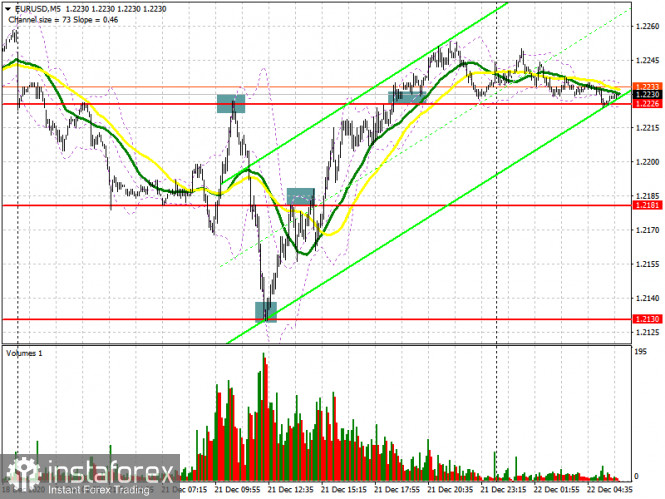

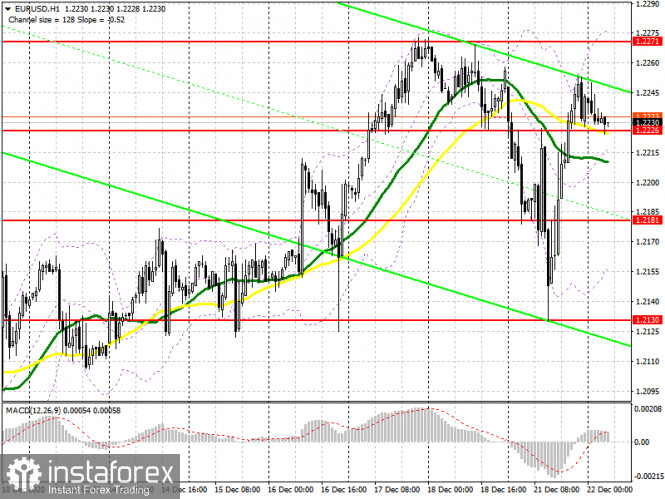

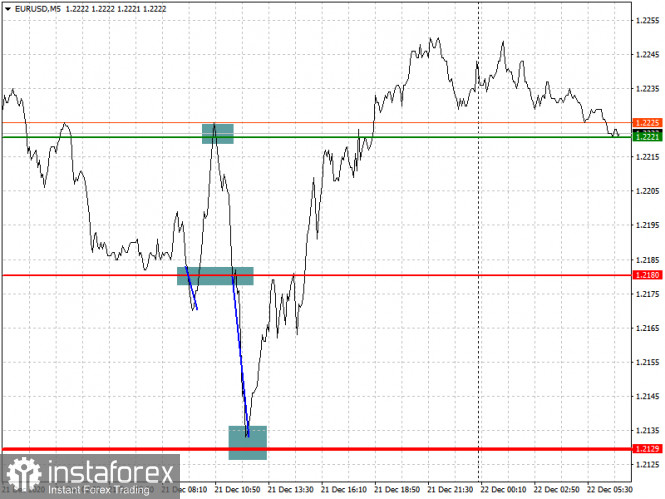

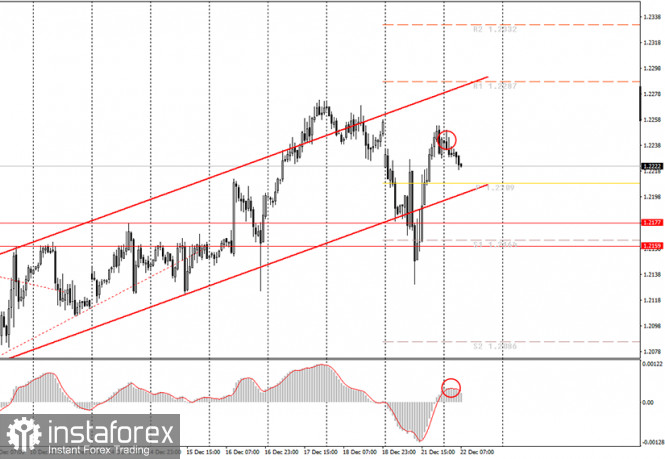

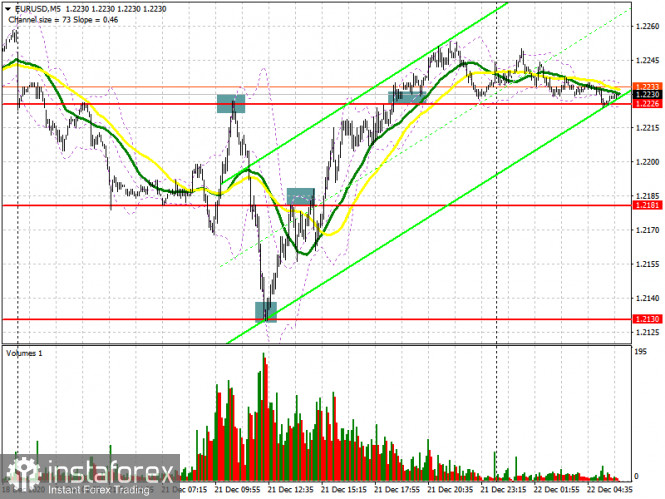

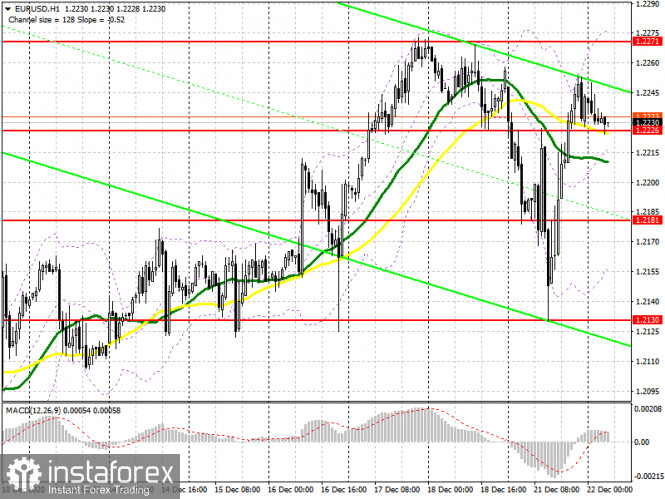

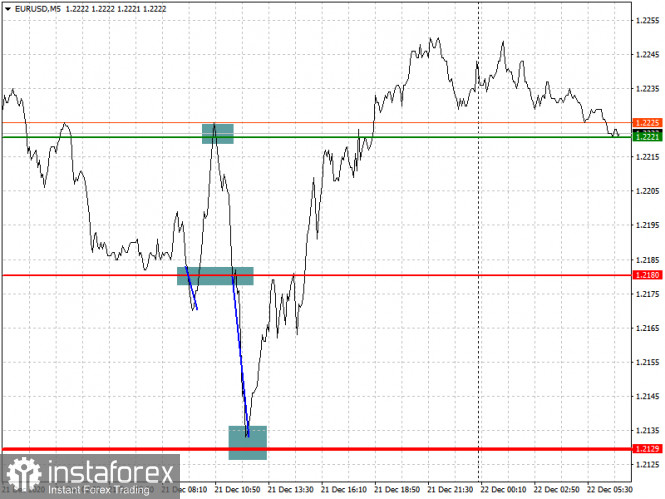

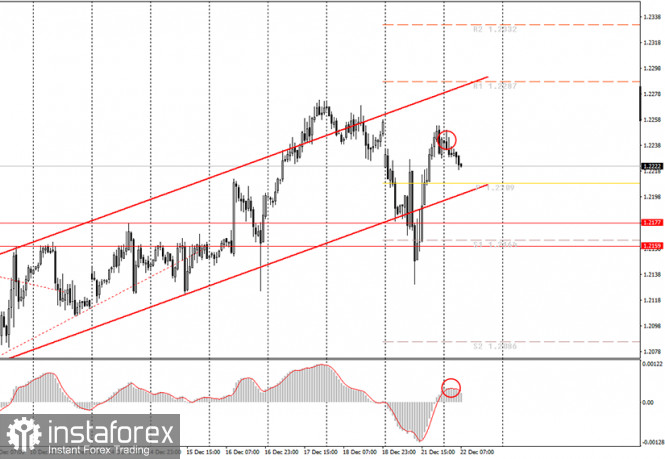

| EUR/USD: plan for the European session on December 22. COT reports. New 900 billion bailout package hit dollar's position, euro strengthens as a result 2020-12-22 To open long positions on EUR/USD, you need: Yesterday, the United States House of Representatives approved a new US $900 billion bailout package for the US economy, which pushed the euro against the dollar. This made it possible to win back the entire fall that was observed in the first half of the day. Good data on consumer sentiment in the eurozone also managed to support the euro during the US session. Let's take a look at the 5-minute chart and talk about where you could have entered the market in the afternoon. Buying from the 1.2130 level quickly brought the pair back to the resistance of 1.2181, where we had a false breakout and a sell signal in order to pull down the euro. However, a major downward movement did not take place, as a result of which the bulls regained control of the 1.2181 level and continued to rise from it. At the end of the day, the pair settled above 1.2226, which resulted in a signal to buy the euro, but the growth was no more than 25 points.

Today, buyers of the euro will be puzzled with protecting the support level of 1.2226 in the first half of the day, where the pair is currently trading. Moving averages also pass there, which play on the side of buyers. Forming a false breakout in the 1.2226 area will help stop the bearish momentum, which will lead to producing a convenient entry point into long positions to sustain the upward trend in order to return to a high of 1.2271. A breakout and being able to settle above this range, along with good news on the Brexit trade deal, will open new highs for euro buyers in the 1.2304 and 1.2339 areas, where I recommend taking profits. Significant reports on the state of the European economy will not be released in the morning, so the emphasis will shift to US indicators. If bulls are not active in the 1.2226 area, a breakdown of this level may take place. In this case, it is better not to rush to buy, but to wait until a larger low at 1.2181 has been updated, from where you can open long positions if a false breakout is formed. I recommend buying the pair immediately on a rebound after updating this week's low in the 1.2130 area, counting on an upward correction of 25-30 points within the day. To open short positions on EUR/USD, you need: Sellers of the euro aim to regain control over the 1.2226 level. Getting the pair to settle below this range and testing it from the other side will increase the pressure on the pair, which produces a good entry point for short positions. In this case, the main target will be the 1.2181 area, where I recommend taking profits. We can expect the euro to return to the support area of 1.2130, in the event that the epidemiological situation in the eurozone countries deteriorates and a new strain of coronavirus appears in Germany, France and a number of other states. If the bulls manage to defend support at 1.2226, we can expect the bull market to resurface again and EUR/USD can return to an annual high in the 1.2271 area. I recommend opening short positions from there only after forming a false breakout. It is best to count on selling on a rebound only after testing 1.2304 and 1.2339, counting on a downward correction of 20-25 points within the day.

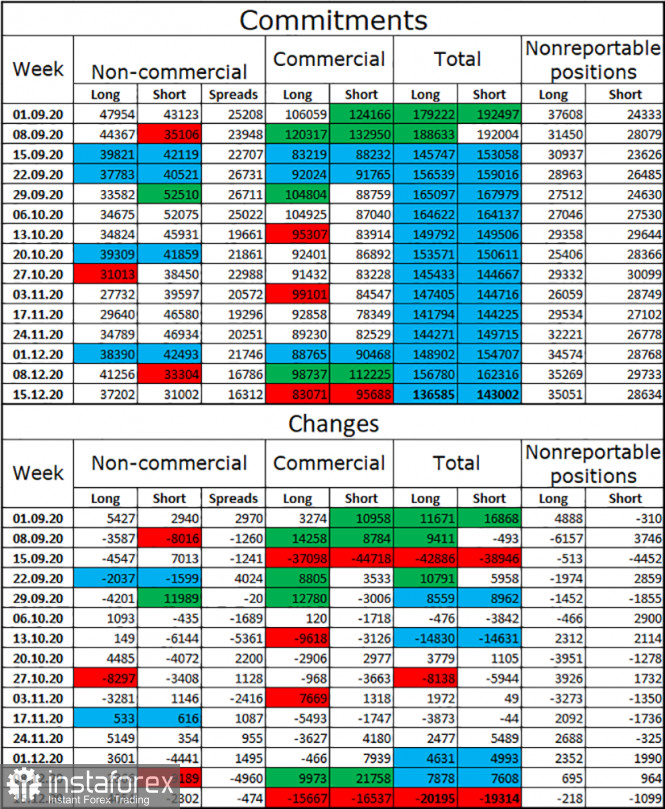

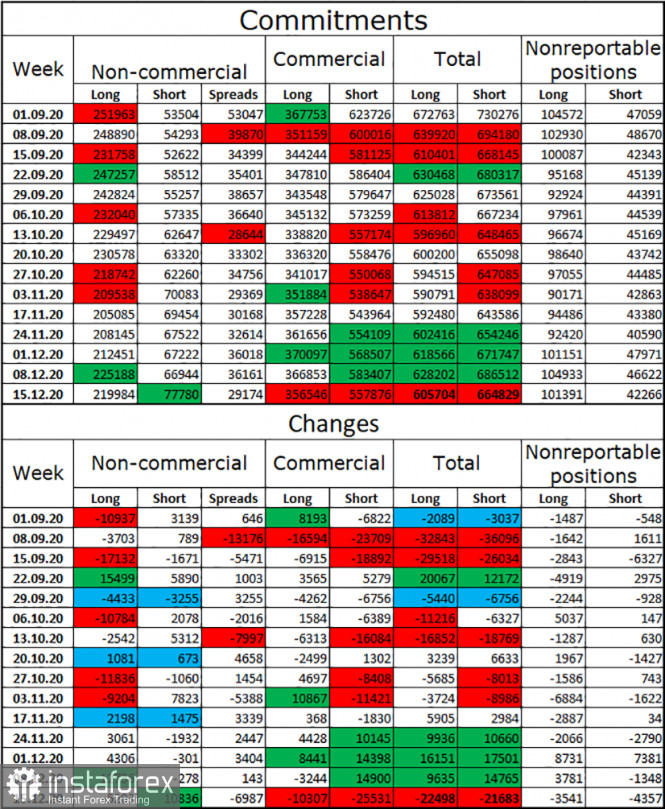

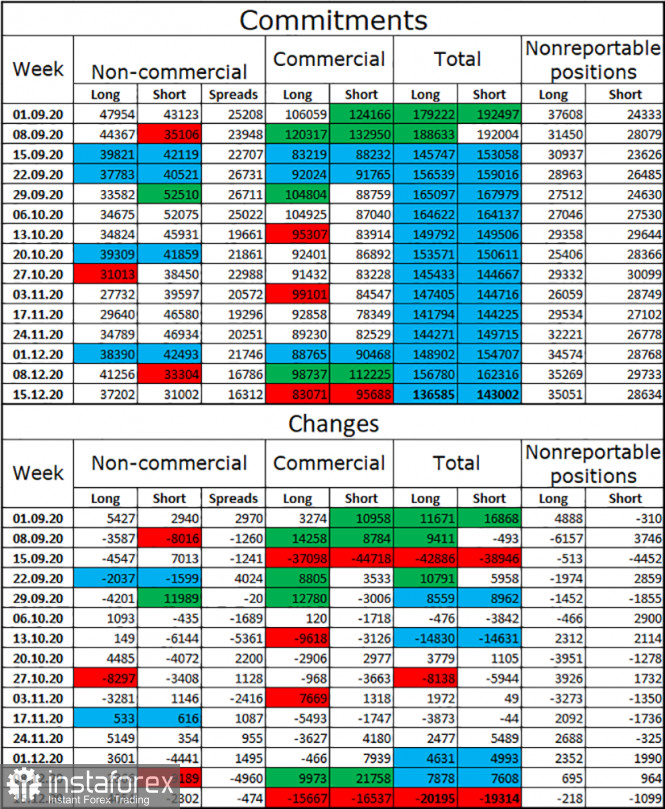

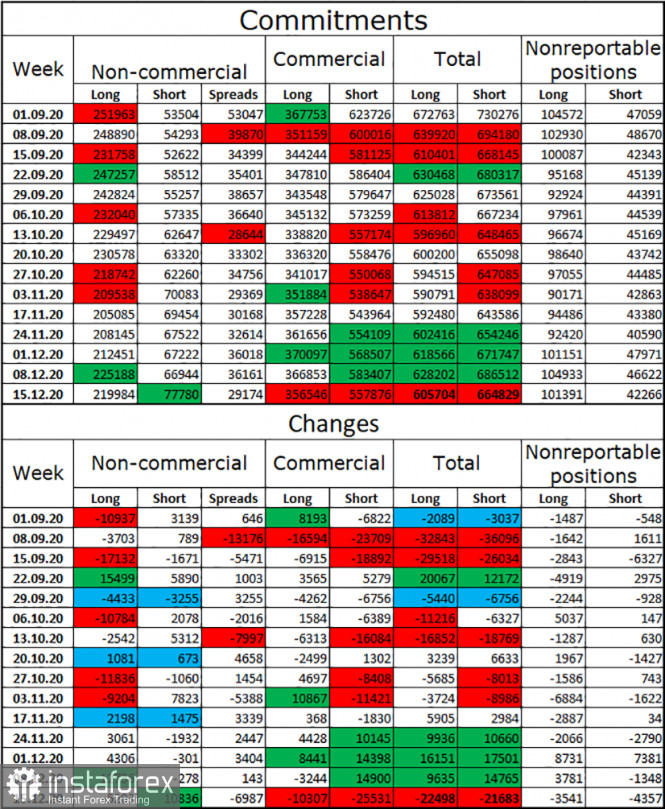

The Commitment of Traders (COT) report for December 15 showed an increase in short positions and a reduction in long ones. Although buyers of risky assets believe that the bull market will proceed, especially amid expectations of vaccinations in the eurozone, which will begin from December 25 to 27, however, the rush to buy at current highs has obviously decreased. Thus, long non-commercial positions fell from 222,521 to 218,710, while short non-commercial positions increased from 66,092 to 76,877. The total non-commercial net position fell from 156,429 to 141,833 a week earlier. The growth of the delta, which was observed for three consecutive weeks, has stopped, so one can hardly count on the euro's rapid growth at the end of this year. There will be no further major recovery until European leaders negotiate a new trade agreement with Britain. Indicator signals: Moving averages Trading is carried out slightly above 30 and 50 moving averages, which indicates the buyers' attempt to continue the upward trend. Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart. Bollinger Bands A breakout of the upper border of the indicator in the 1.2271 area will result in pushing the euro to the upside. A breakout of the average border of the indicator in the 1.2220 area will increase pressure on the pair and the euro to fall. Description of indicators - Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

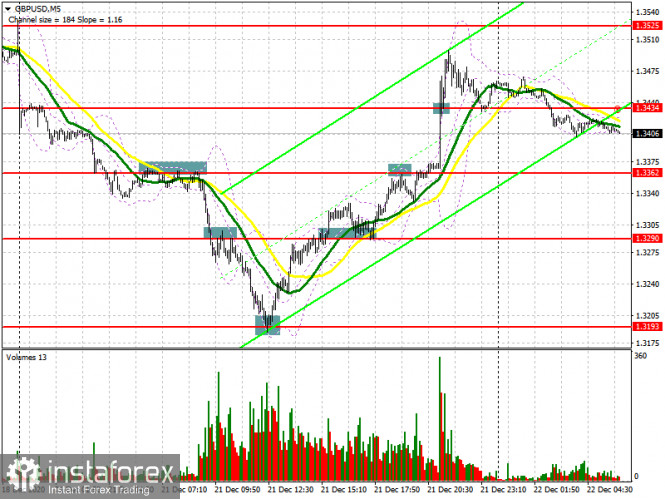

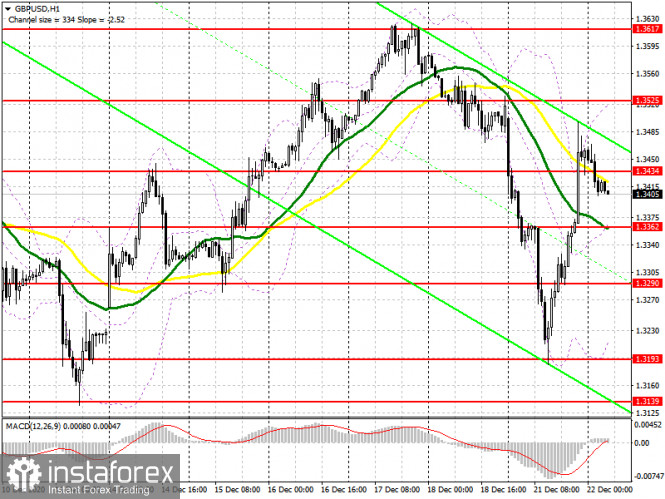

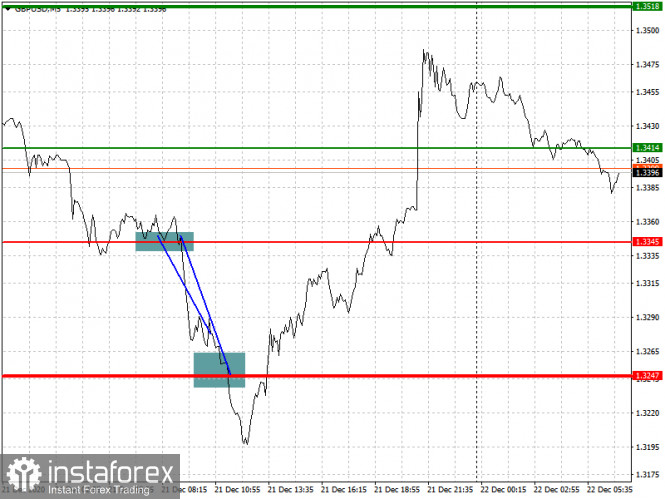

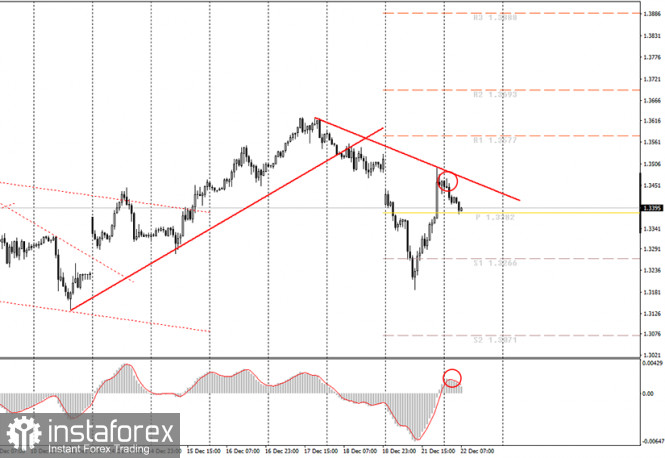

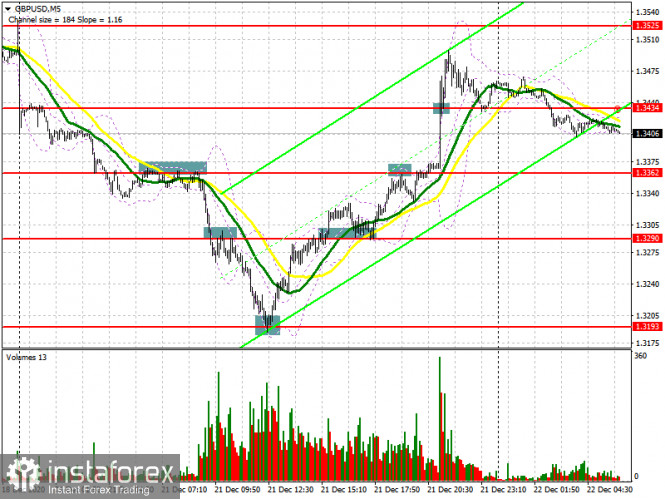

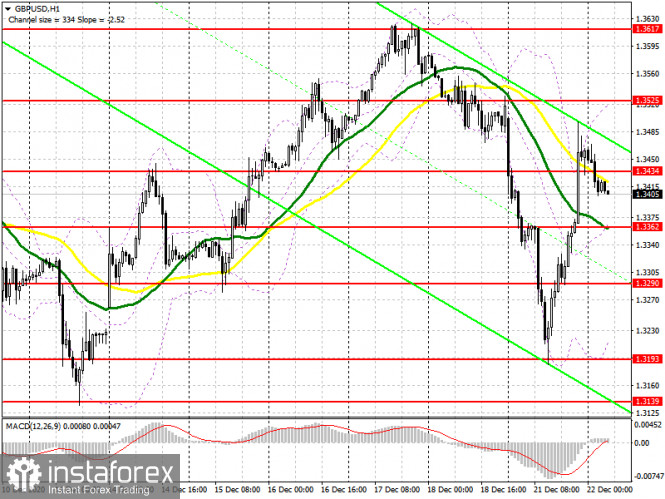

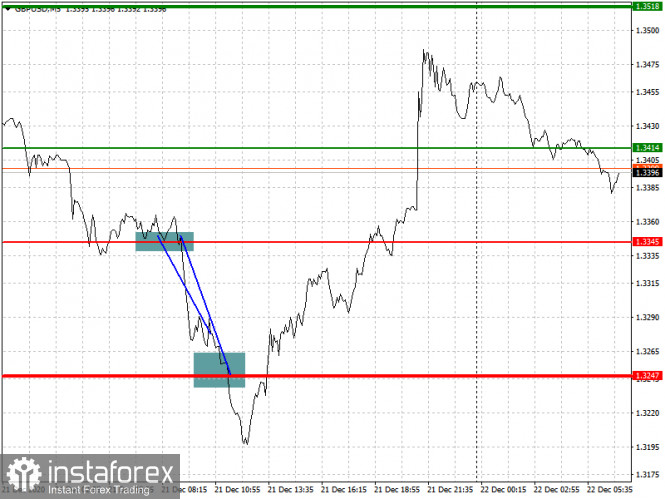

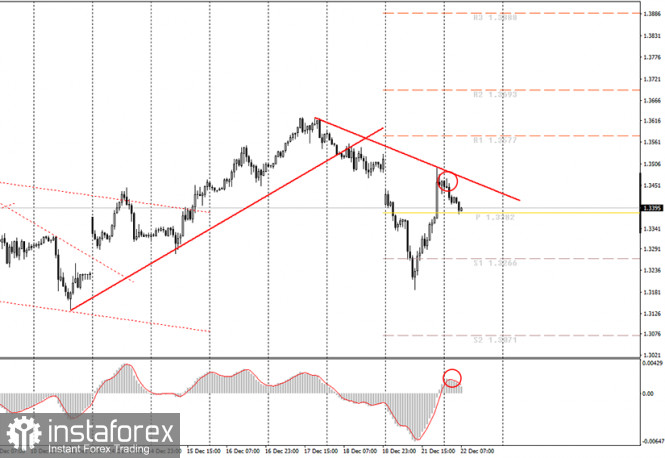

GBP/USD: plan for the European session on December 21. COT reports. Pound won back everything it lost on Monday morning. Bears need control over 1.3362 2020-12-22 To open long positions on GBP/USD, you need: Such strong volatility in the British pound is nonsense. However, when Brexit and the new strain of coronavirus come under pressure, the observed price swings are the norm. Let's take a look at the 5-minute chart and talk about what happened yesterday morning after the great trades that I reviewed at the end of the European session. We can see how the bulls regained control over resistance at 1.3290, surpassing and testing it from top to bottom, which creates a new signal to buy the pound. It slightly retreated after rising to the resistance area of 1.3362. I recommended selling on a rebound from the 1.3362 level. However, there was no major sell-off and the bulls easily surpassed 1.3362, collecting the bears' stop orders. All this leads to a large rise and a breakdown of 1.3434. Selling from this level on a rebound resulted in a loss. But this is not scary, since there were just a huge number of positive deals yesterday.

Despite the extremely high volatility of the pound, buyers must maintain control over the 1.3362 level in the first half of the day. Forming a false breakout there will be a signal to open long positions in hopes for the pound to recover in the short term and reach the resistance of 1.3434. The main goal will be to surpass it and settle. Testing this level from top to bottom creates an additional entry point into long positions in order to reach a high of 1.3525, where I recommend taking profits. The succeeding targets will still be resistances at 1.3617 and 1.3690, but they will be available only if we receive good news on the Brexit deal. In case bulls are not active in the 1.3362 support area, it is best not to rush into long deals, but wait until the 1.3290 low has been updated. However, I recommend opening long positions from this level only after forming a false breakout. A larger support level is seen in the 1.3193 area, where you can buy GBP/USD immediately on a rebound, counting on a correction of 35-40 points. To open short positions on GBP/USD, you need: Bears will focus on today's UK GDP data, but this report is unlikely to lead to a strong surge in volatility. Forming a false breakout in the resistance area of 1.3434 will return the pressure to the pair and result in the pair's decline and a test of the next support at 1.3362. Surpassing this level and testing it from the bottom up, similar to the sales that I analyzed in yesterday's forecast for the pound, creates a good signal to open short positions in GBP/USD, in hopes for it to fall to lows of 1.3290 and 1.3193, from where there was strong demand yesterday buyers. Only bad news on the trade agreement can significantly pull down GBP/USD to the 1.3114 low. If bulls manage to defend the 1.3362 level, then it is better not to rush with short positions. The optimal scenario for selling the pound will be failure to settle above 1.3434. I recommend opening short positions immediately on a rebound from the high of 1.3525, counting on a downward correction of 30-35 points within the day.

The Commitment of Traders (COT) reports for December 15, there is a decrease in interest in the British pound for both buyers and sellers. Long non-commercial positions decreased from 39,344 to 35,128. At the same time, short non-commercial positions decreased from 33,634 to 31,060. As a result, the non-commercial net position, although it remained positive, dropped to 4,068, against 5,710 versus a week earlier. All this suggests that traders are taking a wait-and-see attitude, although a small preponderance of buyers, even in the current situation, continues to be observed. Given that the UK has imposed tough quarantine measures due to a new strain of coronavirus that has gotten out of control and for which there is no vaccine yet, then expecting the pound to strengthen further at the end of this year will not be the right decision. Only good news on Brexit can bring new players back into the market, betting on GBP/USD growth. Indicator signals: Moving averages Trading is carried out in the area of 30 and 50 moving averages, which indicates some confusion in the market regarding the pair's succeeding direction. Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart. Bollinger Bands If the pound rises, the upper border of the indicator at 1.3510 will act as resistance. A breakout of the middle border of the indicator in the 1.3365 area will increase the pressure on the pair. Description of indicators - Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

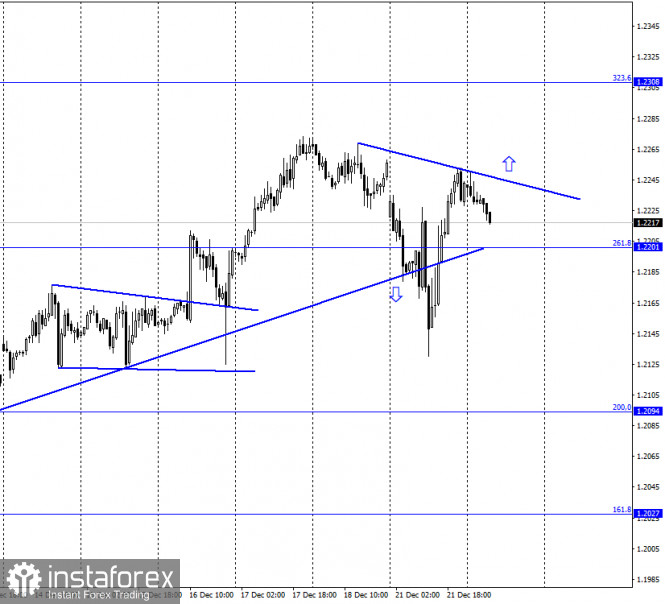

GBP/USD: Will the pound get out from an outsider position? 2020-12-22  The current week began extremely unsuccessfully for the British currency: it sharply declined on Monday, December 21. However, it gained confidence the next day amid the probability of a new solution to hot issues. Strong impulses for the pound's decline were the worsening situation about the new COVID-19 strain discovered in the UK, as well as the lack of Brexit compromise, particularly on the fisheries issue. However, if the British authorities hardly controlled the first problem, then there have been positive changes with regard to the second one. Bloomberg said that Boris Johnson, UK Prime Minister, has approached the European Commission with a new fisheries proposal. The British currency immediately reacted to the official's speech, which soared during the late evening on Monday. Analysts are sure that such a reversal greatly affected the pound. Previously, when it was impossible to solve the problem of fishing in British waters, the pound declined in line with the lack of agreement between the parties. However, it changed on late Monday night when the GBP/USD pair actively traded at peak values, near the level of 1.3483. Today, the pair lost some of its position. It is trading in the range of 1.3397-1.3398, trying to increase. However, experts recorded a decline again.  The pound's current collapse was facilitated by the worsening situation with COVID-19. The tightening of quarantine in the country due to a new strain of the indicated virus was complemented by difficult, tense negotiations with the EU. Experts emphasized that the quick completion of the Brexit transition period aggravated the current situation. Nevertheless, there was a little hope put forward last night by Britain's Prime Minister regarding the new fishing proposal. Brussels is currently considering a new proposal from Boris Johnson. It provides for a compromise in solving the problem of fishing in British territorial waters. Bloomberg reported that the UK authorities may concede to the EU on the issue of lowering fishing quotas, provided that the other side compromise regarding the remaining points. Last night, London announced its readiness to make concessions on fishing in exchange for similar actions by Brussels in other areas. The new initiative of the British negotiators involves reducing the amount of catch transferred to the United Kingdom by almost a third. Earlier, the United Kingdom insisted on the adoption by the European Union of conditions for quotas of at least 60%, but now it is ready to reduce this figure. Such a political turn weakened the pound's position. Based on analysts' observations, the GBP has repeatedly tried to leave the position of an outsider, but the difficult situation with Brexit and the new type of coronavirus throws it back. Its attempts to rise were sometimes successful, albeit temporary. Nevertheless, experts expect its dynamic to relatively stabilize. Indicator analysis. Daily review on the EUR/USD currency pair for December 22, 2020 2020-12-22 Yesterday, the pair unexpectedly worked out a strong low (93 points) on the news, but then the trend took its toll, and the daily candlestick closed with a white doji, breaking up the historical resistance level of 1.2234 (blue dotted line). Today, the price may continue to move down. As per the economic calendar, news is expected at 13.30, 15.00 UTC (dollar). Trend analysis (Fig. 1). Today, the market from the level of 1.2242 (closing of yesterday's daily candlestick) in the morning will try to continue moving down with the target of 1.2177 resistance level (blue thick line). After testing this level, the price may start moving up with the target of 1.2274 – an 85.4% pullback level (yellow dotted line).

Figure 1 (Daily Chart). Comprehensive analysis: - Indicator analysis - down

- Fibonacci levels - down

- Volumes - down

- Candlestick analysis - down

- Trend analysis - down

- Bollinger bands - up

- Weekly chart - up

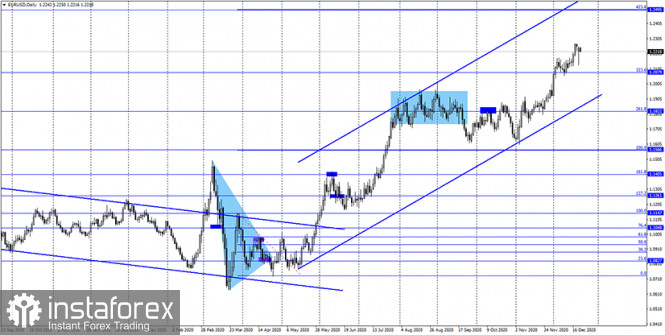

General conclusion: Today, the price from the level of 1.2242 (closing of yesterday's daily candlestick) can continue to move down with the target of 1.2177 resistance level (blue thick line). After testing this level, the price may start moving up with the target of 1.2274 – an 85.4% pullback level (yellow dotted line). Unlikely scenario: when working down to reach the resistance level of 1.2177 (blue bold line), it is possible to work down with the target of 1.2117 - a 23.6% pullback level (red dotted line). Technical Analysis of EUR/USD for December 22, 2020 2020-12-22 Technical Market Outlook: The EUR/USD pair has broken out from the ascending channel around the level of 1.2220 and made a new local low at the level of 1.2130. The short-term demand zone located between the levels of 1.2154 - 1.2177 has been violated and will no longer be effective. The next technical support is seen at the level of 1.2088. Please notice, the market is coming off the overbought conditions and the momentum is already below the neutral level of fifty, so the deeper pull-back might develop soon. Weekly Pivot Points: WR3 - 1.2470 WR2 - 1.2364 WR1 - 1.2314 Weekly Pivot - 1.2216 WS1 - 1.2157 WS2 - 1.2054 WS3 - 1.2003 Trading Recommendations: Since the middle of March 2020 the main trend is on EUR/USD pair has been up. This means any local corrections should be used to buy the dips until the key technical support is broken. The key long-term technical support is seen at the level of 1.1609. The key long-term technical resistance is seen at the level of 1.2555.

Technical Analysis of GBP/USD for December 22, 2020 2020-12-22 Technical Market Outlook: The GBP/USD pair has closed the Monday open gap located at the level of 1.3476. Moreover, the market retraced more than 61% of the last wave down, but reversed anyway as the bearish pressure is clear. The next technical support is located at the level of 1.3264 and 1.3240. Please notice, that if the level of 1.3240 is violated, the price will be close to the main trend line support located around the level of 1.3175. The key technical support is still seen between the levels of 1.3165 - 1.3121. Weekly Pivot Points: WR3 - 1.3982 WR2 - 1.3787 WR1 - 1.3662 Weekly Pivot - 1.3457 WS1 - 1.3286 WS2 - 1.3107 WS3 - 1.2936 Trading Recommendations: The GBP/USD pair might have started a long term up trend and the trigger for this trend was the breakout above the level or 1.3518 on the weekly time frame chart. All the local corrections should be used to enter a buy orders as long as the level of 1.2674 is not broken. The long-term target for bulls is seen at the level of 1.4370.

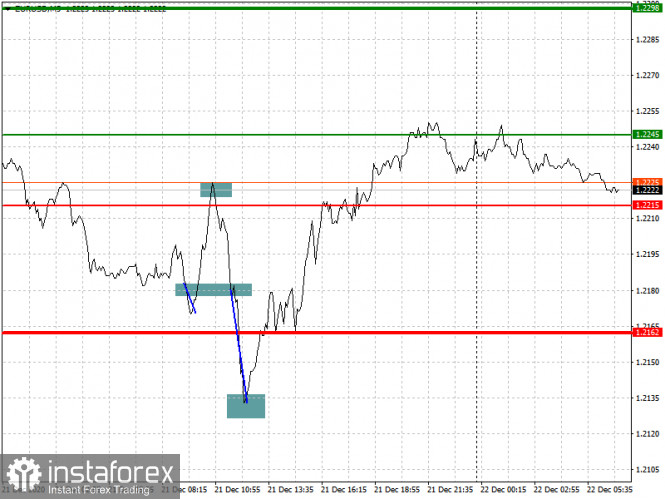

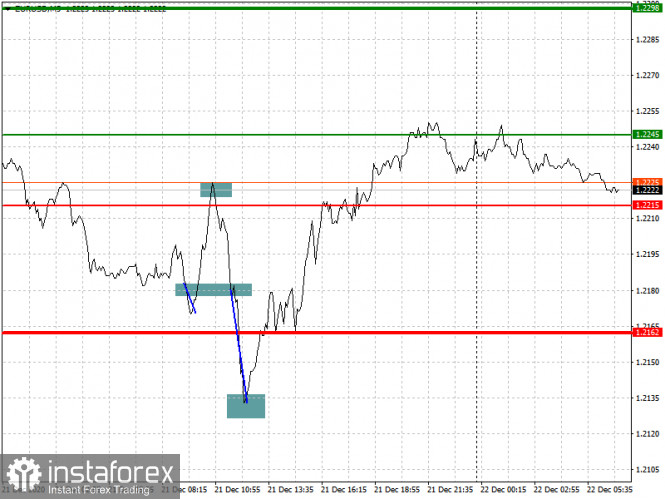

Analysis and trading recommendations for the EUR/USD and GBP/USD pairs on December 22 2020-12-22 Analysis of transactions in the EUR / USD pair The latest data on EU consumer confidence increased the demand for the euro yesterday, thereby allowing the bulls to offset any losses seen earlier. At first, the quote moved 10 pips down from 1.2180, but after that the market reversed. And although long positions from 1.2221 were not that profitable, the downward move from 1.2180 to 1.2129 pips to about 40 pips, which compensated the losses from earlier transactions.

Trading recommendations for December 22 News that the US House of Representatives approved the $900 billion bailout bill led to the sharp collapse of the dollar, and accordingly, a rise in the European currency. But today, the euro could turn down if it is reported that the new strain of coronavirus first discovered in the UK is also found in other EU countries, and if the data on US consumer confidence, which is expected to come out in the afternoon, turns out to be better than expected. Meanwhile, data on EU GDP is unlikely to lead to strong changes in the market, as no major revision of this indicator is expected.

- Open a long position when the euro reaches a quote of 1.2245 (green line on the chart) and then take profit at the level of 1.2298. However, growth can only happen if the economic report from the US comes out worse than the forecasts. At the same time, the euro could jump sharply if a Brexit trade agreement is reached.

- Open a short position when the euro reaches a quote of 1.2215 (red line on the chart) and then take profit around the level of 1.2162. Many are expecting a decline in EUR / USD especially since there is a new strain of coronavirus spreading in the UK.

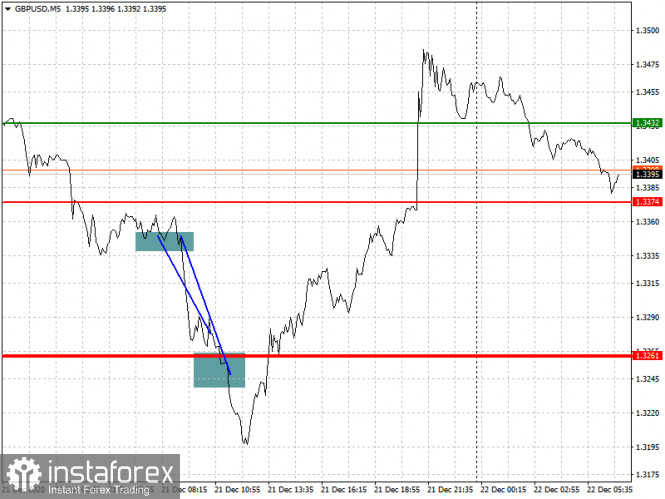

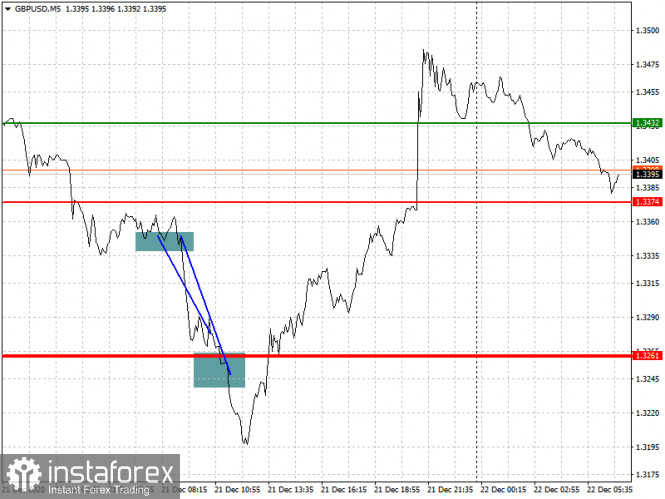

Analysis of transactions in the GBP / USD pair Pound bears earned quite a lot of profit yesterday, when the quote moved 100 pips down from 1.3345 to 1.3247. The sharp decline was fueled by the concerns about the disruption to supply chains, as many European countries have tightened border controls due to the new coronavirus outbreak in the UK.

Trading recommendations for December 22 Although the UK implemented tougher quarantine restrictions, the pound still traded upwards yesterday, mainly due to the news that the US finally adopted a new package of stimulus. Then, today, data on UK GDP will be released. However, it may not affect the market much especially if they coincide with the forecasts of economists. In the afternoon though, there is a high chance that the dollar could gain back its positions, as soon as the data on US consumer confidence is released. At the same time, news containing the rapid spread of the new strain of coronavirus in the UK will dampen demand for the pound, as will the likelihood of a Brexit breakdown. This week will be the last in which the parties will try to come to an agreement. Therefore, in this regard, it would be best to short the GBP / USD pair in the short term.

- Open a long position when the quote reaches the level of 1.3432 (green line on the chart) and then take profit around the level of 1.3557 (thicker green line on the chart). Good news on Brexit, as well as strong data on UK GDP, may strengthen the position of the British pound.

- Open a short position when the quote reaches the level of 1.3374 (red line on the chart) and then take profit around the level of 1.3261. If there is bad news on Brexit or on the COVID-19 situation, the downward trend in the GBP / USD pair will resume.

Elliott wave analysis of NZD/USD for December 22, 2020 2020-12-22

On December 15, we posted an article on NZD/USD. The article focused on NZD/USD having stamped a five wave rally since the 0.5468 low in March 2020 and a top was nearby, but a break below key-support at 0.7006 would be needed to confirm the top of wave 5/ was in place and a larger correction towards at least 0.6522 unfolding. Wave 5/ moved slightly higher that the peak we already had seen at 0.7120 to a new high at 0.7172. At this peak wave 1/ and wave 5/ was equal in length and at the same point wave 5/ was 50% of the distance traveled from the low of wave 1/ through the peak of wave 3/ added to the low of wave 4/. This means the odds of a top being in place at 0.7172 is high and a break below key support at 0.7006 only should be a matter of time confirming the onset of a larger correction in wave 2 or B. RSI continues to flag a clear loss of upside momentum and has already broken down indicating increased downside pressure on NZD/USD R3: 0.7172 R2: 0.7140 R1: 0.7113 Pivot: 0.7055 S1: 0.7006 S2: 0.6960 S3: 0.0.6907 Trading recommendation: Protect long positions and revers to a short NZD position upon a break below 0.7006 Elliott wave analysis of GBP/JPY for December 22, 2020 2020-12-22

GBP/JPY failed to break above short-term key resistance at 140.35 for a continuation higher to 142.72. The failed attempt to break above the key-resistance continues to GBP/JPY in a 136.95 - 140.35 range. Ultimately we expect a break above key-resistance at 140.35 but with the potential risk of a hard Brexit has increased the risk of a break below support at 136.95 that will revers the uptrend to renewed downside pressure towards 133.02 and possibly even closer to 128.70 in the weeks ahead. R3: 140.35 R2: 139.59 R1: 139.05 Pivot: 138.77 S1: 138.29 S2: 137.69 S3: 136.95 Trading recommendation: We will sell a break below 136.95 or buy a break above 140.35 Analytics and trading signals for beginners. How to trade EUR/USD on December 22? Plan for opening and closing deals on Tuesday 2020-12-22 Hourly chart of the EUR/USD pair

The EUR/USD pair made an attempt to bring back the downward movement last night. Take note that the euro's quotes collapsed on Monday, but it did not last long, and it eventually grew on the same day. In fact, the price simply went down 100 points, and then up by the same amount. Despite this, the upward trend was broken as the quotes were leaving the rising channel. Consequently, we expect the euro to fall. Logically, now the price can rush to the previous local low near the 1.2130 level, especially since the pair was already falling to it and also rebounded a couple of days ago. If so, then the potential for the pair's decline is around 90 points from current positions. Yesterday evening we advised you to wait for a new sell signal from the MACD indicator. It was formed that night (circled in the chart). It has a sufficiently strong status, since the indicator has managed to discharge itself properly. Therefore, novice traders could enter the market at the rate of 1.2130 and already be in profit at the moment. You are advised to maintain open sell orders today. The US will release its third quarter GDP today. However, as we mentioned yesterday, this indicator is already well known to traders, since this is its third estimate. With a high degree of probability, GDP will grow by 33.1% in the third quarter. Market participants should be more interested in the fourth quarter and its performance. Take note that there was a new lockdown in the European Union in the fourth quarter, but the US did not implement one. Therefore, the American economy should do without losses during this period of time, and the European one should not. Therefore, the euro may soon come under market pressure if this factor is taken into account. Moreover, this is an important factor. In addition, the index of consumer confidence in the United States will also be released today, but traders are likely to ignore all of the macroeconomic reports today. With great excitement, the markets will be waiting for news on the new strain of coronavirus. Possible scenarios for December 22: 1) Long positions are currently irrelevant, since the quotes were leaving the rising channel. Thus, we would not recommend opening new long positions right now, no matter how attractive they may seem. Instead, you need to wait for a new upward trend in order to consider long deals. 2) Trading down looks more appropriate. The MACD indicator formed a rather strong buy signal that night, which we advise you to work out today. Targets - support levels 1.2164 and 1.2086. The second target is located very far away, so we are unlikely to reach it today. It is quite possible that the pair will fall by a total of 50-90 points. If not, then an upward reversal of the MACD indicator will signal the loss of bears' interest in trading the pair. In this case, we would recommend waiting for a new sell signal. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. Analytics and trading signals for beginners. How to trade GBP/USD on December 22? Plan for opening and closing deals on Tuesday 2020-12-22 Hourly chart of the GBP/USD pair

The GBP/USD pair also faced a downward reversal last night and started a new round of decline. In addition, a new downward trend line has appeared, which supports those who are trading to the downside. Consequently, there is a very high chance that the pound could fall. Last night, we advised you to open new short positions if a sell signal from MACD is generated. The signal has been generated (circled in the chart). Unfortunately, it appeared at night, but those who waited for it are now in profit of several tens of points. Yes, 30 points is not much, given the current volatility of the pound/dollar pair, but it's still a profit. Considering how Monday's trading went, many newbies could have finished their trek through the currency market. We advise you to open positions when there is a strong signal and strictly follow the trend. The market should be as calm as possible. It is better to make a small profit than a big loss. 2020 is nearing its end, however, as we see, it continues to present surprises. Yesterday is proof of that. The most interesting thing is that it is easy to explain why both the euro and the pound fell in the morning and eventually grew within the day, which is perhaps very rare in this crazy year. However, everything was logical yesterday. The euro and pound fell synchronously on news of a new strain of coronavirus that was found in the UK, and then synchronously rose when Democrats and Republicans in the US Congress finally agreed on a new stimulus package worth $900 billion for the US economy. This means that almost a trillion more US dollars will be poured into the markets, which naturally increases its supply. That is why the US dollar suffered in the afternoon. Today, the UK and the US are set to release GDP reports for the third quarter. However, we believe that market participants will pay more attention not to statistics, but to more global topics such as the coronavirus, a new stimulus package in the US, and negotiations on the Brexit trade deal. Logically, all of Monday's news has already been worked out, so the dollar may slightly rise again, at least to the area of yesterday's highs. However, today's volatility will almost definitely decrease, since it cannot go through 300 points every day. Possible scenarios for December 22: 1) The upward trend is temporarily canceled since the price has settled below the upward trend line. So in order for you to consider trading up again, you need to wait until quotes settle above the downward trend line. In this case, you are advised to trade up while aiming for the resistance levels of 1.3577 and 1.3693. The second target is too far. 2) Sales, from our point of view, are now practical, since a new downward trend has formed. So now it is possible to maintain short positions opened on the last MACD signal, while aiming for the support level of 1.3266 and slightly below. Beginners have a potential to earn up to 100 points of profit on this signal. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. Indicator analysis. Daily review for the GBP/USD currency pair 12/22/20 2020-12-22 Trend Analysis (figure 1). Today, the market will try to continue going down from the level of 1.3462 (the closing of yesterday's daily candle) with the target of 1.3299 at the pullback level of 14.6% (red dotted line). If this level is reached, it will go up with the target of 1.3481 at the historical resistance level (blue dotted line).

Figure 1 (daily chart). Comprehensive Analysis: - Indicator Analysis - down

- Technical Analysis - down

General Conclusion: Today, the price will try to continue going down from the level of 1.3462 (the closing of yesterday's daily candle) with the target of 1.3299 at the pullback level of 14.6% (red dotted line). If this level is reached, it will go up with the target of 1.3481 at the historical resistance level (blue dotted line). Unlikely scenario: from the level of 1.3462 (closing of yesterday's daily candle), it will try to continue going down with the target of 1.3299 at the pullback level of 14.6% (red dotted line). If this level is reached, it will continue to go down with the target of 1.3099 rolling back the level of 23.6% (red dotted line). GBP/USD. December 22. COT report. The Briton is getting more expensive again on rumors. Boris Johnson refuses to extend negotiations to 2021. 2020-12-22 GBP/USD – 1H.

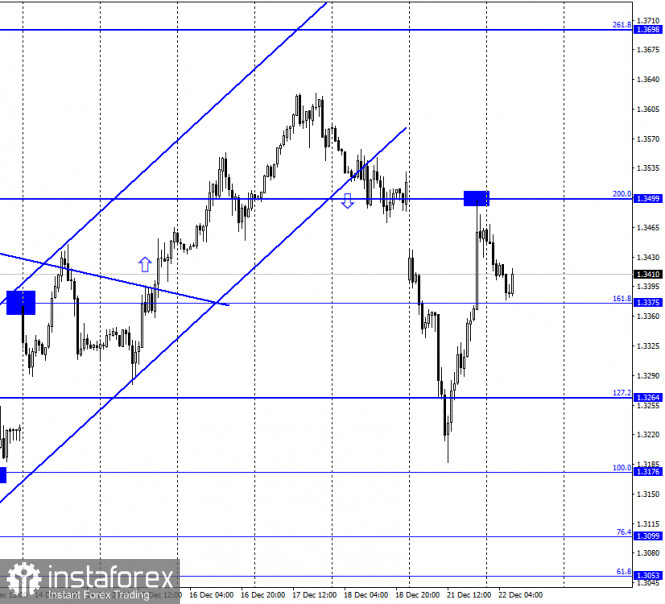

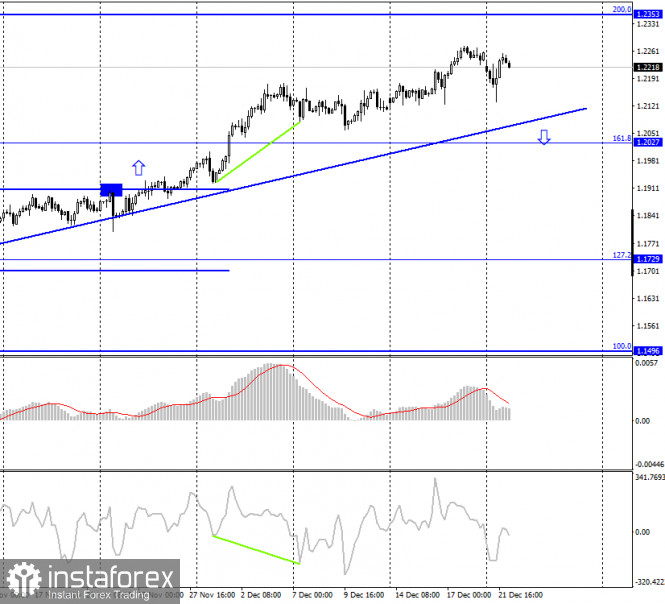

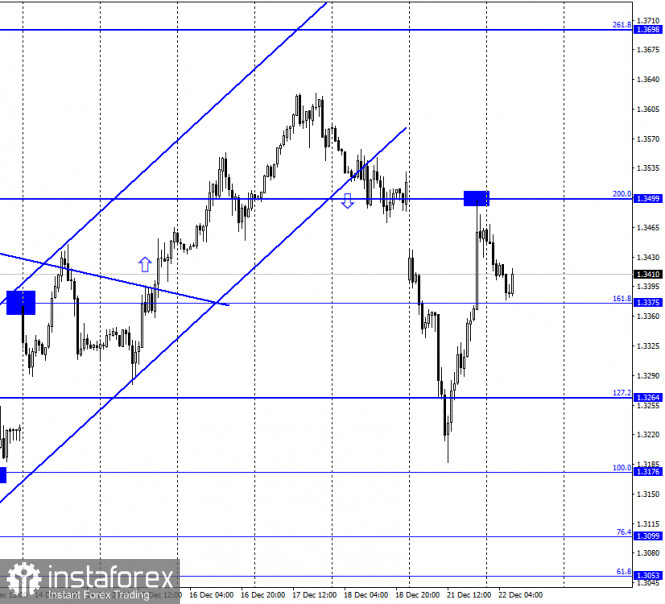

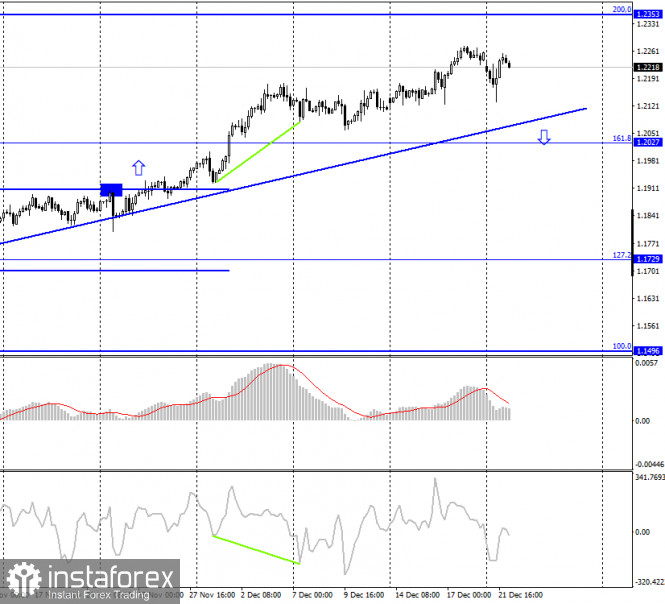

According to the hourly chart, the quotes of the GBP/USD pair performed a strong fall yesterday, then a strong growth, a rebound from the Fibo level of 200.0% (1.3499) and a new reversal in favor of the US currency with a fall to the corrective level of 161.8% (1.3375). A rebound of the pair's exchange rate from this level will work in favor of the UK currency and new growth in the direction of the Fibo level of 200.0%. Closing quotes below the level of 161.8% will increase the chances of continuing to fall in the direction of the next Fibo level of 127.2% (1.3264). Meanwhile, new rumors about Brexit negotiations have come out of the UK. According to these rumors, London and Brussels are still approaching a trade agreement, some of them even say about the possible conclusion of a deal in the next day. According to unverified information, the EU and the UK are still moving towards each other on the issue of fishing and a consensus can be reached in the near future. However, the official information says that the European Parliament reiterates its invitation to London to extend the transition period. Senior EU officials remind that Britain now has a double burden: Brexit and the new strain of COVID-2019. However, British Prime Minister Boris Johnson continues to reject this proposal. "Our position in the transition period is clear. It will end on December 31. Our decision will not change," Johnson said. Also, Boris Johnson himself said that the negotiations are progressing very difficult. Thus, I tend to believe that the parties continue to move not to meet the deal, but to meet the failure. GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair returned to the corrective level of 100.0% (1.3481), rebounded from it, and turned in favor of the US currency. As a result, the decline in quotes can now be continued in the direction of the corrective level of 76.4% (1.3291). Today, the divergence is not observed in any indicator. Fixing the pair above the level of 100.0% will work in favor of resuming growth in the direction of the corrective level of 127.2% (1.3701). GBP/USD – Daily.

On the daily chart, the pair's quotes performed a consolidation under the corrective level of 100.0% (1.3513), which now increases the probability of a new fall with the target of the Fibo level of 76.4% (1.3016). GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed an increase to the second downward trend line. A rebound from it in the long term will mean a reversal in favor of the US dollar and a long fall in the British dollar's quotes. Overview of fundamentals: On Monday, there was not a single economic report in the UK and the US, however, there was a whole lot of other news and rumors that had a strong impact on the British. News calendar for the United States and the United Kingdom: UK - change in GDP (07:00 GMT). US - change in GDP for the quarter (13:30 GMT). US - consumer confidence indicator (15:00 GMT). On December 22, the UK already released a report on GDP for the third quarter, which increased compared to the previous estimate to 16.0% q/q. The Briton didn't react. Next up is the US GDP report for the third quarter. COT (Commitments of Traders) report:

The latest COT report showed that speculators were getting rid of both long and short contracts. This again suggests that traders are afraid of the Briton and the information background that exists now. It is extremely difficult to predict what will happen to the UK economy in 2021. Therefore, the "Non-commercial" category of traders prefers to close trades rather than open new ones. This time, speculators closed 4 thousand long contracts and 2.5 thousand short contracts. Thus, the mood of speculators has become much less "bullish". At the same time, the British continued the growth process, thus, I can draw the same conclusion as for the euro. Major traders are preparing for a new fall in the pound. GBP/USD forecast and recommendations for traders: I recommend buying the British dollar when the quotes rebound from the corrective level of 161.8% (1.3375) on the hourly chart with a target of 1.3499. You can sell the pound sterling when it is fixed at the level of 161.8% (1.3375) on the hourly chart with a target of 1.3264. Terms: "Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors. "Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations. "Non-reportable positions" - small traders who do not have a significant impact on the price. EUR/USD. December 22. COT report. A new package of aid to the US economy has been approved by the lower house of the US Congress. 2020-12-22 EUR/USD – 1H.

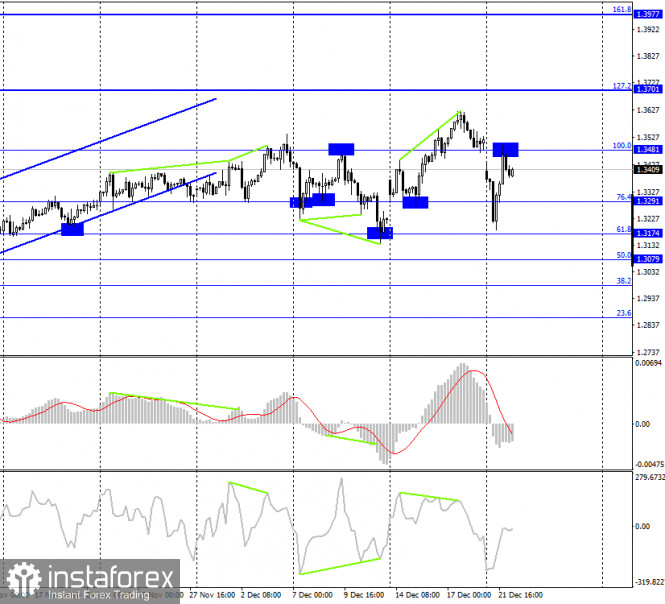

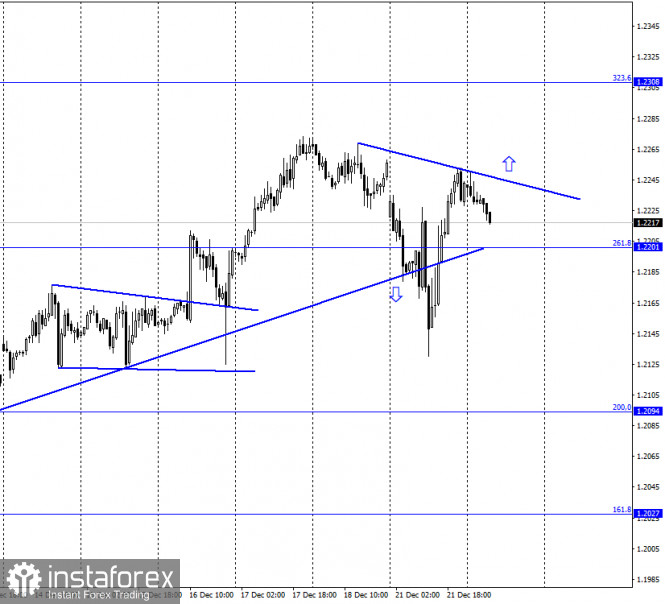

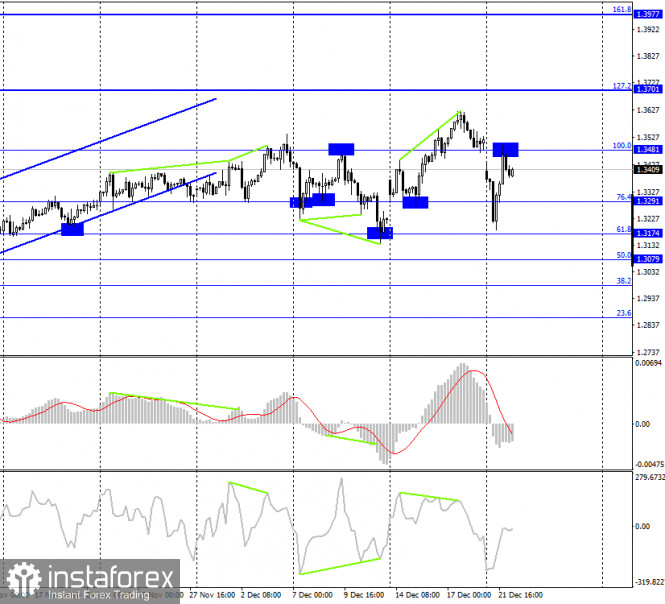

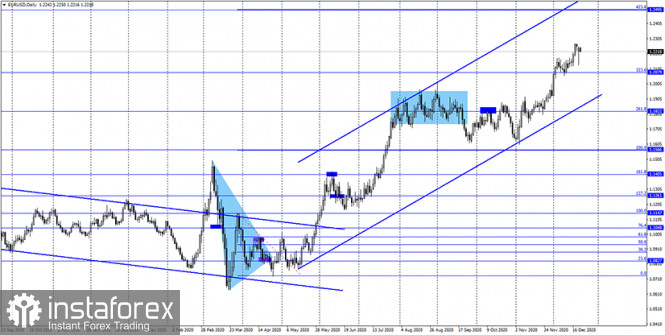

On December 21, the EUR/USD pair performed a fall under the upward trend line, followed by a reversal in favor of the EU currency and growth to the opening levels of the day, after which it again performed a reversal in favor of the US currency and began a new process of falling quotes. A new downward trend line has also formed, which characterizes the current mood of traders as "bearish". Fixing the pair's rate above it will allow us to count on a new increase in the euro's quotes in the direction of the corrective level of 323.6% (1.2308). Traders did not have time to fully digest the information about the new strain of coronavirus and all the possible consequences of a new wave of the pandemic, as news came from America about the approval by the House of Representatives of a new package of financial assistance to the US economy, which has been discussed since the beginning of August. However, Democrats and Republicans, especially in the run-up to the presidential election, could not agree on it. And so, by the end of 2020, the two main parties of the United States still agreed on a package of measures for 900 billion. This package provides for payments to Americans of $ 600 (which is twice as much as in the spring), in addition to this, unemployment benefits will be increased by $ 300. The new agreement also includes measures to help companies most vulnerable to the pandemic and the resulting crisis. This applies to the service sector, airlines, and so on. About $ 300 billion will be spent on lending to small businesses. This news caused the fall of the US currency, as it means a sharp increase in the number of dollars in circulation. Also, this package of measures will have to spur inflation in the United States. EUR/USD – 4H.

On the 4-hour chart, the pair's quotes performed a reversal in favor of the European currency, but in general, they are trading between the corrective level of 200.0% (1.2353) and the upward trend line, which keeps the current mood of traders "bullish". However, I believe that it is better now to pay more attention to the hourly schedule, where you can track changes more quickly. EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair continue the process of growth in the direction of the corrective level of 423.6% (1.2495). Until the moment when the pair performs consolidation under the level of 323.6%, there are still high chances of growth. EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair in the long term. Overview of fundamentals: On December 21, the European Union and the United States did not have a single important economic report or event. However, there was a lot of news that was not on the calendar, and traders reacted very actively to this news. News calendar for the United States and the European Union: US - change in GDP for the quarter (13:30 GMT). US - consumer confidence indicator (15:00 GMT). On December 22, a GDP report and a consumer confidence indicator will be released in America. Not the most important data in the current environment. Traders may trade less actively today than they did yesterday. COT (Commitments of Traders) report:

For four weeks in a row, the mood of the "Non-commercial" category of traders became more "bullish". This was indicated by COT reports and it coincided with what was happening on the euro/dollar pair. However, in the reporting week, speculators opened as many as 11 thousand new short-contracts, and also closed 5200 long-contracts. Thus, they significantly weakened their bullish mood. And despite this, the euro continues to show growth. However, a sharp change in the mood of the "Non-commercial" category of traders does not mean that the euro currency should immediately collapse. The latest COT report shows that speculators are once again preparing for the fall of the euro currency, or at least for the end of its growth. EUR/USD forecast and recommendations for traders: Today, I recommend selling the euro with a target of 1.2201, as there was a rebound from the trend line on the hourly chart. If it is fixed below the level of 1.2201, the pair may fall by another 40-50 points today. New purchases of the pair can be opened with a target of 1.2308 when the quotes are fixed above the trend line on the hourly chart. Terms: "Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors. "Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations. "Non-reportable positions" - small traders who do not have a significant impact on the price. Simplified wave analysis and forecast for GBP/USD and USD/JPY on December 22 2020-12-22 GBP/USD Analysis: The price decline that began last Thursday has a powerful wave level. It changed the current wave layout. The previous movements of the last 3 weeks refer to the extended correction plane of TF H4. The next suitable section has a reversal potential. Forecast: In the next day, a flat mood is expected to move in the price corridor between the opposite zones, with a general downward vector. In the European session, you can expect a short-term rise to the resistance zone. Potential reversal zones Resistance: - 1.3450/1.3480 Support: - 1.3330/1.3300 Recommendations: Trading on the pound market today is possible within the intraday with a reduced lot. Sales can be unprofitable. It is recommended to skip this phase of movement and look for buy signals in the support zone.

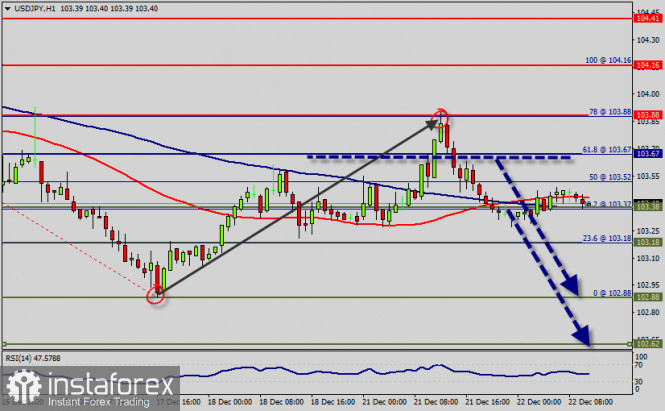

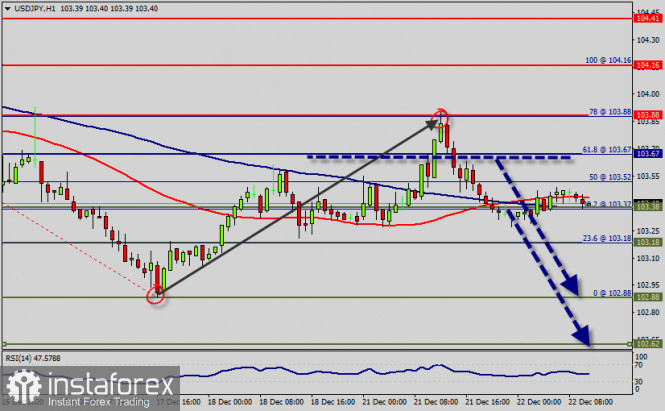

USD/JPY Analysis: On the chart of the Japanese yen, the direction of price fluctuations is set by the algorithm of the downward wave of November 9. Yesterday, the hidden correction of the wrong view was completed. The subsequent decline has a reversal potential and can be the beginning of the final section of the main trend. Forecast: In the first half of the day, a flat is expected today. The price is likely to rise in the area of the resistance zone. By the end of the day, you can expect a reversal and a second decline. The resistance zone shows the lower limit of the expected price move. Potential reversal zones Resistance: - 103.50/105.80 Support: - 102.90/102.60 Recommendations: There are no conditions for purchases today. It is recommended to track signals for selling the instrument in the area of the resistance zone.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure, and the dotted one shows the expected movements. Attention: The wave algorithm does not take into account the duration of the instrument's movements in time! EUR/USD: UK's mutant COVID-19, Bloomberg's article and the US Congress 2020-12-22 The US dollar index continues to stay above the 90-point mark, indicating the increased demand for the US currency. The indicated currency keeps its positions not only amid panic about the new COVID-19 strain, but also due to other fundamental factors. In particular, the USD bulls strengthened their position after Bloomberg's powerful publication, in which experts suggested that the new US Treasury Secretary, Ms. Janet Yellen, would pursue a strong dollar policy. Brexit also indirectly supported the US currency, wherein serious issues are also unfolding. In other words, the final events this year are such that market participants are nervous. All this hype allowed the US dollar to partially recover its lost positions, although the overall market situation is highly uncertain.

Let's start with the so-called "UK's mutant", as some journalists dubbed the new COVID-19 strain. This new type of coronavirus discovered in the UK has provoked a serious panic throughout the markets, including the currency one. In particular, the euro/dollar pair declined by more than 100 points yesterday, but it regained its lost positions before the day closed. The lack of clear information regarding the new strain made the markets nervous yesterday, resulting in inconsistent price movements. Initially, the dollar gained impulse, but then lost its gained points again. At the same time, macroeconomic statistics faded into the background, as traders primarily reacted to comments from virologists and representatives of relevant ministries (Ministry of Health) in Europe and the UK. According to the results of yesterday, a more or less clear preliminary picture emerged about the "British mutant". The bad news is that the mutated form of coronavirus does appear to be more contagious, although experts still can not determine the degree of contagion relative to the normal strain. Many experts say that the figure announced by Boris Johnson – 70%, is not entirely correct, since it has not been confirmed experimentally and is based only on computer modeling. The good news is that the new strain will not affect vaccination – that is, the strategy to combat COVID-19 remains the same and does not require any changes. Simply put, pharmacologists do not need to develop a new vaccine, spending priceless time and huge amounts of money on it. In addition, experts believe that there is currently no evidence that the new strain leads to a more severe course of the disease. Due to this, the Euro recovered again its lost positions before the closing of yesterday's trading, returning to the area of 1.22 level. On the other hand, the situation has not yet returned to normal. The new COVID-19 strain has not yet been studied much, so many countries of the world, including members of the European Union, stayed away from the UK. The general nervousness and uncertainty did not allow the EUR/USD bulls to develop a further upward offensive: traders retreated from yesterday's price high to the base of the 22nd market at the end of the Asian session today. The US dollar, in turn, received unexpected support from Bloomberg. Yesterday, journalists of the news agency published a detailed material dedicated to Janet Yellen, the future US Treasury Secretary. The subject of the article is that her appointment to the White House will help the administration formulate "a more coherent policy on the dollar." At the same time, some insiders reported that Joe Biden's economic advisers are persuading Ms. Yellen to return to the strong dollar policy. There are some reports that say that the future minister agrees at least not to hinder the revaluation of the national currency. Not a single president (before Trump) complained about the overvalued dollar, while the US pursued a policy of a strong national currency over the past 15 years (since 1995). Bloomberg reporters recalled that in the role of the Fed's head, Janet Yellen often spoke about the advantages of a weak dollar in the context of rising inflation and a favorable impact on the export sector. However, in her ministerial role, the former Fed's head will not repeat the above theses, which will maybe help strengthen the US dollar.

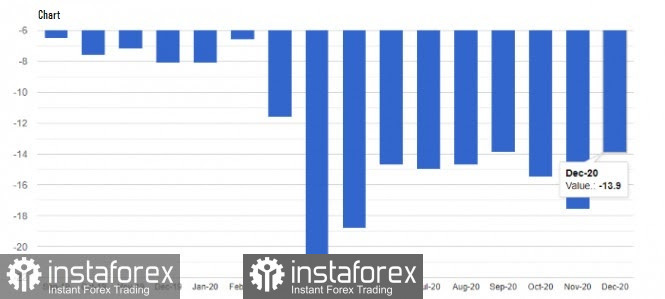

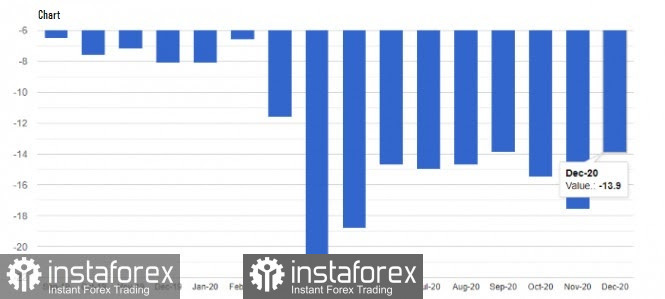

Such assumptions of the influential publication helped sellers of EUR/USD to restrain buyers' attacks. Today, the bearish mood for the pair has begun to prevail again. Many factors put pressure on the pair such as Brexit uncertainty, new US sanctions against high-ranking officials of the Chinese Communist Party, nervousness about a new strain, and a sharp decline in US Treasury yields. In fact, the market ignored that the US Congress approved a new stimulus package worth $ 892 billion. However, this fundamental factor was played out yesterday, when politicians announced that they had reached a compromise agreement. The final vote was just a formality. Thus, long positions on the EUR/USD pair look extremely risky now, given the combination of the above factors. Sales are uncertain which was proven by yesterday's price dynamics. Therefore, it is recommended to take a wait-and-see position for the pair. If we talk about short-term prospects, then the price may further decline to the nearest support level of 1.2175 (Tenkan-sen line on the daily time frame) within the day. The main support level is located slightly below it, which is around 1.2110 (lower line of the Bollinger Bands indicator on the same time frame). GBP/USD and EUR/USD: Pound rose amid news that the EU is considering the UK's latest proposal on Brexit. Meanwhile, the dollar collapsed due to news that the US approved the $900 billion bailout package. 2020-12-22 The US dollar collapsed amid news that the US House of Representatives approved the $ 900 billion bailout bill. Soon, this package will be voted in the Senate.  The bill includes funds that will help households and businesses affected by the coronavirus pandemic. In particular, these are the small businesses that are in very bad shape due to the crisis. The House of Representatives also approved government funding worth $ 1.4 trillion, and it will run until the end of September 2021. If the bill is approved by the Senate, Americans will receive another round of direct payments worth $ 600. Co-payments or unemployment benefits worth $ 300 a week have also been approved, and another $ 300 billion will go to help small businesses. Aside from that, $ 50 billion will be allocated for the distribution of COVID-19 vaccines. At the time of writing, it was reported that the Senate also passed the bill. Therefore, it is now heading to the White House to wait for US President Donald Trump's signature. Last night, US Treasury Secretary Steven Mnuchin said that payments to households could begin as early as next week. In his opinion, this is a rather extremely fast way to inject money into the economy, and should provide undoubted support in the coming months. Amid this news, the euro jumped up in the market, thereby winning back all the positions it lost yesterday. As a result, the EUR / USD pair went back to its earlier price level, so euro bears have to bring the quote below 1.2180 if they want the euro to trade at 1.2130 and 1.2080. But if the quote consolidates above 1.2225, the EUR / USD pair may trade at 1.2275, and then move towards the 23rd figure, which is the key target of the bulls for this week. GBP: At first, the pound was trading downwards because of the new coronavirus outbreak in the UK, but news emerged that the European Union was considering a new proposal for fishing rights, which led to a sharp strengthening of the pound against the US dollar. UK Prime Minister Boris Johnson also said yesterday that he intends to conclude a trade deal within the next 11 hours.  Over the weekend, both sides made it clear that they could not make further compromises, but on Monday, the UK offered to backtrack on its terms if the EU also accommodated them. According to the latest proposal from the UK, the EU should reduce its fishing in UK waters by about a third, that is, a 60% cut in production. Meanwhile, the proposal from the EU was only a 25% reduction, but such was disagreed by France and Denmark, who said that they could block the agreement if they do not like the terms. The European Commission said they have to discuss the issue first with the heads of European governments that have a large fishing industry before giving a response to the UK's proposal. Nonetheless, amid this news, the pound jumped up by 200 pips, thereby winning back all the positions it lost on Monday. And since the GBP / USD pair went back to its earlier price level, the bears will have to bring the quote below 1.3350 if they want the pound to trade at 1.3240. Their further targets are 1.2190 and 1.2135. Meanwhile, if the quote returns to 1.3435, the GBP / USD pair will be able to move towards 1.3525. With regards to the state of the economy, a report was published yesterday which indicated that consumer confidence in the eurozone increased in December, mainly due to the emergence of the COVID-19 vaccines. According to the data published by the European Commission, the index rose to -13.9 points, which leaves hope that the expected contraction of the EU economy this 4th quarter will be limited.  Meanwhile, in the US, the Chicago Fed reported that economic activity in its area decreased in November, coming out at only 0.27 points against a value of 1.01 points in the previous month. Growth has slowed due to the quarantine restrictions implemented because of the second COVID-19 outbreak. Forex forecast 12/22/2020 on USD/CHF, GBP/USD and AUD/USD from Sebastian Seliga 2020-12-22 Let's take a look at the forex calendar and the technical picture of USD/CHF, AUD/USD and GBP/USD at the daily time frmae chart. Gold collapses below $ 1900 2020-12-22

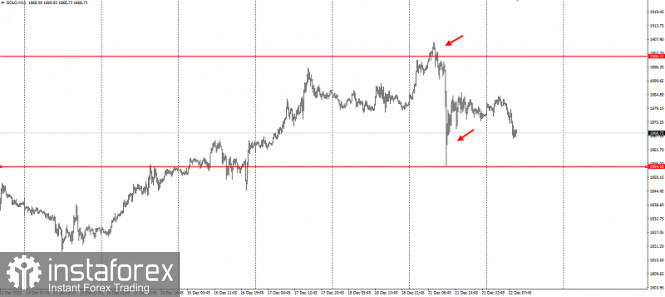

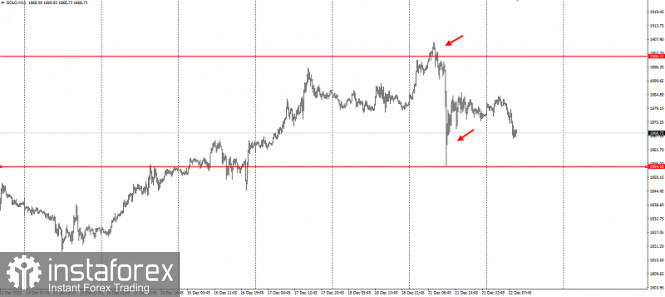

On Sunday night, the US Congress approved a $ 900 billion bailout bill, which is less than what some analysts and economists had expected. And the gold market, struggling to stay above $ 1900, collapsed on Monday during the European session.

However, one market analyst said gold bulls should not give up, as the US economy will continue to need further support since the economic effects of the lockdowns will remain deep even in 2021. Steve Dunn, head of ETFs in Aberdeen Standard Investments, said he expects gold to rise to above $ 2,000 an ounce next year. "I believe that this will not be the last stimulus package since some of the problems that the economy faces will still haunt in 2021," he said. At the very least, Dunn said that interest rates will not rise next year, which will continue to provide significant support to gold. He added that even without additional stimulus, low interest rates would affect the US dollar, and accordingly, the yellow metal. Most likely, the bond market will be the biggest growth driver in 2021. And aside from that, the increasing global debt has already reached more than $ 18 trillion, a new record for the new year. "We haven't heard much about the growing debt, but it's actually quite big and alarming," he said. "We're starting to see what fixed income investors are currently interested in. There are not many alternatives to the traditional fixed income portfolio. In this scenario, I think gold will get a lot of attention in 2021, since it is the best alternative when the yield on 10-year bonds is below 1%. " Not only are nominal yields expected to remain low until 2021, but Dunn noted that once inflation starts to rise, real yields could fall even further into the negative zone, eventually driving gold prices higher. "Whatever one may say, gold has a really positive outlook in 2021. We may even see gold reaching $ 2,000 again," Dunn said. Technical analysis of USD/JPY for December 22, 2020 2020-12-22  A general review : - Pair : USD/JPY.

- Pivot : 103.67.

- Trend : Downwards.

- The article will be relevant : 24h.

- Forecast : Bearish market.

The USD/JPY pair retains its bearish position. In the 1-hour chart, it met sellers around its 100 SMA and 50 SMA, which heads firmly lower at around 103.38. The USD/JPY pair is still staying in long term falling channel that started back in 104.16 since Decmeber 14, 2020). Hence, there is no clear indication of trend reversal yet. The USD/JPY pair has broken support at the level of 103.67 which acts as a resistance now. According to the previous events, the USD/JPY pair is still moving between the levels of 103.67 and 102.88. Therefore, we expect a range of 79 pips in coming hours. The trend is still below the 100 EMA for that the bearish outlook remains the same as long as the 100 EMA is headed to the downside. Thus, the price spot of 103.67 remains a significant resistance zone. The price of 103.67 coincided with a golden ratio (61.8% of Fibonacci), which is expected to act as a major resistance today. Consequently, there is a possibility that the USD/JPY pair will move downside. The structure of a fall does not look corrective. In order to indicate a bearish opportunity below 103.67, sell below 1.1239 with the first target at 103.18. Since the trend is below the 61.8% Fibonacci level, the market is still in a downtrend. Overall, we still prefer the bearish scenario. The trend is still bearish as long as the level of 103.67 is not broken From this point, we expect the USD/JPY pair to continue moving in the bearish trend from the support level of 103.67 towards the target level of 103.18. If the pair succeeds in passing through the level of 103.18, the market will sign the bearish opportunity below the level of 103.18 so as to reach the second target at 102.88 (low wave, bottom). In the same time frame, resistance is seen at the levels of 103.88 and 103.67. The stop loss should always be taken into account for that it will be reasonable to set your stop loss at the level of 104.16.

Author's today's articles: Maxim Magdalinin  In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006. In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006. l Kolesnikova  text text Sergey Belyaev  Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis. Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis. Sebastian Seliga  Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu Pavel Vlasov  No data No data Torben Melsted  Born in November 1962. Graduated from CBS, got Diploma in Finance. Began trading on Forex in 1986 and since that time held various positions such as advising clients, hedging client flows on FX and commodity markets. Also worked for major corporations as Financial Risk Manager. Uses Elliott wave analysis in combination with classic technical analysis, and has been using a Calmar Ratio of 5.0 for over 3 years. Has his own blog, where he uses Elliott wave and technical analysis on all financial markets. Born in November 1962. Graduated from CBS, got Diploma in Finance. Began trading on Forex in 1986 and since that time held various positions such as advising clients, hedging client flows on FX and commodity markets. Also worked for major corporations as Financial Risk Manager. Uses Elliott wave analysis in combination with classic technical analysis, and has been using a Calmar Ratio of 5.0 for over 3 years. Has his own blog, where he uses Elliott wave and technical analysis on all financial markets. Stanislav Polyanskiy  Graduated from Odessa State Economic University. On Forex since 2006. Writes analytical reviews about international financial markets for more than 3 years. Worked as a currency analyst in different finance companies for a long time including the biggest companies of Russia and Ukraine. Graduated from Odessa State Economic University. On Forex since 2006. Writes analytical reviews about international financial markets for more than 3 years. Worked as a currency analyst in different finance companies for a long time including the biggest companies of Russia and Ukraine. Grigory Sokolov  Born 1 January, 1986. In 2008 graduated from Kiev Institute of Business and Technology with "Finance and Credit" as a major. Since 2008 has studied the behavior of various currency pairs and their correlation on Forex. In his works and trading practice he uses candlestick analysis and Fibonacci technique. Since 2009 has written analytical reviews and articles which are published on popular Internet resources. Interests: music, computers and cookery. "Out of five deadly sins of business and as a rule, the most widespread, excessive striving to get profit is the worst". P. Drucker Born 1 January, 1986. In 2008 graduated from Kiev Institute of Business and Technology with "Finance and Credit" as a major. Since 2008 has studied the behavior of various currency pairs and their correlation on Forex. In his works and trading practice he uses candlestick analysis and Fibonacci technique. Since 2009 has written analytical reviews and articles which are published on popular Internet resources. Interests: music, computers and cookery. "Out of five deadly sins of business and as a rule, the most widespread, excessive striving to get profit is the worst". P. Drucker Vyacheslav Ognev  Vyacheslav was born on August 24, 1971. In 1993, he graduated from Urals State University of Economics in the Russian city of Ekaterinburg holding a degree in Commerce and Economics of Trade. In 2007, he started concentrating on the Russian stock market, trading stocks on the RTS Stock Exchange and futures contracts on FORTS. Since 2008 he has been engaged in analyzing Forex market and trading currencies. He is an author of a simplified wave analysis method. He has also developed a trading strategy. At present, Vyacheslav is a co-author of training materials on two web portals dedicated to Forex trading education. Interests: fitness, F1 "Experience is the best of schoolmasters, only the school fees are heavy." - Thomas Carlyle Vyacheslav was born on August 24, 1971. In 1993, he graduated from Urals State University of Economics in the Russian city of Ekaterinburg holding a degree in Commerce and Economics of Trade. In 2007, he started concentrating on the Russian stock market, trading stocks on the RTS Stock Exchange and futures contracts on FORTS. Since 2008 he has been engaged in analyzing Forex market and trading currencies. He is an author of a simplified wave analysis method. He has also developed a trading strategy. At present, Vyacheslav is a co-author of training materials on two web portals dedicated to Forex trading education. Interests: fitness, F1 "Experience is the best of schoolmasters, only the school fees are heavy." - Thomas Carlyle Irina Manzenko  Irina Manzenko Irina Manzenko Andrey Shevchenko  Andrey Shevchenko Andrey Shevchenko Mourad El Keddani  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Languages: Arabic, English, French and Dutch.

Interests: Algorithm, Graphics, Social work, Psychology and Philosophy.

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

A Zotova, Aleksey Almazov, Alexander Dneprovskiy, Alexandr Davidov, Alexandros Yfantis, Andrey Shevchenko, Arief Makmur, Dean Leo, Evgeny Klimov, Fedor Pavlov, Grigory Sokolov, I Belozerov, Igor Kovalyov, Irina Manzenko, Ivan Aleksandrov, l Kolesnikova, Maxim Magdalinin, Mihail Makarov, Mohamed Samy, Mourad El Keddani, Oleg Khmelevskiy, Oscar Ton, Pavel Vlasov, Petar Jacimovic, R Agafonov, S Doronina, Sebastian Seliga, Sergey Belyaev, Sergey Mityukov, Stanislav Polyanskiy, T Strelkova, Torben Melsted, V Isakov, Viktor Vasilevsky, Vladislav Tukhmenev, Vyacheslav Ognev, Yuriy Zaycev, Zhizhko Nadezhda

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006.

In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006.  text

text  Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis.

Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis.  Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu

Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu  No data

No data  Born in November 1962. Graduated from CBS, got Diploma in Finance. Began trading on Forex in 1986 and since that time held various positions such as advising clients, hedging client flows on FX and commodity markets. Also worked for major corporations as Financial Risk Manager. Uses Elliott wave analysis in combination with classic technical analysis, and has been using a Calmar Ratio of 5.0 for over 3 years. Has his own blog, where he uses Elliott wave and technical analysis on all financial markets.

Born in November 1962. Graduated from CBS, got Diploma in Finance. Began trading on Forex in 1986 and since that time held various positions such as advising clients, hedging client flows on FX and commodity markets. Also worked for major corporations as Financial Risk Manager. Uses Elliott wave analysis in combination with classic technical analysis, and has been using a Calmar Ratio of 5.0 for over 3 years. Has his own blog, where he uses Elliott wave and technical analysis on all financial markets.  Graduated from Odessa State Economic University. On Forex since 2006. Writes analytical reviews about international financial markets for more than 3 years. Worked as a currency analyst in different finance companies for a long time including the biggest companies of Russia and Ukraine.

Graduated from Odessa State Economic University. On Forex since 2006. Writes analytical reviews about international financial markets for more than 3 years. Worked as a currency analyst in different finance companies for a long time including the biggest companies of Russia and Ukraine.  Born 1 January, 1986. In 2008 graduated from Kiev Institute of Business and Technology with "Finance and Credit" as a major. Since 2008 has studied the behavior of various currency pairs and their correlation on Forex. In his works and trading practice he uses candlestick analysis and Fibonacci technique. Since 2009 has written analytical reviews and articles which are published on popular Internet resources. Interests: music, computers and cookery. "Out of five deadly sins of business and as a rule, the most widespread, excessive striving to get profit is the worst". P. Drucker

Born 1 January, 1986. In 2008 graduated from Kiev Institute of Business and Technology with "Finance and Credit" as a major. Since 2008 has studied the behavior of various currency pairs and their correlation on Forex. In his works and trading practice he uses candlestick analysis and Fibonacci technique. Since 2009 has written analytical reviews and articles which are published on popular Internet resources. Interests: music, computers and cookery. "Out of five deadly sins of business and as a rule, the most widespread, excessive striving to get profit is the worst". P. Drucker  Vyacheslav was born on August 24, 1971. In 1993, he graduated from Urals State University of Economics in the Russian city of Ekaterinburg holding a degree in Commerce and Economics of Trade. In 2007, he started concentrating on the Russian stock market, trading stocks on the RTS Stock Exchange and futures contracts on FORTS. Since 2008 he has been engaged in analyzing Forex market and trading currencies. He is an author of a simplified wave analysis method. He has also developed a trading strategy. At present, Vyacheslav is a co-author of training materials on two web portals dedicated to Forex trading education. Interests: fitness, F1 "Experience is the best of schoolmasters, only the school fees are heavy." - Thomas Carlyle