| | | | | | | Presented By Masterworks | | | | Login | | By Ina Fried ·Oct 21, 2020 | | Welcome to a special edition of Login. Today we are devoting the entire newsletter to the DOJ's antitrust suit against Google. The downside, is there wasn't a spot to include this story on Rep. Alexandria Ocasio-Cortez drawing more than 400,000 people to a Twitch stream where she played the hit game Among Us with gamers and fellow congresswoman Ilhan Omar. Get smart, 5G fast: Axios debuts a free, 5-part video "short course" on 5G to get you up to speed on what it is, who's involved, and why it matters. Sign up here. Today's Login is 1,894 words, a 7-minute read. | | | | | | 1 big thing: U.S. vs. Google — the siege begins |  | | | Illustration: Sarah Grillo/Axios | | | | The Justice Department fired the starter pistol on what's likely to be a years-long legal siege of Big Tech by the U.S. government when it filed a major antitrust suit Tuesday against Google, Axios' Scott Rosenberg, Ashley Gold and Kyle Daly report. The big picture: Once a generation, it seems, federal regulators decide to take on a dominant tech company. Two decades ago, Microsoft was the target; two decades before that, IBM. Yes, but: Today's fight takes place on a very different landscape. Unlike Microsoft in the '90s, Google is only one of a quintet of giant companies, including Facebook, Apple, Amazon and (still!) Microsoft — all competing across a broad landscape involving online ads, search, media, e-commerce, workplace communication, social networking, voice and AI. Why it matters: Lawmakers, experts and critics have long warned that these companies' unprecedented concentration of power threatens competition, free speech, consumer choice and user privacy. The Google suit represents the biggest U.S. effort yet to rein in that power. Details: The suit by DOJ and 11 states accuses Google of using anticompetitive tactics to illegally monopolize the online search and search advertising markets, using exclusionary deals with phone makers and other tactics to lock in its search as a default. - The suit asks for "structural relief," which could mean an effort to break up Google in some way.

For its part, Google says it's got plenty of competition and the government has failed to make a case that its actions have harmed consumers, most of whom never pay a penny for Google's services. Between the lines: The Justice Department prosecutors were careful to keep the the issue of alleged bias against conservatives by Google and other tech giants out of this suit's complaint, preserving prospects for bipartisan support. But a change in administration come January could still mean a change in DOJ's strategy with the advent of a new attorney general. The bottom line: Courts move slowly and tech moves fast. That means antitrust enforcement actions often lag the marketplace — and by the time cases conclude, they barely seem relevant. - For all that, in almost any timeline you can imagine five or 10 years hence, Google Search will still be a foundation stone of the digital world — and that, in itself, may give this lawsuit some extra gravity.

|     | | | | | | 2. Here's what the U.S. is charging Google with | | The Justice Department says Google has built a self-reinforcing machine to illegally insulate it from any serious competition in search, Kyle reports. Why it matters: DOJ spent more than a year investigating Google to assemble what prosecutors believe is the cleanest case for convincing a court that the company is deliberately hamstringing would-be competition. The big picture: Others have raised antitrust concerns around Google's other lines of business, such as the video ads attached to YouTube clips and the technology that powers its ad platforms. - The DOJ avoided getting drawn into philosophical and practical debates around defining such markets by zeroing in on the one that Google unambiguously dominates: searching for general information on the internet.

Of note: Prosecutors have to prove that Google holds not just a monopoly, but a harmful monopoly. - In its suit, the DOJ argues consumers are harmed because Google's anti-competitive behavior ends up "reducing the quality of general search services (including dimensions such as privacy, data protection, and use of consumer data), lessening choice in general search services, and impeding innovation."

The suit focuses on arrangements Google has made to share ad revenue with wireless carriers, device makers and web browser developers in exchange for making its search the default. - The deals artificially constrain competition for two reasons, the DOJ suggests throughout its suit: Opting out of these arrangements is bad for business, and inertia keeps people from changing their search engine default.

Google's structural advantages are self-reinforcing, the DOJ says. - More usage yields more data on what users find and click through as they search. More data yields a better product. A better product yields more usage.

