| | | | | | | Presented By Koch Industries | | | | Pro Rata | | By Dan Primack ·Dec 03, 2020 | | 🎧 Axios Re:Cap digs into GM's plan to become an all-electric vehicle company, including its ambition to be "significantly turned over" from combustion engines by 2025. Listen via Apple, Spotify or Axios. 🖥️ You're invited to an Axios virtual event today at 12:30pm ET on the future of broadband connectivity, including my conversation with FCC commissioner Geoffrey Starks. Register here. | | | | | | Top of the Morning |  | | | Illustration: Eniola Odetunde/Axios | | | | Price discipline is dead. Long live the tech bubble. The big picture: Determining "proper" tech startup valuations has always been subjective, but lately it's been more akin to throwing a dart at the ceiling than at the board. By the numbers: Private markets are following public markets, as they're wont to do, with median valuations for early-stage and later-stage startups hitting record highs, per PitchBook. - The pandemic is now viewed as a "heads I win, tails you lose" situation for a majority of startups. Either they benefit from trends like work-from-home, or investors are paying for expected growth post-vaccine.

- "I give up," a Silicon Valley venture capitalist told me while discussing Salesforce's $27.7 billion deal for Slack. "I could have made a solid case for Slack at one-third that amount or at even more than what Salesforce is paying, and I'm feeling the same about most of the venture deals I see getting done."

There are signs of a bubble everywhere, but that's arguably been true for years. Any "smart money" that pulled back, including early in the pandemic, looks dumb, while plenty of dumb money looks prophetic. - Venture capital shifted years ago into a less price sensitive model, deciding it was better to overpay for everything than hold the line and miss out on a mega-win. That trend has only accelerated, particularly after the seed-stage.

The bottom line: "Value-add" has taken on increased importance when it comes to winning competitive deals, as so many investors have become price insensitive (in action, if not in words). |     | | | | | | The BFD |  | | | Illustration: Sarah Grillo/Axios | | | | Uber (NYSE: UBER) is in advanced talks to sell its Uber Elevate unit to Santa Cruz, Calif.-based Joby Aviation, Axios has learned from multiple sources. A deal could be announced later this month. - Why it's the BFD: Shedding money-losing experiments is a key part of Uber's push toward profitability.

- $$ history: Joby, a strategic partner to Uber Elevate, has raised around $730 million from firms like Toyota, Intel, JetBlue, AME Cloud Ventures and Ballie Gifford.

- Unrelated Uber: The company's deal for Postmates closed this week, but the all-stock deal's initial $2.6 billion value has now swelled to over $4.4 billion. None of the shares include lockup provisions.

- Bottom line: "[Uber's] plans were ambitious, and perhaps doomed, from the start. It relied on a technology — electric-powered aviation — that was still under development and had yet to be tested as part of a commercial service. And it would have been costly to implement, requiring the construction of a vast network of rooftop or ground-level 'skyports' and regulatory approval from a host of federal, state, and local agencies." — Andrew Hawkins, The Verge

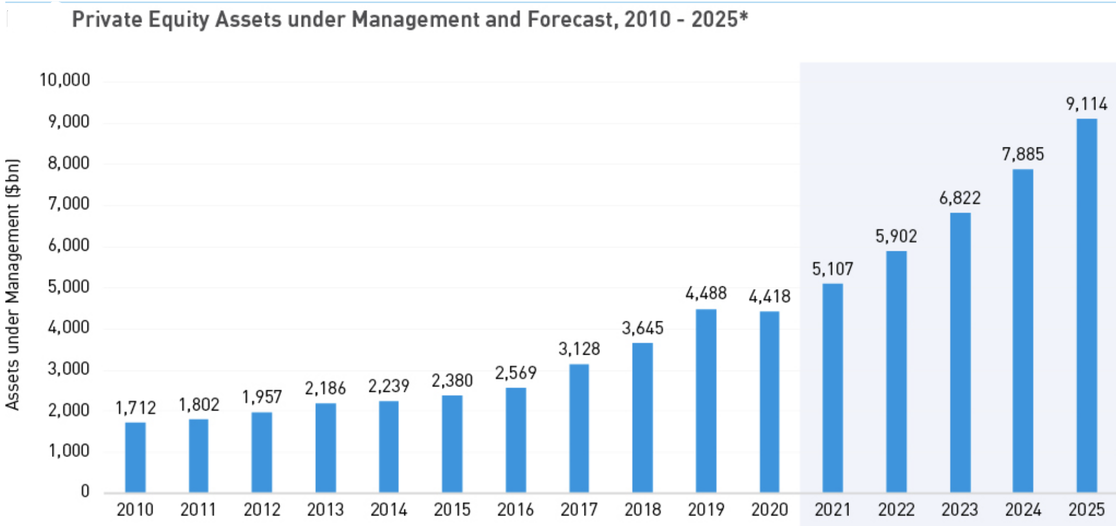

|     | | | | | | Venture Capital Deals | | • TuSimple, a San Diego-based self-driving truck startup, raised $350 million. VectoIQ led, with TechCrunch reporting other investors included Goodyear, Union Pacific, CN Rail, U.S. Xpress, Kroger, Traton Group and Navistar. http://axios.link/k1eg 🚑 Everywell, an Austin, Texas-based in-home health testing platform, raised $175 million in Series D funding from BlackRock, TCG, Foresite Capital, Greenspring Associates, Morningside Ventures, Portfolio and return backer Highland Capital Partners. http://axios.link/EPdf • Amount, a Chicago-based API framework for retail banks, raised $81 million at a $600 million pre-money valuation. Goldman Sachs led, and was joined by return backers August Capital, Invus Opportunities and Hanaco Ventures. http://axios.link/EcKb 🚑 Virta Health, a San Francisco-based biotech that aims to reverse Type 2 diabetes, raised $65 million at a valuation north of $1 billion from Sequoia Capital Global Equities and return backer Caffeinated Capital. http://axios.link/BGq7 • Pigment, a Paris-based business forecasting platform, raised $25.9 million. Blossom Capital led, and was joined by FirstMark Capital. • Ultimate.ai, a German customer service automation platform, raised $20 million in Series A funding. Omers Ventures led, and was joined by Felicis Ventures, HV Capital and Makio.vc. http://axios.link/6TS9 • Shop-Ware, a San Francisco-based provider of management software for independent auto repair shops, raised $15 million in Series A funding led by Insight Partners. http://axios.link/Grgm • MEL Science, a London-based science educational platform, raised $14 million in Series B funding from Mubadala and Channel 4 Ventures. www.melscience.com 🚀 Space Perspective, an Orlando, Fla.-based space tourism startup, raised $7 million in seed funding from Prime Movers Labs and Base Ventures. http://axios.link/xKam • Fylamynt, a Mountain View, Calif.-based cloud workflow automation startup, raised $6.5 million in seed funding. Gradient Ventures led, and was joined by Mango Capital and Point72 Ventures. http://axios.link/P6mM • Supergreat, a New York-based community app for beauty, raised $6.5 million in Series A funding. Benchmark led, and was joined by Shrug Capital, Thrive Capital and individuals. http://axios.link/fP3Q • Karukuri, a British food robotics startup, raised £6.3 million. Firstminute Capital led, and was joined by Hoxton Ventures, Taylor Brothers, Ocado Group and Future Fund. http://axios.link/PBKT • Welcome, a New York-based hiring and onboarding platform, raised $6 million in seed funding. FirstMark Capital led, and was joined by Ludlow Ventures and individuals. http://axios.link/VnSC • Wellory, an "anti-diet" nutrition app, raised $4.2 million. Story Ventures led, and was joined by Harlem Capital, Ground Up Ventures and individuals. http://axios.link/BdzL • Orbit, a San Francisco-based community experience platform, raised $4 million in seed funding. Andreessen Horowitz led, and was joined by return backers Heavybit and Harrison Metal. http://axios.link/mocP • Soil Connect, a New York-based digital marketplace for the soil and aggregates industry, raised $3.25 million in seed funding led by Heartland Ventures. http://axios.link/BQ4y 🚑 Neuroglee, a Singapore-based digital therapeutics platform for neurodegenerative diseases, raised $2.3 million led by Japanese drugmaker Esai. http://axios.link/CEZb • Okay, a New York-based team performance dashboard, raised $2.2 million led by Sequoia Capital. http://axios.link/uScg • Jitsu, a Berkeley, Calif.-based enterprise predictive modeling platform, raised $2 million in seed funding. Costanoa Ventures led and was joined by YC. http://axios.link/fNfD 🚑 Segmed, a Stanford, Conn.-based cloud platform for medical data management, raised $2 million in seed funding. Blumberg Capital led, and was joined by Nina Ventures. http://axios.link/G3Zg • Heru, a Mexico City-based provider of software services for gig workers, raised $1.7 million led by Mountain Nazca. http://axios.link/8LLZ |     | | | | | | A message from Koch Industries | | Bill Tai talks tech disruption and transformation | | |  | | | | Prolific tech investor Bill Tai has learned what it takes to thrive in an industry defined by constant disruption and change. In a discussion with Koch Disruptive Technologies managing director Jason Illian, he shares what he's learned. More. | | | | | | Private Equity Deals | | • Altair Investments agreed to buy the polymer screws and barrels product lines from Nordson (Nasdaq: NDSN). www.nordson.com • CVC Capital Partners agreed to buy the RiverStone Europe insurance business of Canada's Fairfax Financial (TSX: FFH) for $750 million. http://axios.link/FXUd • Hg Capital invested in Benevity, a Canadian corporate purpose cloud software provider. www.benevity.com • Insight Partners acquired a majority stake in CommerceHub, an Albany, N.Y.-based provider of e-commerce supply chain software, from GTCR and Sycamore Partners at a $1.9 billion valuation. http://axios.link/aWdp • KKR is nearing an $800 million deal for a portfolio of U.S. warehouses, per Bloomberg. http://axios.link/e8t3 • Nesco (NYSE: NSCO) agreed to buy CTOS, a Kansas City-based heavy equipment maker, for nearly $1.48 billion. Platinum Equity will help finance the deal via an $850 million common stock investment in Nesco, while existing CTOS backer The Blackstone Group will retain an equity stake. http://axios.link/IGhx • NuWave Solutions, a McLean, Va.-based portfolio company of AE Industrial Partners, acquired BigBear, a provider of big data analytics to the U.S. national security community. www.nuwavesolutions.com • Profile Products, a Buffalo Grove, Ill.-based portfolio company of Incline Equity Partners, acquired Sunterra Horticulture, a Canadian peat extraction company. www.profileproducts.com • Welsh, Carson, Anderson & Stowe completed its previously-announced buyout of TrueCommerce, a Cranberry Township, Penn.-based provider of trading partner connectivity solutions, from Accel-KKR. http://axios.link/Rvgm • York Capital invested in F1 Payments, an Austin, Texas-based payment processing app. www.f1payments.com |     | | | | | | Public Offerings | | 🚑 Certara, a Princeton, N.J.-based drug development consultancy owned by EQT Partners, set IPO terms to 24.4 million shares at $19-$22. It would have a fully diluted market value of $3.1 billion, were it to price in the middle, and plans to list on the Nasdaq (CERT) with Jefferies as left lead underwriter. Certara reports $5 million of net income on $179 million in revenue for the first nine months of 2020. http://axios.link/gSmf 🚑 Kinnate Biopharma, a San Diego-based oncology biotech, raised $240 million in its IPO. The pre-revenue company priced 12 million shares at $20, versus initial plans to offer 11.5 million shares at $16-$18, for an initial market cap of $821 million. It will list on the Nasdaq (KNTE), used Goldman Sachs as lead underwriter and had raised nearly $200 million from Foresite Capital (33.3% pre-IPO stake), OrbiMed (10.5%), RA Capital Management (10%), Nextech (8.9%) and Vida Ventures (7.9%). http://axios.link/AtkT |     | | | | | | SPAC Stuff | | • Dyal Capital Partners, a Neuberger Berman unit that buys passive stakes in alternative asset managers, and direct lender Owl Rock Capital Partners are in talks to be taken private via a combination and reverse merger with Altimar Acquisition Corp. (NYSE: ATACU), a SPAC formed by HPS Investment Partners. • Highland Transcend Partners I, a tech-focused SPAC formed by Highland Capital Partners and led by Ian Friedman (ex-Goldman Sachs), raised $275 million in an upsized IPO. http://axios.link/c49T • Far Peak Acquisition, the second SPAC formed by former NYSE president Tom Farley, raised $550 million in its IPO. http://axios.link/g8qO 🦈 Jaws Spitfire Acquisition, the second SPAC led by Barry Sternlicht, raised $300 million in an upsized IPO. http://axios.link/Ylob • Live Oak Acquisition II, a growth biz-focused SPAC formed by Live Oak Merchant Partners, raised $200 million in its IPO. http://axios.link/vy2w • RMG Acquisition II, a SPAC co-led by James Carpenter (Riverside Management Group) and Robert Mancini (ex-Carlyle Group), cut its proposed IPO size from $350 million to $250 million. The initial RMG SPAC recently agreed to buy EV battery maker Romeo Power. http://axios.link/SiXM |     | | | | | | Liquidity Events | | • FedEx (NYSE: FDX) agreed to buy ShopRunner, a Chicago-based shipping payment e-commerce network that had raised around $40 million from August Capital, UPS and Illinois Growth & Innovation Fund. http://axios.link/7Thu • Google (Nasdaq: GOOG) agreed to buy Actifio, a Waltham, Mass.-based data management software company, for an undisclosed amount. Actifio had raised $460 million in VC funding, most recently at a $1.3 billion valuation, from firms like Andreessen Horowitz, North Bridge Venture Partners, 83North, Advanced Technology Ventures, Heritage Group and Crestline Investors. http://axios.link/pZih • Intuit (Nasdaq: INTU) completed its $7.1 billion purchase of Credit Karma, a San Francisco-based provider of consumer credit-score checks and monitoring services. Credit Karma had raised around $370 million in VC funding from firms like Ribbit Capital, Felicis Ventures, CapitalG, QED Investors, and Susquehanna Growth Equity. Silver Lake purchased a 12.5% stake from insiders in early 2018 at an estimated $4 billion valuation. • The London Stock Exchange (LSE: LSE) is expected to win EU antitrust approval for its $27 billion purchase of financial data company Refinitiv from The Blackstone Group, Thomson Reuters, GIC and CPPIB. http://axios.link/zBil |     | | | | | | More M&A | | • Flutter Entertainment (Ireland: FLTR), the company formerly known as Paddy Power, will pay $4.2 billion in cash and stock to increase its stake in online sports betting and fantasy sports site FanDuel from 58% to 95%, buying the position from Fastball. http://axios.link/UKTX • Westdale made an all-cash takeover offer for Denver-based apartment Apartment Investment & Management Co. (NYSE: AIV), which had a $4.7 billion market cap before Bloomberg broke the news. http://axios.link/L1xR • XPO Logistics (NYSE: XPO) will split its trucking and logistics units into separate, publicly-traded business via a tax-free spinoff. http://axios.link/VrZs |     | | | | | | Fundraising | | • Arena Investors raised $519 million for a credit-oriented opportunities fund. www.arenaco.com 🚑 OTV, an Israeli VC firm, raised $170 million for a fund focused on digital health startups. www.olivetree.vc • Plexo Capital, a VC firm led by Lo Toney (ex-GV), is raising $100 million for its second fund, per an SEC filing. www.plexocap.com • Scale Venture Partners raised $600 million for its seventh fund. www.scalevp.com |     | | | | | | It's Personnel | | 🚑 Christina Farr is joining OMERS Ventures as a healthcare investor. She previously was a (frustratingly good) reporter at CNBC. • Jenny Harris (ex-BNP Paribas) joined Houston-based The Sterling Group as a managing director and head of the firm's credit fund. www.sterling-group.com |     | | | | | | Final Numbers | Source: Preqin. Notes: 2020 data is annualized based on data to October. 2022-2025 are Preqin's forecasted figures. |     | | | | | | A message from Koch Industries | | Bill Tai talks tech disruption and transformation | | |  | | | | Prolific tech investor Bill Tai has learned what it takes to thrive in an industry defined by constant disruption and change. In a discussion with Koch Disruptive Technologies managing director Jason Illian, he shares what he's learned. More. | | | | ✔️ Thanks for reading Axios Pro Rata! Please ask your friends, colleagues and air taxi drivers to sign up. | | | | Axios thanks our partners for supporting our newsletters.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment