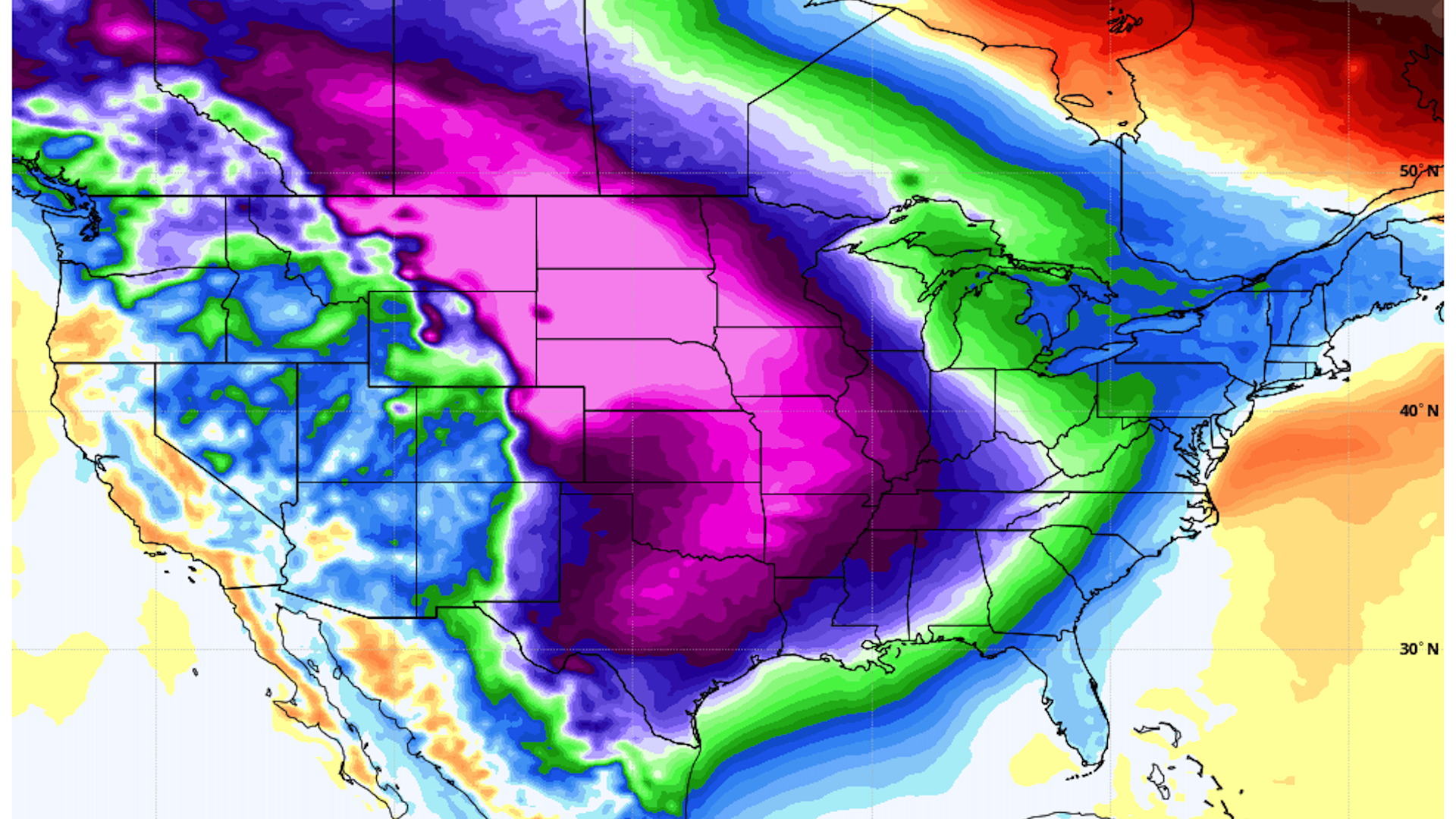

| | | | | | | | | | | Axios Generate | | By Ben Geman and Andrew Freedman · Dec 15, 2022 | | ☕ Good morning! Today's newsletter has a Smart Brevity count of 1,255 words, 5 minutes. 👀 Attention Hill staffers: Axios Pro: Policy is our radical new approach to policy reporting. Sign up to secure heavily discounted pricing for your office. 🎶 Now for a very '80s flashback: At this moment in 1985, Mr. Mister ruled the Billboard Hot 100 with today's intro tune... | | | | | | 1 big thing: A frigid Christmas is coming |  | | | Map showing computer model projection of temperature departures from average for Dec. 23, Image: Weatherbell.com | | | | A blast of Arctic air straight from Siberia is poised to spread across the continental U.S. toward Christmas, shattering records and potentially spinning up major storms, Andrew writes. Why it matters: Meteorologists tell Axios this may be the most extreme cold air mass to affect the U.S. during December in many years, with computer model data showing temperatures running 30 degrees below average by Dec. 23. - The end result may revive talk of more extreme cold as a paradoxical effect of human-caused global warming since the Arctic will wind up milder than average while the lower latitudes freeze.

- It will also drive up prices for natural gas at a time of tight global energy supplies and could test electrical grids.

The big picture: The Arctic outbreak, which will first affect western Canada early next week before diving into the Plains, Central U.S. and East, is the product of several weather phenomena. - There is an unusually powerful area of high pressure over Greenland, known as the Greenland Block, which enhances the odds of cold and snow in Europe and the U.S.

- There is also an extreme alignment of weather systems over the North Atlantic, which also favors extreme cold in Europe and North America.

- Next, the final key piece will move into place: An area of high pressure across eastern Siberia and Alaska that will funnel frigid air across the Arctic and into the U.S.

- Such cross-polar winds are a hallmark of extreme cold outbreaks.

Zoom in: Recently, the astonishing cold has been building up in Siberia, with temperatures as low as -61°C (-77.8°F) recorded just this week. It is this air mass that will slither its way toward the U.S., moderating some as it does so. What they're saying: Judah Cohen, head of seasonal forecasting at AER, a Verisk company, told Axios via email the coming event has the potential to be "one of the coldest Arctic outbreaks in December in years." - Cohen compared the intensity of the upcoming episode to February 2021, which resulted in the failure of the Texas grid.

- "The overall setup for this event is classic for major cold air outbreaks across much of central North America," Jason Furtado, a University of Oklahoma meteorologist, told Axios via email.

- He said the unusual cold may last into early 2023.

Yes, but: While a noteworthy cold outbreak seems a virtual lock, there are important uncertainties. - These include just how intense this cold air will be, the duration of the cold snap, as well as how many winter storms may sweep across the U.S. and potentially up the East Coast.

|     | | | | | | 2. Corporate giants roll out CO2 removal buys |  | | | Illustration: Gabriella Turrisi/Axios | | | | Breaking: Frontier, a major corporate fund looking to speed commercialization of carbon removal tech, just unveiled new purchases totaling $11 million, Ben writes. Why it matters: Frontier's second tranche of its nearly $1 billion eight-year plan backs a wide array of concepts and startups. Driving the news: The latest buys are on behalf of Shopify and Stripe. Other members of Frontier — which is aimed at seeding the market for future growth — include Alphabet, McKinsey and Meta. Zoom in: Today's announcement includes a definite $3.5 million, and $7.5 million if projects reach certain technical milestones. Among the recipients... - Arbor, a startup working on biomass-based removal.

- Captura, a Caltech spinout using an ocean-based CO2 capture method.

- Carbin Minerals, which has a process for speeding uptake of CO2 in mine tailings.

- Carbon to Stone, which combines direct air capture with mineralization in a way that cuts energy needed for DAC.

The bottom line: "If we're going to have a chance of removing billions of tons of atmospheric carbon a year by 2050 — as IPCC models predict we must — we need to get many more approaches to the starting line," Frontier head Nan Ransohoff said in a statement. |     | | | | | | 3. Vietnam unveils $15.5B energy transition deal |  Data: Global Carbon Project (using BP data); Chart: Erin Davis/Axios Visuals Vietnam will be the focus of a $15.5 billion "Just Energy Transition Partnership," or JETP, to help finance the country's move away from carbon-intensive energy sources, officials announced Wednesday, Andrew writes. Driving the news: This is the third such JETP to be unveiled, following South Africa and Indonesia. - Each aims to leverage Western financial resources to help decarbonize developing economies.

Zoom in: If successful, the latest JETP deal would reduce the building of new coal-fired power plants and ramp up renewable energy deployment in Vietnam. - As part of the deal, Vietnam will set a target of achieving 47% of its electricity from renewables by 2030, up from the currently planned 36%.

- It also sets an upper limit for peak coal power capacity, a fast-growing, carbon-intensive power source in Vietnam.

- The partnership includes $7.75 billion from the public sector among G7 countries, and the same amount from private finance.

Yes, but: As has been seen with South Africa's JETP, announced during COP26, the actual sums required may be higher than what has been committed. - Also, the types of financing could prove significant, since certain loans would add to Vietnam's debt compared to grants.

|     | | | | | | A message from Chevron | | The Human Energy Newsletter: energy insights, delivered | | |  | | | | Staying informed on the future of energy is as easy as a click. Subscribe to Chevron's Human Energy Newsletter and be the first to receive our recently release methane report, energy sector news and powerful insights so you can stay ahead of energy trends. Subscribe now. | | | | | | 4. 2022 closes in on a 6th-place finish |  Data: NOAA; Chart: Axios Visuals This year is tracking to be the sixth-warmest in 143 years of instrument record-keeping, according to new NOAA data, Andrew writes. - November 2022 was a bit cooler than that, as the ninth-warmest such month on record globally.

Why it matters: The monthly and annual data together comprise the long-term record showing the unequivocal signal of human-caused global warming. The big picture: The meteorological fall was the fifth-warmest such period on record, tied with 2016 and 2018, NOAA found. - NOAA assesses there is at least a 95% chance the year will wind up as the sixth warmest.

- While western North America, Australia and other parts of the world had a relatively cold month, no region on Earth had a record cold month.

- Yet record-warm temperatures covered 8.68% of the world's surface.

|     | | | | | | 5. Emerging U.S. "battery belt" grows |  | | | Rendering courtesy Redwood Materials | | | | Battery company Redwood Materials is investing $3.5 billion in a gigantic new South Carolina recycling and manufacturing campus that will produce enough components to power a million electric vehicles, Axios' Joann Muller reports. Why it matters: It's the latest notch in America's emerging "battery belt" that's spurred on by new government policies and tax credits to help create a domestic EV supply chain. The big picture: At least 21 U.S. battery "gigafactories," worth $54.3 billion overall, have been announced since the beginning of 2021, per Dallas Fed research. - Domestic capacity is expected to grow over fivefold from 2021 to 2026, projects Benchmark Mineral Intelligence. By 2031, U.S. capacity is expected to expand another 86%.

Yes, but: Despite the recent investments, the U.S. still won't have enough battery capacity to meet expected EV demand by the end of the decade. Read the whole story |     | | | | | | 6. Catch up fast on tech finance | | This week is bringing new moves by some of the world's largest companies, Ben writes. ♨️ Chevron and Baseload Capital, a geothermal investment firm, yesterday said they're creating a joint venture to develop U.S. projects, beginning with one in Weepah Hills, Nevada. 🔋Microsoft's climate innovation fund is among the investors behind $214 million in additional Series C funding for battery startup Group14 Technologies. - Group14 has developed battery anode technology that uses silicon instead of graphite, enabling greater energy density in batteries. The WSJ has more.

☀️ BP's venture arm is investing roughly $13.5 million in the Australia-based solar firm 5B Holdings Pty Ltd, part of a wider $37 million Series B round. Bloomberg has more. ⛏️ Oh, and last week brought news that mining giant Anglo American's nuGen arm is acquiring First Mode, which specializes in decarbonizing mining trucks and other equipment. - It includes a $200 million equity investment from Anglo American and values the nuGen-First Mode combo at $1.5 billion.

|     | | | | | | A message from Chevron | | The Human Energy Newsletter: energy insights, delivered | | |  | | | | Staying informed on the future of energy is as easy as a click. Subscribe to Chevron's Human Energy Newsletter and be the first to receive our recently release methane report, energy sector news and powerful insights so you can stay ahead of energy trends. Subscribe now. | | | | 📬 Did a friend send you this newsletter? Welcome, please sign up. 🙏 Thanks to Mickey Meece and David Nather for edits to today's newsletter. We'll see you back here tomorrow! |  | | Your personal policy analyst is here. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment