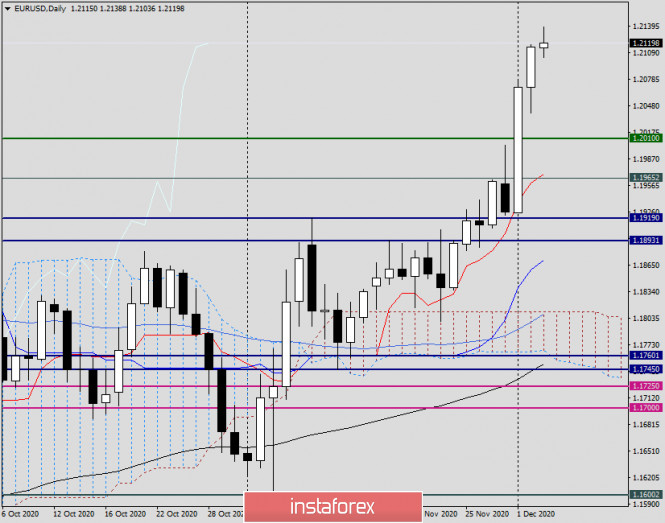

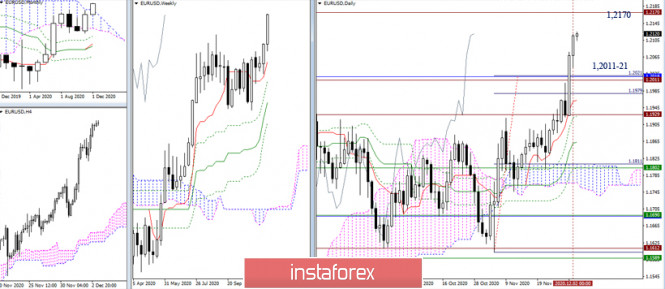

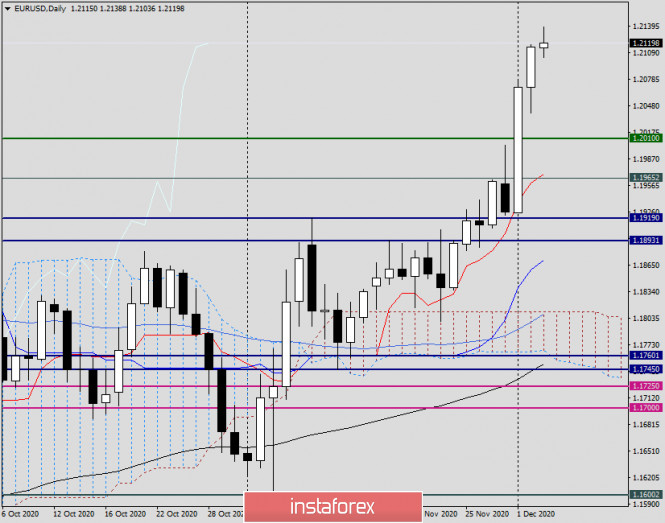

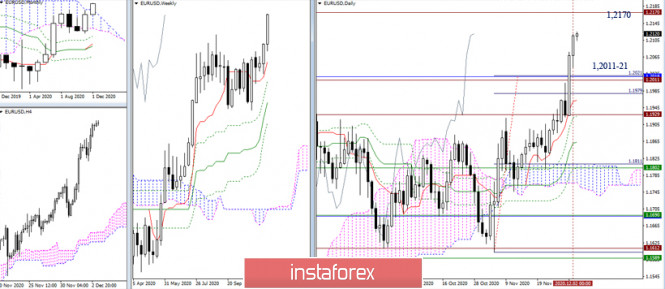

| Analysis and forecast for EUR/USD on December 3, 2020 2020-12-03 Well, the assumptions made earlier about the subsequent growth of the main currency pair were fully justified. The main target for euro bulls was to be the price area of 1.2000-1.12010, where the subsequent direction of the exchange rate was to be decided. That's exactly what happened. The appetite for risk sentiment in the market was driven by the expectation of the adoption of a fiscal stimulus package in the United States to deal with the effects of the COVID-19 pandemic. Let me remind you that US Treasury Secretary Steven Mnuchin has resumed negotiations on this issue with Nancy Pelosi, and for the time being, the current President Donald Trump is likely to sign an agreement on the adoption of a package of assistance, the volume of which will be 908 billion dollars. And in several European countries, despite the easing of restrictions, they will be extended. In particular, the German authorities decided to extend the restrictive measures until January 10. In the run-up to the Christmas holidays, the European Union is preparing for the next wave of COVID-19, and the main topic is still vaccination of the population of EU countries. If you look at today's economic calendar, those who trade the euro/dollar should pay attention to the retail sales of the Eurozone, which will be published at 11:00 (London time). Later, at 14:30 London time, there will be initial applications for unemployment in the United States. However, the main events of the current week, as usual, will be presented by the American labor reports, which will be published tomorrow at 14:30 London time. Daily

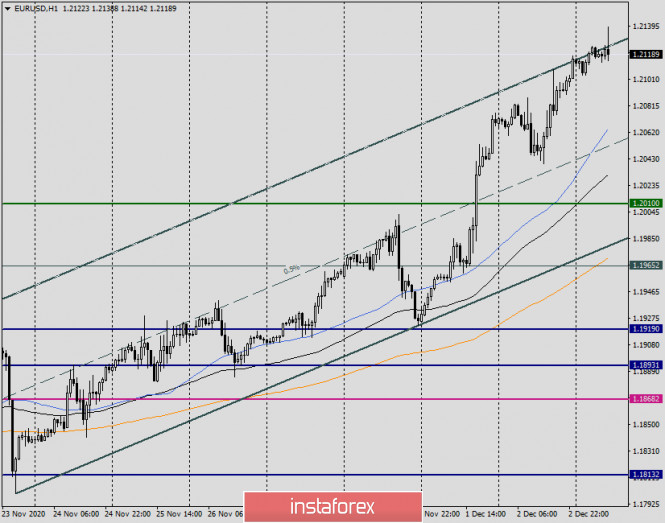

On the last autumn day, the pair rose to the landmark psychological and technical level of 1.2000, after which it bounced off quite expectedly. I would like to note that such important and significant levels, as a rule, are not passed the first time. However, the next day, on December 1, the main currency pair showed impressive growth and ended trading with the formation of a huge white candle with a closing price of 1.2069. Yesterday, the quote reported strengthening and trading ended above another fundamentally important mark of 1.2100. At the time of writing, EUR/USD is trading near 1.2123. The pair shows its readiness to continue strengthening, however, we cannot rule out another pullback to the broken resistance of sellers in the area of 1.2010-1.2000. On the other hand, if you look closely at the daily and weekly timeframes, you can see that the path up to 1.2400-1.2450 looks open and does not portend any serious difficulties for players to increase. H1

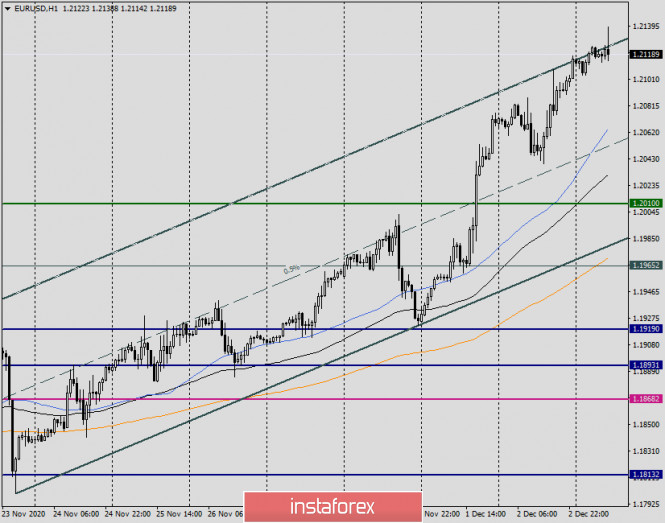

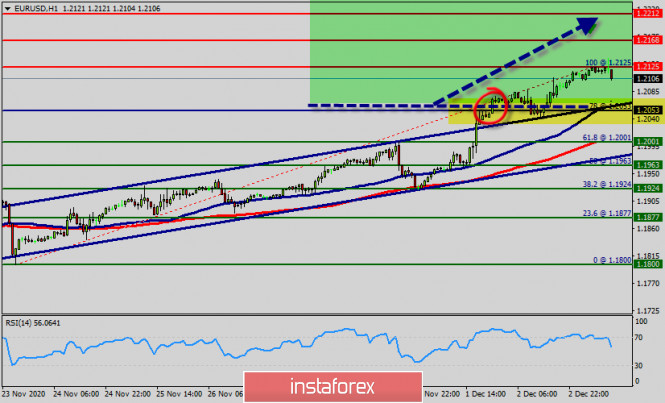

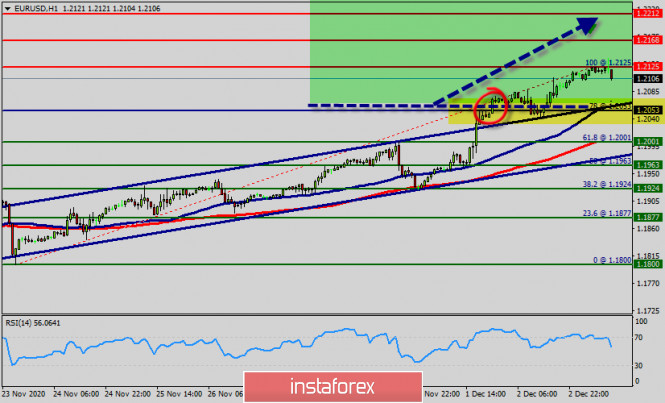

On the hourly chart, the pair moves in an ascending channel with parameters: 1.1800-1.1922 (support line) and 1.2109 (resistance line). Since the growth was already quite impressive and also taking into account the fact that the pair is trading right under the upper border of the channel, I do not exclude a corrective pullback to the area of 1.2080-1.2050, from where I recommend considering opening long positions on EUR/USD. Earlier and more aggressive purchases can be tried near 1.2100. As for sales, they seem to be much more risky positioning, since they are against the current and rather strong upward dynamics. Although we should not forget about tomorrow's publication of nonfarm. Any price movement options are possible on these most important American reports, and you need to keep this in mind. Technical analysis of EUR/USD for December 03, 2020 2020-12-03  Overview : Right now, a bear market can be more dangerous to invest in, as many equities lose value and prices become volatile. The EUR/USD pair gained strong upside momentum and managed to settle above the support at 1.2053. The EUR/USD pair is moving so fast that's it's high time to take a look at the H1 chart to evaluate it. The EUR/USD pair continues moving in a bullish trend from the support levels of 1.2053 and 1.2001. Currently, the price is in a bullish channel. This is confirmed by the RSI indicator signaling that we are still in a bullish trending market. As the price is still above the moving average (100), immediate support is seen at 1.2053, which coincides with a golden ratio (78% of Fibonacci). This level has served as a major support level for the EUR/USD pair in early 1.2053, and I'd expect a lot of interest from traders if the EUR/USD pair gets to the test of this level. At this point, the EUR/USD pair managed to get above the support at 1.2053 and is moving towards the first resistance level at 1.2125. If the EUR/USD pair manages to settle above this level, it will head towards the next resistance at 1.2168. A successful test of this resistance level will push EUR/USD towards the resistance at 1.2168. Although some investors can be "bearish," the majority of investors are typically "bullish." The stock market, as a whole, has tended to post positive returns over long time horizons. Consequently, the first support is set at the level of 1.2053. So, the market is likely to show signs of a bullish trend around the spot of 1.2053 - 1.2070. In other words, buy orders are recommended above the major support (1.2053) with the first target at the level of 1.2125. Furthermore. We should see the pair climbing towards the double top (1.2125) to test it. Therefore, strong double top will be formed at the level of 1.2125 providing a clear signal to rebuy with the targets seen at 0.6768. if the trend is able to breakout through the first resistance level of 1.2125. The pair will move upwards continuing the development of the bullish trend to the level 1.2165 (daily resistance 2). Also, it might be noted that the level of 1.2212 (R3) is a good place to take profit because it will form a double top. On the other hand, in case a reversal takes place and the EUR/USD pair breaks through the support level of 1.2001, a further decline to 1.1877 can occur which would indicate a bearish market. Analysis and forecast for GBP/USD on December 3, 2020 2020-12-03 The growth of the British pound against the US dollar still limits the very small probability of a trade deal for the UK's exit from the European Union. The issues in dispute are still the same - fishing issues, as well as mutually acceptable terms of trade competition with equal conditions for both subjects. Let me remind you that there is less time left until the end of the year, when the Brexit issue should be finally resolved, and the chances for a deal are fading. Well, all this could be assumed, and the exit of the United Kingdom without an agreement is largely already taken into account in the price of the British currency. The situation with COVID-19 is still far from stable, especially in the United States of America, where the increase in the daily number of people infected with coronavirus is still very high. In such conditions, investors are not in a hurry to open a deal to buy the "British". To better understand this, we will immediately go to the technical picture for the GBP/USD currency pair. Daily

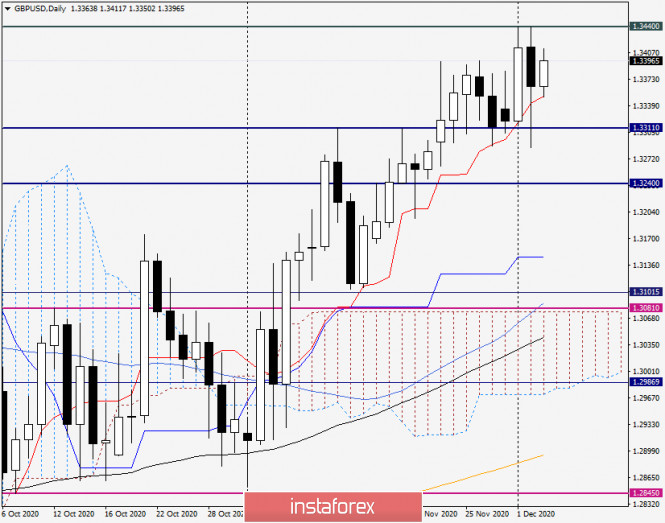

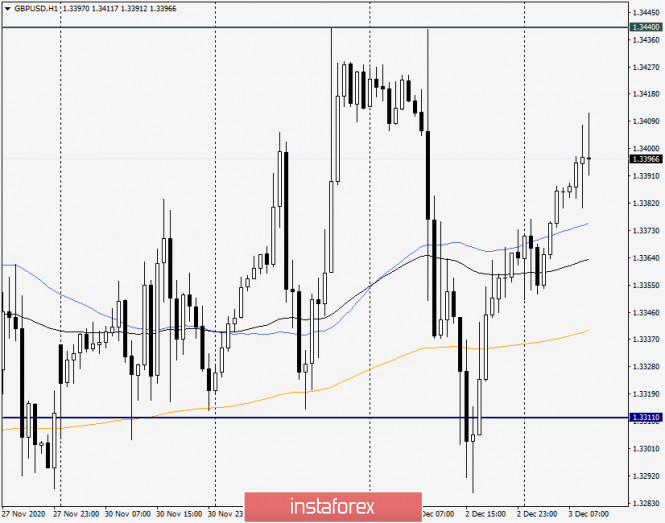

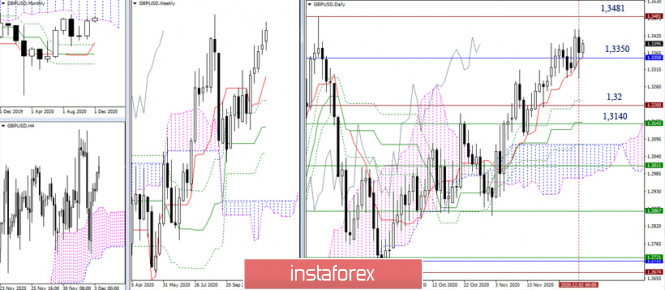

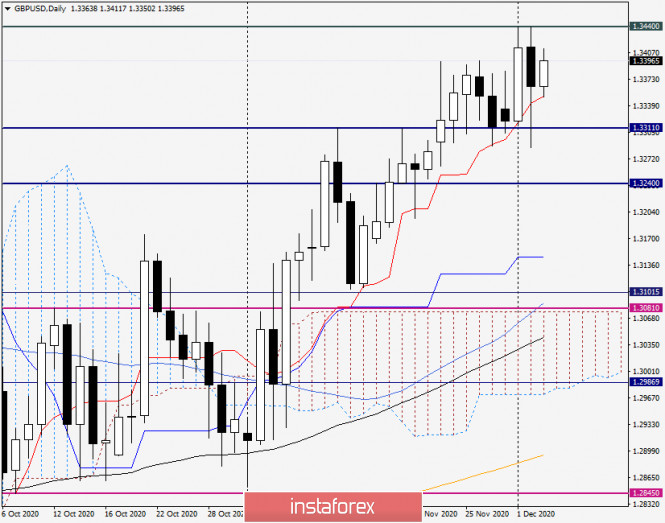

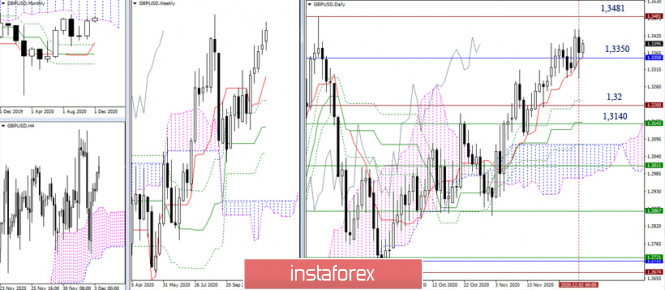

However, as a result of the rise, the pair broke through the important and strong resistance of sellers at 1.3310, after which it continued its upward movement and reached 1.3440. However, the growth stopped and the pair began to consolidate. As you can see, a pullback was given to the broken resistance of sellers in the area of 1.3300, after which the quote bounced up quite strongly, leaving a long shadow at the bottom. As a rule, after such candles, which were formed at yesterday's trading, you can expect a subsequent strengthening of the quote with a high degree of probability. At the moment of writing, the pair is trying to continue its upward trend and is trading near the iconic level of 1.3400. Strong support for the quote is provided by the Tenkan line of the Ichimoku indicator. If the growth continues and today's trading closes above the resistance of 1.3440, it will be time to hope for reaching the important psychological and technical level of 1.3500. I believe that near this level, the pound/dollar will suspend possible growth for some time and will consolidate. The further direction of GBP/USD will be largely influenced by tomorrow's statistics on the US labor market, which will be published at 14:30 London time. However, at the moment, the main trading idea for this currency pair is to buy it after corrective pullbacks. H1

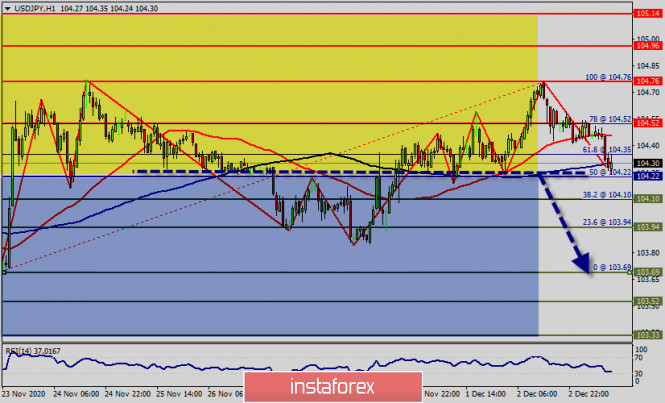

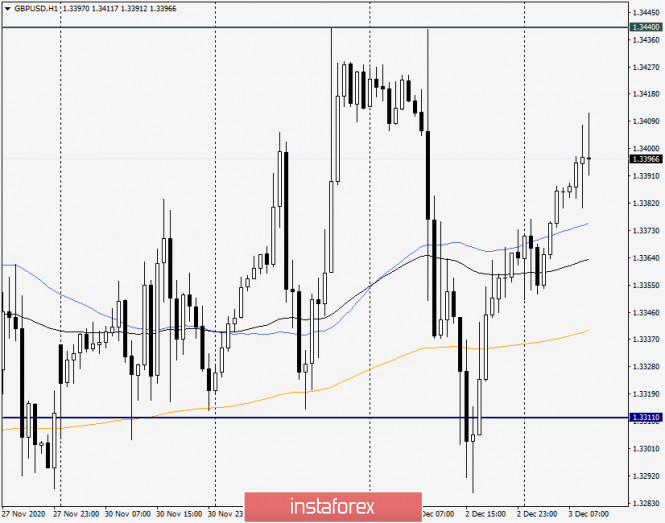

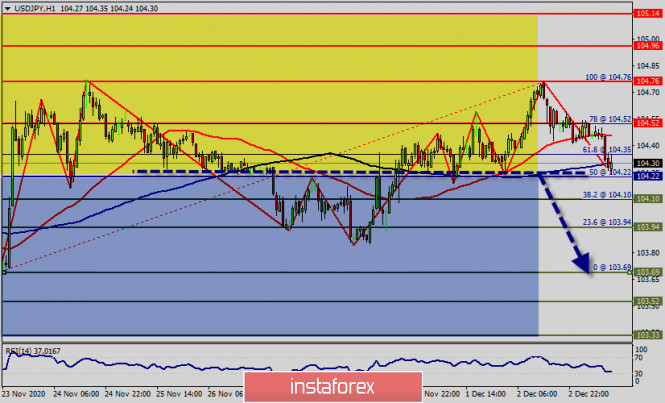

Taking into account the fact that the pair is trading above the moving averages used on the hourly chart (50 MA, 89 EMA, and 200 EMA), a decrease to each of the indicated moving averages can be used to consider opening buy trades since each of these moving averages can provide good support for the pair and turn it in the north direction. Thus, I recommend considering opening long positions on GBP/USD after short-term declines to the levels of 1.3380, 1.3355, and 1.3343. At the same time, if bearish patterns of Japanese candlesticks appear on the four-hour, hourly, or even daily timeframes after the rise to 1.3440, a signal will appear to open sales. However, according to the general technical picture, the main trading idea for this currency pair is to buy from the prices indicated above. EUR/USD and GBP/USD: Euro may reach the 21st figure soon. Meanwhile, France may block the UK-EU trade deal. 2020-12-03 The euro may reach the 21st figure soon, especially since demand for the US dollar is declining due to weak data on the US labor market. Clearly, employment in the US is slowing amid the persistent second pandemic wave. The recent statements of Fed Chairman Jerome Powell also did not give optimism to dollar bulls, since they hinted of a large stimulus package and long-term support from the Central Bank. In this vein, there is no need to hope for any increase in interest rates.  In his speech, Powell repeated his earlier statements that the government should do more to help the labor market, small business and local authorities. Accordingly, he promised that the Fed will continue to provide support to the economy until it no longer needs it. In terms of a positive outlook, real change will take place only after a COVID-19 vaccine is available. Meanwhile, US Treasury Secretary, Steven Mnuchin, was criticized by Democrats who could not forgive him for deciding to end a number of lending programs. According to Mnuchin, a $ 2 trillion package in March prevents him from extending five emergency lending programs, and in addition, he believes that those are not needed anymore. He said the released funds can be used more effectively within the framework of other incentive programs. For their part, the Democrats felt that Mnuchin misinterpreted the legislation, but they failed to change his decision. On December 31, the United States will cease to operate lending programs for the corporate and municipal sectors, as well as the program to support lending to small and medium-sized businesses. Meanwhile, four other programs that support the functioning of the liquidity mechanism have been extended until this spring. These include payroll retention programs, the program to support the short-term corporate debt market, as well as the program that allows loans to primary dealers, providing them with a wider range of assets to secure debt obligations. Anyhow, on the topic of economic statistics, the US released data on its labor market yesterday, which definitely put pressure on the US dollar. According to the report published by the ADP, jobs in the private sector increased by only 307,000 in November, which directly speaks of a slowdown in the rate of hiring. The Economists had expected the figure to increase by 475,000.  In the data, the most active jobs were created in medium-sized companies, followed by small businesses. The least number were from large companies. Surprisingly though, despite the second coronavirus outbreak, most jobs were created in the service sector. It seems that the absence of restrictive measures made the service sector feel more free, in contrast to what is happening now in the EU. Today, a number of PMI reports will be released for Europe, UK and the US, which will make the picture become clearer. With regards to the labor market, the US Department of Labor will publish its official November employment report tomorrow, where the number of non-farm jobs is expected to rise by 440,000, as the unemployment rate fell from 6.9% to 6.7%. As for other less important data, they did not give much impact to the US dollar, even though they showed weakness. One report was from ISM New York, which said that business activity declined significantly in November, dropping to a 3-month low. Current business conditions, meanwhile, fell to 44.2 points, from 65.1 points in October. Many Fed representatives also delivered speeches yesterday, but generally, all of them were talking about the same thing: the US economy is still in a very deep recession, and despite some recovery, a new wave of COVID-19 will negatively affect activity. Everyone is looking forward to a vaccine, as only by its appearance will the situation improve. No one spoke much about the future of monetary policy, and this suggests that the Fed has not decided on it yet, so perhaps, the central bank will tackle it at its meeting this December. With regards to the EUR/USD pair, movement depends on whether the quote will manage to break above price level 1.2135, as only by that will the euro be able to reach the levels 1.2200 and 1.2260. But if the quote drops to 1.2090 instead, the euro will collapse to the lows 1.2040 and 1.2000. GBP/USD Yesterday, French authorities said they could veto the trade deal between the UK and the EU if they don't like the terms. Many European leaders seem to dislike the idea that EU chief negotiator, Michel Barnier, will be the one to make concessions in order to reach a deal. According to France, although pressure is being exerted to the EU, it is unacceptable to make concessions to reach an agreement. Barnier rejected the request from EU officials to see key parts of the agreement before it was prepared, so many expressed their outrage and said that this was done on purpose to leave too little time for a thorough study of all the nuances of the agreement. Against this, the pound dropped sharply, but then it recovered quickly, as optimism and expectations of reaching an agreement at the last moment sparked investors' appetite, especially after such an attractive decline. On the technical side, everything is the same in the GBP/USD pair, but a breakout of 1.3435 will lead to a new upward move towards 1.3510 and 1.3605. If an agreement is not made by the end of this week, the quote may break below 1.3295, which will lead to a collapse to 1.3200 and 1.3110. Technical analysis of USD/JPY for December 03, 2020 2020-12-03  Overview : USD/JPY : The 104.22 pair is representing psychological level on the H1 chart. Also, the level of 104.22 represents a daily pivot point for that it is acting as major resistance/support this week. Because the market's behavior is impacted and determined by how individuals perceive and react to its behavior, investor psychology and sentiment affect whether the market will rise or fall. The market performance and investor psychology are mutually dependent. In a bull market, investors willingly participate in the hope of obtaining a profit. Factly, the USD/JPY pair movement was debatable as it took place in a narrow sideways channel for a while. The market showed signs of instability. Amid the previous events, the price is still moving between the levels of 104.76 and 103.69. The pair is still in a downtrend, because the USD/JPY pair is trading in a bearish trend from the new resistance line of 104.76 towards the first support level at 104.22 in order to test it. The daily resistance and support are seen at the levels of 104.76 and 104.22 respectively. In consequence, it is recommended to be cautious while placing orders in this area. Thus, we should wait until the sideways channel has completed. The price spot of 104.76remains a significant resistance zone. Therefore, there is a possibility that the USD/JPY pair will move to the downside and the fall structure does not look corrective. Resistance is seen at the level of 104.76 today. So, sell below 104.76 with the first target at 103.69 to test yesterday's bottom. In overall, we still prefer the bearish scenario as long as the price is below the level of 103.69. Furthermore, if the USD/JPY pair is able to break out the bottom at 103.69, the market will decline further to 103.19. On the support side, the previous support at 104.22 will likely serve as the first resistance level for the USD/JPY pair. A move below this level will push the USD/JPY pair towards the next support at 102.77. However, it would also be sage to consider where to place a stop loss; this should be set above the second resistance of 104.96. Forex forecast 12/03/2020 on AUD/USD, SP500 and Dow Jones from Sebastian Seliga 2020-12-03 Let's take a look at the AUD/USD , SP500 and Dow Jones technical picture at the daily time frame chart Technical recommendations for EUR/USD and GBP/USD on December 3 2020-12-03 EUR / USD  The Euro has maintained its mood, and the pair continues to rise. The historical level of 1.2170 is still the upward pivot point, since it has repeatedly shown itself in the past and formed the resistance of the upper limit of the monthly cloud for a long time. Now, a reliable consolidation above will allow us to consider new prospects and make further plans. The closest, significant support in this situation is the previously overcame combined levels located at 1.2011-21 (daily target for the breakout of the cloud + the high extremum of the upward trend + the upper limit of the monthly cloud).  The bulls maintain the advantage and continue the upward trend. The intraday upward targets are the resistance levels of 1.2143 - 1.2170 - 1.2222. On the other hand, the key supports for the smaller time frames significantly increase the chances for a downward correction and are now located at 1.2091 (central pivot level) and 1.1992 (weekly long-term trend), while nearest supports can be noted at 1.2064 (S1) and 1. 2012 (S2). GBP / USD  The current distrust among bullish traders does not allow them to achieve good results for a long time, so the opponent took the lead. Nevertheless, the pair is currently continuing to trade above 1.3350 (lower limit of the monthly cloud) and maintains the support for the daily short-term trend (1.3352). The high extremum of 1.3481 is the upward target. Meanwhile, breaking through the level of 1.3350 will change the current balance of power, opening the way to the downside targets of 1.32 (historical level + daily Fibo Kijun) and 1.3140 (daily Kijun + weekly Tenkan).  The uncertainty in the bigger time frames makes the pair spin around the key levels of the smaller TFs, which are now in a horizontal position and join forces in the area of 1.3365-57 (central pivot level + weekly long-term trend). Working above these levels transfers the advantages to the bulls' side, increasing their chances to reach further results and strengthen their mood. The next resistances of the classic pivot levels, which serve as upside targets within the day, are located today at 1.3443 - 1.3518 - 1.3596. Alternatively, if we work below the key levels (1.3365-57), the distribution of forces will change in favor of the bears. If they manage to break through it and further decline, then the next pivot points such as the supports of the classic pivot levels 1.3290 - 1.3212 - 1.3137 will be considered. Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120) Analysis of Gold for December 03,.2020 - Key pivot level at $1.850. Watch for the price action around the key level to confirm further direction 2020-12-03 Brexit: Same issues still outstanding in trade talks, says EU diplomat Still not there yet on level playing field - UK state aid solutions not in a position that we can agree to

- Major gap still remains on fisheries

- We are milimetres away from touching red lines in talks

- We are not hours away from a deal

- What is needed to agree upon is still quite substantial

There doesn't seem to be much room to compromise and that bolsters the narrative that if both sides are to magically come up with an agreement, it may very well exclude the three key outstanding issues i.e. postponing them to a future date.

Further Development

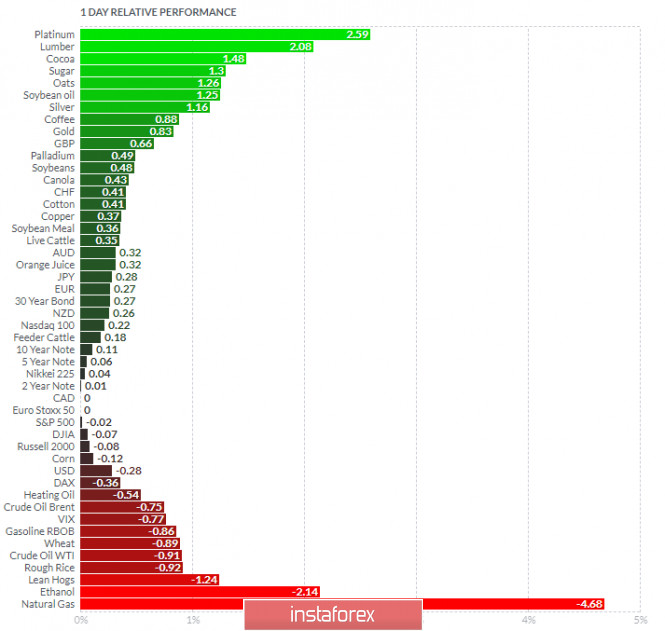

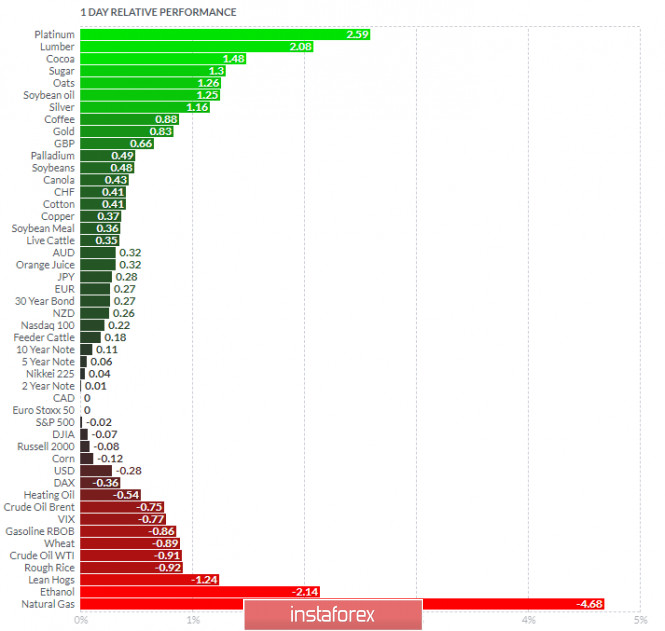

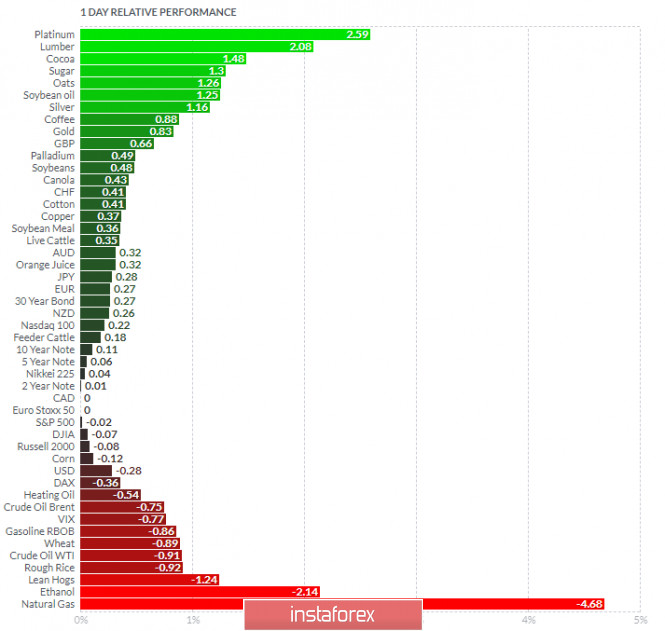

Analyzing the current trading chart of Gold, I found that the buyers are in control and that Gold is aproaching the strong pivot level at the price of $1,850, which might be the good level for potential sell positions. 1-Day relative strength performance Finviz

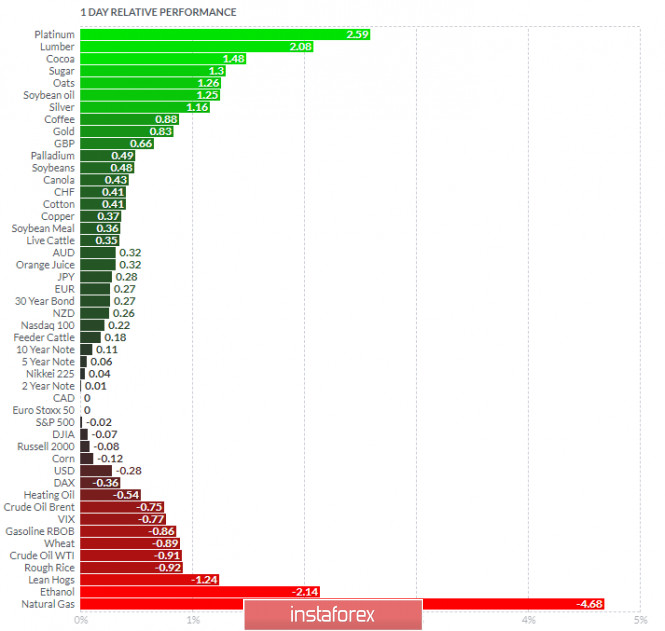

Based on the graph above I found that on the top of the list we got PLatinum and Lumber today and on the bottom Natural gas and Ethanol. Key Levels: Resistance: $1,850 Support levels: $1,815 GBP/USD analysis for December 03, 2020 - Watch for selling opportuntiies due to intraday overbought condiiton 2020-12-03  Brexit: Internal Market Bill to return to the Commons on Monday next week Jacob Rees-Mogg says the government will reject all the amendments by the House of Lords on the Internal Market Bill The market may not need to pay much attention to this right now, but it is something worth noting in case talks fail to reach a compromise this week or over the weekend. Barnier had previously warned that if the UK moves forward with the threatened clauses that it will throw trade talks into "crisis mode", so yeah. But before we get to this, we may already get white smoke from London possibly in the next few days and before Monday. Further Development Analyzing the current trading chart of GBP/USD, I found that the buyers are in control today but that there might be the overbought condiiton. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Platinum and Lumber today and on the bottom Natural gas and Ethanol. GBP is on topside of the list. Key Levels: Resistance: 1,3450 Support levels: 1,3410 and 1,3390

Author's today's articles: Ivan Aleksandrov  Ivan Aleksandrov Ivan Aleksandrov Mourad El Keddani  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Languages: Arabic, English, French and Dutch.

Interests: Algorithm, Graphics, Social work, Psychology and Philosophy. Pavel Vlasov  No data No data Sebastian Seliga  Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu Zhizhko Nadezhda  Graduated from Irkutsk State University. Having acquainted with Forex market in 2008, followed the courses in the International Academy of Stock Exchange Trading. The agenda was so exiting that she moved to St. Petersburg in order to get professional education. Obtained a diploma of the retraining course on the discipline Exchange market and stock market issues, defended the graduation paper with distinction on the subject "Modern technical indicators as the basis of the trading system". At the moment obtains a master degree in International Banking Institute on specialty Financial markets and investments. Apart from trading is occupied with development of trading systems and formalization of the working strategies using Ichimoku indicator. At the moment is working on the book dedicated to the peculiarities of Ichimoku indicator and its operating methods. Interests: yoga, literature, travelling and photograph. "You can only get smarter by playing a smarter opponent" Basics of Chess play, 1883 "Successful people change by themselves, the others are changed by life" Jim Rohn Graduated from Irkutsk State University. Having acquainted with Forex market in 2008, followed the courses in the International Academy of Stock Exchange Trading. The agenda was so exiting that she moved to St. Petersburg in order to get professional education. Obtained a diploma of the retraining course on the discipline Exchange market and stock market issues, defended the graduation paper with distinction on the subject "Modern technical indicators as the basis of the trading system". At the moment obtains a master degree in International Banking Institute on specialty Financial markets and investments. Apart from trading is occupied with development of trading systems and formalization of the working strategies using Ichimoku indicator. At the moment is working on the book dedicated to the peculiarities of Ichimoku indicator and its operating methods. Interests: yoga, literature, travelling and photograph. "You can only get smarter by playing a smarter opponent" Basics of Chess play, 1883 "Successful people change by themselves, the others are changed by life" Jim Rohn Petar Jacimovic  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work" Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

A Zotova, Aleksey Almazov, Alexander Dneprovskiy, Alexandr Davidov, Alexandros Yfantis, Andrey Shevchenko, Arief Makmur, Dean Leo, Evgeny Klimov, Fedor Pavlov, Grigory Sokolov, I Belozerov, Igor Kovalyov, Irina Manzenko, Ivan Aleksandrov, l Kolesnikova, Maxim Magdalinin, Mihail Makarov, Mohamed Samy, Mourad El Keddani, Oleg Khmelevskiy, Oscar Ton, Pavel Vlasov, Petar Jacimovic, R Agafonov, S Doronina, Sebastian Seliga, Sergey Belyaev, Sergey Mityukov, Stanislav Polyanskiy, T Strelkova, Torben Melsted, V Isakov, Viktor Vasilevsky, Vladislav Tukhmenev, Vyacheslav Ognev, Yuriy Zaycev, Zhizhko Nadezhda

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

Brexit: Internal Market Bill to return to the Commons on Monday next week

Brexit: Internal Market Bill to return to the Commons on Monday next week

Ivan Aleksandrov

Ivan Aleksandrov  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). No data

No data  Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu

Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu  Graduated from Irkutsk State University. Having acquainted with Forex market in 2008, followed the courses in the International Academy of Stock Exchange Trading. The agenda was so exiting that she moved to St. Petersburg in order to get professional education. Obtained a diploma of the retraining course on the discipline Exchange market and stock market issues, defended the graduation paper with distinction on the subject "Modern technical indicators as the basis of the trading system". At the moment obtains a master degree in International Banking Institute on specialty Financial markets and investments. Apart from trading is occupied with development of trading systems and formalization of the working strategies using Ichimoku indicator. At the moment is working on the book dedicated to the peculiarities of Ichimoku indicator and its operating methods. Interests: yoga, literature, travelling and photograph. "You can only get smarter by playing a smarter opponent" Basics of Chess play, 1883 "Successful people change by themselves, the others are changed by life" Jim Rohn

Graduated from Irkutsk State University. Having acquainted with Forex market in 2008, followed the courses in the International Academy of Stock Exchange Trading. The agenda was so exiting that she moved to St. Petersburg in order to get professional education. Obtained a diploma of the retraining course on the discipline Exchange market and stock market issues, defended the graduation paper with distinction on the subject "Modern technical indicators as the basis of the trading system". At the moment obtains a master degree in International Banking Institute on specialty Financial markets and investments. Apart from trading is occupied with development of trading systems and formalization of the working strategies using Ichimoku indicator. At the moment is working on the book dedicated to the peculiarities of Ichimoku indicator and its operating methods. Interests: yoga, literature, travelling and photograph. "You can only get smarter by playing a smarter opponent" Basics of Chess play, 1883 "Successful people change by themselves, the others are changed by life" Jim Rohn  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

No comments:

Post a Comment