| | | | | | | Generate | | By Ben Geman ·Oct 16, 2020 | | Happy Friday. Today's Smart Brevity count: 1,133 words, 4 minutes 🎸And tomorrow marks 40 years since Dire Straits (a Generate favorite) released the album "Making Movies," which provides this week's final intro tune... | | | | | | 1 big thing: What money thinks about oil and gas |  Data: BCG Center for Energy Impact; Chart: Axios Visuals Investors in the oil-and-gas industry want companies to get greener, and they're losing faith that the sector, which is underperforming broader market indices, is a good long-term bet. Driving the news: Those are two takeaways from a new Boston Consulting Group survey of investors that arrives as the industry is under growing pressure on climate and mired in a yearslong slump made much worse by COVID-19. The big picture: Check out the chart above, and some other findings are available here. - Just a quarter see oil-and-gas stocks playing a more prominent role in their portfolios in the future, and less than a third see the industry as a more attractive investment than renewables.

- They also typically want to see international oil companies undertake more aggressive overhauls to improve total shareholder returns and provide more clarity on their climate posture.

Where it stands: Here are a few more takeaways... - 80% want to see companies set long-term emissions-cutting targets, something that big U.S.-based companies have resisted that's now standard among European-headquartered giants like Shell.

- 52% agree it's "extremely important" for currently healthy companies to strengthen their balance sheets, compared to 21% who say it's "extremely important" to maintain or increase shareholder payouts.

- 49% say it's "extremely important" for companies to build up a portfolio in renewables and other fossil fuel alternatives, while another 33% say it's "somewhat" important.

- 63% say it's very or somewhat important for companies to pursue an environmental, social and governance (ESG) agenda even if that means lower earnings per share.

- Only a third of investors say it's important for companies to increase hydrocarbon reserves.

Why it matters: The investor views come as the industry is facing its highest levels of uncertainty and environmental pressure in a long time, if ever. - COVID-19's unknown duration and evolving government policy responses making gauging the near- and long-term future of oil consumption very hard.

- Some analysts see global demand peaking or at least hitting a plateau within the next decade (if it hasn't happened already).

- Speaking of demand, however, the BCG survey shows some bullishness, with two-thirds of investors expecting demand to reach pre-pandemic levels in the second half of next year.

- Meanwhile, policymakers in Europe and, if Joe Biden wins, in the U.S. are vowing to impose tougher climate policies. China, the world's largest oil importer, is also promising an aggressive long-term carbon-cutting effort.

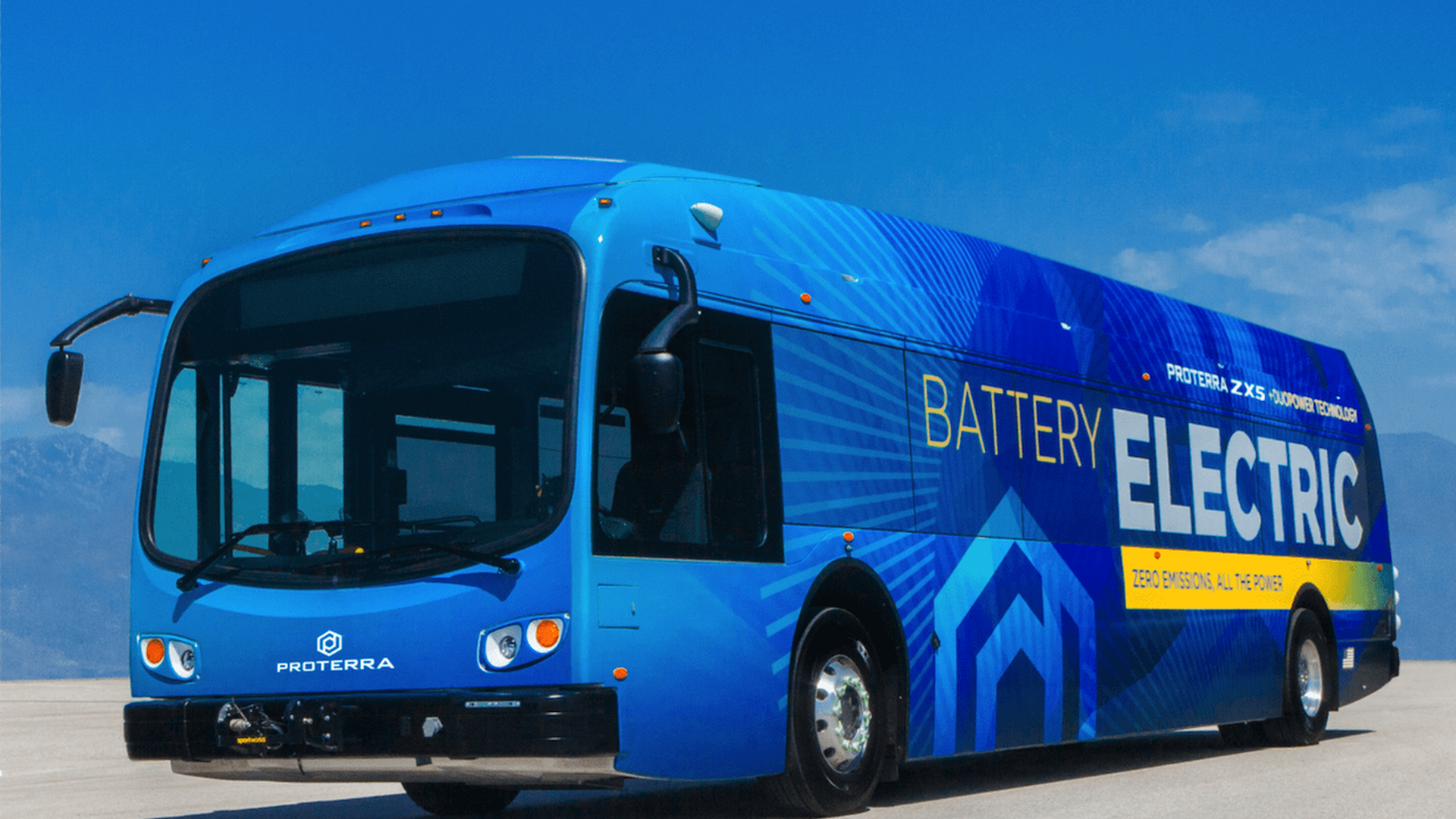

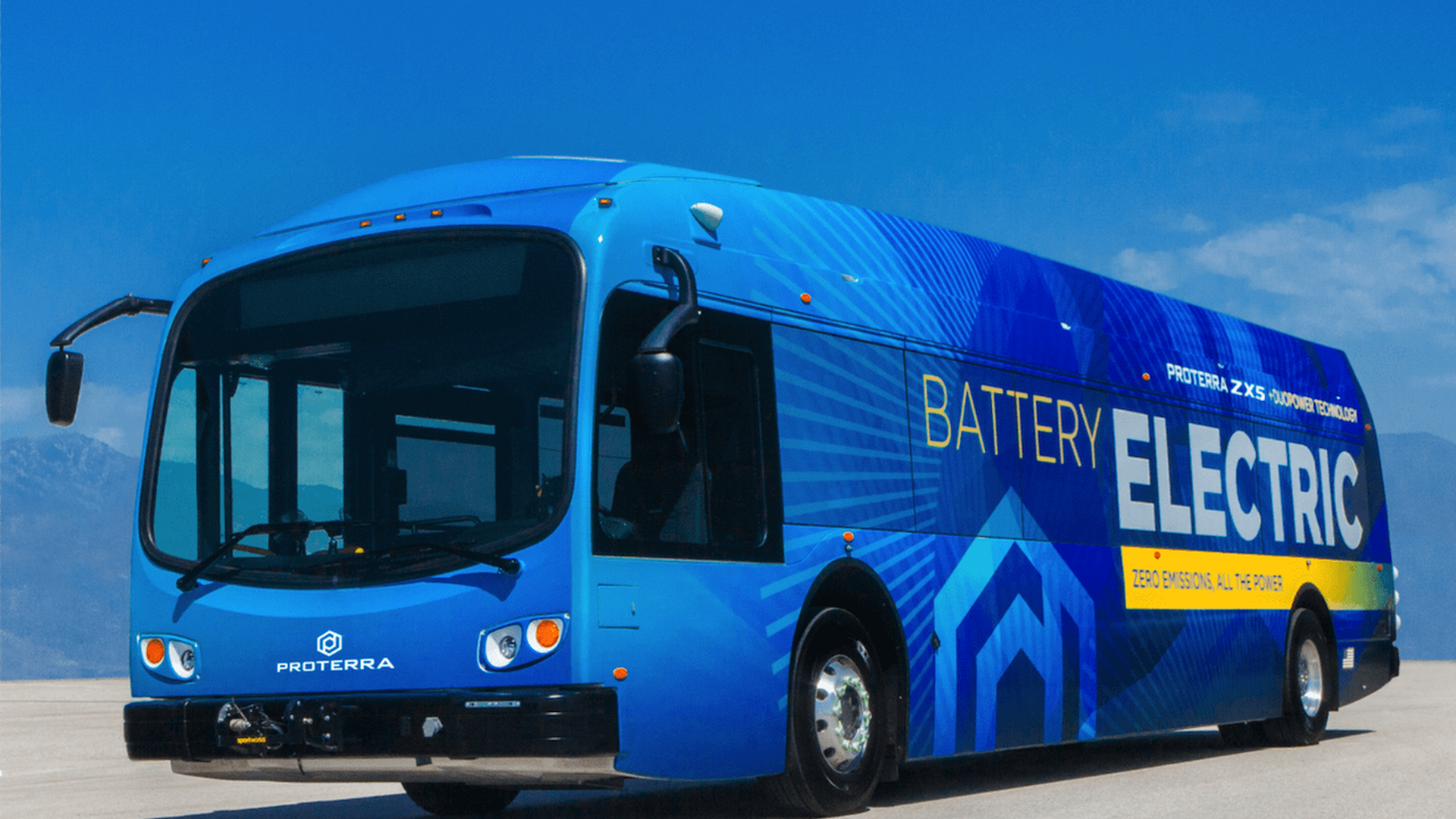

* * * One more crude thing: Top executives with a pair of prominent U.S. producers believe domestic output will never again reach its pre-COVID peak of about 13 million barrels per day, per Argus Media. Why it matters: The comments from CEOs of Occidental Petroleum and Parsley Energy at a virtual conference this week underscore the pandemic's long-term impact. |     | | | | | | 2. The message behind a splashy solar debut | | Shares of Array Technologies, which makes tracking systems that optimize solar project performance, surged 66% in the company's public trading debut yesterday. Why it matters: Via Greentech Media, "Array is riding two trends: growing demand for equipment that allows solar projects to squeeze out more power and strong demand for clean energy stocks ahead of November's presidential election." The big picture: Bloomberg, noting a "surge in investor interest for green stocks and equities with an ESG bent," makes a similar point: "Stocks of several solar companies have hit all-time highs this month as anticipated industry growth could be super-charged under a potential Joe Biden presidency," they report. |     | | | | | | 3. Proterra's new cash and more EV notes |  | | | Image courtesy of Proterra | | | | The electric bus company Proterra has raised another $200 million in a round led by Cowen Sustainable Advisors that also includes Soros Fund Management, Generation Investment Management and Broadscale Group. Why it matters: The California-based company has also expanded into providing tech for other types of heavy vehicles, and there have long been rumblings it might go public. Reuters reported over the summer that it could happen via a merger with a special purpose acquisition company * * * Speaking of electric vehicles, CNN reports, "Fisker, a Manhattan Beach, California-based electric car maker is partnering with Magna International, a major contract auto manufacturing company based in Canada, to build its new electric SUV." And via the Financial Times ($): "Nikola's chief executive has played down the importance of the Badger pick-up truck to its business, in the latest effort by the start-up to distance itself from the pet projects of its departed founder, Trevor Milton." |     | | | | | | 4. The complex case for trees |  | | | Illustration: Sarah Grillo/Axios | | | | Trees can help to combat climate change, but determining what to plant and where is complex — and whether to plant them at all is a growing debate, Axios' Alison Snyder reports. The big picture: Protecting, planting and restoring forests can help offset global warming, but experts stress that greenhouse gas emissions still must be dramatically cut. - "There is an enormous amount of science that shows trying to protect forests and stop the loss of forests is a good idea," says Yale University's Mark Ashton.

- "After that, things get very difficult to define and describe," he says.

Driving the news: The Trump administration this week established an interagency council to put more weight behind its role in the international One Trillion Trees Initiative. How it works: The ecological considerations of large-scale tree planting initiatives are complex. - There are questions about the species and diversity of trees that should be planted, how they interact with the soil and insects (which can affect how much carbon they sequester), and their odds of survival in environments already in transition due to climate change.

What's new: In a recent study, the University of Connecticut's Robin Chazdon and colleagues mapped the potential carbon that could be captured in forests that are allowed to naturally regrow. - They identified as many as 1.7 billion acres that could be naturally regrown.

- Those areas — which exclude grasslands, boreal biomes, current croplands and population centers — have the potential to absorb roughly 70 billion tons of CO2 over the next 30 years, or the equivalent of about one-quarter of global fossil fuel emissions each year.

Restoring tropical forests, in particular, would deliver the most benefits to biodiversity and mitigating climate change at the lowest cost, per another study published this week in the journal Nature. Go deeper |     | | | | | | 5. Catch up fast: Deals, SCOTUS, GE | | Solar: "Norwegian solar firm Scatec Solar said on Friday it had agreed to buy state-owned hydropower firm SN Power in a $1.17 billion deal as it transforms itself into a global renewables company." (Reuters) Climate: "During two grueling days of questioning over her Supreme Court confirmation, Judge Amy Coney Barrett did her best to avoid controversy. But her efforts to play it safe on the subject of climate change have created perhaps the most tangible backlash of her hearings." (New York Times) Pledges: "General Electric Co. aims to be carbon-neutral at its more than 1,000 factories and other facilities worldwide by 2030, leaving aside emissions from the fossil-fuel burning products that have defined much of the company's recent history." (Bloomberg) |     | | | | | | 6. Quote of the day | | "We've left the football field entirely to the Democrats out of ideological reasons. We should be there." Who said it: Via E&E News, that's retiring GOP Rep. Francis Rooney lamenting his party's lack of engagement on climate change. The intrigue: E&E asks Rooney, who has proposed a carbon tax, whether any Republicans will take up that mantle when he's gone. "Well, that's a tough one, because none of them have signed on here. There's a few of them that talk fairly positively about it, but they're just not willing to stick their neck out," he said. |     | | | | | | Axios thanks our partners for supporting our newsletters.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment