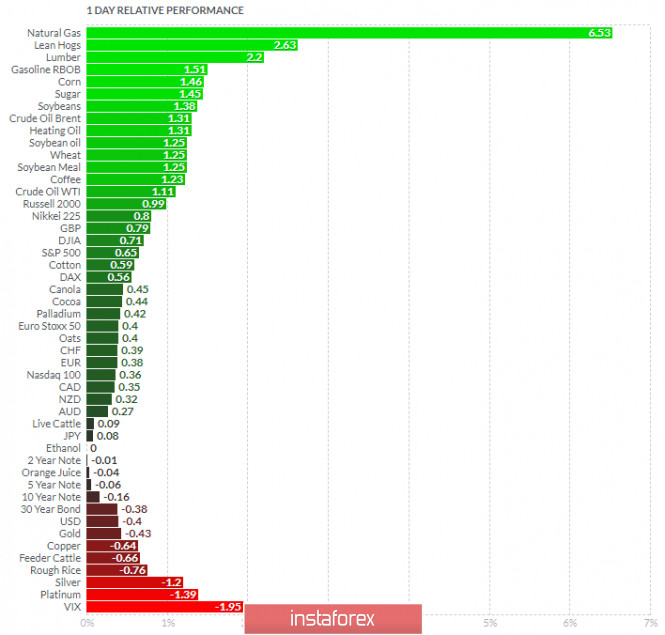

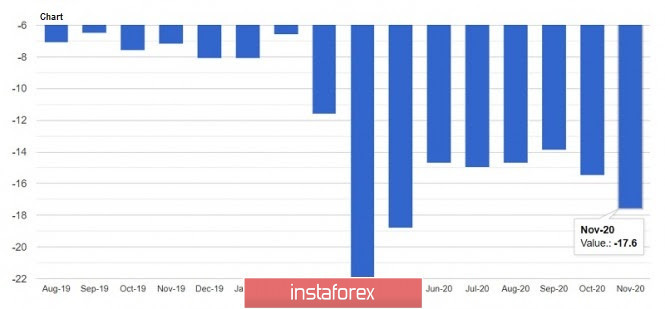

| EUR/USD and GBP/USD: Germany is ready to overspend. UK government is testing a new method to fight the coronavirus 2020-11-23 Demand for risky assets fell late last week after Poland and Hungary blocked the approval of the EU recovery fund. Apparently, the two parties disagree that the fund's availability is conditional on the rule of law. Aside from that, the latest reports on the eurozone economy were weak, thereby indicating a slowdown in economic growth and recovery. The drop in consumer confidence, which negatively affects household expenditures, has led to a wait-and-see attitude and an increase in savings.  Regarding the issue on the EU recovery fund, negotiations have already begun, however, it will most likely be completed only on the EU summit scheduled for December 10-11. Neither Poland nor Hungary can afford to be left without financial support, thus, the governments of these countries are unlikely to seriously balk, which means that the existing differences will be quickly resolved. Another important news is the current state of Germany's economy, which, according to recent reports, have shrank sharply. Because of this, the government is no longer adhering to austerity measures and has quickly moved from a supporter of asceticism to a leader in spending. The current COVID-19 crisis is to blame, as it has led to an increase in government spending aimed at supporting the economy. Significant changes in the country fiscal policy once again prove the seriousness of the problem faced by Germany and other European countries. In fact, the amount of budget that Angela Merkel's government is currently promoting speaks for itself. Although Germany is far from being among the leaders in coronavirus infection, the government's support for the population and business is quite serious. It seems that the "frugality" in earlier years allowed increasing government spending without serious problems. Already, the government of Chancellor Angela Merkel is asking lawmakers to approve a spending plan for next year, which increases the planned new national debt by about 70% to cover the effects of the coronavirus pandemic. According to the document, the government is seeking approval to increase net new borrowing by € 160 billion against € 96.2 billion in the latest version. The document states the majority will have to help companies trying to survive under the restrictions imposed by the government. During the interview, German Finance Minister, Olaf Scholz, said the partial restrictions on the country's economy, which are in force in November this year, may have to be extended in December. In this case, it is necessary to expand financial support for companies and businesses. In another note, a number of economic data were published for the euro area last Friday, however, the only thing that attracted attention was the report on consumer confidence. According to the report published by the European Commision, the index continued to decline in November, reaching a value of -17.6 points from -15.5 points in October. This was already expected though, since most of Europe is in a partial lockdown again. But if the measures are extended until December, further decline in the figure can be expected.  As for the EUR/USD pair, everything depends on whether the bulls manage to break above the monthly high of 1.1900, as only such will increase demand for risky assets, opening a straight path to highs at 1.1960 and 1.2010. However, if the quotes return to the level of 1.1820, the EUR/USD pair will collapse to 1.1760, and then to the base of the 17th figure. GBP/USD The pound rallied amid news that Brexit negotiations have resumed remotely. However, until now, no progress has been made on the issue with fishing. Only a compromise on this problem will lead to the sharp strengthening of the pound towards new highs, but in the meantime, pound bulls are aiming to protect the level of 1.3310. As long as the quote remains above this range, the GBP/USD pair can be expected to rise to the highs of 1.3380 and 1.3470. But if the quote declines below 1.3235, the pair will go to the level of 1.3165, and then to the base of the 31st figure. With regards to the COVID-19 situation in the UK, over the weekend, it was reported that Prime Minister Boris Johnson plans to hold mass testing for coronavirus as part of a program to re-introduce multi-level restrictions instead of a nationwide lockdown. The current partial lockdown in the UK ends on December 2, and Johnson announced that regular checks will be carried out in areas with the highest incidence of the disease. People who have been in contact with carriers of the virus will be able to avoid quarantine, but they will have to be tested every day for seven days in a row. The effectiveness of this program will determine the further steps of the UK government in the fight against the coronavirus. Johnson said that even if COVID-19 incidence in the country is declining, the problem remains at a fairly high level. The UK government expects that mass testing, plus the arrival of vaccines and the deployment of a regional tiered disease control system, will help bring the virus back under control and contain it. EUR/USD: US dollar will not sharply decline 2020-11-23

Major analysts are trying to predict how much the US currency will decline, which continues to do so. Experts were previously pessimistic about the dollar's likely growth, but their opinion has now changed. This currency's hidden potentials, which are starting to show themselves, are important for its growth. Experts say that they help the US dollar to remain above, preventing it to sharply decline. Citigroup's currency strategists warned that the USD will drop 20% next year, however, not everyone agrees with these calculations. According to the opinion of ING Bank specialists, the dollar will only plummet by 5-10% in 2021, which is considered as an acceptable range. ING believes that the reasons for such a small decline for the US currency will be the growth in fiscal stimulus and Fed's ultra easing of monetary policy. The bearish forecast for the dollar is due to increased expectations in US inflation and support for minimum interest rates from the regulator. The Bank is confident that easing monetary policy and abandoning protectionism by the new White House administration led by Mr. J. Biden will help other currencies strengthen against the USD. Moreover, many analysts believe that the dollar's drawdown will rise, if the risk sentiment persists. This is supported by a number of factors, including the refusal of the US monetary authorities regarding the stimulus measures taken earlier. It should be recalled that Last Friday, Mr. Mnuchin, US Treasury Secretary, announced the curtailment of the so-called "emergency" support measures by the end of the year. Among them were financial instruments used to save the corporate bond market. At the same time, experts emphasize that it is expected to close lending programs for the real economy in the US. Last Friday, the US regulator also published information on current financing. It should be noted that the Fed's balance sheet was restored with $ 67.66 billion throughout the past week. Analysts recorded high growth rates of money supply, which is a negative factor for the US dollar. The volume of assets on the Fed's balance sheet broke all records, reaching $ 7.24 trillion. On the other hand, the balance sheet of ECB increased by € 36.57 billion during the reporting period. Experts emphasize that the Fed's growth in balance sheet is ahead of that of the ECB. This measure has a positive effect on the dynamics of the EUR/USD pair, which is found in the range of 1.1874-1.1875 today. Therefore, experts believe that the dollar's further dynamics will be determined by the current economic and political situation. It is currently quite tense, which brings a note of imbalance to the state of the EUR/USD pair. However, experts positively assess the high possibility of the US dollar to rise in 2021, believing that it will use its hidden potential and will be able to pleasantly surprise the market. Technical analysis of the GBP/USD pair for the week of November 23-28, 2020 2020-11-23 Trend analysis. Price is expected to move up this week, rising from the level of 1.3280 (closing of the last weekly candle) towards the level of 1.3381 (blue dotted line). If this happens, the GBP / USD pair will continue climbing up to the target level which is 1.3481 - the upper fractal (weekly candle on August 30).

Figure 1 (weekly chart). Comprehensive analysis: - indicator analysis - up; - Fibonacci levels - up; - volumes - up; - candlestick analysis - down; - trend analysis - up; - Bollinger lines - up; - monthly chart - up. Based on comprehensive analysis, the GBP/USD pair will continue its upward movement this week. The candlestick on the weekly chart also indicates an upward trend for the pair, in which it will have no first lower shadow in the weekly white candlestick (Monday - up) and no second upper shadow (Friday - up). The first target will be the level of 1.3381 (blue dotted line), which is also the historical resistance level. If this line is reached, the quote will most likely continue moving upwards, towards the target level which is 1.3481 - the upper fractal (blue dotted line). Another scenario is an upward movement from 1.3280 (closing of the last weekly candle) to 1.3381 (blue dotted line). But in this case, working for a decline towards 1.3177 is possible - 14.6% Fibonacci (red dotted line). GBP/USD analysis on November 23. Markets are targeting the 1.3480 level 2020-11-23  In the most global terms, the construction of the upward trend section continues but the wave marking is taking a complex form and may become even more complicated. The section of the trend that started on September 23 took a five-wave form, but not an impulse one. A successful attempt to break the previous peak indicates that the markets are ready for further purchases of the British pound. The supposed e-wave took a five-wave form.  The lower chart clearly shows the a-b-c-d-e waves of the uptrend section. However, the assumed e-wave took a more complex five-wave form. Nonetheless, even with this complication, it is nearing completion. Thus, another downward correction wave can further confuse the entire wave markup after which the increase will resume. I still expect to build a new downward wave but the high demand for the British dollar continues to complicate the upward trend. The British pound continues to be in much higher demand than the US dollar and this is the most interesting question on the currency market in recent days and weeks. There is still no information that the UK and the European Union have managed to agree on a trade agreement, but the pound still continues to grow, while completely ignoring any other news from both America and Britain. The EU officials made a statement last Friday that the issues of fishing, competition and state support and dispute resolution between London and Brussels remain controversial. These are the issues that were controversial from the very beginning and caused the most controversy. As we can see, they are still not resolved even though the head of the European Commission Ursula Von Der Leyen assures that progress has been made recently. Some support for the Briton could be provided by statistics on Friday. Retail sales in October were higher than what is expected in the market. It increased by 1.2% compared to September and excluding fuel by 1.3%. However, there is still no news or reports received from the UK yet and the British pound has already added about 60 basis points. Thus, I believe that statistics have absolutely nothing to do with it now. Markets continue to buy the pound solely on expectations of reaching an agreement on trade relations. I don't see any other reasons. During this week, it should be known for sure whether the deal will be made or not. There are just over 5 weeks left until the end of the year and the final Brexit. General Conclusions and Recommendations: The Pound-Dollar instrument has resumed building an upward trend but its last wave is nearing completion. Thus, I recommend that you look now closely at the sales of the instrument as the British is not yet giving clear signals about the end of the upward section of the trend. At the same time, purchases of the instrument are now quite dangerous given the uncertainty associated with the trade deal. Biden's plans may drive gold up in the coming years 2020-11-23

According to MarketWatch, on Thursday, Senate minority leader Chuck Schumer said that Senate majority leader Mitch McConnell had agreed to reopen talks over the new coronavirus relief bill. Secretary of the Treasury, Steven Mnuchin, also said he was preparing to contact House Speaker Nancy Pelosi for this issue. For months, Republicans and Democrats have been arguing about the size and scope of the potential aid package. However, it is unclear yet if the debate will resume in earnest. Nonetheless, investors deem that recent reports are sufficient enough to buy gold in anticipation that governments may spend more on stimulus. Edward Moyer, senior market analyst at Oanda, said: "If the stimulus talks continue to go in the right direction, gold should start to rally again." He also added: "From now on, every additional stimulus will be a bullish catalyst for gold. Too much of the US economy is vulnerable and this will keep the stimulus flowing in the first half of next year. " Although gold has traded well at a new record high of $ 2088 (reached on August 10), it has been on a decline since then. Prices will be heavily driven by headlines next week, with market participants wanting more information on whether the aid package will be approved before the end of 2020. If there are further positive changes in relation to the package, gold will exhibit a more bullish outlook. But before entering any investment in the yellow metal, you need to understand first that its current location is its 38% retracement, which at this time shows strong historical support, especially over the past two months. It is too early to assert the likelihood of a sharp climb upward, but of course, if President-elect Joe Biden takes office on January 20, he will try to allocate huge sums of capital not only to the stimulus bill, but also to other programs that, in his opinion, are long overdue. According to many news publications, including the Penn Wharton Budget Model from the University of Pennsylvania, "Biden's platform will generate $ 3.375 trillion in new tax revenue, all while increasing spending by $ 5.37 trillion." Other estimates suggest Biden's budget will increase national spending and raise taxes, which will further increase public debt. In doing so, he proposes to accept about $ 3 trillion in new taxes, while his proposals will cost about $ 11 trillion in expenses. Joe Biden's plan is a huge new public investment that can be divided into three main categories: education, infrastructure, and research and development. The Penn Wharton Budget Model estimates spending at $ 1.9 trillion over 10 years, which will be directly invested in education. It also envisions infrastructure spending and research and development plans that would require an additional $ 1.6 trillion. These funds will go towards new investments in water infrastructure, high-speed rail, municipal transport, green infrastructure projects, and R&D. $ 650 billion will also be allocated for new housing over the next 10 years. To add to that, Biden plans to add provisions related to social security. His plan is aimed at increasing benefits, especially for low-income households, which are expected to require additional spending of $ 290.7 billion over the next 10 years. If the budget that Biden plans to implement comes close to projections, we will see the largest volume of government spending in history. This can certainly have a dramatic and disruptive impact on the value of the US dollar, while at the same time drive the price of gold up in the coming years. Analysis of Gold for November 23,.2020 - Breakout of the 12-hour balance to the downside and potential for re-test of $1.850 2020-11-23 UK November flash services PMI 45.8 vs 42.8 expected Prior 51.4 - Manufacturing PMI 55.2 vs 50.5 expected

- Prior 53.7

- Composite PMI 47.4 vs 42.5 expected

- Prior 52.1

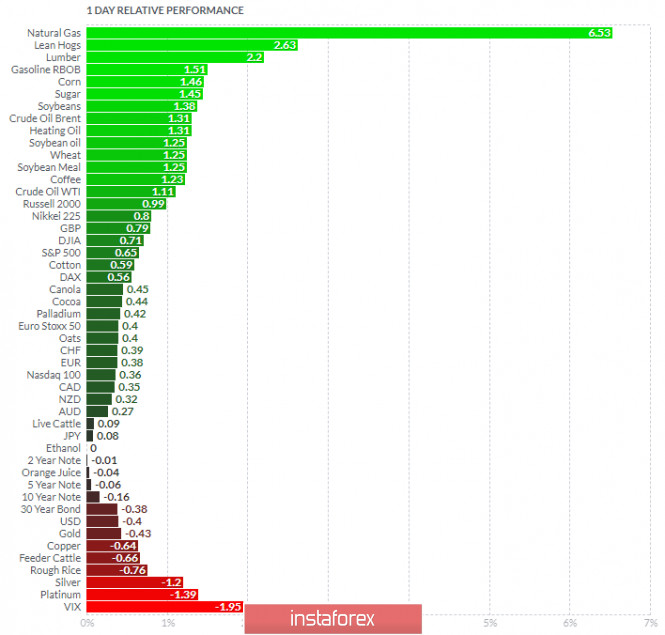

The UK economy falls back into contraction territory amid a renewed lock down, but the decline in business activity is less than anticipated with the rise in manufacturing helping to slightly offset the drop in services. However, the devil is in the details. The jump in the manufacturing reading owes much to an increase in supplier delivery times amid severe delays at UK ports, as well as robust levels of stock building ahead of the end of the Brexit transition period on 31 December. Further Development Analyzing the current trading chart of Gold, I found that there is the breakout of the rising channel and potential for the new downside leg. 1-Day relative strength performance Finviz

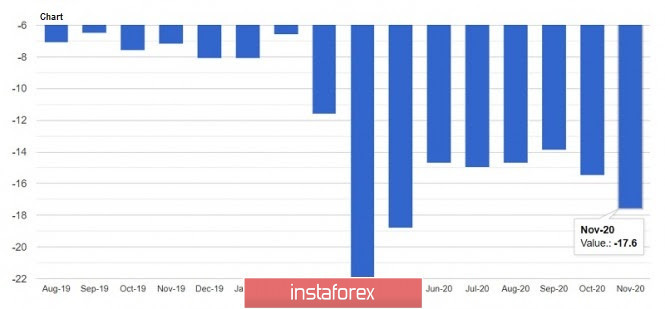

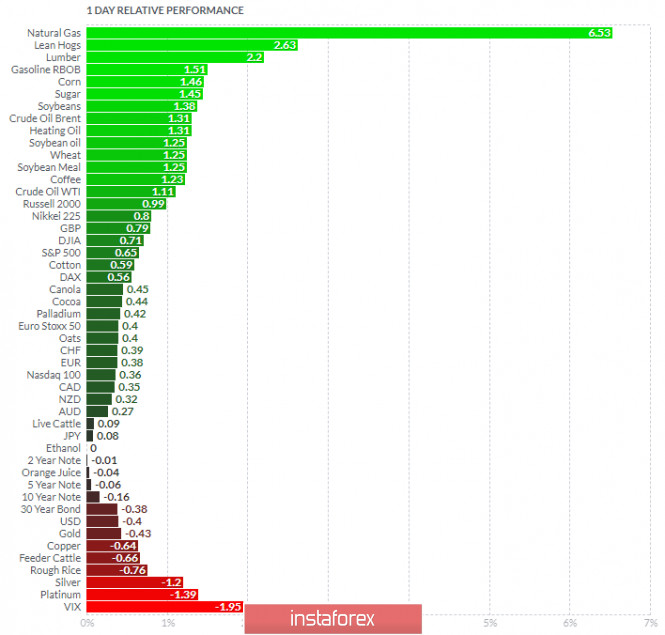

Based on the graph above I found that on the top of the list we got Natural Gas and Lean Hogs today and on the bottom VIX andPlatinum. Gold is negative on the list, which is another sign of the weakness. Key Levels: Resistance: $1,880 Support level: $1,850 EUR/USD analysis for November 23 2020 - Potential for the dowsnide rotation towards the 1.1850 2020-11-23  SNB total sight deposits w.e. 20 November CHF 707.3 bn vs CHF 707.9 bn prior Latest data released by the SNB - 23 November 2020 - Domestic sight deposits CHF 643.3 bn vs CHF 644.5 bn prior

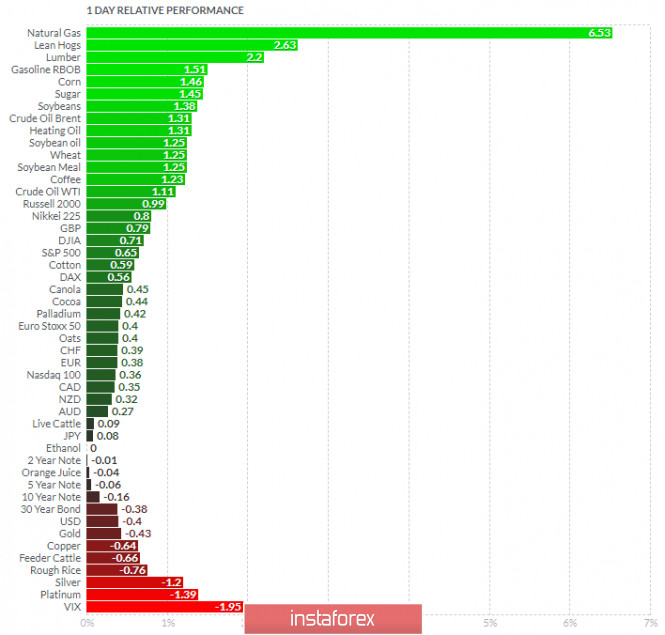

Overall sight deposits actually fell in the past week as it seems the recent push and pull in the market amid vaccine optimism is seeing less incentive for the SNB to step into the market. Further Development Analyzing the current trading chart of EUR/USD, I found that EUR got rejected of the main resistance at 1,1920 and that we might see downside rotation. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Natural Gas and Lean Hogs today and on the bottom VIX and Platinum. Key Levels: Resistance: 1,1920 Support level: 1,1850

Author's today's articles: Pavel Vlasov  No data No data l Kolesnikova  text text Sergey Belyaev  Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis. Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis. Alexander Dneprovskiy  Graduated from Kiev State University of Economics. On Forex market since 2007. Started his work at Forex as a trader. Since 2008 is working as a currency analyst. Graduated from Kiev State University of Economics. On Forex market since 2007. Started his work at Forex as a trader. Since 2008 is working as a currency analyst. Andrey Shevchenko  Andrey Shevchenko Andrey Shevchenko Petar Jacimovic  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work" Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

A Zotova, Aleksey Almazov, Alexander Dneprovskiy, Alexandr Davidov, Alexandros Yfantis, Andrey Shevchenko, Arief Makmur, Dean Leo, Evgeny Klimov, Fedor Pavlov, Grigory Sokolov, I Belozerov, Igor Kovalyov, Irina Manzenko, Ivan Aleksandrov, l Kolesnikova, Maxim Magdalinin, Mihail Makarov, Mohamed Samy, Mourad El Keddani, Oleg Khmelevskiy, Oscar Ton, Pavel Vlasov, Petar Jacimovic, R Agafonov, S Doronina, Sebastian Seliga, Sergey Belyaev, Sergey Mityukov, Stanislav Polyanskiy, T Strelkova, Torben Melsted, V Isakov, Viktor Vasilevsky, Vladislav Tukhmenev, Vyacheslav Ognev, Yuriy Zaycev, Zhizhko Nadezhda

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

SNB total sight deposits w.e. 20 November CHF 707.3 bn vs CHF 707.9 bn prior

SNB total sight deposits w.e. 20 November CHF 707.3 bn vs CHF 707.9 bn prior

No data

No data  text

text  Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis.

Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis.  Graduated from Kiev State University of Economics. On Forex market since 2007. Started his work at Forex as a trader. Since 2008 is working as a currency analyst.

Graduated from Kiev State University of Economics. On Forex market since 2007. Started his work at Forex as a trader. Since 2008 is working as a currency analyst.  Andrey Shevchenko

Andrey Shevchenko  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

No comments:

Post a Comment