| Editor's note: Our friend and colleague Dr. David Eifrig from our corporate affiliate Stansberry Research is back... As regular Empire Financial Daily readers know, after getting his MBA from Northwestern's Kellogg School, "Doc" worked on Wall Street with financial heavyweights Goldman Sachs and Chase Manhattan before earning his MD from the University of North Carolina... where he became a medical doctor and board-eligible eye surgeon. Right now, Doc is following a huge trend in the health care sector. And in today's essay, he explains that the "big fish" are betting on it also...

The 'Sharks' Are All-In on the Platinum Age of Health CareBy Dr. David Eifrig  The 'sharks' were circling... The 'sharks' were circling...

Julia Cheek didn't get overwhelmed, however. She stood in front of all five of them – all of whom had earned their vicious reputations – and managed to keep her composure. Over the next few minutes, Cheek was bombarded with questions. She responded each time without hesitation. And even after four sharks rejected her – including renowned billionaire investor Mark Cuban – she wasn't fazed. One reporter later described her as "the epitome of poise and sophistication." Eventually, her calm nature paid off. She got the last shark to bite – entrepreneur Lori Greiner. It was 2017... And Cheek was on the hit TV show Shark Tank. She pitched her at-home health-testing company Everlywell to the five investors, hoping to secure financing. The deal she made with Greiner was for a $1 million line of credit at 8% interest. Greiner also received 5% equity of the business. Cheek's pitch for Everlywell was simple... Each year, millions of Americans avoid some type of lab testing because of high or unknown costs. They also don't want to make the trip to the doctor's office only to wait around for an hour in a room full of sick people. Everlywell offers a solution. With Everlywell's testing kits, you order a test online or go pick it up from your local drugstore. You then follow the testing instructions, send it back in the mail, and wait a few days for the results to come in. It's simple. No doctor visit required. And the whole time, you'll know exactly what you're going to pay.  Cheek's appearance on Shark Tank was a game changer for Everlywell... Cheek's appearance on Shark Tank was a game changer for Everlywell...

The show has millions of viewers. So when Cheek's episode aired, the company instantly had access to a massive potential customer base. When Cheek pitched her company to the "sharks," it had $2.5 million in sales. By 2021, Everlywell was valued at $2.9 billion. The future is creating a huge space for self-directed, data-driven health care. And that's exactly what the big fish in the ocean are betting on... With Everlywell, Cheek and Greiner were latching onto a megatrend we've identified – the boom in the life-sciences industry. After Shark Tank, the investor dollars continued to roll in for Everlywell. Big-name investment firms like BlackRock (BLK), Lux Capital, and Goodwater Capital all handed over their checkbooks. Everlywell has raised about $250 million from outside investors.  Silicon Valley is all-in on the life-sciences boom... Silicon Valley is all-in on the life-sciences boom...

"Life sciences" refers to companies related to the research side of medical care... pharmaceutical and biotech companies that develop new treatments, and the supply chain they rely on. The convergence of life sciences with Big Data and other technologies like artificial intelligence is finally coming into focus. Regulators are approving more drugs every day... as researchers create new treatments to help save lives.  This story has ramped up over the past few years... This story has ramped up over the past few years...

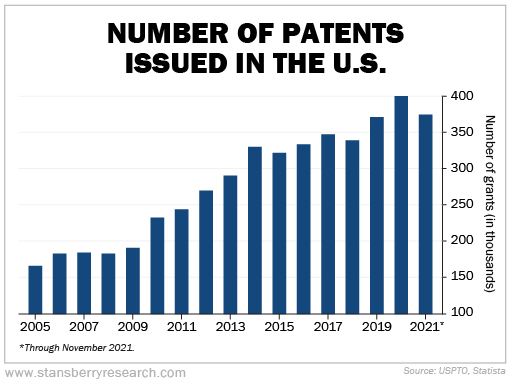

The number of patents issued in the U.S. has more than doubled since 2008. This shows that the rate of scientific advancement is across the board, and many of these patents are in the health care space. Take a look...  Spending has also skyrocketed over time... Spending has also skyrocketed over time...

A record $70 billion of private and public capital – mostly venture capital and initial public offerings ("IPOs") – poured into the life-sciences industry in 2020. The previous record came in 2018 with total spending of $36 billion... So spending nearly doubled in that short window of time. In 2020, 71 biotech companies held IPOs of at least $50 million. That was nearly a double from 2018 and 2019, when there were 38 and 44 IPOs at that level, respectively. And last year, more than 100 biotechs went public... raising nearly $15 billion in funds. COVID-19 played a big role in this. With the success of the COVID-19 mRNA vaccine technology, many researchers and scientists have been encouraged by the advancement of technology to fight infectious diseases, cancers, and more.  We've seen a slowdown in IPOs in 2022... We've seen a slowdown in IPOs in 2022...

Economic headwinds have gotten in the way – for now. But with the long-term trend in life sciences, we should see this as a buying opportunity... When early-stage companies in biotech are struggling, the outcome is simple – the sharks will eat. Bigger fish in the markets will be looking to scoop up all kinds of promising tech for a fraction of its value. For investors like ourselves, this is a rare and exciting time... It's a time when investors should get greedy. Money is going to keep rolling into life-sciences companies for a long time. This boom is in its early innings... So be ready for a potentially life-changing opportunity. Regards, Dr. David Eifrig

November 30, 2022 Editor's note: As Doc says, health care in the U.S. is undergoing a massive transformation. For investors, that could mean quadruple-digit gains in the best opportunities – even in a potential recession. In a special presentation, he breaks down this total transformation of American health and medicine... and how you can position yourself to take advantage. Get the details here.

If someone forwarded you this e-mail and you would like to be added to the Empire Financial Daily e-mail list to receive e-mails like this every weekday, simply sign up here. |

No comments:

Post a Comment