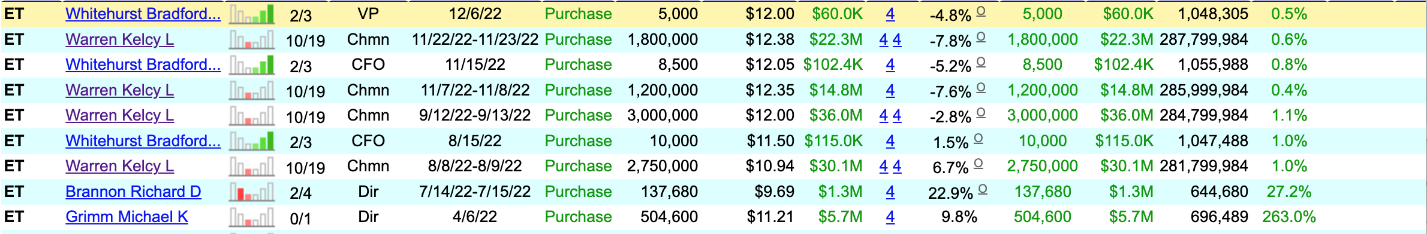

| The CEO has stated over and over again that while the company generally trades with the prices of oil and gas, it is relatively immune to energy price fluctuations. Here's what he says in just about every earnings call or release: "The vast majority of the Partnership's segment margins are fee-based and therefore have limited commodity price sensitivity." ET distributes energy. It owns pipelines. It collects tolls. Unless you think energy is a dead play for the U.S. and Europe, this play could fulfill what every investor looks for: capital gains and dividends. Right now, ET is paying a 9% yield (not a typo), and the shares have recently corrected from their highs as oil prices have fallen. (Just be aware that as a master limited partnership, it has special tax treatment.) But the shares have barely corrected compared with many oil and gas producers and explorers, whose prices are directly linked to the prices of oil and gas. YOUR ACTION PLAN If you're not interested in owning the shares and collecting dividends, you can play the long-term options on Energy Transfer (NYSE: ET), as we have done in The War Room over and over again. Just today we made a play that gets us in for around a buck! To get plays like this one on a frequent basis, sign up for The War Room now! We have a 77% win rate in 2022, and right now we're guaranteeing members will receive 252 winning trades in their first 12 months of membership. Click here to unlock The War Room. |

No comments:

Post a Comment