| EUR/USD. Brexit is back in focus after the market presumably settled the new COVID-19 strain 2020-12-23 The euro/dollar pair is trading in a wide 150-point range this week, reacting to fundamental major events. Thus, macroeconomic reports have faded into the background – the tone of trading is set by other factors. The focus is primarily on the situation with the new strain of coronavirus, as well as negotiations around the prospects of Brexit. These topics continue to determine the level of anti-risk sentiment in the market, thereby determining the level of demand for the US currency. At the moment, the panic among traders has slightly cooled down. The US dollar index declined, while a cautious interest in risky assets arose in the market. The EUR/USD pair was no exception: Buyers took the lead during the Asian session, slowly recovering lost points. On the wave of the downward impulse, the bears could not pull the price below the level of 1.2100, so it is quite natural that the pair is now trying to return to the level of 1.22. So far, the fundamental background contributes to this, although the overall market situation is still unstable.

The market participants initially called the situation with the new COVID-19 strain "unsettled", since events were unfolding so rapidly that the market did not have time to properly comprehend what was happening: Boris Johnson announced a new threat over the weekend, while the European Union was actually isolated from Britain on Monday. This was after admitting that a new strain has been discovered in 5 EU countries. However, there are not much details about the updated COVID-19, except that it is more contagious. Initially, experts could not clearly answer the key question about the effectiveness of vaccination in view of new coronavirus mutations. Therefore, investors' panic was quite justified. But fortunately, the overall picture of the current situation has slowly been getting clear. The new strain is indeed more infectious (by 50-70% of the usual COVID variant) and is more often recorded in children, but at the same time, it yields to those vaccines that have already been developed and are used in some countries. As experts explained, there is a concept of "dose" in virology: when a small amount of a virus enters the body, it does not have time to contact the receptors, and the person does not become infected. However, the new strain (VUI-202012/01) does it faster – roughly speaking, a person needs less of the notorious "dose" of this strain to catch COVID. At the same time, scientists assure that the new strain will not affect the effectiveness of the vaccine. To simply put, the coronavirus can spread faster, but this threat has been somewhat leveled given the fact that mass vaccination has already begun in the United States, and it is about to begin (tentatively - next week) in Europe. Amid such news, currency markets are gradually recovering, at least major stock indexes in the Asia-Pacific region rose 1.2% today. On the other hand, long positions in the EUR/USD pair still look risky, although the same can be said about sales. The US dollar, as a protective asset, is in investors' field of view in connection with the uncertain prospects for Brexit. This is a kind of "time bomb" that can explode any time, provoking a surge in anti-risk sentiment, and, consequently, an increased demand for the US dollar. Rumors surrounding the prospects for a trade deal between London and Brussels are controversial. Unfortunately, traders are forced to rely mainly on unofficial information, since official comments lack details. Insiders voice more information, but its reliability is doubtful. For example, the journalists of the ITV TV channel stated this morning that the parties are literally one step away from signing the deal – the parties allegedly can shake each other's hands before the end of Wednesday, although Reuters wrote last night that the fishing issues remain the main hindrance. According to journalists, this information was announced by EU's chief negotiator, Michel Barnier, to the EU representatives following the results of yesterday's negotiations. At the moment, no one can say with certainty how Brexit will end, since any forecast is based on subjective assessments. Let's say, in my opinion, the parties still make a deal, but it will be done either tomorrow (before Christmas day), or next week – that is, at the last moment. There are many prerequisites for the British to eventually compromise on the fishing issue, opening the way to an agreement. However, it should be noted that this is just a subjective assessment of the situation.

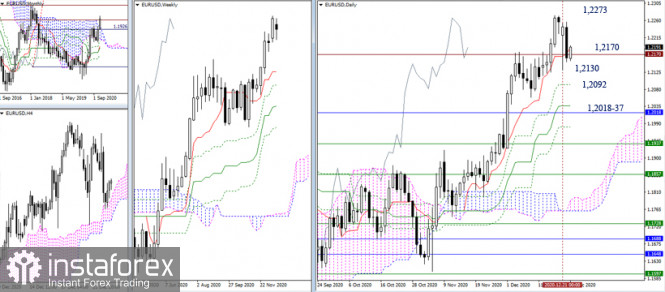

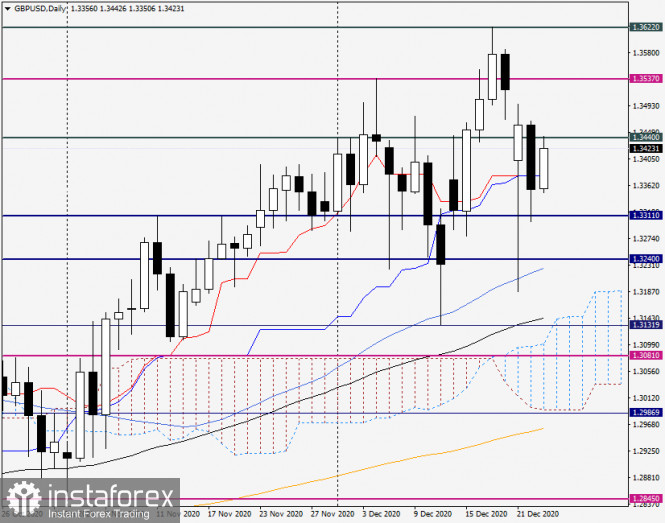

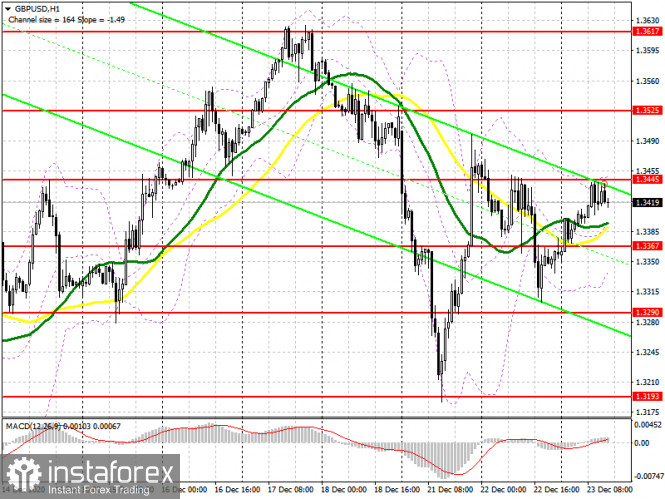

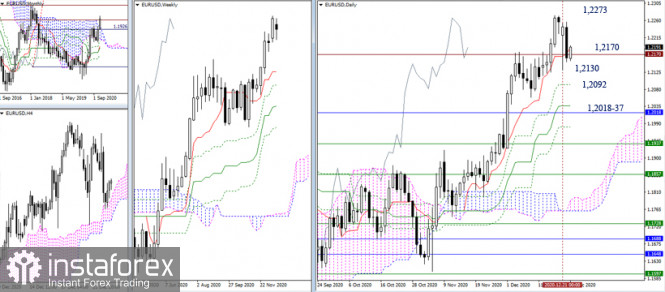

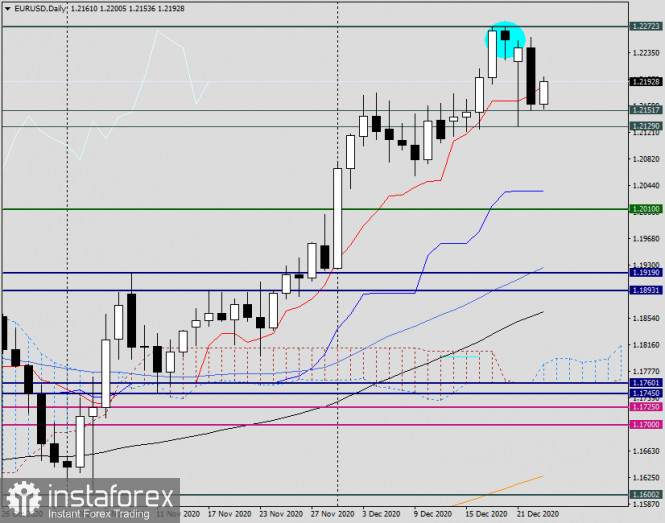

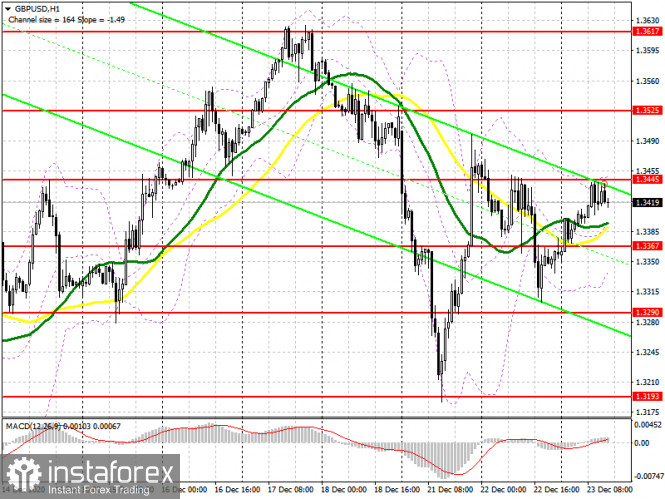

The situation still remains unsolved. If the pressure swings towards the conclusion of the deal, the euro will receive significant support, as the market will increase interest in risky assets. Otherwise, dollar bulls will take the lead again, returning the EUR/USD pair to the base of the 21st figure. Thus, the indicated pair's fate in the medium term depends on Brexit. The "British mutant" factor has already been used in many ways, so traders focused on trade negotiations. On the one hand, it is currently best to take a wait-and-see position for the pair, since the pressure can swing in any direction (the latest optimistic rumors should not be trusted). On the other hand, assessing the insider information of many influential publications (in particular, the Financial Times), it can be assumed that the parties will come to a compromise decision at the last moment, announcing their readiness to conclude a trade deal. Therefore, the US dollar will not be in favor if you enter the market, excluding short-term time periods. The first upward target is the level of 1.2273 (two and a half year high that was reached last week). The main target is located above it, which is around 1.2310 (upper line of the Bollinger Bands indicator on the daily time frame). Technical recommendations for EUR/USD and GBP/USD on 12/23/20 2020-12-23 EUR/USD  The pair returned to the attraction zone and support of the historical level of 1.2170, but failed to move beyond Monday's low (1.2130). As a result, the situation did not change significantly, so the conclusions and expectations about possible scenarios for the development of the situation remain unchanged. The role of attraction and support belongs to the level of 1.2170, while the nearest important upward level is located at 1.2273 (last week's high). In turn, the downward targets can now be noted at 1.2130 (Monday's low extreme) - 1.2092 (daily Fibo Kijun) - 1.2018 -37 (daily Kijun + monthly cloud limit).  The key levels in the smaller time frames are currently located at 1.2190 - 1.2216 (central pivot level + weekly long-term trend). Now, if we move beyond the attraction zone with small deviations above or below, it will contribute to the preservation of uncertainty, which means the lack of clear preferences and directional movements. On the other hand, if we move beyond the previous movement (1.2273 - 1.2130), it will return the relevance to the classic pivot support levels 1.2085 - 1.2019 as well as resistances 1.2295 - 1.2334. GBP/USD  The lower limit of the monthly cloud becomes the middle ground once again. Yesterday, the situation did not change significantly in the main direction. The resistance levels for the bulls, which open up new prospects, are still located at 1.3481 - 1.3538 - 1.3627. In case the price consolidates below the level of 1.3350, the area of 1.32 (historical level + weekly short-term trend) will continue to be important for bearish traders.  In the smaller time frames, the key levels have occupied an almost horizontal position and are now at 1.3458 (weekly long-term trend) and 1.3377 (central pivot level). A movement in the influence and attraction zone will contribute to the development of uncertainty. The resistances of the classic pivot levels are now located at 1.3543 (R2) - 1.3617 (R3). The main task for the bulls will be to consolidate above the high (1.3624). Here, the support of the classic pivot levels can be currently noted at 1.3285 (S1) - 1.3211 (S2) - 1.3119 (S3). Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120) Trading idea for the EUR/USD pair 2020-12-23  EUR / USD declined sharply yesterday, all according to the plan we presented earlier . In fact, traders can continue setting up short positions, following this strategy:  Since the quotes have formed three wave patterns (ABC), in which wave A is the downward move during yesterday's trading, short positions may be opened from 61.8% and 50% Fibonacci. These transactions have risk/profit ratio of 2:1. Of course, traders have to closely monitor the risks to avoid losing profit. Trading in this market is precarious, but is very profitable as long as you use the right approach. Price Action and Stop Hunting were used for this trading strategy. Good luck! Analysis and forecast for EUR/USD on December 23, 2020 2020-12-23 In yesterday's trading, the US dollar was in demand among investors as a safe asset and strengthened across a wide range of markets. In all likelihood, market participants were frightened by a new strain of COVID-19, which has already been called "British". Although, if you remember this, as it is believed, the new strain did not appear yesterday. Its appearance in the second half of this year has already been noted in Wales, Scotland, as well as several Scandinavian countries, such as Sweden and Norway. As already suggested in previous materials, the excitement caused by the new strain of coronavirus in the UK, as well as the isolation of the United Kingdom, is nothing but another (perhaps the last) lever to influence the Cabinet of Boris Johnson to sign a trade agreement with the European Union and leave the EU with the deal concluded. The countdown to the moment when the UK leaves the European Union has already started. This was once again reminded by the EU negotiator Michel Barnier, however, a compromise has still not been found. It is likely that, under certain conditions, negotiations will continue after the first of January next year, when the UK officially leaves the pan-European economic area. Let us go back to yesterday's statistics. The final data on US GDP for the third quarter came out better than expected (33.1%) and the growth of the world's leading economy was 33.4%. However, consumer confidence in the United States was worse than economists' expectations, which were reduced to 97, while the actual figure was 88.6. Although, I do not think that yesterday's strengthening of the US currency was caused solely by these macroeconomic indicators, especially since they were mixed. It should be noted that yesterday the US Congress still passed a bill on the $ 892 billion aid package from COVID-19, thereby preventing the possible closure of government structures. Most likely, this news, along with concerns about a new strain of coronavirus, supported the US currency. Today, starting from 14:30 London time, a large block of macroeconomic statistics will begin to arrive from the United States, where the main attention of investors will be attracted by personal expenses and incomes of Americans, as well as orders for durable goods. European macroeconomic reports are not scheduled for today. Daily

