Editor's note: Be ready to buy on a pullback... Many investors are hesitant to embrace the uncertainty that comes with putting their money to work when a presidential election is looming over the economy. But according to Pete Carmasino – chief market strategist for our corporate affiliate Chaikin Analytics – history shows a pullback during an election year like the one we experienced last month signals a slew of buying opportunities ahead for stocks... That's why he believes you need to ignore today's bleak political backdrop in order to avoid missing out on massive gains in the long term. In today's Masters Series, originally from the April 12 issue of the Chaikin PowerFeed e-letter, Pete explains why we're poised to experience heightened volatility throughout this election year... details how history shows this turbulence could create a slew of buying opportunities moving forward... and reveals how investors can capitalize on this unique setup...

We Could See an Election 'Slingshot' in Stocks By Pete Carmasino, chief market strategist, Chaikin Analytics Folks, as we all well know, it's an election year. And we typically see a lot of volatility – or "noise" – during years like this one... But it's not necessarily bad volatility. In fact, history shows us that it's usually good news for investors... For starters, we need to remember that stocks go up more than they go down over the long run. That's clear if we look at any long-term chart of the S&P 500 Index...

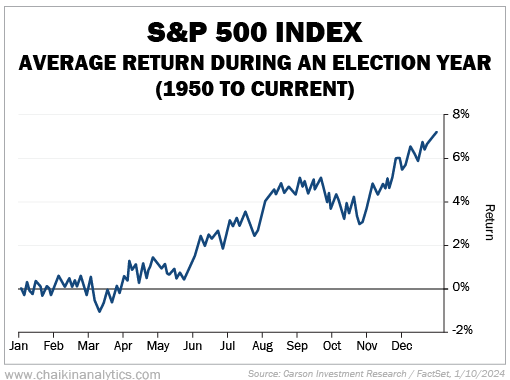

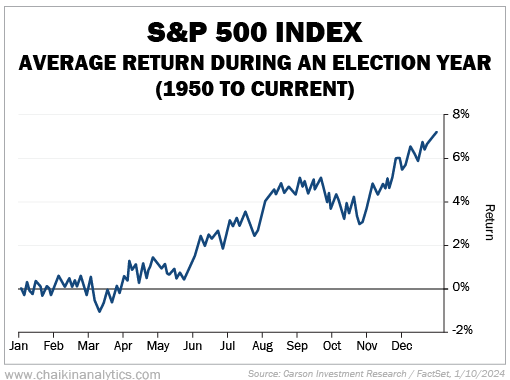

Taking it a step further, the good times typically last longer than the bad times... Fidelity Investments studied stock market data going all the way back to 1872. According to the financial-management firm, we've had 26 bull markets and 26 bear markets over that span. The bear markets lasted an average of about 19 months. Meanwhile, the bull markets went on for an average of roughly 42 months. So based on 152 years of data, we know that bull markets typically go on for more than twice as long as bear markets. With that in mind, let's zoom in on election years... According to financial-services company Carson, stocks have typically risen 7.3% during election years since 1950. And they've gone higher an incredible 83.3% of the time. But I have a twist on this data. And it's even more "bullish" for folks like us. See if you can spot what I mean in the following chart from Carson...

In short, election years are usually weaker at the start. Then, they rally later in the year. This trend goes back to 1950. So we're talking about almost 75 years' worth of data. But that's not the case through the first four months of 2024...

| Recommended Link: | |  Massive Financial Reset Begins on May 15 You have just days left to prepare for a sudden shift in the stock market that could double your money six different times – without touching AI stocks, the Magnificent Seven, or any other popular stock. The man whose work pointed to the top nine stocks of 2023 explains the full details here. |  | |

Stocks have already surged higher. The S&P 500 is already up about 8% this year. That's nearly 18 times better than the average election year's roughly 0.5% gain at this point. Now, you'll also notice in the above chart that stocks tend to pull back in mid-March. Again, I'm just talking about the average results since 1950. With that said, it's not surprising that we saw stocks fall throughout most of April... The S&P 500 has already exceeded the full-year average of 7.3%. So the bull-case scenario for this presidential-election year is even better than history suggests. That doesn't mean stocks will go straight up. Pullbacks happen. In fact, we just saw the S&P 500 dip more than 5% throughout the first three weeks of April. And yet, we could still see a huge move higher before the summer ends. I picked the summer for good reason. Again, it relates to the noise in an election year... Remember, both political parties hold their national conventions over the summer. This year, the Republicans will gather in July. And the Democrats' event will follow in August. So I expect a lot of movement in the markets this summer. In the best-case scenario, we could see what I call a "slingshot" move... If you've ever used a slingshot, you know that you need to pull it back and slightly downward to make it work properly. If you do, your object will fly a lot higher and farther. That's what I believe could happen with stocks... Any pullback likely won't last long. And like a slingshot, we could then experience a rapid move higher. The pullback before the slingshot could be our best "buy the dip" opportunity in 2024. And for the record, as inflation stays persistent, the very best place to invest money is in the stock market. How else can you keep up with high prices for goods and services? Now, I want to be clear... The markets have already overshot the average return in a presidential-election year to the upside. So it wouldn't surprise me if the pullback were a little worse than the average, too. But don't panic. As I've explained, stocks have room to run higher this year. Good investing, Pete Carmasino

Editor's note: The election cycle isn't the only development investors should be paying attention to right now. Chaikin Analytics founder Marc Chaikin believes the stock market will hit a massive turning point on May 15... That's why he recently went on camera to share how you can use this market shift to double your money – with a little-known strategy that has nothing to do with stocks, bonds, or cryptocurrencies. Click here to catch up on the full details... |

No comments:

Post a Comment