| | | | | | | Presented By Walmart | | | | Axios Markets | | By Matt Phillips and Emily Peck · Dec 15, 2022 | | Happy Thursday. The first half of the week was action-packed — SBF, CPI, Fed — maybe things will cool off as we head to the weekend. Today's newsletter is 1,104 words, 4.5 minutes. | | | | | | 1 big thing: Crypto's Wild West |  | | | Illustration: Natalie Peeples/Axios | | | | The cascade of legal charges dropped on Sam Bankman-Fried and his collapsed empire this week will do little to dispel the regulatory fog surrounding crypto, Matt writes. Why it matters: At first glance, the arrest, criminal indictment and civil charges — brought by the SEC and CFTC — against Bankman-Fried seem a symbolic end to the initial, Wild West era of crypto. - His attorney previously told Axios, via an emailed statement: "Mr. Bankman-Fried is reviewing the charges with his legal team and considering all of his legal options."

The big picture: Former regulators, legal scholars and defense attorneys say that even if Bankman-Fried is convicted of criminal charges and loses the civil cases, it will do little to immediately change standards in the U.S. crypto industry — where many companies don't comply with the financial regulations that, say, banks are held to. - Crypto broker-dealers and exchanges "do not observe requirements to segregate customer assets, to prohibit conflicts of interest, to have active procedures to prevent fraud and manipulation," said Timothy Massad, former chairman of the U.S. Commodity Futures Trading Commission and a senior fellow at Harvard University's Kennedy School of Government, of the prevailing industry status quo.

- Crypto players argue that such rules don't apply to digital assets.

Catch up fast: For years, efforts to regulate crypto have been mired in debates over whether digital assets can be regulated under existing law, or whether new laws tailored to the technology are needed. State of play: In theory, litigation can provide some answers. But in practice, the criminal case against Bankman-Fried will do little to clarify the rules. - That's because the criminal charges center on fairly straightforward allegations of fraud rather than technical questions about the nature of crypto.

- "It's alleged that he used money obtained from investors and made material misrepresentations to them as to how that money was going to be used or invested. That's it," says Ira Sorkin, a well-known white-collar criminal defense attorney who represented convicted Ponzi schemer Bernie Madoff.

Yes, but: Some say the SEC's civil charges against Bankman-Fried might shed some light, at least, on whether digital assets qualify as securities, and are therefore subject to SEC regulation (as opposed to commodities subject to CFTC oversight). - After all, if you can be successfully sued by the SEC for defrauding customers and investors under existing securities laws, that suggests those laws actually apply to you.

- The problem is it could take years to get the answer. And it's uncertain that the resolution of cases surrounding FTX will be broadly applicable to the world of crypto and other crypto companies, Howell Jackson, a professor at Harvard Law School, says.

What's next: At the very least, the FTX debacle has stimulated a fresh round of debate — and Congressional hearings — on the future of regulation. Massad and Jackson both say there's still a need for Congress to write laws to clarify the agencies' roles in the crypto market. - "There are also a lot of people out there who will continue to lose money if the industry is allowed to persist with current practices," says Jackson.

|     | | | | | | 2. Catch up quick | | ⚡️ SEC proposes the biggest stock market trading reforms in decades. (Barron's) 🏦 Bank of England raises rates by 0.5 percentage points to 3.5%. (WSJ) 💸 Elon Musk sells $3.6 billion of Tesla shares. (Axios) |     | | | | | | 3. 💬 Quoted: "It's not knowable" |  | | | Jerome Powell. Photo: Al Drago/Getty Images | | | | "I just don't think anyone knows whether we're going to have recession or not — and if we do, whether it's going to be a deep one or not. It's just...It's not knowable." — Jerome Powell, chair of the Federal Reserve Driving the news: The Fed raised rates another half a percentage point yesterday, and said that it would remain vigilant and probably keep hiking until inflation shows signs of a more durable slowdown, Matt writes. - Stocks slumped on the announcement.

Context: When asked at his post-decision press conference whether he believes it's no longer possible to engineer a so-called soft landing — shorthand for a situation where inflation eases without a sharp rise in unemployment — Powell disagreed. - That's when he made the unusually forthright comment questioning whether anybody, even the most powerful economic policymakers, can tell you what's going to happen to the economy.

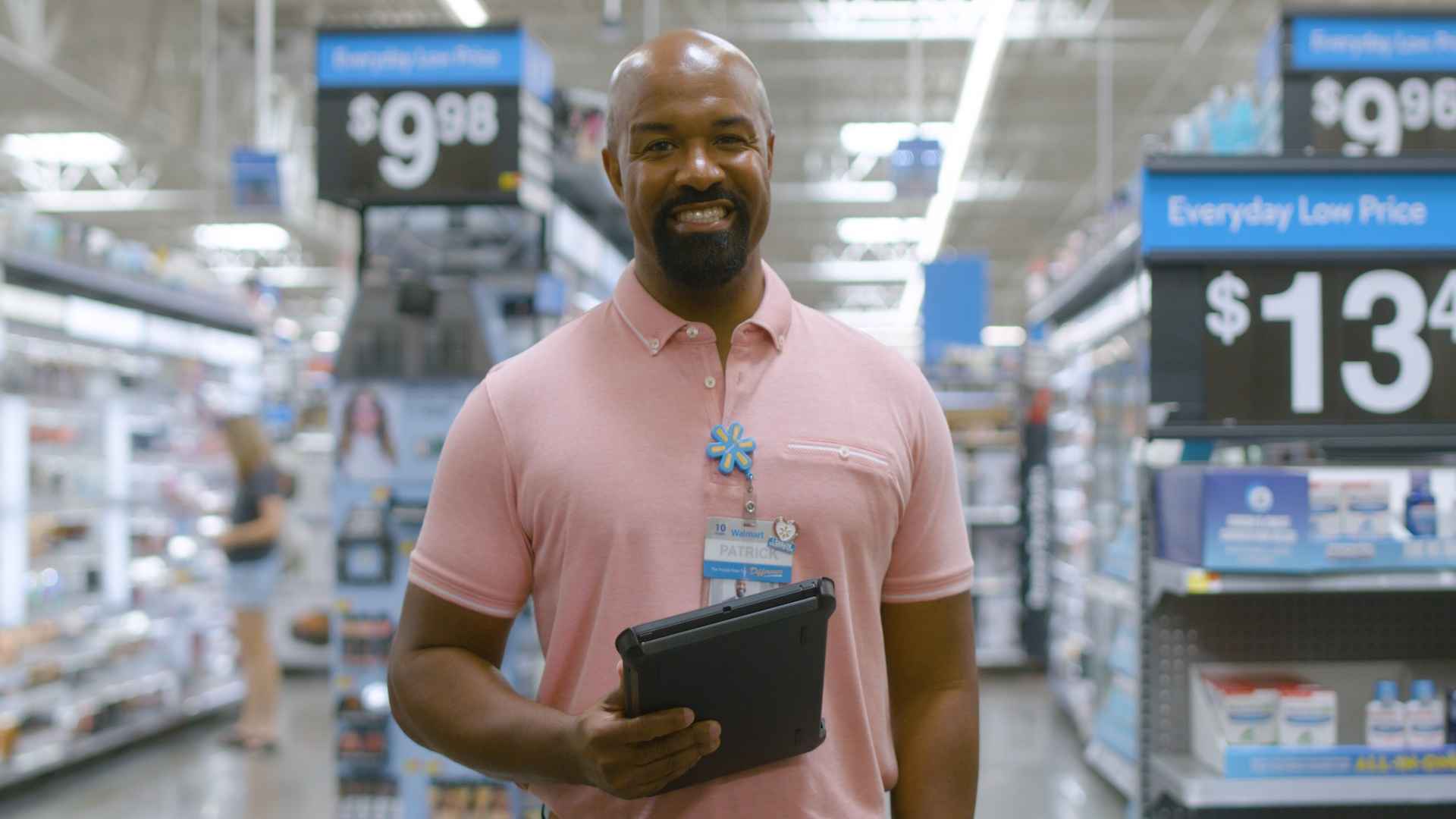

💭 Our thought bubble: He's right. Nobody knows. It's refreshing to hear somebody say it clearly. |     | | | | | | A message from Walmart | | Walmart named one of LinkedIn's Top 20 Companies to Grow a Career | | |  | | | | Patrick Joseph began his Walmart career as a pharmacy intern. Today, he oversees 11 pharmacies and eight vision centers — and his story is just one of many. See how Walmart's focus on mentorship and advancement helps create more stories like Patrick's. | | | | | | 4. Charted: SpaceX defying gravity |  Note: Prices are adjusted for the 10-for-1 stock split in December 2021; Data: Rainmaker Securities; Chart: Erin Davis/Axios Visuals Even as demand for private company stock has cratered pretty much across the board this year, there's at least one exception: SpaceX, Emily writes. The big picture: "Pretty much every company we trade is down versus the end of 2021," Glen Anderson, co-founder of Rainmaker Securities, told Axios. "SpaceX is an exception," Anderson said. - In Q3, shares of private tech companies traded at a median discount of over 40% compared with their most recent primary fundraising valuation, as we reported last week.

State of play: Few companies are going public right now, which depresses demand for private company shares. Investors worry about the illiquidity of these shares. - But SpaceX, founded by Elon Musk, has managed to buck the trend because it's typically done an annual tender offer.

- Investors have consistently been able to get liquidity during those windows, said Rainmaker co-founder Greg Martin.

- Earlier this week, Bloomberg reported SpaceX's latest tender offer valued the company at $140 billion, citing people familiar with the matter. In July the company was valued at $127 billion, per PitchBook.

- Plus: The company's Starlink business — which provides internet service via satellites — is taking off this year. "Some people believe [Starlink] could be a multi-hundred-billion-dollar business," said Martin.

The intrigue: Shares of Musk's public company, Tesla, are down 56% this year. |     | | |  | | | | If you like this newsletter, your friends may, too! Refer your friends and get free Axios swag when they sign up. | | | | | | | | 5. Fastest rent drop in 7 years |  Data: Zillow; Note: Typical rent is the average rent of the middle 30% of units; Chart: Axios Visuals Rent prices fell 0.4% in November — the largest month-over-month drop since Zillow started tracking this data in 2015, according to the real estate company's latest rent report, Emily writes. Why it matters: This is another sign that inflation is easing. - Month-over-month prices are falling fastest in Raleigh (-1.3%), Austin (-1.2%), San Jose (1.1%) and Seattle (-1.1%).

The big picture: The rent got too damn high. Fewer folks could afford to pay these prices, particularly when the cost of everything else was going up, too. - Now more people are "doubling up with roommates or family," instead of striking out on their own, Zillow reports.

- Rents are still way higher than before the pandemic, at a national average of $2,008 per month.

What we're watching: The recent declines will take time to filter into the government's Consumer Price Index numbers because of the way rent is measured in that report. - Fed chair Jerome Powell acknowledged this at his press conference yesterday, noting that inflation readings for rent will likely "come down sometime next year."

|     | | | | | | A message from Walmart | | Walmart is investing $1 billion in career training and development | | |  | | | | At Walmart, a first promotion is often just the first of many — 75% of management started as hourly associates. That's just one reason why Walmart was named one of LinkedIn's Top Companies to Grow a Career in 2022. Learn how Walmart's mentorship and training help associates advance in their careers. | | | | Was this email forwarded to you? Sign up here to get Axios Markets in your inbox. Today's newsletter was edited by Kate Marino and copy edited by Mickey Meece. |  | | Why stop here? Let's go Pro. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment