| There are two ways to think about this... - "Glass Half Full" Approach: Since the S&P's gains have been driven by so few stocks, the rest of the market could experience a "catch-up" effect... which would extend the bull market for the remainder of the year.

- "Glass Half Empty" Approach: Since the S&P's gains have been driven by so few stocks, there are only seven strong companies out there... and the rest are weak. As soon as those seven exhaust their upside, the market will head lower.

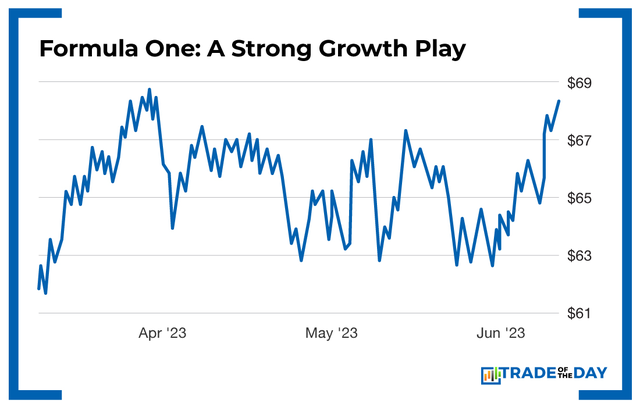

Conclusion: No matter what happens, one thing is certain: Market volatility is here to stay. And this leads directly into today's new play... You see, in addition to the seven major tech stocks leading the S&P 500 upward, there's another stock that's been performing very well in 2023... Formula One Group (FWONA). A subsidiary of Liberty Media, Formula One Class A shares are up more than 20% year to date - partly due to Formula One racing seeing a resurgence in popularity due to the Netflix docuseries Formula 1: Drive to Survive. Here's a quick overview... Formula One Group engages in motorsports in the United States and internationally. It owns the commercial rights for the World Championship, which is a nine-month-long motor-race-based competition in which teams compete for the Constructors' Championship and drivers compete for the Drivers' Championship. The interesting thing here is that the season is far longer than a normal sports season - which keeps fans engaged over a longer period of time. NBC just reported that "Formula 1 popularity [is exploding] in U.S. as 2023 season begins." The 2023 season will be highlighted by three U.S. races, including one at a new track along the Las Vegas Strip. The 2022 season became the first in U.S. television history to average at least 1 million viewers per race, and in 2021, F1 reported a global TV audience of 1.55 billion. Often compared to NASCAR, Formula One is more global. Most NASCAR races occur in the Americas, but F1 takes place at various locations worldwide. YOUR ACTION PLAN While tech stocks are getting all the attention, Formula One Group (Nasdaq: FWONA) represents an undiscovered growth play that could continue moving higher. To get my exact entry point, click HERE to sign up for Trade of the Day Plus, where I'll give you a full rundown this Wednesday. Speaking of exact entry points, I just posted a new video that reveals something extraordinary... At THIS exact time... stocks go up BIG. When it comes to bold claims (that are fully backed up by verifiable research), it doesn't get any better than this. As you'll see, I'll tell you exactly why my newest pick could soon become the "Next Major American Index." Do yourself a favor... and check out the 1:37 mark of the video. |

.jpg)

No comments:

Post a Comment