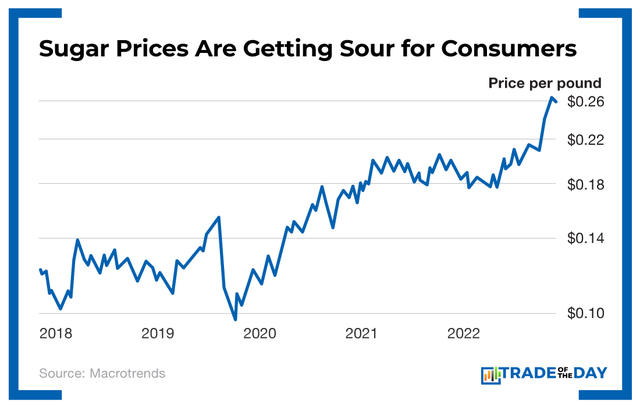

| That's going to affect companies like Tootsie Roll (NYSE: TR), whose flagship product lists sugar as its first ingredient. Kellogg (NYSE: K) also has strong exposure to sugar prices with sweet breakfast foods like Frosted Flakes, Froot Loops and Pop-Tarts. High sugar prices will affect Hershey Co. (NYSE: HSY), which is facing a double whammy due to rising cocoa prices as well. Cocoa is trading at its highest level in seven years, and prices are forecast to rise to nearly $3,400 per metric ton next year from the current price of $3,065. And it's no better for coffee, especially the cheaper robusta beans. Vietnam, one of the world's major coffee producers, had its smallest harvest in four years. That's bad news for my daughter, who needs her Starbucks (Nasdaq: SBUX) fix of Mocha Frappuccinos, which are all sugar, chocolate and coffee with some milk. (At least milk prices have come back down!) Surging global demand for agricultural products, unpredictable weather and the war in Ukraine are causing prices of many commodities to rise - and they likely will for some time. Companies like the ones mentioned above will see their expenses rise and will either have to pass them along to consumers or see their profits get squeezed. On the other hand, the businesses that produce the stuff we eat every day or help the growers will likely boom. I'm talking about companies like the Brazilian energy and sugar producer Cosan (NYSE: CSAN) and Bunge (NYSE: BG), which also produces sugar as well as a variety of other products, including wheat, milled corn, oils used in food, and plant proteins from soy, peas and more. Not only will investors who are able to cash in on rising commodities prices help their families keep up with inflation, but if they end up "sticky and sweet, from my head to my feet," they won't fret about the high cost of their indulgence. YOUR ACTION PLAN If you want to know more about how I'm playing these commodities and how you could cash in, I'm showing investors exactly how to do this in my Commodities Supercycle Summit. I'm also revealing a special $1 investment that could become a 10-bagger in the upcoming once-in-a-generation commodities supercycle. You won't want to miss it. Click here now to reserve your spot. Good investing, Marc |

No comments:

Post a Comment