |

No comments:

Post a Comment