The Barchart Chart of the Day belongs to the information technology company ServiceNow (NYSE:NOW). I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent prices appreciation. Since the Trend Spotter signaled a buy on 9/25 the stock gained 8.75%. ServiceNow, Inc. provides enterprise cloud computing solutions that defines, structures, consolidates, manages, and automates services for enterprises worldwide. The company offers information technology (IT) service management applications; and digital workflow products for customer service, human resources, security operations, integrated risk management, and other enterprise departments. It operates the Now platform that offers workflow automation, electronic service catalogs and portals, configuration management systems, data benchmarking, performance analytics, encryption, and collaboration and development tools. The company also provides IT service management product suite for enterprise's employees, customers, and partners; IT operations management product that connects a customer's physical and cloud-based IT infrastructure with applications and platforms; IT Asset Management product to automate IT asset lifecycles with workflows; IT business management product suite to manage IT priorities; and enterprise development operations product for developers' toolchain. In addition, it offers customer service management product for customer service cases and requests; human resources service delivery product; security operations product for security operations management requirements of third-party; governance, risk, and compliance product to create policies and controls; and field service management application. Further, the company provides professional, training, and customer support services; and certification programs. It serves government, financial services, healthcare, telecommunications, manufacturing, IT services, technology, oil and gas, education, and consumer products. The company sells its products through direct sales team and resale partners. The company was formerly known as Service-now.com and changed its name to ServiceNow, Inc. in May 2012. The company was founded in 2004 and is headquartered in Santa Clara, California.

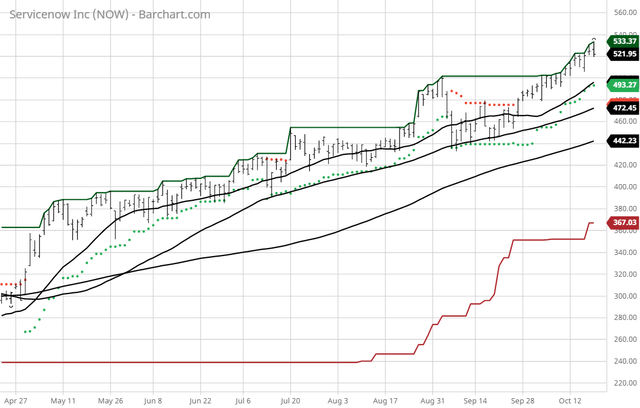

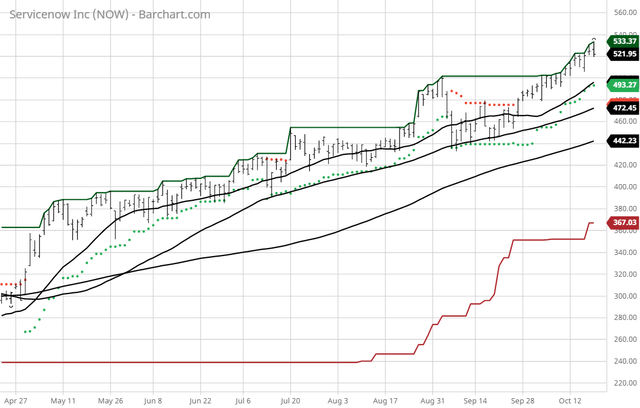

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. Barchart technical indicators: - 100% technical buy signal

- 118.57+ Weighted Alpha

- 114.79% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 17 new highs and up 15.20% in the last month

- Relative strength index 67.15%

- Technical support level at 516.44

- Recently traded at 521.95 with a 50 day moving average of 472.45

Fundamental factors: - Market Cap $100 billion

- P/E 433.90

- Revenue expected to grow 27.50% this year and another 24.40% next year

- Earnings estimated to increase 33.10% this year, an additional 24.20% next year and continue to compound at an annual rate of 27.71% for the next 5 years

- Wall Street analysts issued 13 strong buy, 17 buy and 4 old recommendations on the stock

- The individual investors following the stock on Motley Fool voted 430 to 36 that the stock will beat the market

- 45,120 investors are monitoring the stock on Seeking Alpha

The #1 strategy that could have sent you 20 years with no losing years… Trophy Trades have already proven to have the potential to earn you as much as $13.5 million dollars… But it’s never been released to the public before - now that changes for you

More on this symbol: |

No comments:

Post a Comment