| | Andy Snyder

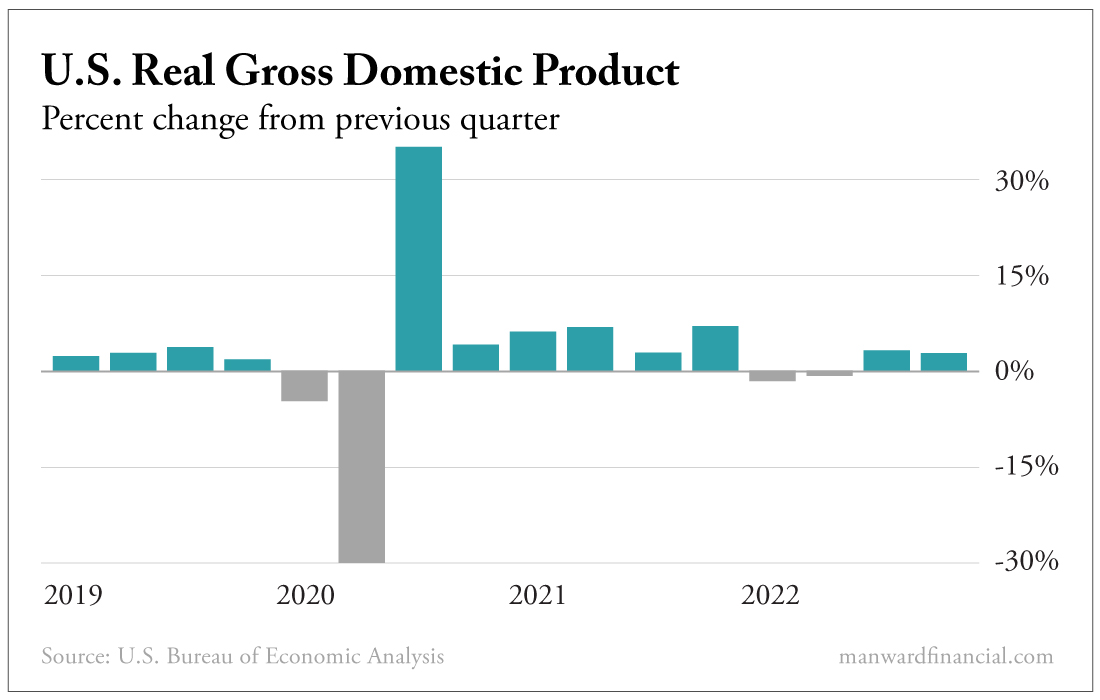

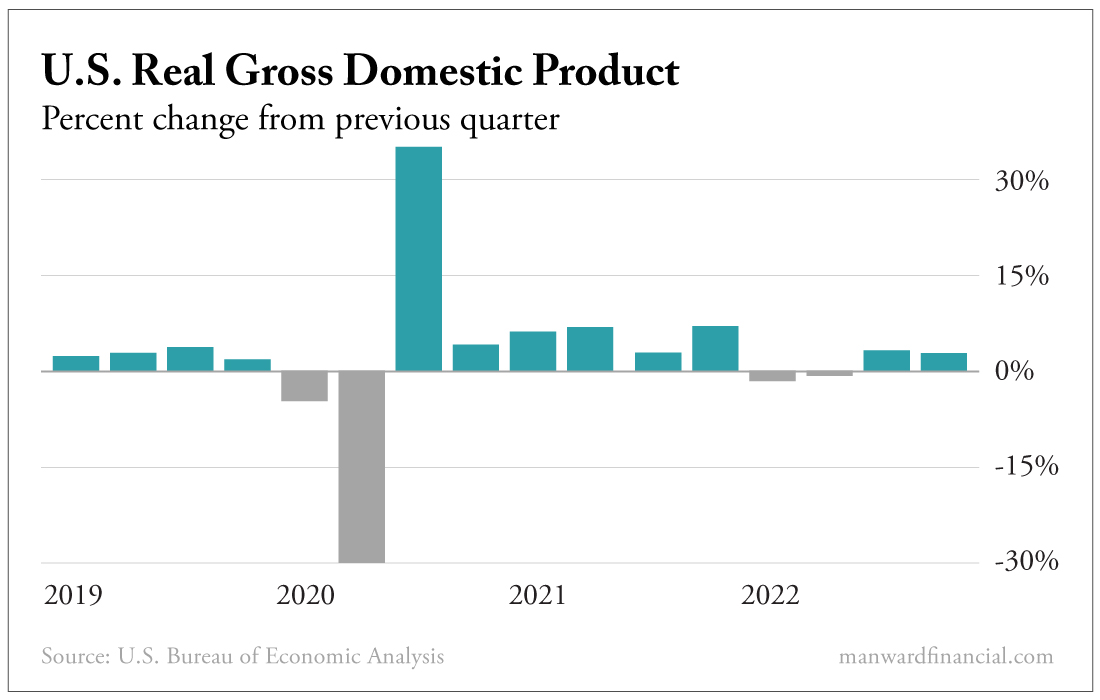

Founder | Isn't that crazy... Germans report their economy is now on the brink of a recession. GDP shrunk by 0.2% during the final quarter of last year. It's odd because just days ago, the man in charge of it all swore up and down that no such thing would happen. [Those who act BEFORE February 3 could collect regular income plus the chance at MASSIVE returns with one $3 asset. Click here for the URGENT briefing.] "I'm absolutely convinced that this will not happen that we are going into a recession," Chancellor Olaf Scholz said little more than a week ago. "We showed that we are able to react to a very difficult situation." One more quarter like that one and it'll be official... Europe's largest economy will be in a recession. But have no fears. They'll just deny it. They'll say up is down and left is right... and that it's not a real recession. Oh no, not on their watch. We saw it here in the States last year. Two quarters of significantly shrinking GDP... and yet, oh my no, there was nothing real about last year's recession.

View larger image But with an even bigger downturn threatening to upend the political rhetoric, Washington has upped its game. These days, it's manipulating not just the definition of a recession. It's manipulating the economy itself. You may have heard that the American economy grew at a better-than-expected pace last quarter (the same period the German economy was going backward). U.S. GDP grew at an annual rate of 2.9%, we were told. But did it? If we dare to dig into the details, we can see that things are askew. With near-perfect timing, federal government spending surged by 6.2% during the quarter. The figure was propelled higher by a whopping 11.2% surge in nondefense spending. This spending alone added 0.64% to the GDP growth figure. Subtract it and that figure falls to just 2.26%. But let's remember something here. When last year's Q1 and Q2 GDP figures were in the red, the bean counters inside the Beltway blamed it on temporary inventory adjustments. Those things don't really count, they said. Well... do they count now that they're going the other direction? Last quarter, inventory adjustments added some 1.5% to the GDP figure. Take them away (it's only fair, right?) and the growth figure falls to a mere 0.76% for the quarter. It appears the U.S. economy, too, is on the brink. But maybe there's something more important for us to learn in all of this. Maybe it's time we realize that these numbers are cooked and can't be trusted. Maybe we should look at the massive surge in layoffs in recent weeks for the truth... Maybe we should look at the 30% plunge in home sales (a sector that makes up more than 15% of overall GDP) as a sign that things aren't all that great... Maybe we should look at the more than $1.5 trillion in home equity that vanished in recent months... and think about how that may affect spending going forward. If your investments depend on the good word of the folks in charge.... or if you're buying because of a man who depends on your vote to stay employed... think again. You, too, could be on the brink... Be well, Andy Want more content like this? | | | | | Andy Snyder | Founder Andy Snyder is the founder of Manward Press, the nation's premier source of unfiltered, unorthodox views on money and what it means for a free society. An American author, investor and serial entrepreneur, Andy cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. He's been a keynote speaker and panelist at events all over the world, from four-star ballrooms to Capitol hearing rooms. | | | |

No comments:

Post a Comment