| | | | | | | Presented By Wondrium | | | | Axios Markets | | By Matt Phillips and Emily Peck · Feb 06, 2023 | | Oh hi. What a weekend. The Chinese spy balloon was shot down and Beyoncé made history with the most Grammy wins ever. Also, it was extremely cold up in our neck of the woods. 🥶 OK, on to the main event. Today's newsletter is 1,125 words, 4.5 minutes. | | | | | | 1 big thing: Stocks struggle with good news |  Data: FactSet, U.S. Bureau of Labor Statistics; Chart: Axios Visuals Friday's blockbuster jobs report left investors struggling to fit the idea of sizzling job growth into the soothing story of a steady decline in growth and inflation that many investors had started to believe, Matt writes. Why it matters: Fresh data showing unemployment at the lowest level since 1969 reignited questions about how much more the Fed will raise interest rates. - The data came just two days after Fed chair Jerome Powell acknowledged the clear slowdown in inflation, triggering a broad-based rally in stocks.

Driving the news: On Friday, markets seemed befuddled by the 517,000 new jobs the economy reportedly created in January. - Bond yields rose violently, as investors bet that jobs strength will almost certainly mean more Fed rate hikes are coming.

- Over the last year, such moves in bonds have often hammered the stock market.

- Not so on Friday: Stocks declined a relatively modest 1%, suggesting that equity investors are unsure how higher interest rates will hit stocks if those hikes come with strong and durable economic growth.

The big picture: The unusual cohabitation — falling inflation and falling unemployment — is part of a broader economic question confronting economists and investors in the post-COVID economy: Has the Phillips Curve been totally debunked? - The Phillips Curve is the economic term of art describing the traditional relationship between inflation and employment.

- The TL;DR is that inflation and unemployment move inversely. When inflation rises, unemployment is supposed to fall, and vice versa.

State of play: We currently have the opposite situation. - While still high, inflation has fallen from 9% in June to about 6.5%, as measured by the Consumer Price Index.

- But that drop hasn't driven unemployment up. The jobless rate has actually fallen, to 3.4% from 3.6%.

What they're saying: "Unemployment remains low, and inflation has come down notably. We are not yet at the Fed's 2% target, but the progress is undeniable and without a recession," wrote former Federal Reserve economist Claudia Sahm. 💭 Our thought bubble: If the Fed can keep raising interest rates without crushing employment and the economy, it has huge implications for the stock market. - That's because strong growth boosts corporate earnings, and could potentially offset some of the negative impact that higher rates typically have on valuations.

- In other words, ongoing rate hikes — as long as they aren't expected to lead to a recession — shouldn't be as painful for shareholders as the one's last year.

Yes, but: This could be wishful thinking, after last year's 19.4% plunge in stocks. What we're watching: Powell's comments at the Economic Club of Washington tomorrow, where he may be forced to talk about how the central bank views the latest jobs figures. |     | | | | | | 2. Catch up quick | | 🚨Earthquake rocks Syria and Turkey, killing more than 1,300. (AP) 🛑 Washington turns hostile on crypto. (Axios) 💻 Dell to lay off some 6,650 workers due to falling sales. (Bloomberg) |     | | | | | | 3. When you hate your house, but love your mortgage |  Data: TransUnion; Chart: Axios Visuals Home equity lines of credit are the belle of the ball in the new world of high mortgage rates. Originations soared in the third quarter of last year, per TransUnion data released last week, Emily writes. What's happening: Homeowners are "suffering" from what the Urban Institute calls the "I hate my house, but I love my mortgage" syndrome. How it works: A homeowner might ideally want to buy another house with different features, but either can't afford a higher mortgage rate or doesn't want to give up their 3% bargain. (The golden handcuffs!) - Maybe back in the day, these folks would do a cash-out refinance. But that would be nuts right now — you'd wind up paying a higher mortgage rate.

- Enter the home equity line of credit (HELOC), which lets homeowners borrow some amount of money — less than the value of the whole house, as with a refi — to make home renovations, pay down credit card debt, deal with expenses, etc.

- To put it in fancier parlance, "Borrowers can preserve the low rate on their first mortgage while tapping equity to meet cash needs," write the authors of the Urban Institute report.

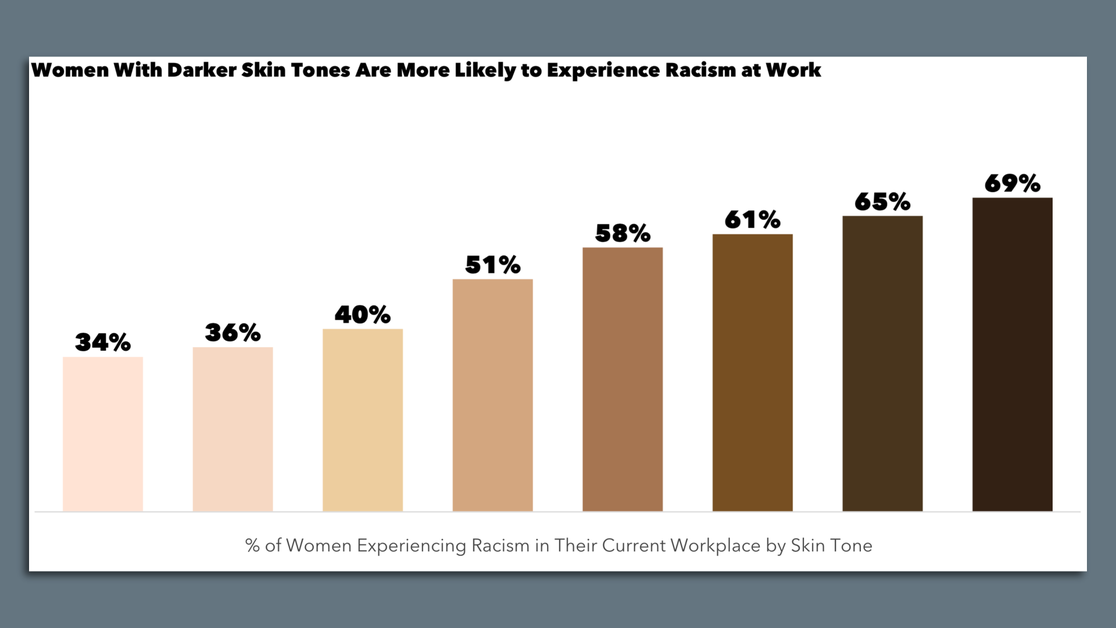

The catch: Because banks tend to hold HELOCs on their balance sheets rather than sell them, borrowers need very high credit scores to qualify. What they're saying: With consumers looking to consolidate high-interest credit card debt, and lenders looking to gin up business in the wake of the lackluster first mortgage market, "HELOCs will likely remain a popular option in 2023," said Andy Walden, VP of enterprise research at Black Knight. |     | | | | | | A message from Wondrium | | Explore the world — anytime, anywhere | | |  | | | | Learn anything about everything with expert-led courses, documentaries and other immersive educational adventures. Here's how: From history to cooking to business, discover more about the world from your favorite device. Start with a 14-day free trial— then save 50% off your first 3 months. | | | | | | 4. Women report stunning levels of discrimination |  | | | Illustration: Sarah Grillo/Axios | | | | About 51% of women in marginalized racial and ethnic groups in the U.S. and four other countries said they'd experienced racism or discrimination at their current workplace, according to a new survey released last week, Emily writes. The big picture: The survey's stark results come when some companies are pulling back on certain efforts around diversity and inclusion. What they did: Researchers from Catalyst, a women's advocacy group, surveyed 2,734 women from Australia, Canada, South Africa, the United Kingdom and the U.S. - The research included anyone who selected at least one race or ethnicity besides white.

- They asked a yes or no question: "Have you experienced racism or discrimination because of your ethnicity, nationality, race or religion in your current workplace?"

- The respondents were also asked whether or not they identified as women or trans women, and if they were LGBTQ. They were also given a palette of eight skin colors and asked to select one that matched their own most closely.

- "We really wanted to push the conversation on racism further, and highlight the intersectional nature of racism," said Kathrina Robotham, Ph.D., a senior associate at Catalyst and one of the study's co-authors.

What they found: Trans women and queer women were also more likely than cisgender women to say they'd experienced racism. And women with darker skin tones were far more likely to say they'd experienced racism at work, as this chart from Catalyst illustrates: Image: Catalyst Respondents were also asked to share examples of their experiences with racism at work. "We got an overwhelming amount of stories," Robotham said. - There's a notion that racist incidents in the modern workplace are fairly covert or subtle, she said, but the incidents respondents described were "blatant."

- The report features several quotes from these women, describing colleagues making racist comments about their appearance, their competence and even using slurs.

By the numbers: 48% of women in the U.S. said they experienced racism, compared to 59% in the U.K., 67% in South Africa, 39% in Canada, and 48% in Australia. What's next: The authors suggest there's a lot that company leaders can do to try to address this issue. Crucially, they can speak up — and set a tone that their workplace is not one where these behaviors are tolerated. Go deeper: Read Catalyst's full report. |     | | | | | | A message from Wondrium | | Start binge-learning in 2023 | | |  | | | | Go from binge-watching to binge-learning. With Wondrium, find new passions or dig deeper into your favorite topics with expert-led courses, documentaries and other educational adventures. Start with a 14-day free trial— then save 50% off your first 3 months. | | | | Was this email forwarded to you? Sign up here to get Axios Markets in your inbox. Today's newsletter was edited by Kate Marino and copy edited by Mickey Meece. |  | | Why stop here? Let's go Pro. | | | | | | Axios thanks our partners for supporting our newsletters.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

To stop receiving this newsletter, unsubscribe or manage your email preferences. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment