What Is My #1 Macro Indicator Predicting? | | Sponsored Content If Trump wins: This American Energy stock could soar There are many uncertainties about the upcoming election…But if the polls are right, and President Donald Trump retakes the Oval Office next year… There's one thing I am 100% certain about. American companies will soar. Because that's been Trump's mission since the day he stood on the golden escalator, smiling and waving, as he accepted the Presidential nomination in 2016. But the question is...Which stocks will soar if Trump wins again? There's one American Energy stock that stands to benefit the most, and it is throwing an ultra-high 12% dividend. Click here to learn more. | | | "Never fight the Fed." -- Marty Zweig

"Don't fight the Fed -- fear the Fed." -- Michael Sincere (MarketWatch)

The markets -- stocks, tech, bitcoin, gold and even uranium -- rallied after Fed Chairman Jay Powell maintained his stance to cut interest rates three times in 2024 once inflation has subdued.

Since price inflation is staying stubbornly high at 3% or more, the Fed has postponed cutting short-term interest rates for now. Moreover, as we get closer to the election, the Federal Reserve Board members may be reluctant to cut rates. Powell & Co. want to maintain their independence from politics. | | Top 20 Living Economist Shares the Largest Position in His Personal IRA Investing legend Dr. Mark Skousen recently gave a talk to a small group in the heart of Washington, D.C. In it, he revealed the cornerstone of his retirement plan -- and the one investment that helped make him a millionaire. Click here to watch Dr. Skousen's presentation -- and learn about "the best way to become a millionaire in America." | | | What About Gross Output (GO)?

In addition to Fed policy, my other key indicator is gross output (GO), which measures total spending in the economy, including the value of the supply chain. Like gross domestic product (GDP), real GO for the United States has been rising lately, and that's a good sign for the economy. Other nations, including Europe and China, are struggling these days, so America is carrying the weight of economic growth.

See my latest press release here.

First-quarter GO will be released next week on Thursday, March 28. I'll issue a press release at that time and give a summary in the Skousen CAFÉ.

The unemployment rate remains low, and corporate profits are high and doing better than expected.

'The trend is your friend… until it ends.'

Despite perennial forecasts of a bear market or even a crash in the stock market, I join Jay Powell in maintaining our bullish stance in the stock market and alternative investments like gold, silver, uranium and bitcoin.

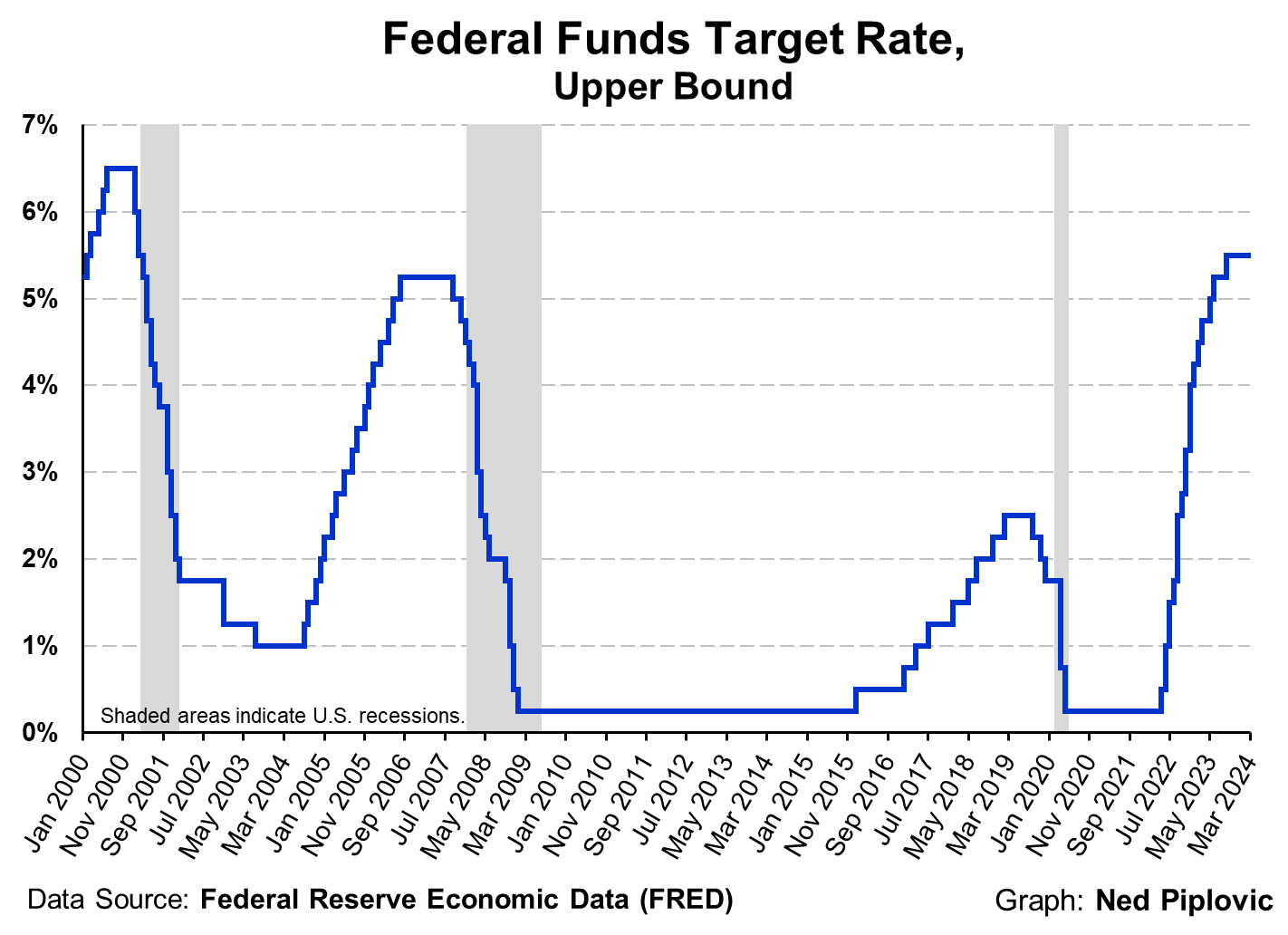

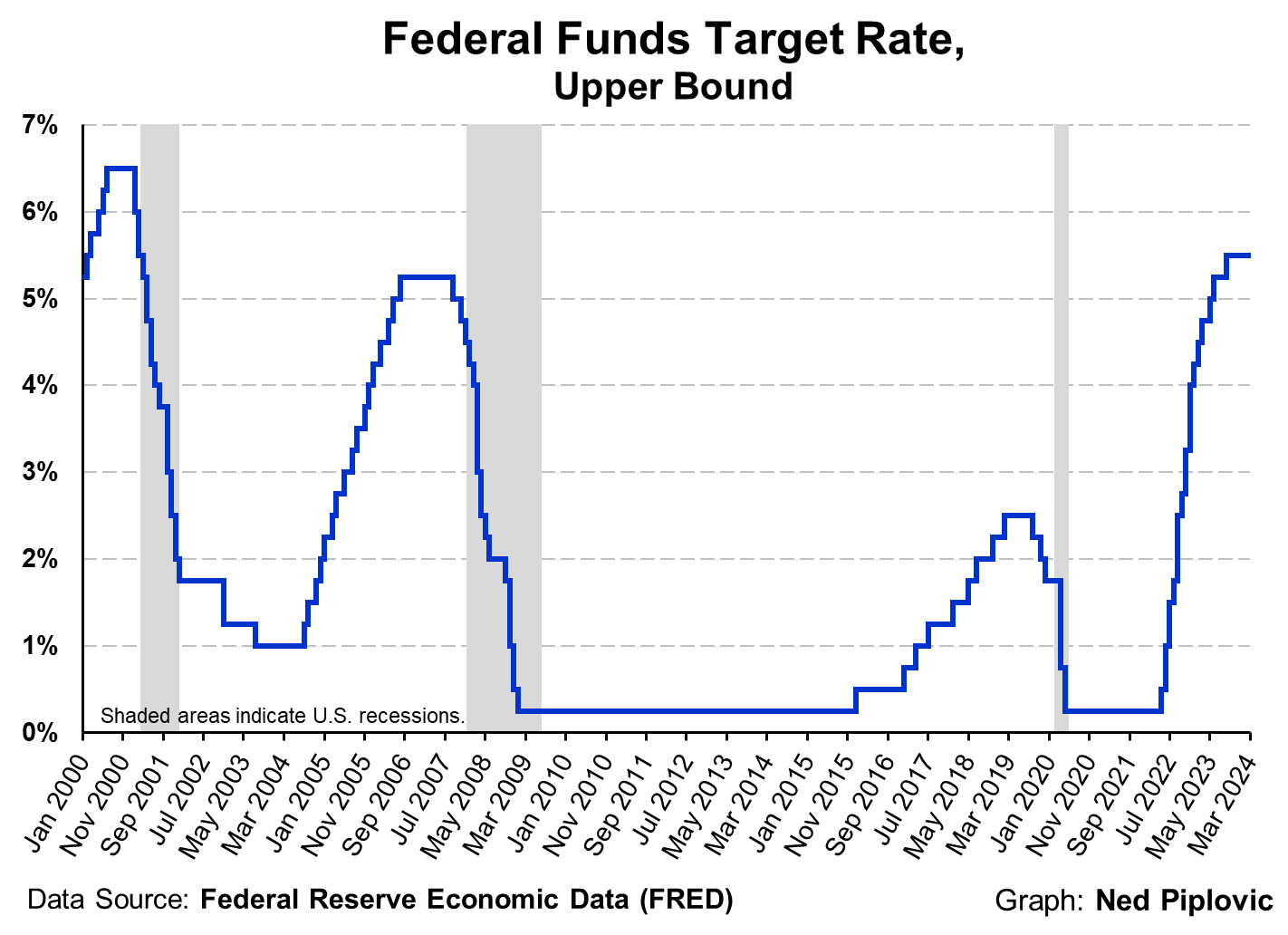

The Fed is famous for its volatile policies. As the chart below shows, the Fed has switched from easy money to tight money, or vice versa, six times.

But note that there is a lag between interest rates policy and the stock market, and the lag can sometimes be a couple of years.

Since 2022, the Fed has imposed a tight money policy. The initial reaction on Wall Street was negative, but since 2023, we've enjoyed a bull market.

That bull market has been extended after the Fed announced late last year that it was pausing its aggressive rate increases.

The Fed is notorious for panicking when there's a sudden financial panic or the economy turns south. My biggest fear is another commercial banking crisis like the one we had in early 2022, which could be caused by the low occupancy rate of commercial buildings in cities like New York. | | Step by Step Guide to Revolutionize Your Options Trading Would you like a step-by-step guide to walk you through how to maximize your Options strategies? Best of all, anybody can learn how to do it.

All you need is about 1 hour to learn how you can execute this simple strategy.

Do NOT miss this opportunity to revolutionize your Options trading. | | | Upcoming Report on China and Asia

I've been invited this week to join Steve Forbes as a speaker on a Forbes Cruise to Asia, with port stops in Indonesia, Singapore, Vietnam and Thailand. I'll be speaking on the outlook for China and emerging markets and will have a full report next week. China in particular is in deep trouble right now. Stay tuned.

Good Investing, AEIOU,

Mark Skousen

Doti-Spogli Endowed Chair of Free Enterprise, Chapman University

Wikipedia

Newsletter and trading services

Personal website

FreedomFest | | Biden Administration Issues Radical Anti-Democratic Rule to Ban Gas-Fueled Automobiles By Mark Skousen

Editor, Forecasts & Strategies

Driven by ideology rather than science, President Biden's Environmental Protection Agency (EPA) unilaterally announced a rule that will force all automobile manufacturers to produce only electric vehicles or hybrids by 2032.

Air pollution is no longer a problem in the United States, but nevertheless Biden and his radical Democrats are determined to destroy the oil and gas industry, even though they know full well that it takes fossil fuels to build the batteries and the electric/hybrid cars.

The New York Times and other establishment alarmists even have the audacity to suggest that driving cars and trucks in the United States caused "the hottest year in recorded history." We've been driving cars and trucks for a century in this country, and transportation pollution has been in sharp decline in the past 50 years... and yet, car/truck pollution helped contribute to the "hottest year in recorded history?" Give me a break!

For an alternative view, see Wrong Again: 2023 Edition -- 'Hottest Lying Ever' -- The Heartland Institute

The unilateral decision by the White House should have been made in Congress. That's what democracy is all about.

Fortunately, if the Republicans win in November, this decision could be (and ought to be) reversed. The automobile/trucking industry has been doing a great job on its own reducing pollution to acceptable levels in the U.S. and doesn't need to the government to do its job. | | | About Mark Skousen, Ph.D.:

Mark Skousen is an investment advisor, professional economist, university professor, author of more than 20 books, and founder of the annual FreedomFest conference. For the past 40+ years, Dr. Skousen has been investment director of the award-winning newsletter, Forecasts & Strategies. He also serves as investment director of four trading services: TNT Trader, Five Star Trader, Home Run Trader, and Fast Money Alert. Mark Skousen is an investment advisor, professional economist, university professor, author of more than 20 books, and founder of the annual FreedomFest conference. For the past 40+ years, Dr. Skousen has been investment director of the award-winning newsletter, Forecasts & Strategies. He also serves as investment director of four trading services: TNT Trader, Five Star Trader, Home Run Trader, and Fast Money Alert. | | | | | |

No comments:

Post a Comment