- To Google, this represents a virtuous spiral of innovation and refinement. To the DOJ's antitrust enforcers, it's a vicious circle that's helped Google break away from would-be competitors.

By the numbers: In the suit, the DOJ says Google controls 88% of the general online search market, to Bing's 7%. Yahoo, which simply repackages Bing results under a deal with Microsoft, has less than 4%, while privacy-centric alternative engine DuckDuckGo has less than 2%, the DOJ says. Yes, but: Google has one big rejoinder to all these claims: - "[P]eople don't use Google because they have to, they use it because they choose to," global legal chief Kent Walker wrote in a Tuesday blog post.

What's next: The suit warns that unless the government reins Google in, it will take the unfair advantages it has accumulated in the mobile era and port them to the next generation of connected devices. |     | | | | | | 3. The Microsoft case's long shadow over Google |  | | | Illustration: Sarah Grillo/Axios | | | | Microsoft's epic battle with the U.S. government from 1997 to 2002, the last major federal antitrust action in tech, casts a long shadow over today's DOJ lawsuit against Google — but the industry landscape today is profoundly different, Scott reports. The big picture: Microsoft's legal ordeal came at a moment when its old competitors, like Apple, were on the ropes, and new competitors, like Google, were just launching. The antitrust case preoccupied Bill Gates and the rest of Microsoft's leadership for years and arguably gave those newcomers (and comebacks) the breathing room to grow toward their current success. Yes, but: Today, if Google gets similarly distracted, it has many heavyweight competitors already poised to seize the moment. Flashback: Beginning in 1997, the government charged Microsoft with using its dominance in the desktop operating system market to corner the web browser market. - The government won in court and in 2000 a judge ordered Microsoft split into two companies. However, an appeals court unanimously overturned the order and a new administration agreed to a less punitive settlement.

The Microsoft case, like the Google suit, centered on issues like the definition of a market, the power of defaults (browsers then, search providers now), and questions of "tying" — when companies make deals with third parties that leverage their monopoly power in one realm to pursue market dominance in another. Lessons for Google: 1. Federal antitrust cases have a way of growing over time, expanding in scope, adding additional state actions and sometimes even private suits into the mix. 2. Some of Microsoft's troubles resulted from its own combativeness. Gates' defiant testimony before Congress and the company's unwillingness to admit error or find grounds for compromise pushed the case to a more definitive judgment against the company. - By contrast, during the same era Intel — another market dominator — found all sorts of ways to settle with regulators when they came after it.

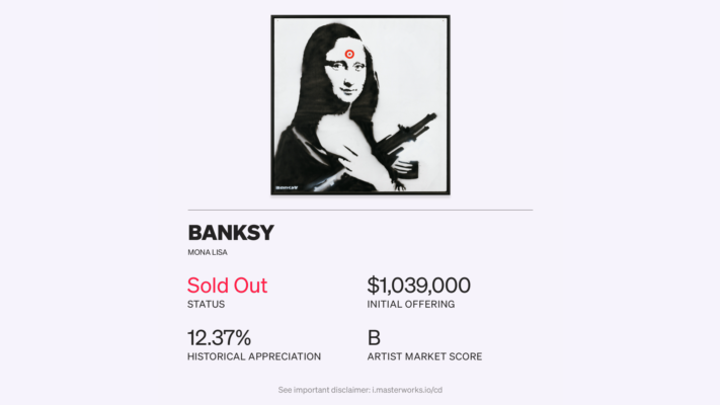

|     | | | | | | A message from Masterworks | | 88% of wealth managers recommend investing in art | | |  | | | | When the majority of wealth managers recommend investing in art, we're inclined to agree. Thanks to Masterworks, anyone can buy art investments at a fraction of the cost. Don't wait - access paintings by artists like KAWS and Banksy today. Learn more. | | | | | | Bonus: Charting Google's dominance in search ads |  Data: eMarketer; Chart: Axios Visuals Google is expected to net more than 71% of the U.S. search advertising spending this year, down from roughly 74.7% of market share in 2017, per eMarketer, Sara Fischer reports. Why it matters: Google relies on search advertising for the majority of its revenue. The DOJ's lawsuit threatens the core of its business. Be smart: Over the past few years, Amazon has slowly started to give Google a run for its money in search advertising. - By 2021, it's expected to control nearly 16% of the search ad market, up from 6.5% in 2017.

|     | | | | | | 4. Google's 20-year path from David to Goliath | | It's taken Google two decades to transform from a beloved search innovator into a Big Tech behemoth, Scott writes. Flashback: At Google's launch 22 years ago, it provided accurate, simple, fast results — unlike its competitors in search, which had become bloated "portals" — and quickly won the hearts first of internet insiders and then of the broader public. Yes, but: "That Google is long gone," declares the Justice Department's new antitrust lawsuit against the company — replaced by today's "monopoly gatekeeper for the internet." Context: Google spent its first decade as the clear first choice for search, putting usability first, reducing clutter on its pages, impartially ranking search results and generally avoiding "evil," as an early company motto urged. - Google earned a ton of goodwill and loyalty from users who saw little reason over the years to switch to older competitors like Yahoo (which for a time even used Google to run its search) and later ones like Microsoft's Bing and Amazon's A9.

What changed: 1. Google figured out how to make money. The company started out openly hostile to advertising, and when it first introduced targeted search ads, they were unobtrusive text links that were well distinguished from the "organic" search results. - But after Google's 2004 IPO, as the company sought to fund growth and a wide array of "moon shots," ads gradually took over more and more of the search page.

2. Google bought other companies. The two most important acquisitions were YouTube (2006), which pulled Google into the media world, and DoubleClick (2007), which gave Google the foundation to seize control of a huge chunk of the online advertising market. 3. Google moved into all sorts of other businesses beyond search. Gmail (2004) brought Google's simplicity and reliability to email. Google Maps (2005) made geography programmable. Google Docs (2006) offered a streamlined, free, cloud-based alternative to Microsoft Office. - By age 10, Google was way more than a search company.

4. Google built a free mobile operating system, Android, cementing its power as smartphones became the dominant tech platform. What's next: Google successfully ferried its dominant search franchise from the desktop era into the mobile age. Now, on the threshold of tech's next transformative moment, as mobile begins to give way to voice, VR/AR, and other alternatives, the company has to pull off the same stunt — while fighting off the government in court. |     | | | | | | 5. States get in on the antitrust act | | The Justice Department sued Google Tuesday without the backing of most of the state attorneys general who have also probed the search giant, Ashley reports. Yes, but: Those states may well swoop in later to expand the case to cover even more competition concerns. What's happening: 11 Republican AGs from states including Texas, Florida and Georgia joined the DOJ suit, but conspicuously absent from the group were dozens more AGs comprising a bipartisan coalition of nearly every top state prosecutor in the country that has been investigating the company on antitrust grounds for more than a year. The catch: That doesn't mean the other AGs oppose bringing antitrust action against Google. The remaining states may want to move ahead with separate legal actions and join the case later, DOJ officials told reporters Tuesday. - New York, Colorado, Iowa, Nebraska, North Carolina, Tennessee, Arizona and Utah will continue investigating Google's dominance in search and related industries, New York AG Letitia James said shortly after the Google suit was filed.

What's next: Google has 30 days to respond to the initial DOJ filing, a person familiar with the case said. Ashley has more here. |     | | | | | | 6. Take Note | | On Tap Trading Places - Pinterest added former Disney executive Salaam Coleman Smith to its board of directors.

- Freshworks hired former Atlassian executive José Morales as chief revenue officer.

Errata ICYMI |     | | | | | | 7. After you Login | | Let this extremely '90s video serve as a reminder to Google top brass that tech billionaires can still cut loose even with antitrust clouds gathered over them. |     | | | | | | A message from Masterworks | | 88% of wealth managers recommend investing in art | | |  | | | | When the majority of wealth managers recommend investing in art, we're inclined to agree. Thanks to Masterworks, anyone can buy art investments at a fraction of the cost. Don't wait - access paintings by artists like KAWS and Banksy today. Learn more. | | | | | | Axios thanks our partners for supporting our newsletters.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment