| | | | | | | Presented By Air Products | | | | Axios Generate | | By Ben Geman and Andrew Freedman · Jul 26, 2022 | | 👋 Hello readers! Today's newsletter, edited by Mickey Meece, has a Smart Brevity count of 1,260 words, 5 minutes. 🚨 EU countries today backed a scaled-back plan to cut natural gas demand as they brace for more Russian supply cuts, Reuters reports. 🎸 Today marks the 1973 release date of ZZ Top's album "Tres Hombres," so their killer Texas blues-rock animates today's intro tune... | | | | | | 1 big thing: Global nuclear hydrogen group forms |  | | | Illustration: Rebecca Zisser/Axios | | | | First look: A global coalition of more than 40 participants is launching the Nuclear Hydrogen Initiative today to advance the development of such technologies, Andrew writes. Why it matters: Using nuclear power to generate hydrogen gas is one route to being able to store energy to power trucks, factories, and other difficult-to-decarbonize sectors of the economy. The big picture: Hydrogen has promise, but faces hurdles such as the huge amounts of electricity required to produce it, and hydrogen's effects on the atmosphere if it leaks out. - The companies comprising the NHI are seeking to drive down costs by pairing hydrogen production with nuclear power. This would use electrolyzers to take water and split it into hydrogen and oxygen.

- The group plans to pursue nuclear hydrogen demonstration projects, engage the financial sector to finance such technologies, and advocate for policies that support deploying nuclear hydrogen, members tell Axios. It is not a lobbying organization, however.

Zoom in: The members range from environmental groups like the Clean Air Task Force to companies that design next-generation nuclear plants, such as X-energy. - Others include nuclear plant operators Entergy and Constellation, government entities including the International Atomic Energy Agency and Idaho National Lab, and hydrogen supply chain players Bloom Energy, Cummins and Siemens.

What they're saying: "Today the global market for hydrogen is around 70 million tons of hydrogen a year. By 2050, that number can be as high as between 500 million to a billion tons of hydrogen produced a year," Carlos Leipner, who directs global nuclear energy strategy at the Clean Air Task Force, tells Axios. - "That will require a tremendous amount of energy," Leipner says, pointing to nuclear plants as a promising way to generate large amounts of power at a low cost.

Yes, but: Hydrogen gas is an indirect contributor to global warming over the short term, according to Ilissa Ocko, a senior climate scientist at the Environmental Defense Fund. - Hydrogen can increase the amount of methane, tropospheric ozone and stratospheric water vapor in the air, each of which enhances warming, Ocko tells Axios.

- Hydrogen's global warming influence has largely been overlooked, because of its short atmospheric lifespan compared to carbon dioxide.

- Once one accounts for this, Ocko says, "It becomes clear that hydrogen is a lot more potent" of a warming agent than once thought.

- She urges groups to work to limit hydrogen leakage from manufacturing and transportation infrastructure.

|     | | | | | | 2. A big week for EV battery and supply deals |  | | | Illustration: Gabriella Turrisi/Axios | | | | Breaking Tuesday: GM announced a deal with lithium supplier Livent for supplies sourced largely to Livent's South American facilities, and a separate cathode material deal with LG Chem, Ben writes. - GM and LG also said they're exploring a new North American cathode materials facility.

Why it matters: The auto giant says that overall, it now has contracts in place for all the battery materials it needs for the capacity to build 1 million EVs annually by the end of 2025. The big picture: It comes on the heels of fresh evidence of the federal and private-sector push to expand U.S. battery and battery-component manufacturing to supply the growing electric car market. Driving the news: Redwood Materials plans to invest $3.5 billion over a decade on a Nevada project to build battery cathode and anode components, the company said. - The Wall Street Journal first reported the news.

- Separately, the Energy Department announced conditional plans to loan $2.5 billion to a joint venture between GM and LG Energy.

- The loan would help finance construction of battery manufacturing in Ohio, Tennessee and Michigan, DOE's loan programs office said.

- The companies are investing over $7 billion overall in the plants, per Reuters, which broke the news of the loan.

The intrigue: The NYT's coverage of the Ultium loan explores the politics of the announcement. - "The investments in Ohio and Michigan will help reassure labor leaders and state officials that they will not be left out of the electric vehicle boom," it reports, noting many industry investments are going to Southern states.

|     | | | | | | Bonus: The growing EV education push |  | | | GM's EV Live studio is staffed by specialists who can explaining battery technology, charging and more. Photo: GM | | | | General Motors is launching an ambitious effort to educate the public about EVs, including a platform for curious shoppers to pepper specialists with questions over video chat, Axios' Joann Muller reports. The intrigue: GM isn't alone in looking to help drivers navigate the purchase and use of EVs. Smart Cities Dive reports on Chase's new website aimed at helping people learn more. Why it matters: Automakers are spending billions of dollars to develop EVs, but the public remains wary. A Consumer Reports survey showed only 9% of Americans are "very familiar" with the fundamentals of EV ownership. Zoom in: GM's website, EV Live, is meant to supplement its dealer network by providing customers with one-on-one tutorials. Read Joann's whole story. |     | | | | | | A message from Air Products | | Making zero- and low-carbon hydrogen projects a reality | | |  | | | | We're committing an additional $4 billion in new capital for the clean energy transition. What this means: We're committing a total of $15 billion in first-mover energy transition projects through 2027. Our unique technology portfolio and experience lead the way. Find out more. | | | | | | 3. Charted: U.S. LNG surge |  Data: EIA; Chart: Axios Visuals The Energy Department's stats arm is out with a nice primer showing the U.S. emergence as the world's largest exporter of liquefied natural gas, Ben writes. The big picture: The U.S. was No. 1 over the first half of 2022 for three key reasons: more infrastructure coming online, higher global demand and attractive prices. Why it matters: LNG has become a geopolitical as well as a commercial asset for the U.S., especially as European officials look to ditch Russian gas. Quick take: That leverage is one reason the White House appears unlikely to agree with climate activists battling U.S. export and infrastructure growth. The intrigue: While Asia has historically been the top destination for U.S. LNG exports, that has shifted amid Europe's scramble to diversify. The EU and U.K. together absorbed 71% of U.S. exports in the first five months of 2022. |     | | | | | | 4. Wind and solar see a big U.S. slowdown |  Data: American Clean Power Association; Chart: Erin Davis/Axios Visuals The pace of new U.S. wind and solar projects slowed greatly in the first half of 2022 amid policy, trade and supply chain headwinds, a major industry group said, Ben writes. Why it matters: The data partly reveals uncertainty and supply delays related to the Commerce Department probe into accusations China is dodging U.S. solar panel tariffs, the American Clean Power Association said in a report and accompanying statement. More broadly, the decline in wind and solar shows the cumulative impact of higher commodity costs, uncertainty over whether Congress will extend key incentives, supply chain woes and more, it said. Zoom in: Cumulative wind, utility-scale solar and grid-connected battery storage deployments were 25% lower in the first half compared to 2021. - Q2 levels were 55% lower than Q2 2021, marking the slowest three-month stretch since 2019.

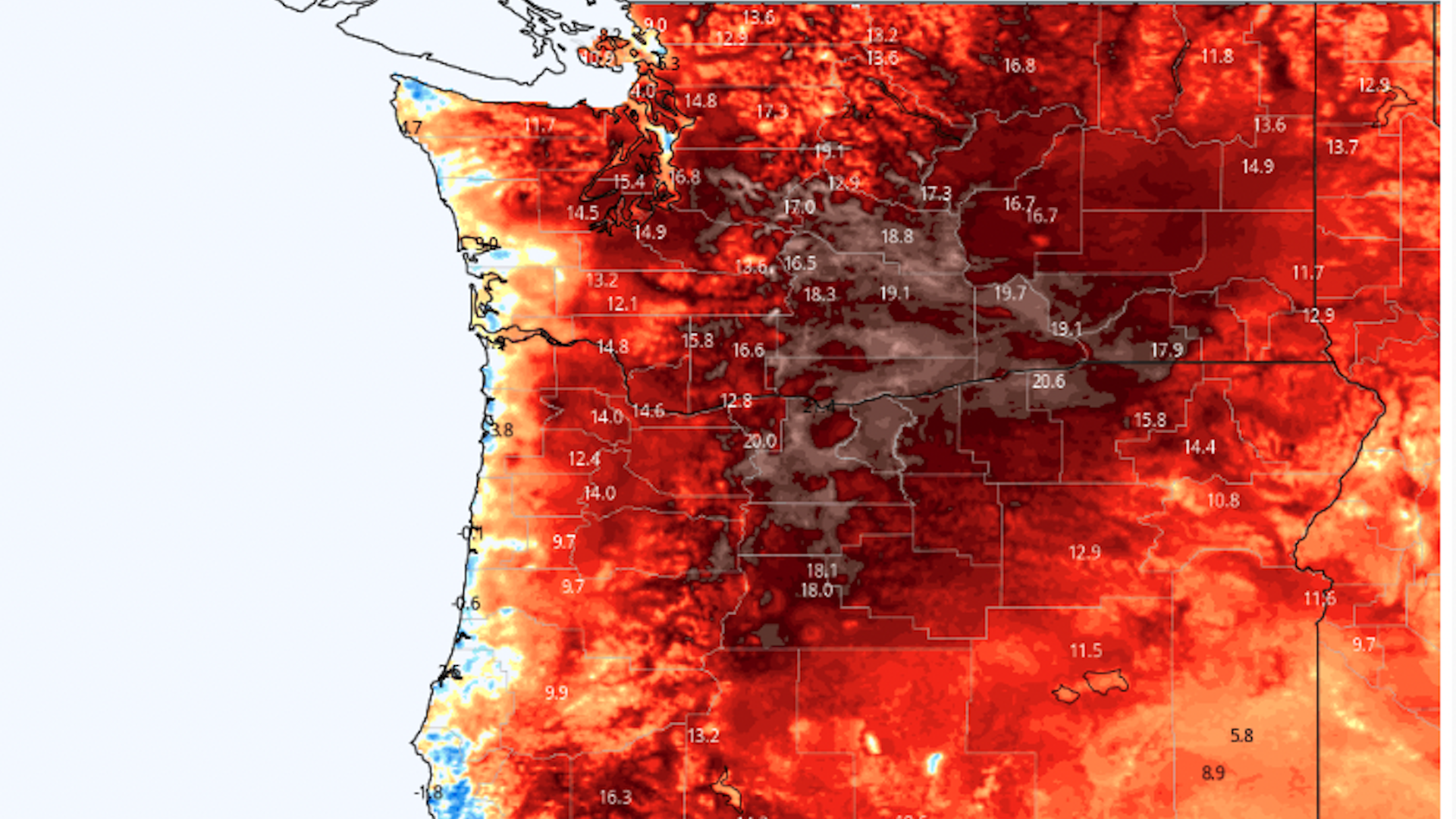

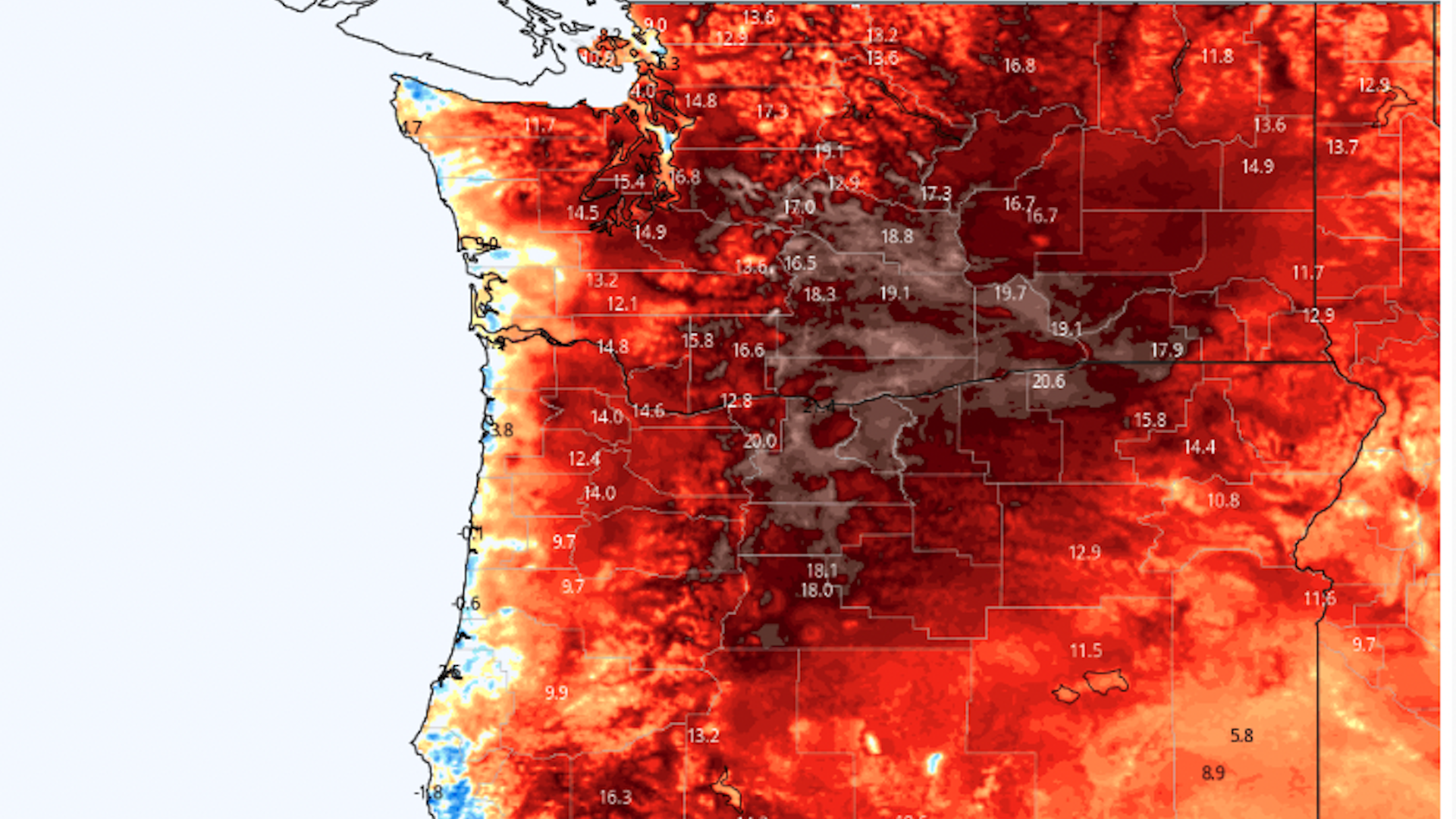

- Wind and solar additions declined greatly this year, but storage has grown, including a record Q2.

Catch up fast: President Biden last month announced a two-year delay of potential tariffs that may stem from the Commerce inquiry. Read the whole report. |     | | | | | | 5. Heat wave grips the Pacific Northwest |  | | | Computer model projection of high temperature departures from average in the Pacific Northwest on July 28, 2022. (Weatherbell.com) | | | | An extended period of unusually hot weather is affecting the Pacific Northwest, with much of Washington, Oregon, and parts of Idaho and far Northern California under heat warnings and advisories this week, Andrew writes. The big picture: The heat will continue through the weekend in the Pacific Northwest, with daytime highs in the triple digits in the Columbia Basin and central Oregon. - The Seattle and Portland metro areas will see temperatures challenge record highs in the mid-to-upper 90s through Thursday, before moderating some this weekend.

- Meanwhile, in the South Central states, particularly Oklahoma and Arkansas, heat combined with high humidity will yield heat indices as high as 110°F.

Context: While this is the hottest time of year, climate change is increasing the severity, duration and odds of extreme heat, and this is playing out in the U.S., Europe and Asia this summer. What's next: There are signs of another intense heat dome in the Plains beginning early next week, which may expand into the Midwest. |     | | | | | | A message from Air Products | | Tackling CO2 emissions head-on | | |  | | | | We'll eliminate more than 500 million tonnes of CO2e over the lifetime of our hydrogen projects in execution if all the hydrogen is used for the heavy-duty truck market. That's the same as eliminating emissions from 50 billion gallons of diesel fuel. See energy transition leadership in action. | | | | 📬 Did a friend send you this newsletter? Welcome, please sign up. Thanks for reading, and we'll be back with you tomorrow. |  | | Why stop here? Let's go Pro. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment