| | | | | | | Presented By OurCrowd | | | | Pro Rata | | By Dan Primack ·Feb 08, 2021 | | 🎧 Axios Re:Cap talked with Tampa Bay Bucs lineman Ndamukong Suh, who had 1.5 sacks last night, about pro athletes having off-field biz careers (including SPACs). Listen via Apple, Spotify or Axios. | | | | | | Top of the Morning |  | | | Illustration: Sarah Grillo/Axios | | | | John Matze, fired last month as CEO of social media app Parler, tells Axios on HBO that he feels "betrayed" by investor Rebekah Mercer, the heiress daughter of hedge fund billionaire Robert Mercer. Why it matters: Never before has a social media startup risen so high and fallen so far in such a short period of time. - Matze says he first met Rebecka Mercer while doing IT consulting for her father's firm, and remained in touch.

- "She seemed very nice ... and I don't judge anybody by the press that I see."

- Mercer helped fund Parler in 2018, and became its controlling shareholder. Matze says she and her people began getting more operationally involved as the site gained traction around the 2020 presidential election.

Early cracks in the partnership began to form last summer, according to Matze, when there was internal disagreement over how Parler should define "violence" in its terms of service. He claims that he wanted a broader definition than what was ultimately adopted, although he publicly supported the TOS in several subsequent interviews. - But Matze, whose libertarian leanings seemed to interfere with his ability to be a strong CEO, says the internal conflicts intensified around Jan. 6, as Parler's popularity peaked and its problematic posts proliferated.

- In short, he says he wanted more automated moderation than did Mercer's reps and allies, adding that Parler had added a remedial AI solution just before being kicked off of Amazon's cloud hosting services.

- Matze claims he continued advocating for moderation, as a way to get Parler back online, but was met with resistance. It's a retelling that seems supported by a recent public statements of Dan Bongino, the Trump acolyte and Parler shareholder who has criticized Matze for speaking publicly about his firing.

- Matze, who says he voted for Trump in 2016 but didn't vote at all in 2020, was fired via email on Jan. 29.

What he's saying: "I thought I knew her. She invited my family on trips with them and everything, I thought that she was, generally speaking, I thought she was being real. And then she just abruptly has her people fire me and doesn't even talk to me about it ... I feel like it was a stab in the back by somebody that I thought I knew. And so for me, you know, I would never do business with her again." |     | | | | | | The BFD |  | | | Illustration: Aïda Amer/Axios | | | | A French court has ordered Veolia (Paris: VIE) not to launch a $13.6 billion hostile takeover bid for rival water and waste management firm Suez (Paris: SEV). - Why it's the BFD: France is culturally adverse to corporate takeover fights, as evidenced by government officials pleading for peaceful resolution.

- Backstory: Veolia acquired a 29.9% stake in Suez last fall, saying that any future acquisition offer would "require a prior favorable reception from Suez's board of directors." But the two sides couldn't agree, and Veolia on Sunday announced plans to go straight to Suez shareholders, with an €18-per-share offer for the remaining 70.1% stake. In response, Suez petitioned the court.

- Bottom line: "This is the latest twist in a months-long battle that's playing out in the boardroom, the courts and the French political arena. A hostile takeover is a rare thing in France, and the unions compared Veolia's move to a 'declaration of war.' The increasing tensions may put pressure on the government to broker a deal." — Marthe Fourcade, Bloomberg

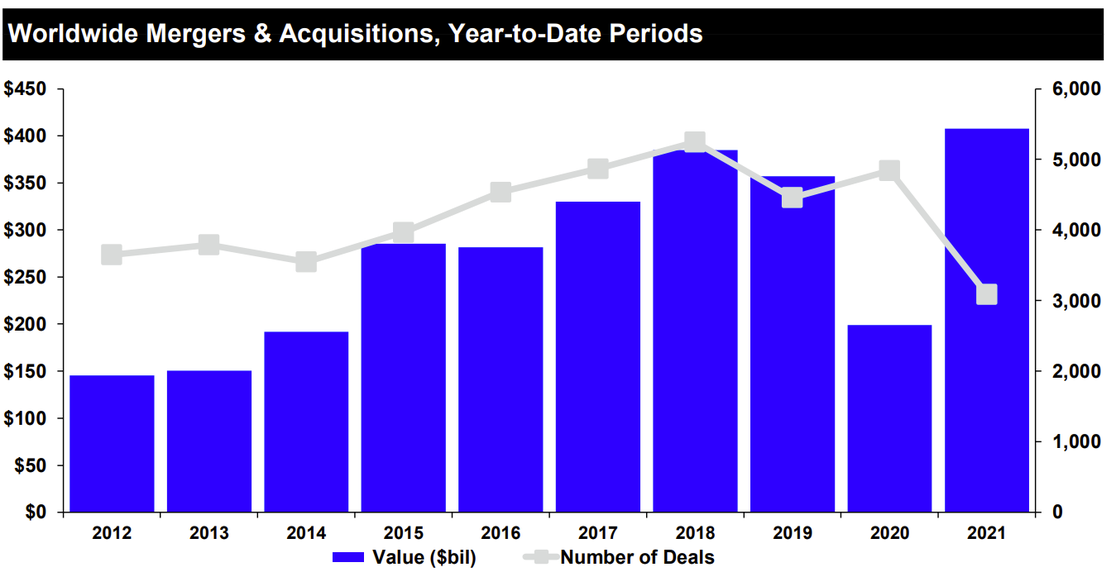

|     | | | | | | Venture Capital Deals | | • Nexthink, a Swiss provider of digital employee experience management software, raised $180 million in Series D funding at a $1.1 billion post-money valuation. Permira led, and was joined by return backers Highland Europe and Index Ventures. http://axios.link/kiJ5 • Clear, a provider of security identity solutions, raised $100 million from Danny Meyer's Enlightened Hospitality Investments, 32 Equity (NFL's investment arm) and the Partnership Fund for New York City. www.clearme.com • VerSe Innovation, the Indian parent company of news/entertainment app Dailyhunt and short video app Josh, raised over $100 million in Series H funding from Qatar Investment Authority and Glade Brook Capital Partners. http://axios.link/h5Rs • Cuemath, an Indian online math learning platform, raised $40 million in Series A funding. Lightstone Aspada and Alpha Wave Incubation co-led, and were joined by insisders Sequoia Capital India, CapitalG and Manta Ray. http://axios.link/969d • Isotropic Systems, a London-based provider of satellite terminal solutions, raised $40 million in Series B equity and U.K. government grant funding. SES led, and was joined by Boeing HorizonX, Space Angels and Orbital Ventures. http://axios.link/JDS2 • Coterie, a Cincinnati-based small business insurance startup, raised $11.5 million in Series A-1 funding. Intact Ventures led, and was joined by Alpha Edison, Lackawanna Insurance Group, RPM Ventures and Allos Ventures. http://axios.link/HIF4 • BeyondID, a Dallas-based cloud identity consulting firm, raised $9 million in Series A funding led by Tecera. http://axios.link/ErhS |     | | | | | | A message from OurCrowd | | Proven VC platform helps you add top startups to your portfolio | | |  | | | | The challenge: Startups are staying private longer, keeping investment growth behind closed doors. The solution: OurCrowd is changing that. They have 73K members and have invested $1B+ in companies like Lemonade and Beyond Meat — pre-IPO. Get in early on tomorrow's big deal - with OurCrowd. | | | | | | Private Equity Deals | | • The Blackstone Group is investing $150 million in startup capital to a new Asia-focused hedge fund led by Anand Balakrishna Madduri (ex-Lone Star Funds), per Reuters. http://axios.link/d4at • Elliott Management and Veritas Capital agreed to buy Cubic Corp. (NYSE: CUB), a San Diego-based company that develops payment system for subways and defense industry tech, for $2.8 billion in cash. Cubic had previously adopted a poison pill after Elliott disclosed a 15% equity stake. www.cubic.com • Equistone invested in Ligentia, a U.K.-based global supply chain management provider that reports around £300 million in 2020 revenue. www.ligentia.com • Lone Star Funds is considering a bid for all or part of Ulster Bank, the Irish retail unit of NatWest Group (LSE: NWG), per Bloomberg. http://axios.link/gOuT • Mill Point Capital acquired Prime Pensions, a Florham Park, N.J.-based provider of retirement plan recordkeeping and related services. www.primepensions.com • Peak Rock Capital acquired a majority stake in AMB, an Italian packaging manufacturer. http://axios.link/YNoW • TDR Capital made its fourth takeover offer for Arrow Global (LSE: ARW), a British buyer of defaulted customer accounts from retail banks and credit card companies, this time for around £540 million. http://axios.link/g1zo • TDR Capital and I Squared Capital are in talks to buy Aggreko (LSE: AGK), a British provider of portable power generators that could fetch around £2.25 billion, per Bloomberg. http://axios.link/tt3Q • Thomas H. Lee Partners invested in Ashling Partners, a Chicago-based provider of intelligent automation solutions. www.ashlingpartners.com |     | | | | | | Public Offerings | | • Eleven companies plan to go public on U.S. exchanges this week. http://axios.link/jgBC • Bumble, a dating app controlled by The Blackstone Group, raised its IPO terms from 34.5 million shares at $28–$30 to 45 million shares at $37–$39. It would raise $1.7 billion at a $7 billion market value, were it to price in the middle of its revised range. http://axios.link/Ddd4 🚑 Decibel Therapeutics, a Boston-based biotech focused on hearing loss and balance disorders, set IPO terms to 5.9 million shares at $16–$18. The pre-revenue company would have a fully diluted value of $427 million, were it to price in the middle, and raised $215 million from Third Rock Ventures (22% pre-IPO stake), OrbiMed (21.4%), Regeneron (14.7%), GV (11.3%), Surveyor Capital (7.5%), GlaxoSmithKline (7.2%), BlackRock, Casdin Capital, Janus Henderson, Samsara BioCapital and Foresite Capital. http://axios.link/y63F 🍷 Duckhorn Wine, a St. Helena, Calif.-based vintner owned by TSG Consumer Partners, hired banks for an IPO, per Bloomberg. http://axios.link/pX1h • Oatly, which yesterday tied with Andy Reid for wasting the most of a Super Bowl opportunity, may seek a $10 billion valuation in its U.S. IPO, per Bloomberg. http://axios.link/qD2Q 🚑 Oscar, a New York-based health insurer, filed for an IPO that Renaissance Capital estimates will raise up to $600 million. It plans to list on the NYSE (OSCR) and raised around $1.4 billion from firms like Alphabet, Thrive Capital, Founders Fund, Formation8, Fidelity, General Catalyst and Khosla Ventures. It also added former Obama administration official David Plouffe to its board of directors. http://axios.link/Lijc |     | | | | | | SPAC Stuff | | Source: GIPHY • Hippo, a Palo Alto, Calif.-based home insurance startup, is in talks to be acquired by the Reinvent SPAC co-founded by Mark Pincus and Reid Hoffman. Hippo has raised over $700 million from firms like Propel Venture Partners, Lennar, RPM Ventures, Bond, Dragoneer, Ribbit Capital, Felicis Ventures, Zeev Ventures, Fifth Wall, Comcast Ventures and Mitsui Sumitomo Insurance Co. http://axios.link/6chO • Matterport, a Sunnyvale, Calif.-based provider of 3D capture software, is in talks to be acquired by a Gores Group-sponsored SPAC at a valuation north of $2 billion, per Bloomberg. Matterport has raised nearly $170 million in VC funding from firms like DCM, Lux Capital, Red Swan Ventures, Qualcomm Ventures, AMD Ventures, and Navitas Capital. http://axios.link/dfd8 • Athena Technology Acquisition, a tech SPAC led by Isabelle Freidheim (Starwood VC) and Phyllis Newhouse (Xtreme Solutions), filed for a $250 million IPO. http://axios.link/EHsO • Churchill Capital Corp VII, a SPAC led by Michael Klein, more than tripled its expected IPO size to $1 billion. http://axios.link/7fE8 • Colicity, a TMT SPAC led by Craig McCaw, filed for a $275 million IPO. http://axios.link/9w3W ⛽ Flame Acquisition, an energy SPAC led by James Flores (ex-Sable Permian Resources, Freeport-McMoRan), filed for a $250 million IPO. http://axios.link/TCAJ • SilverBox Engaged Merger Corp., a SPAC formed by SilverBox Capital and Engaged Capital, filed for a $300 million IPO. http://axios.link/0w6s • Silver Spike Acquisition II, a cannabis SPAC formed by Silver Spike Capital, filed for a $250 million IPO. http://axios.link/yVbY • SoftBank filed IPO paperwork for two new tech SPACs, one targeting $350 million and the other $200 million. http://axios.link/oVnH • USHG Acquisition, a SPAC chaired by restauranteur Danny Meyer, filed for a $250 million IPO. http://axios.link/mCpE • Velocity Acquisition, a digital transformation SPAC led by Adrian Covey (ex-Accenture Interactive), filed for a $200 million IPO. http://axios.link/oT5u • Warrior Technologies Acquisition, a environmental services SPAC, filed for a $200 million IPO. http://axios.link/LKD5 |     | | | | | | Liquidity Events | | • AnaCap sold Equa Bank, a Czech challenger bank, to Raiffeisen Bank International. www.equabank.cz 🚑 Audax Private Equity hired Moelis to find a buyer for Gastro Health, a Miami-based GI health services company that generated $65 million in 2020 EBITDA, per PE Hub. http://axios.link/mzkG • Automattic agreed to buy Parse.ly, a Beaverton, Ore.-based web traffic analytics provider that had raised around $14 million (plus a PPP loan) from firms like Blumberg Capital, Grotech Ventures and ff Venture Capital. http://axios.link/hsjs |     | | | | | | More M&A | | • Box (NYSE: BOX) agreed to buy SignRequest, a Dutch electronic signature company, for $55 million. http://axios.link/kFRU • PPG Industries (NYSE: PPG) prevailed in its efforts to buy listed Finnish paint-maker Tikkurila, with a sweetened bid of €1.4 billion, topping Akzo Nobel (AMS: AKZA). http://axios.link/aRuk • Renesas Electronics (Tokyo: 6723) agreed to buy Dialog Semiconductor (DE: DLGS) for €4.9 billion in cash. http://axios.link/oi8d |     | | | | | | Fundraising | | • Golding Capital Partners of Germany raised €375 million for its latest PE fund-of-funds. http://axios.link/eohk • Marshall Wace, a London-based hedge fund manager, is raising $400 million for a late-stage venture capital fund, per the FT. http://axios.link/NoxD • SoftBank Vision Fund arm reported $12.8 billion in gains (and $8 billion net profit) from its investments in Q4 2020, mainly driven by its stakes in Uber and DoorDash. SoftBank Group itself posted a $11.1 billion net profit. Go deeper. |     | | | | | | It's Personnel | | • Clair Byrd joined Wing Venture Capital as a partner. She previously was senior director of solutions market at Twilio. www.wing.vc |     | | | | | | Final Numbers | Source: Refinitiv Deals Intelligence. Data through Feb. 4, 2020. More YTD data from Refintiv: - Every major global region has experienced year over year growth, save for Japan.

- U.S. deal value is up 177% year-over-year.

- Global strategic deal value is up 95%, while global private equity deal value is up 130%.

|     | | | | | | A message from OurCrowd | | Top startups and VCs increasingly seek strategic partners for success | | |  | | | | OurCrowd accelerates startup's success with a global network of 73K+ members and 1000+ strategic multinational corporations. Typical rounds are $2-$20M, with opportunity for more alongside institutional investors. Take the next step to global success - with OurCrowd. | | | | ✔️ Thanks for reading Axios Pro Rata! Please ask your friends, colleagues and all the Gronkowskis to sign up. | | | | Axios thanks our partners for supporting our newsletters.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment