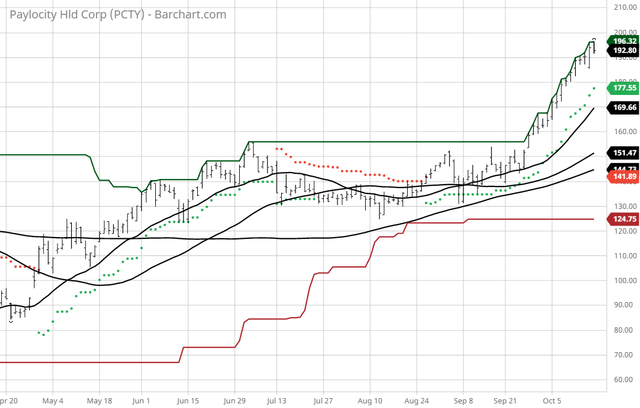

The Barchart Chart of the Day belongs to the human resources software company Paylocity Holding Corp (NASDAQ:PCTY). I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent prices appreciation. since the Trend Spotter signaled a buy on 8/27 the stock gained 34.66% Paylocity Holding Corporation provides cloud-based payroll and human capital management software solutions for medium-sized organizations in the United States. The company offers Payroll module that enables clients to automate key payroll processes and manage compliance; Core HR module, which provides a set of HR capabilities enabling clients to manage HR data; and Talent module that enable clients to manage their talent throughout employees' tenures, starting at recruiting and carrying through onboarding, learning, and performance management. It also provides Workforce Management module for time and attendance and scheduling functionality, enabling clients to collect hourly data for employees, improve productivity, and help organizations control labor costs; Benefits modules, which offers benefit management solutions that integrate with insurance carrier systems to provide automated administrative processes. In addition, the company offers third-party administrative services for clients designed to modernize the administration of flexible spending accounts, health savings accounts, transportation management accounts, premium only plans, and health reimbursement arrangements for their employees. Further, it provides implementation and training, client, and tax and regulatory services. The company sells its products through sales representatives. The company was founded in 1997 and is headquartered in Schaumburg, Illinois.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. Barchart technical indicators: - 100% technical buy signal

- 93.20+ Weighted Alpha

- 93.87% gain in the last year

- Trend Spotter by signal

- Above its 20, 50 and 100 day moving averages

- 18 new highs and up 31.15% in the last month

- Relative strength index 83.14%

- Technical support level at 190.87

- Recently traded at 192.80 with a 50 day moving average of 151.47

Fundamental factors: - Market Cap $10.38 billion

- P/E 168.63

- Revenue expected to grow 11.00% this year and another 23.20% next year

- Earnings estimated to increase 44.50% next year and continue to compound at an annual rate of 22.10% for the next 5 years

- Wall Street analysts issued 5 strong buy, 6 buy and 5 hold recommendations on the stock

- The individual investors following the stock on Motley Fool voted 53 to 3 that the stock will beat the market

- 5,060 investors are monitoring the stock on Seeking Alpha

The #1 strategy that could have sent you 20 years with no losing years… Trophy Trades have already proven to have the potential to earn you as much as $13.5 million dollars… But it’s never been released to the public before - now that changes for you

More on this symbol: |

No comments:

Post a Comment