| EUR/USD. They did not agree again: American politicians knocked down the dollar 2020-10-21 The US currency is declining in all aspects: the dollar index fell to monthly lows settling in the 92nd figure. The key dollar pairs similarly changed their configuration reflecting the General weakening of the greenback. The main reason is the political differences over the new economic aid package. Last night, another deadline set by representatives of the Democratic party expired. The speaker of the house of representatives drew a "red line" last week while delivering an ultimatum: either the parties come to a compromise solution by Tuesday and go to a vote within the next week and a half, or negotiations will resume after the presidential election. It is worth noting that the next session of the Congress will be held only at the end of November and it is very fast, since the Christmas and New Year period begins in the second half of December. Therefore, the market placed high hopes on American politicians to reach a compromise because otherwise the new stimulus package will not be adopted until January or February.  But congressmen and representatives of the White house did not meet the expectations of traders. The parties did not come to a common opinion but voiced only formal and contradictory statements. So, Nancy Pelosi reported that the negotiating groups have made some progress in determining agreement and disagreement. She also added that she had a phone conversation with Treasury Secretary Steven Mnuchin, which they managed to achieve more clarity and understanding. According to her, it demonstrates that both sides are serious about finding a compromise. At the same time, representatives of the Republican Camp voiced tougher, and, in my opinion, more plausible messages. In particular, Senate majority leader Mitch McConnell said that the Democrats are only dragging their feet until the presidential election. On the one hand, they do not refuse to negotiate (since this decision will affect their political positions), but they also do not show flexibility in negotiations. By the way, journalists reminded Nancy Pelosi that Tuesday was the last day to conclude a deal between the White house and Congress before the election. In response, she softened her position, pointing out that before that day, the parties had to come to a common understanding in order to move on to the next stage of negotiations. It is worth remembering that the negotiations on this issue have been going on for five months – since the end of May and traders have already heard similar rhetoric many times. Therefore, the market participants yesterday, did not believe in Pelosi's encouraging statements. The probability of another failure has increased again, which means that the probability of a crisis in the US labor market has increased also. By the way, the number of new applications for unemployment benefits last week jumped to 890 thousand – this is the highest value since mid August. It is obvious that if a negative scenario is implemented, the labor market will pull other macroeconomic indicators that have just begun to show signs of recovery.  In other words, the US events of yesterday put pressure on the dollar, which in response fell in price throughout the market. At the same time, traders ignored the macroeconomic reports that were published yesterday in the States. So, the number of construction permits issued last month increased by more than five percent, while the overall forecast was at the level of 3.2%. At the same time, the number of construction starts in September increased by only 1.9%, while the forecast growth of 3.8%. The published release did not affect the mood of traders – market participants are focused on the future prospects of the American economy and these prospects largely depend on the "ability to negotiate" of congressmen and representatives of the White house. Against the background of such a fundamental picture, the Euro-dollar pair updated its monthly highs and approached the resistance level of 1.1850 – at this price point, the upper line of the Bollinger Bands indicator coincides with the upper boundary of the Kumo cloud. If buyers of EUR/USD overcome this level and gain a foothold above it, they will open their way to the annual maximum – to the 20th figure. Such a price break is sure to cause righteous anger on the part of the ECB, whose representatives will hold their next meeting next week. But if we consider the short-term time period, when overcoming the resistance level of 1.1850, we can consider longs at least to the level of 1.1900 or higher – to the intermediate resistance level of 1.1950. This is the last price Outpost before the key, psychologically important resistance of 1.2000. Trading plan for the EUR/USD pair on October 21. Continued rise of COVID-19 cases in Europe and growth of the European currency. 2020-10-21

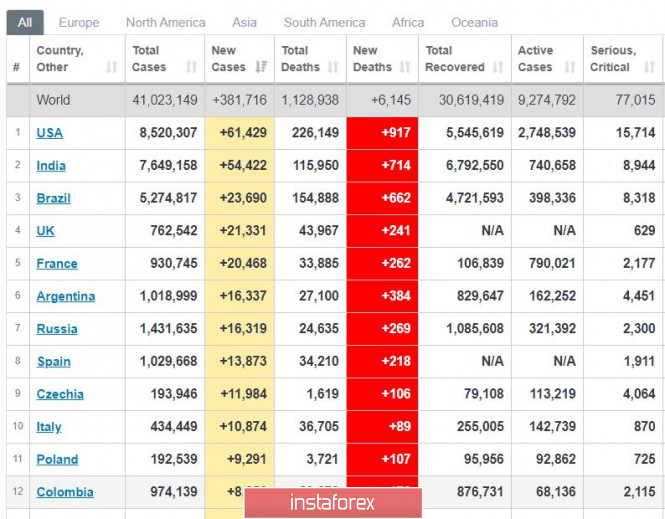

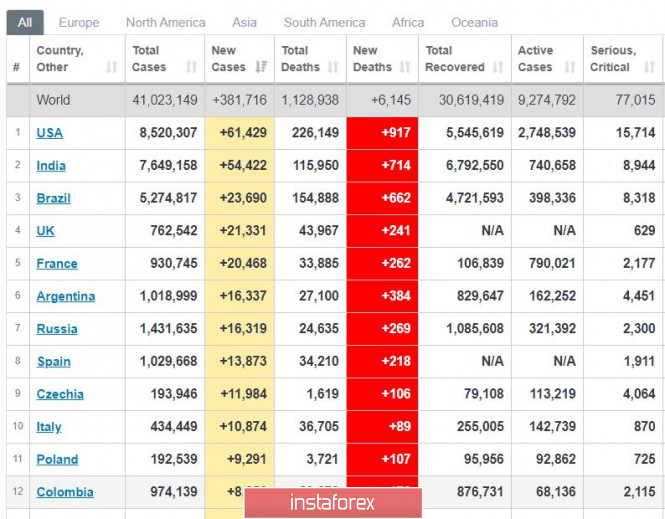

Europe continues to observe record high incidence rates of coronavirus. The most notable of which are the statistics in Britain and France, which are above 20 thousand a day.

The US market is currently preparing for the win of Democrat candidate, Joe Biden, which would result in a change in economic course. Sell when stocks move up again.

EUR/USD - the euro is moving upwards in the market. Keep opening long positions from 1.1710 and 1.1750 You may also buy after a strong pullback, from the level of 1.1790. News from the Fed, which will come out late at night, may influence market demand. Analytics and trading signals for beginners. How to trade EUR/USD on October 21? Plan for opening and closing trades on Wednesday 2020-10-21 Hourly chart of the EUR/USD pair  The EUR/USD pair corrected by only 16 points last Tuesday night and immediately moved up. Therefore, novice traders did not receive a clear buy signal, despite the upward trend. The MACD indicator did not discharge to the zero level and did not even come close to it. So in our opinion, the technical picture does not justify the new longs, especially for beginners. Of course, the market will not generate perfect signals every day. However, novice traders are advised to look for such signals or something close to it. The upward trend line is currently relevant, but the price can still settle below it at any moment, since it has a fairly strong slope. The pair's quotes continue to move confidently in the direction of the upper border of the horizontal channel at 1.1903. We do not see the pair above this level yet. Getting the price to settle below the trend line will make it possible for sellers to enter the market, since the pair will start aiming for the lower border of the 1.1696 horizontal channel. The fundamental background for the EUR/USD pair remains unchanged. We did not receive much news from the European Union and the United States in the last two days. If you try to link the euro's upward movement and the fundamental background, you will hardly be able to do so. There was no macroeconomic statistics and there won't be any today as well. Speeches by Federal Reserve Chairman Jerome Powell and European Central Bank President Christine Lagarde happen almost every day and, of course, the heads of central banks find it very difficult to surprise the markets and provide us with new information. Thus, in the overwhelming majority of cases, no reaction to these events follows. Today, for example, Lagarde is set to deliver another speech. There is also some news coming from the US. The topic of the presidential election is still the most important, but the markets are already tired of the flow of information related to the candidates and their confrontation. And it seems that investors are no longer interested in the topic of coronavirus in the United States, since high incidence rates continue to be reported in this country, but there is no news in the media about this. A strong second wave of the pandemic began in Europe, but the euro is still growing. Thus, it is absolutely unrealistic to figure out what exactly market participants are reacting to and what kind of news they are interested in. We are inclined to the option that the macroeconomic and fundamental backgrounds are not important at all now, and trading proceeds exclusively on technical factors. Possible scenarios for October 21: 1) Buy positions on the EUR/USD pair remain relevant at the moment, since the price continues to trade above the rising trend line. Novice traders are advised to wait for a new round of downward correction, discharge of the MACD indicator and a new buy signal in order to open new long positions while aiming for 1.1855 and 1.1888. Also, if one of the traders has opened longs, then they can keep them until the MACD indicator turns down. 2) You are advised to return to taking sell positions on the currency pair, but first the price should settle below the rising trend line. In this case, the price could tumble with the first targets at the support levels 1.1774 and 1.1726, and in general it will aim for the lower border of the horizontal channel at 1.1696, from which it has rebounded several times. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. Indicator analysis. Daily review for the EUR/USD currency pair 21/10/2020 2020-10-21 Trend analysis (Fig. 1). Today, from the level of 1.1824 (the closing of yesterday's daily candle), the market can continue to move up with the goal of 1.1860 which is a pullback level of 61.8% (red dotted line). If this level is tested, further work up with the goal of 1.1912 which is the historical resistance level (blue dotted line). From this level, you can work downwards.  Figure 1 (daily chart). Complex Analysis: - indicator Analysis – up

- Fibonacci Levels – up

- Volumes – up

- Technical Analysis – down

- Trend Analysis – up

- Bollinger Bands – up

- Weekly Chart - the up

General conclusion: today the price may continue to move up with the target of 1.1860 which is a pullback level of 61.8% (red dotted line). If this level is tested, further work up with the goal of 1.1912 which is the historical resistance level (blue dotted line). Alternative scenario: when moving up and reaching the pullback level of 61.8% - 1.1860 (red dotted line), the price may start moving down to the historical support level - 1.1819 (blue dotted line). Indicator analysis. Daily review on GBP/USD for October 21, 2020 2020-10-21 Trend analysis (Fig. 1). Today, the market will attempt to resume its upward movement from the level of 1.2950 (closing of yesterday's daily candle) in order to reach the pullback level of 50% - 1.3078 (blue dotted line). If this level is tested, work downward with the target of 1.3023, which is a pullback level of 14.6% (red dotted line).

Figure 1 (Daily chart). Complex analysis: - Indicator analysis - up

- Fibonacci levels - up

- Volumes - up

- Candle analysis - up

- Trend analysis - down

- Bollinger bands - up

- Weekly chart - up

General conclusion: Today, the price from the level of 1.2950 (closing of yesterday's daily candle) will attempt to continue moving up in order to reach the pullback level of 50% - 1.3078 (blue dotted line). If this level is tested, work downward to the target of 1.3023, which is a pullback level of 14.6% (red dotted line). Alternative scenario: the price from the level of 1.2937 (closing of yesterday's daily candle) works up to reach the 50% pullback level - 1.3078 (blue dotted line). In case of testing this level, work up to the target of 1.3173, which is a retracement level of 61.8% (blue dotted line). EUR/USD: Euro rises amid increasing hopes for a new US stimulus package and statements from the ECB president 2020-10-21 The euro continued to strengthen against the US dollar despite many signals that indicate the overbought status of risky assets in the short-term. The news from the White House yesterday, which hints of a possible stimulus package before the US elections, helped the bulls to continue the upward trend in the EUR/USD pair.  According to White House Chief of Staff Mark Meadows, House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin made enough progress to continue negotiations and come to an agreement. Such news, of course, put pressure on the US dollar and returned the appetite of traders for risky assets. To add to that, ECB President Christine Lagarde came up with a proposal to make a permanent fund for economic response to crises. She said that it would be nice if the current 750 billion fund becomes permanent, as through which it would be possible to provide assistance to European countries that are in crisis. "We should think about keeping the fund among the tools that the European authorities can use in similar circumstances in the future," Lagarde said. With regards to the EUR / USD pair, going beyond the resistance level of 1.1870 will open a chance for a breakdown of the 19th figure, as well as for renewing highs around 1.1920 and 1.1970. However, it should be noted that the current bullish trend could turn into bearish later this week, so it is best to be careful and only open long positions after a downward correction. The acceptable levels for this are 1.1800 and 1.1770. As for economic statistics, a rather disappointing figure was reported on the US housing market. According to the report of the US Department of Commerce, housing starts rose only 1.9% this September and to 1.415 million homes per year, well below the economists' forecast which is an increase of 3.8% to 1.47 million. To add to that, the data is below the pre-crisis level reached in February 2020.  Fed representatives also delivered speeches yesterday, and they were mainly about the growth of the US economy. For example, Chicago Fed president, Charles Evans, said the recovery is clearly uneven, but it will most likely continue, even in 2021, where the unemployment rate could fall to 5.5%. As for inflation, Evans said that problems could arise, but further fiscal policy of the US government will definitely improve the outlook. Trading idea for the GBP/USD pair 2020-10-21

The decline in the US dollar, which was brought by the news that a stimulus package could be signed in the United States soon, led to an upward move in the GBP / USD pair, thereby taking the quote out of the two-week narrow triangle.

And since the dollar has such a weak position in the market, any positive news from the UK could lead to the emergence of strong bullish impulses.

For example, any positive news related to Brexit, that is, the signing of a trade deal in particular, would push the pound to a price level of 1.35. Of course, there is still the need to monitor the risks so as to avoid losing profit. As we already know, trading in this market is very precarious and uncertain, but also very profitable if we use the right approach. Good luck!

Author's today's articles: Irina Manzenko  Irina Manzenko Irina Manzenko Mihail Makarov  - - Stanislav Polyanskiy  Graduated from Odessa State Economic University. On Forex since 2006. Writes analytical reviews about international financial markets for more than 3 years. Worked as a currency analyst in different finance companies for a long time including the biggest companies of Russia and Ukraine. Graduated from Odessa State Economic University. On Forex since 2006. Writes analytical reviews about international financial markets for more than 3 years. Worked as a currency analyst in different finance companies for a long time including the biggest companies of Russia and Ukraine. Sergey Belyaev  Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis. Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis. Pavel Vlasov  No data No data Andrey Shevchenko  Andrey Shevchenko Andrey Shevchenko

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

A Zotova, Aleksey Almazov, Alexander Dneprovskiy, Alexandr Davidov, Alexandros Yfantis, Andrey Shevchenko, Arief Makmur, Dean Leo, Evgeny Klimov, Fedor Pavlov, Grigory Sokolov, I Belozerov, Igor Kovalyov, Irina Manzenko, Ivan Aleksandrov, l Kolesnikova, Maxim Magdalinin, Mihail Makarov, Mohamed Samy, Mourad El Keddani, Oleg Khmelevskiy, Oscar Ton, Pavel Vlasov, Petar Jacimovic, R Agafonov, S Doronina, Sebastian Seliga, Sergey Belyaev, Sergey Mityukov, Stanislav Polyanskiy, T Strelkova, Torben Melsted, V Isakov, Viktor Vasilevsky, Vladislav Tukhmenev, Vyacheslav Ognev, Yuriy Zaycev, Zhizhko Nadezhda

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

Irina Manzenko

Irina Manzenko  -

-  Graduated from Odessa State Economic University. On Forex since 2006. Writes analytical reviews about international financial markets for more than 3 years. Worked as a currency analyst in different finance companies for a long time including the biggest companies of Russia and Ukraine.

Graduated from Odessa State Economic University. On Forex since 2006. Writes analytical reviews about international financial markets for more than 3 years. Worked as a currency analyst in different finance companies for a long time including the biggest companies of Russia and Ukraine.  Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis.

Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis.  No data

No data  Andrey Shevchenko

Andrey Shevchenko

No comments:

Post a Comment