| Battery company Redwood Materials is investing $3.5 billion in a gigantic, new South Carolina recycling and manufacturing campus that will produce enough components to power a million electric vehicles, Joann Muller reports. Why it matters: It's the latest in a wave of huge investments across America's emerging "battery belt," spurred on by new government policies and tax credits designed to promote development of a domestic EV supply chain. Where it stands: At least 21 U.S. battery "gigafactories," worth $54.3 billion overall, have been announced since the beginning of 2021, according to Federal Reserve Bank of Dallas research. - Domestic capacity is expected to grow more than fivefold from 2021 to 2026, projects Benchmark Mineral Intelligence, a battery research firm.

What they're saying: "The federal government has put together a pretty clear set of pretty substantial incentives that guide the direction of this transition, and it's really benefiting the country right now," Redwood Materials CEO JB Straubel, a Tesla co-founder, tells Axios. - "There are incredibly large amounts of investment and economic activity coming straight to the U.S., which is a testament that it's working," he says.

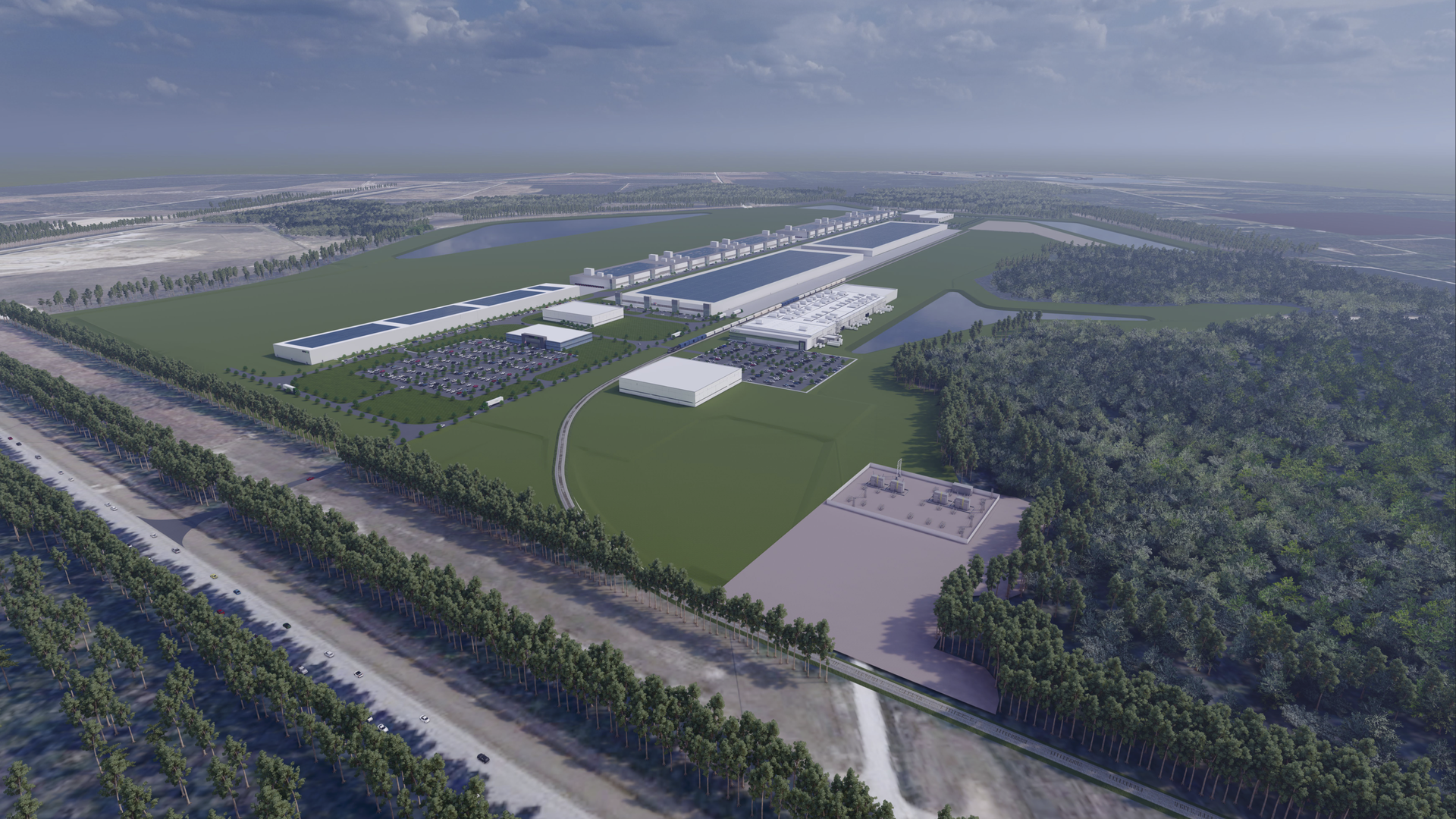

Driving the news: Redwood's new battery materials campus, announced Wednesday, will be built on a 600-acre site near Charleston, South Carolina. - A total of 1,500 jobs will be created, with operations beginning in phases starting by the end of 2023.

- For now, Redwood plans to produce 100 GWh of battery components per year. But the sprawling site has room to expand to "several hundred GWh annually" to meet future demand, says Straubel.

Between the lines: Redwood's technology fills a particular gap in the battery supply chain — the company recycles and processes expensive anode and cathode materials now made almost exclusively in China. - Those U.S.-made components are in high demand, as carmakers now need parts made domestically to qualify for government incentives.

How it works: Redwood recycles, refines and remanufactures battery materials, with the goal of eventually creating a sustainable, closed-loop supply chain. - The company collects end-of-life batteries from EVs — as well as consumer electronics like phones and laptops — and breaks them down to their basic metals, including nickel, copper, cobalt and lithium.

- It then reprocesses those materials into new battery anodes and cathodes — EVs' most critical and expensive components.

- "If we recycle a battery in the U.S., it's equivalent to basically mining that material in the U.S. We can do this faster than starting a new lithium, cobalt or nickel mine in the U.S.," says Straubel.

The bottom line: The more batteries produced or recycled in the U.S., the less geopolitical risk the country faces from relying on foreign supply chains. Yes, but: Even with all the recent investments, the U.S. still won't have enough battery capacity to meet expected EV demand by the end of the decade. Share this story. |

No comments:

Post a Comment