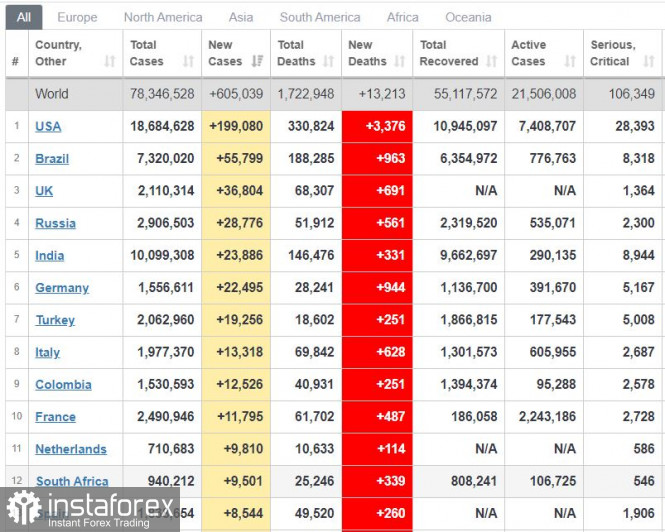

So, following the results of yesterday's trading, a rather impressive bearish candle appeared on the daily chart of the main currency pair with a closing price of 1.2160. As previously expected, the price zone of 1.2177-1.2130 will be extremely important, and a move below 1.2130 may signal a reversal of the course in the south direction. Although yesterday's session ended under the red line of the Tenkan Ichimoku indicator, today the pair did not go below yesterday's lows of 1.2151 but began to strengthen from 1.2153. Such a course of trading, as well as the inability of the euro to update the minimum trading values on December 21 (1.2129), allow us to count on the growth of the single European currency. However, this does not mean the cancellation of the alternative downward scenario, so we will consider both options for today's trading on EUR/USD. H1

In this timeframe, we will focus on the ascending channel, the lower border of which passes near the horizontal levels of 1.2151 and 1.2129. At the same time, by setting two arrows, I completely allow a false breakdown of the support line of the channel, after which the price will return to its limits and continue to grow. On the other hand, the 50 simple and 89 exponential moving averages act as a serious and quite strong resistance, so the appearance of bearish candles or one characteristic candle under the 50 MA and 89 EMA will be a signal to open short positions. In the case of a true breakdown (with fixing) of the brown support line of the channel, as well as two horizontal levels of 1.2151 and 1.2129, you can also try selling on a rollback to them. Technical analysis of EUR/USD for December 23, 2020 2020-12-23  Overview : The EUR/USD pair is trying to settle below the top of 1.2273.The trend of EUR/USD pair movement was controversial as it took place in a narrow sideways channel, the market showed signs of instability. Amid the previous events, the price is still moving between the levels of 1.2273 and 1.2166. If the EUR/USD pair declines below the level of 1.2273, it will gain downside momentum and head towards the next support at the yearly lows at 1.2191 which will be bearish for EUR/USD. The nearest resistance level for the EUR/USD pair is located at the recent highs at 1.2273, although the EUR/USD pair may also face some resistance at the high of the previous trading day at 1.2273. This week, the market moved from its bottom at 1.2191 and continued to rise towards the top of 1.2273. Today, in the one-hour chart, the current drop will remain within a framework of correction. This would suggest a bearish market because the RSI indicator is still in a negative area and does not show any trend-reversal signs. The pair is expected to drop lower towards at least 1.2191 with a view to test the daily pivot point. However, if the pair fails to pass through the level of 1.2191, the market will indicate a bearish opportunity below the strong resistance level of 1.2273 (the level of 1.2273 coincides with the double top too). Sell deals are recommended below the level of 1.2273 with the first target at 1.2166. If the trend breaks the support level of 1.2166, the pair is likely to move downwards continuing the development of a bearish trend to the level 1.2110 in order to test the daily support 2 (horizontal green line). On the support side, the nearest support level for the EUR/USD pair is located at 1.2110. If the EUR/USD pair declines below this level, it will head towards the next support at 1.2056. A move below this support level will open the way to the test of the support at the 50 EMA at 1.2056. The price spot of 1.2273 remains a significant resistance zone. Thus, the trend is still bearish as long as the level of 1.2273 is not breached. At the same time, if a breakout happens at the resistance levels of 1.2273, then this scenario may be invalidated. But in overall, we still prefer the bearish scenario. Trading plan for the EUR/USD pair on December 23. Global COVID-19 incidence increased again. The euro underwent a large pullback. 2020-12-23

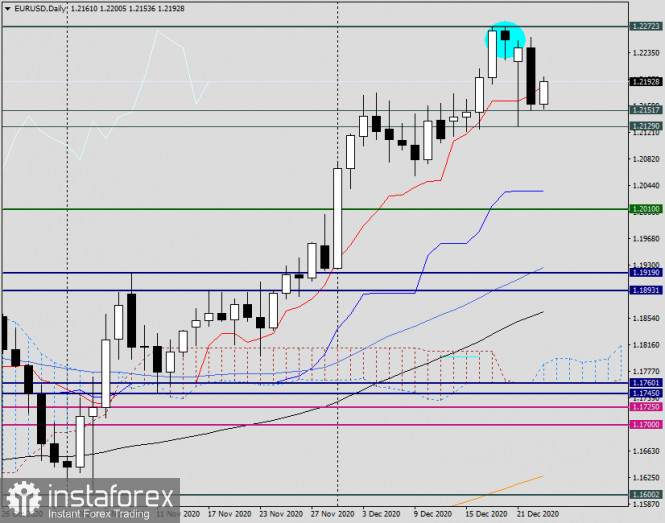

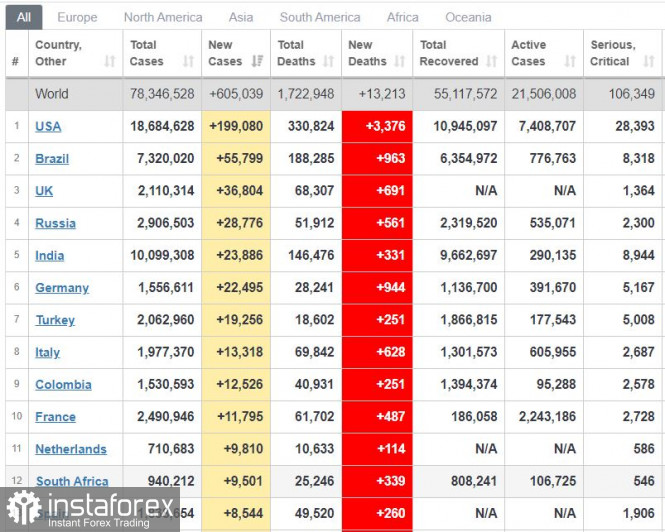

Global COVID-19 incidence increased again, reaching 605,000 yesterday. However, it is below the recorded peak, which is somehow a good sign. In the United States, new cases to 199,000, while deaths hit 3.4 thousand. Meanwhile, because of the new strain of the coronavirus, neighboring countries have interrupted transport links with the UK. Quarantine standards have also been tightened in Europe, but vaccinations both in the US and the UK are progressing rapidly.

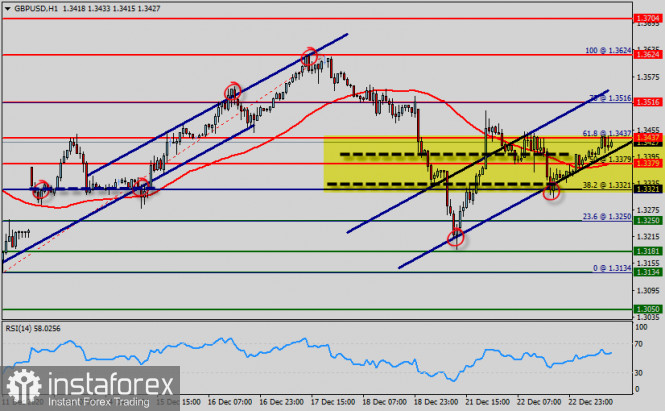

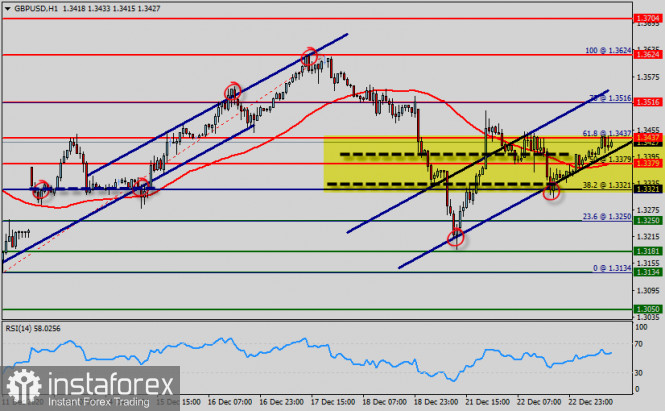

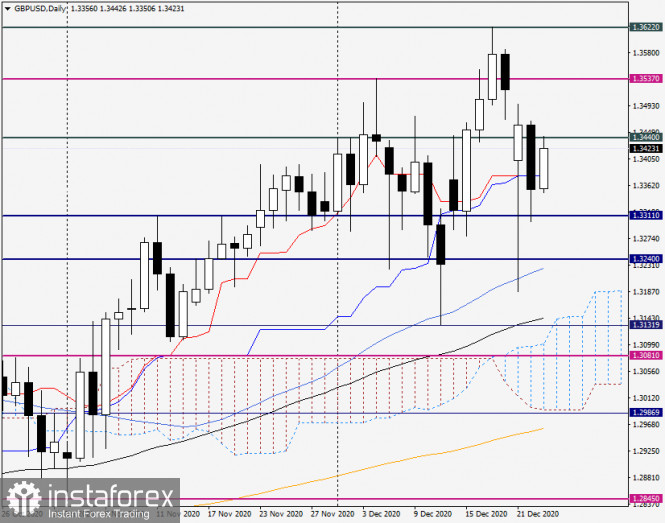

EUR/USD - the euro underwent a large pullback, but the upward trend may still continue. Open long positions from 1.2190. Open short positions from 1.2130. Technical analysis of GBP/USD for December 23, 2020 2020-12-23  Overview : The GBP/USD pair has extended its gains, nearing 1.3437 (double top on the H1 chart). Pound/Dollar : with optimism for vaccines and the peaceful transfer of power in the UK continues at its highest price, nearly two or three week ago. The GBP/USD pair continues to move upwards from the level of 1.3437. Today, the first support level is currently seen at 1.3321, the price is moving in a bullish channel now. Furthermore, the price has been set above the strong support at the level of 1.3321, which coincides with the 38.2% Fibonacci retracement level. This support has been rejected three times confirming the veracity of an uptrend. According to the previous events, we expect the GBP/USD pair to trade between 1.3321 and 1.3624. It may witness a further upward expansion if it comes with a report the Fed is a negative interest tone, but any gains in the GBP against the dollar will not be far from the Coronavirus (COVID-19). So, the support stands at 1.2379, while daily resistance is found at 1.3516. It should be noted that volatility is very high for that the GBP/USD pair is still moving between 1.3379 and 1.3516 in coming hours. This is confirmed by the RSI indicator signaling that we are still in the bullish trending market. Now, the pair is likely to begin an ascending movement to the point of 1.3379 and further to the level of 1.3516. Therefore, the market is likely to show signs of a bullish trend around the spot of 1.3379 - 1.3437. In other words, buy orders are recommended above the spot of 1.3379 with the first target at the level of 1.3516; and continue towards 1.3624. At the same time, if a breakout happens at the support level of 1.3321, then this scenario may be invalidated. Analysis and Forecast for GBP/USD for December 23, 2020 2020-12-23 Tight quarantine measures are further implemented in the United Kingdom following the detection of a new strain of coronavirus infection in the country. This was primarily applied to London and the South-Eastern part of the country. At the same time, there is no guarantee that the increase in quarantine will not happen in the rest of the British regions. Several countries around the globe have already begun to issue transport ban links with the British Isles. Meanwhile, negotiations between the UK and the European Union to reach a trade agreement remain at an impasse. Optimists still believe that the deal can be concluded right on New year's eve. However, the positions of the parties do not yet provide for reaching a compromise, although it should not be completely excluded. Negotiators from both sides, Michel Barnier and David Frost continue to feed promises and instill hope that a compromise is still possible. At least, hard work continues in this direction, but whether it will give any positive results will be known in the very next few days or even hours. According to British Prime Minister Boris Johnson, the end of the transition period until December 31 of this year, in his opinion, does not provide for its extension and the continuation of any negotiations, which means that the UK will leave the EU without a trade agreement. In this case, both parties will have to face significant difficulties and additional costs in the subsequent trade relationship. This scenario is particularly painful for the British economy. GBP/USD, Daily chart:

The GBP/USD pair declined during Tuesday's trading session closing it at the level of 1.3360. Let me remind you that this mark is technically quite strong, hence the reversal or strong rebound of the price has been observed more than once. Tuesday's good GDP reports for the third quarter did not help the pound sterling either. However, the US economy showed stronger growth than experts expected over the same period of time. In today's trading, at the time of writing this article, the GBP/USD pair is trading higher, near 1.3418. If the rise continues, the nearest target will be the levels of 1.3495 and 1.3500 (the highs of trading on December 21, and an important psychological level). Closing today's session above 1.3500 will give new strength to the subsequent growth and strengthen the position of buyers of the pound. If, at the end of trading, a candle with a long upper shadow appears on the daily chart and the closing price is below 1.3380, there is a high probability that the quotes will continue its downward trend. According to trade recommendations, the situation continues to be quite ambiguous and complex. We will focus exclusively on technical signals. If after the rise above 1.3440, in the area of 1.3490-1.3510, bearish patterns of Japanese candlesticks appear on the four-hour or hourly charts, we try to sell the pound sterling with the nearest targets in the area of 1.3400-1.3360. Risky purchases can be tried from current prices or after a decline in the area of 1.3377. It is worth buying the pair above 1.3500 only after a clear consolidation above this mark, and then, even after that, it is impossible to exclude that the quotes will fall to the area of 1.3400. News about the Brexit negotiations and a large block of American statistics, which will start arriving at 13:30 UTC, can play a role in the price dynamics of the GBP/USD pair. EUR/USD: US dollar is showing weakness, but the euro is not happy with it 2020-12-23

The market is worried about the dynamics of the EUR/USD pair during the middle of the final week of the current year. Many experts talked about the US dollar's weakness, but at the same time they hoped that the euro would strengthen. However, analysts say that the weakness of the dollar is unlikely to help the euro this time. Today, the US currency weakened significantly against other global currencies. Experts have recorded a drop in the dollar index (DXY) by 0.2%, to 90.368 after slightly rising (by 0.66%, to 90.546) the day before. The US dollar was supported by the short-term surge in demand for protective assets, but luck turned away from it again. On Wednesday morning, the EUR/USD pair traded near the level of 1.2183, but tested the range of 1.2191-1.2192 a little later.

Market participants are still mainly focused on the difficult situation with the new strain of COVID-19 discovered in the UK. Experts fear that the new virus strain will "spread" to other European countries, primarily Germany and France. On another note, they consider the economic situation in the US relatively stable, where the final data on GDP for the third quarter for this year were published. During the reporting period, this indicator increased by 33.4%, which exceeded experts' forecast by 0.3 percentage points (pp). However, this did not positively affect the US dollar. Analysts believe that the US Congress, approving the new stimulus package, led to investors' profit-taking. Experts emphasized that this contributed to the dollar's further decline. At the same time, Donald Trump's statements about his unwillingness to sign the new fiscal stimulus bill, which provides for the allocation of hundreds of millions of dollars to foreign states for purposes not related to the fight against COVID-19, is another factor that contributed to it. Instead of doing so, the still incumbent US president has demanded that lawmakers amend the bill to increase payments to Americans. According to the analysts of Trading Economics, the adoption of the next package of fiscal measures by the US authorities and the expectation of the emergence of effective vaccines for COVID-19 support investors' optimism about the prospects for the global economy in 2021. However, experts stressed that the current situation does not favor the growth of the US dollar. Moreover, its weakness does not add optimism to the Euro, which is also under pressure from negative factors. According to analysts polled by Reuters, USD will continue to decline until the middle of next year. Experts sum up that the demand for risky assets will remain high if this scenario actually happens. Analysis of Gold for December 23,.2020 - Test of the rising trendline and potetnial for the rally towards $1.884 2020-12-23 US MBA mortgage applications w.e. 18 December +0.8% vs +1.1% prior Latest data from the Mortgage Bankers Association for the week ending 18 December 2020 - Market index 863.9 vs 857.3 prior

- Purchase index 316.3 vs 331.6 prior

- Refinancing index 4,169.0 vs 4,014.5 prior

- 30-year mortgage rate 2.86% vs 2.85% prior

Purchases activity were seen cooling off with refinancing being the one bolstering mortgage activity in the past week. The housing market continues to keep in a solid position throughout the virus crisis and is staying that way through to the year-end.

Further Development

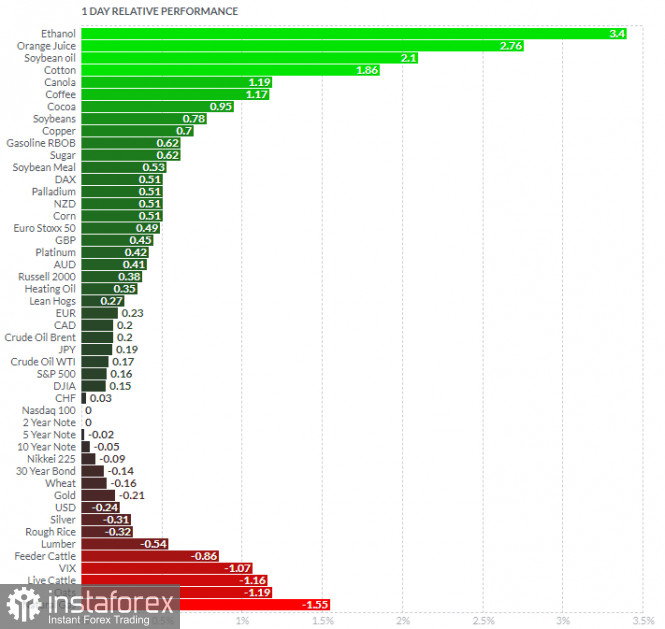

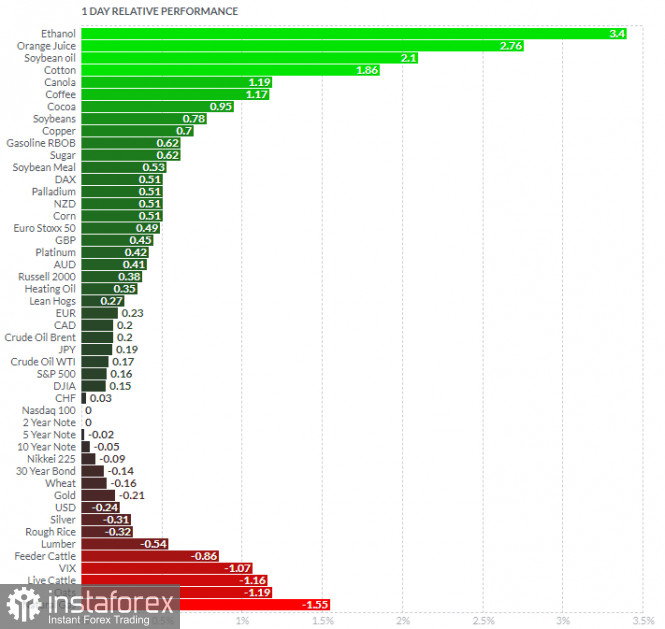

Analyzing the current trading chart of Gold, I found that there is the test of the rising trend line, which can be the good place to watch for buying opportunities. The level at $1,860. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Ethanol and Orange Juice today and on the bottom Natural Gas and Oats. Key Levels: Resistances: $$1,884 and $1,906 Support levels: $1,860 and $1,855 EUR/USD analysis for December 23 2020 - Contraction on the Early Europe session and potentiual for the breakout 2020-12-23 Pfizer, BioNTech to supply the US with 100 million additional coronavirus vaccine doses The US government will pay $1.95 billion for the additional 100 million doses The deal will include option for an additional 400 million doses, with Pfizer noting that they expect the whole initial 200 million doses to be delivered by 31 July 2021. That's some additional good news on the vaccine front and for risk sentiment as well, which has been keeping steadier through European morning trade despite a hiccup on the US stimulus front with Trump having called to amend the virus relief bill. Further Development

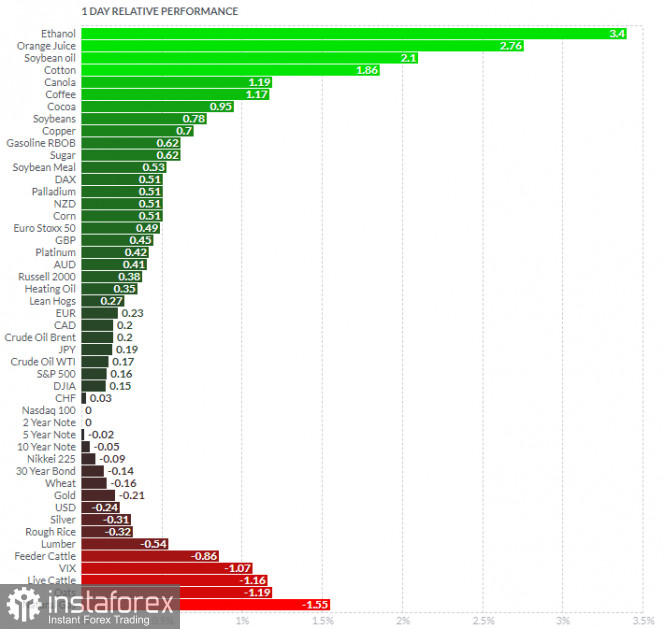

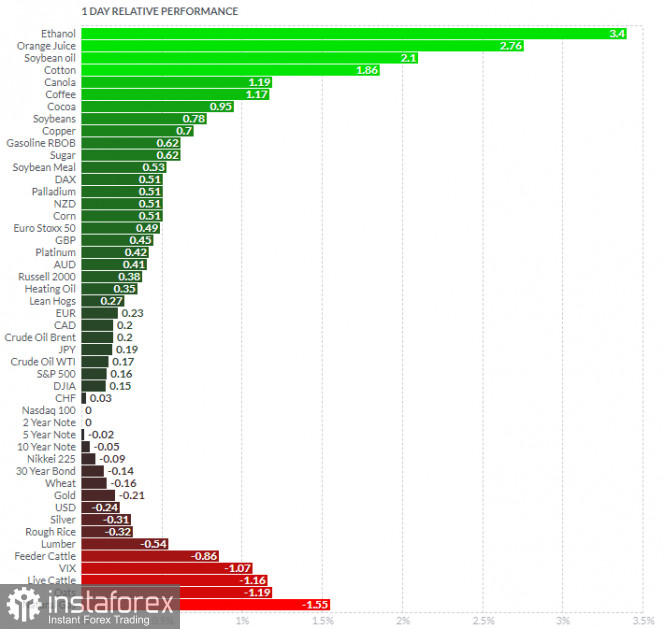

Analyzing the current trading chart of EURUSD, I found that there is contraction and trading range condition in last few hours, which is sign of indecision. 1-Day relative strength performance Finviz

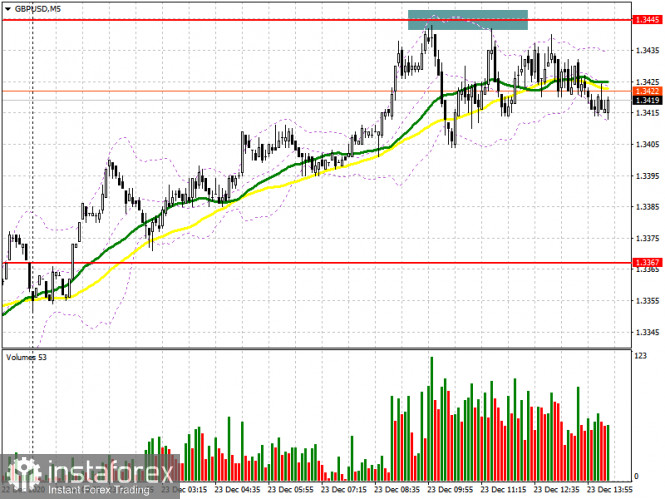

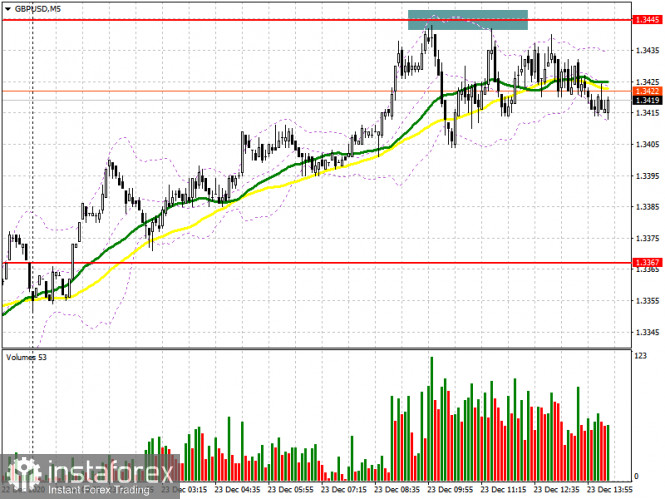

Based on the graph above I found that on the top of the list we got Ethanol and Orange Juice today and on the bottom Natural Gas and Oats. Key Levels: Resistances: 1,2200 Support levels: 1,2178 GBP/USD: plan for the American session on December 23 (analysis of morning deals) 2020-12-23 To open long positions on GBPUSD, you need to: The news that the EU rejected the UK's fishing proposal, which was made the day before, did not lead to a strong fall in the British pound, although it put some pressure on the pair. The risk of disruption of the trade agreement remains quite high, so I do not advise you to rush to buy the pound. In the first half of the day, a sell signal for the pound was formed, similar to yesterday. However, you should pay attention to the fact that there was no false breakout of the level of 1.3445, and if you missed this trade, then it's okay since there was no real confirmation to enter short positions on the system. On the 5-minute chart, the area from where it was possible to sell the pound further along the trend is visible.

The technical picture has not changed in any way and the benchmarks have remained the same. The task of buyers today in the second half of the day today is to once again maintain control over the level of 1.3367. The formation of a false breakout will be a signal to open long positions in the expectation of recovery of GBP/USD in the short term to the resistance of 1.3445. The main goal will be to break through and consolidate above this range, which was not possible during the European session. Only a test of this level from top to bottom forms an additional entry point into long positions intending to reach the maximum of 1.3525, where I recommend fixing the profits. The longer-term target remains the resistances of 1.3617 and 1.3690, however, they will only be available if there is good news on the Brexit agreement. In the scenario of a lack of bull activity in the support area of 1.3367, as it was yesterday in the afternoon when buyers failed to protect the level of 1.3367 after the second test, it is best not to rush to buy but to wait for the update of the minimum of 1.3290. However, I recommend opening long positions from this level only after the formation of a false breakout. A larger support area is seen in the area of 1.3193, where you can buy GBP/USD immediately on the rebound with the expectation of a correction of 35-40 points. To open short positions on GBPUSD, you need to: Bears coped with the task for the first half of the day and did not let the pound above the resistance of 1.3445, which is quite problematic for the British pound. As long as trading is below this range, there is a possibility that the pressure on GBP/USD will return in the near future, especially if the fundamental data on the US economy turn out to be better than economists' forecasts. I recommend paying attention to the data on the number of initial applications for unemployment benefits in the United States, as well as changes in the level of spending and income of Americans. In a downward movement, the sellers' goal will be to test the support of 1.3367, on which a lot depends. A breakthrough of this level with a test from the bottom up forms a good signal to open short positions in the continuation of the downward trend already to reduce to the lows of 1.3290 and 1.3193, from which strong demand was observed at the beginning of the week. Only bad news on the trade agreement will lead to a larger collapse of GBP/USD to the area of the minimum of 1.3114. If the bulls manage to defend the level of 1.3367 and break above 1.3445, I recommend opening short positions immediately on the rebound from the maximum in the area of 1.3525 with the aim of a downward correction of 30-35 points within the day.

Let me remind you that in the COT reports (Commitment of Traders) for December 15, there is a decrease in interest in the British pound, both buyers and sellers. Long non-profit positions fell from 39,344 to 35,128, while short non-profit positions fell from 33,634 to 31,060. As a result, the non-profit net position remained positive, but fell to the level of 4,068, against 5,710 a week earlier. All this suggests that traders are taking a wait-and-see position, although a small preponderance of buyers, even in the current situation, continues to be observed. Given that the UK has imposed strict quarantine measures due to a new strain of coronavirus that is out of control and for which there is no vaccine yet, it will not be the right decision to expect a further strengthening of the pound at the end of this year. Only good news on Brexit can bring new players back to the market, betting on the growth of GBPUSD. Indicator signals: Moving averages Trading is above 30 and 50 daily averages, however, the probability of further growth of the pound raises several questions. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands A break of the upper limit of the indicator in the area of 1.3445 will lead to a new upward wave of the pound. In case of a decline, the lower limit of the indicator in the area of 1.3335 will provide support. Description of indicators - Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

Author's today's articles: Irina Manzenko  Irina Manzenko Irina Manzenko Zhizhko Nadezhda  Graduated from Irkutsk State University. Having acquainted with Forex market in 2008, followed the courses in the International Academy of Stock Exchange Trading. The agenda was so exiting that she moved to St. Petersburg in order to get professional education. Obtained a diploma of the retraining course on the discipline Exchange market and stock market issues, defended the graduation paper with distinction on the subject "Modern technical indicators as the basis of the trading system". At the moment obtains a master degree in International Banking Institute on specialty Financial markets and investments. Apart from trading is occupied with development of trading systems and formalization of the working strategies using Ichimoku indicator. At the moment is working on the book dedicated to the peculiarities of Ichimoku indicator and its operating methods. Interests: yoga, literature, travelling and photograph. "You can only get smarter by playing a smarter opponent" Basics of Chess play, 1883 "Successful people change by themselves, the others are changed by life" Jim Rohn Graduated from Irkutsk State University. Having acquainted with Forex market in 2008, followed the courses in the International Academy of Stock Exchange Trading. The agenda was so exiting that she moved to St. Petersburg in order to get professional education. Obtained a diploma of the retraining course on the discipline Exchange market and stock market issues, defended the graduation paper with distinction on the subject "Modern technical indicators as the basis of the trading system". At the moment obtains a master degree in International Banking Institute on specialty Financial markets and investments. Apart from trading is occupied with development of trading systems and formalization of the working strategies using Ichimoku indicator. At the moment is working on the book dedicated to the peculiarities of Ichimoku indicator and its operating methods. Interests: yoga, literature, travelling and photograph. "You can only get smarter by playing a smarter opponent" Basics of Chess play, 1883 "Successful people change by themselves, the others are changed by life" Jim Rohn Andrey Shevchenko  Andrey Shevchenko Andrey Shevchenko Ivan Aleksandrov  Ivan Aleksandrov Ivan Aleksandrov Mourad El Keddani  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Languages: Arabic, English, French and Dutch.

Interests: Algorithm, Graphics, Social work, Psychology and Philosophy. Mihail Makarov  - - l Kolesnikova  text text Petar Jacimovic  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work" Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work" Maxim Magdalinin  In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006. In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006.

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

A Zotova, Aleksey Almazov, Alexander Dneprovskiy, Alexandr Davidov, Alexandros Yfantis, Andrey Shevchenko, Arief Makmur, Dean Leo, Evgeny Klimov, Fedor Pavlov, Grigory Sokolov, I Belozerov, Igor Kovalyov, Irina Manzenko, Ivan Aleksandrov, l Kolesnikova, Maxim Magdalinin, Mihail Makarov, Mohamed Samy, Mourad El Keddani, Oleg Khmelevskiy, Oscar Ton, Pavel Vlasov, Petar Jacimovic, R Agafonov, S Doronina, Sebastian Seliga, Sergey Belyaev, Sergey Mityukov, Stanislav Polyanskiy, T Strelkova, Torben Melsted, V Isakov, Viktor Vasilevsky, Vladislav Tukhmenev, Vyacheslav Ognev, Yuriy Zaycev, Zhizhko Nadezhda

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

Irina Manzenko

Irina Manzenko  Graduated from Irkutsk State University. Having acquainted with Forex market in 2008, followed the courses in the International Academy of Stock Exchange Trading. The agenda was so exiting that she moved to St. Petersburg in order to get professional education. Obtained a diploma of the retraining course on the discipline Exchange market and stock market issues, defended the graduation paper with distinction on the subject "Modern technical indicators as the basis of the trading system". At the moment obtains a master degree in International Banking Institute on specialty Financial markets and investments. Apart from trading is occupied with development of trading systems and formalization of the working strategies using Ichimoku indicator. At the moment is working on the book dedicated to the peculiarities of Ichimoku indicator and its operating methods. Interests: yoga, literature, travelling and photograph. "You can only get smarter by playing a smarter opponent" Basics of Chess play, 1883 "Successful people change by themselves, the others are changed by life" Jim Rohn

Graduated from Irkutsk State University. Having acquainted with Forex market in 2008, followed the courses in the International Academy of Stock Exchange Trading. The agenda was so exiting that she moved to St. Petersburg in order to get professional education. Obtained a diploma of the retraining course on the discipline Exchange market and stock market issues, defended the graduation paper with distinction on the subject "Modern technical indicators as the basis of the trading system". At the moment obtains a master degree in International Banking Institute on specialty Financial markets and investments. Apart from trading is occupied with development of trading systems and formalization of the working strategies using Ichimoku indicator. At the moment is working on the book dedicated to the peculiarities of Ichimoku indicator and its operating methods. Interests: yoga, literature, travelling and photograph. "You can only get smarter by playing a smarter opponent" Basics of Chess play, 1883 "Successful people change by themselves, the others are changed by life" Jim Rohn  Andrey Shevchenko

Andrey Shevchenko  Ivan Aleksandrov

Ivan Aleksandrov  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). -

-  text

text  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"  In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006.

In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006.

No comments:

Post a Comment