| | | | | | | Presented By Walmart | | | | Axios Markets | | By Emily Peck and Matt Phillips · Dec 08, 2022 | | Good morning! We're talking about private market valuations today. They've plunged, and laid-off tech employees are scrambling. - Meanwhile, speaking of companies that lost value: Sunny Balwani, former president at Theranos — once valued at $11 billion — was sentenced to nearly 13 years in prison yesterday. It's a longer sentence than company founder Elizabeth Holmes received.

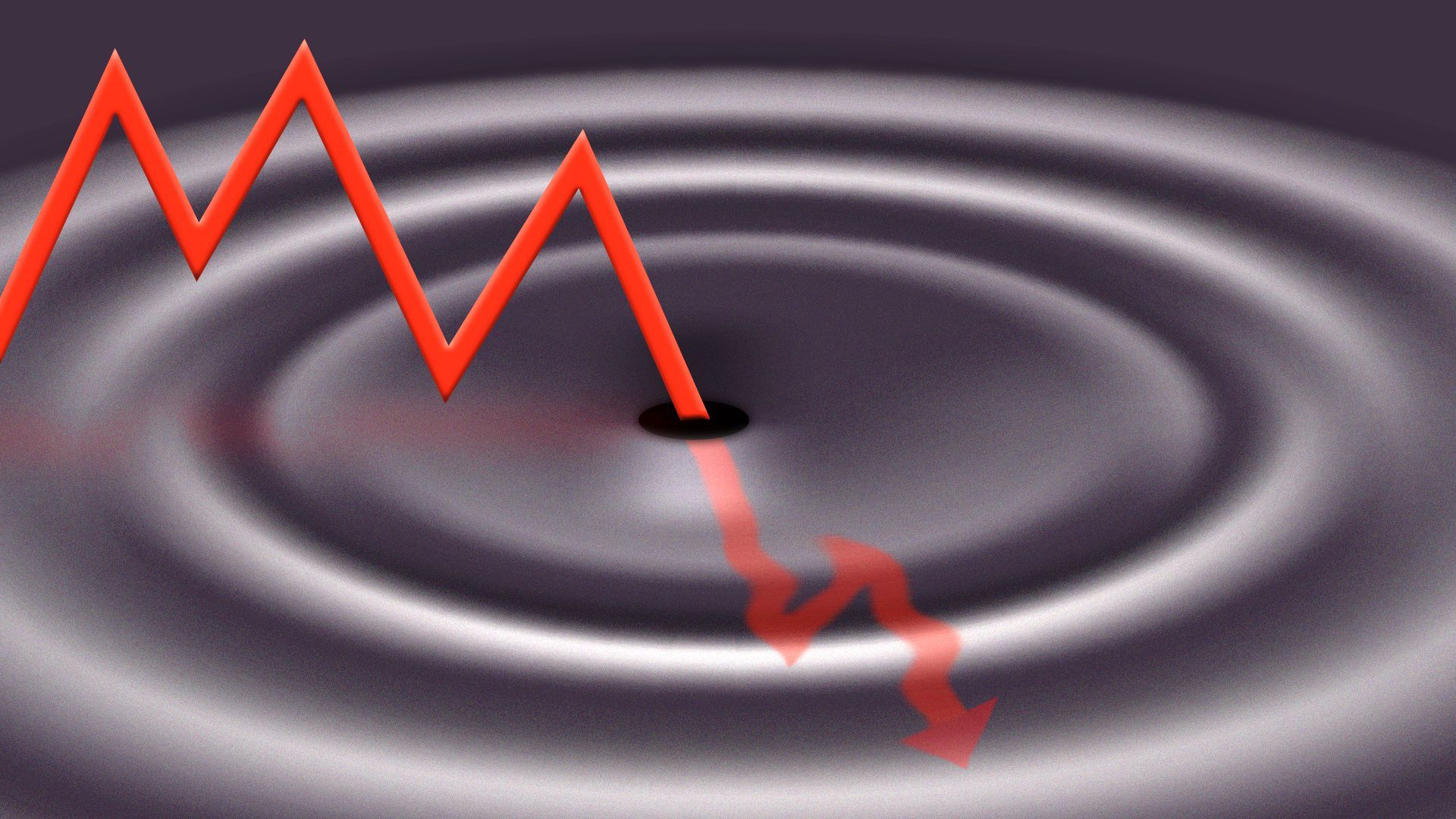

Today's newsletter is 987 words, 4 minutes. Let's do this. | | | | | | 1 big thing: Good-bye to stock options' golden age |  | | | Illustration: Annelise Capossela/Axios | | | | The wave of tech layoffs this year is adding to shockwaves in the private markets, as many workers look to sell their company stock just as valuations are collapsing. Why it matters: Say goodbye to the golden age of employee stock options, Emily writes. - This is part of a big unraveling happening for tech workers, many living through their first downturn and experiencing unfamiliar job woes like layoffs, hiring freezes, and the diminishing value of their stock compensation.

- It's also an example of the real-world impact of the market selloff prompted by the Fed's aggressive rate hiking campaign.

- Plus: Those big stock payouts — and record low interest rates — helped drive the housing boom in 2021.

By the numbers: In Q3, shares of private tech companies traded at a median discount of over 40% compared with their most recent primary fund-raising valuation (see the chart below), according to Forge, a private-market trading platform. Flashback: A year ago, rates were low, capital was aplenty and private company valuations were skyrocketing. - All manner of investors — venture capital, private equity, mutual funds, family offices — were interested in private shares, Greg Martin and Glen Anderson, co-founders of Rainmaker Securities, tell Axios. Rainmaker is a small investment bank that focuses exclusively on private market transactions.

- But demand has fallen off, and now sellers exceed buyers, according to Rainmaker's data.

- Back in December 2021, the ratio of sellers to buyers was 1:1 — but it shot up to 4 sellers to every one buyer this past summer. It's come back a bit since then, but there are still 2.5 sellers for each buyer on Rainmaker's platform.

How it works: Companies like Forge provide platforms that match buyers and sellers; others like SecFi and Quid offer loans to tech employees who use their stock options as collateral. - Startups typically give employees stock options as part of their compensation. Employees can "exercise" them — or buy the shares — at a low price and then, ideally, sell them for a higher price when the company goes public or is sold.

- Back when valuations were moving up and to the right, all was well. An IPO blitz last year allowed loads of startup employees to cash out some of their shares.

What we're watching: The vibe shift is a reckoning of sorts for some tech employees who've grown to feel entitled to making loads of money off stock options. - "In compensation conversations between engineers, they were just, like, savage in their greed," says a tech employee who's worked in the startup world for a decade, speaking to Axios anonymously.

- "What's the word of the year, goblin? It was like goblins," she says.

|     | | | | | | 2. Desperation sets in |  Data: Forge Private Market Update; Chart: Axios Visuals This is a chart of pain for laid-off tech workers. Most only have a short 90-day window to exercise their options — though a handful of employers have extended the time frame, Emily writes. - And because they need money, some wind up selling those shares for far less than they'd hoped — and less than they might be worth if and when the market recovers.

"The desperation seller is starting to hit the market," says Greg Martin, cofounder Rainmaker Securities. "The ability to hang on to price starts to fade when your options expire next week." - Workers at crypto companies are even worse off. "Demand for anything that touches crypto is almost nonexistent right now," Rainmaker cofounder Glen Anderson adds.

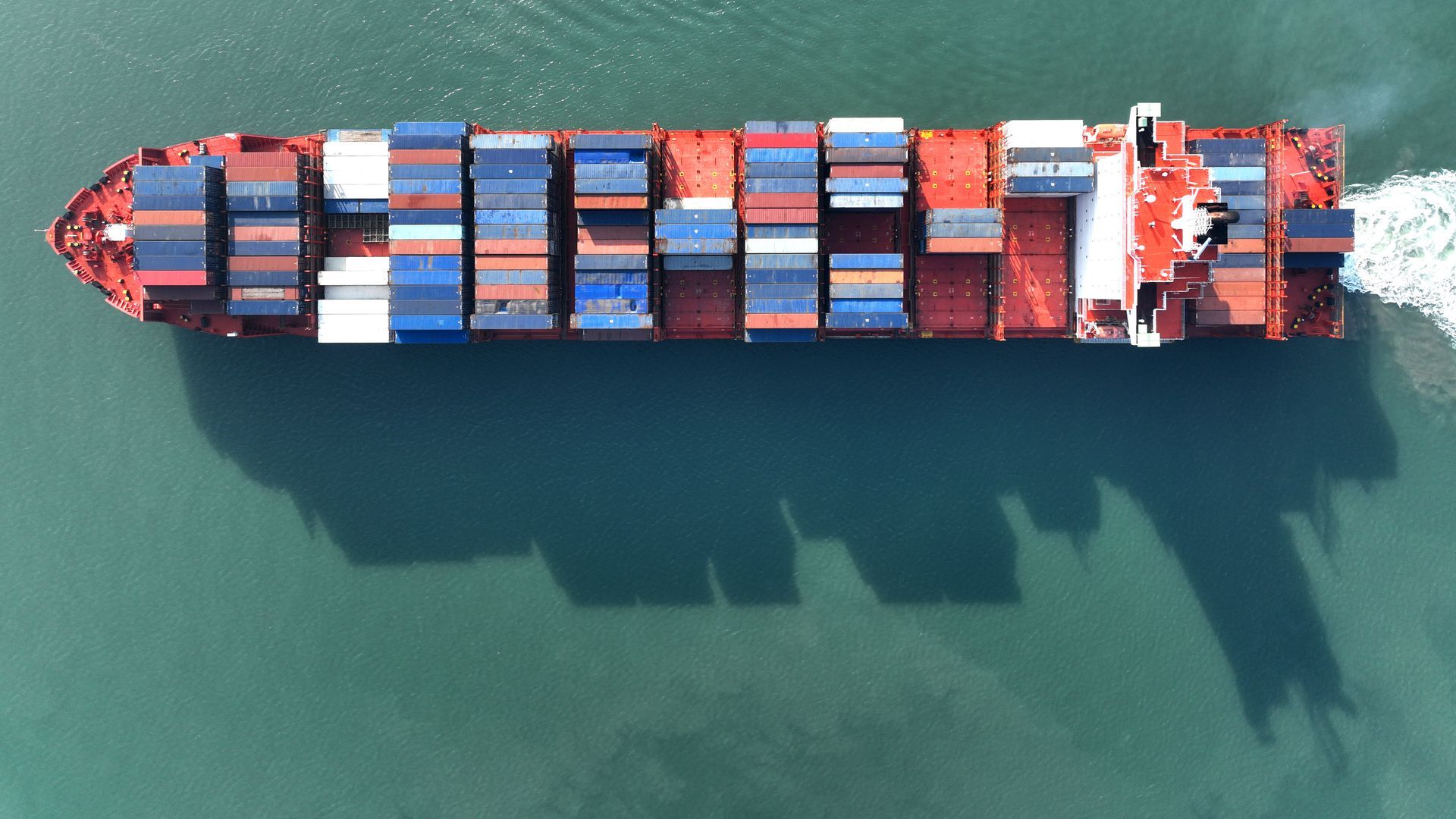

|     | | | | | | 3. Catch up quick | | ⚖ Sam Bankman-Fried could be facing a market manipulation inquiry by federal prosecutors. (NYT) 📰 New York Times staffers to walk out after union negotiations fail. (Axios) 💰 Elon Musk's bankers consider giving him loans secured by Tesla stock to replace some high-interest Twitter debt. (Bloomberg) |     | | | | | | A message from Walmart | | Walmart is investing $1 billion in career training and development | | |  | | | | At Walmart, a first promotion is often just the first of many — 75% of management started as hourly associates. That's just one reason why Walmart was named one of LinkedIn's Top Companies to Grow a Career in 2022. Learn how Walmart's mentorship and training help associates advance in their careers. | | | | | | 4. China trade plunge |  | | | Photo: CFOTO/Future Publishing via Getty Images | | | | Fresh economic data from China shows just how much the nation's "zero-COVID" policies have hammered its crucial export industries, Matt writes. Why it matters: China yesterday moved to meaningfully loosen those restrictive COVID policies. - The greater-than-expected plunge in trade suggests that, in addition to responding to protests, Chinese officials, in part, eased their COVID stance to keep the economic downturn from spiraling out of control.

By the numbers: The new trade numbers for November, out yesterday, showed a worse-than-expected downturn in both exports and imports. - Exports fell 8.7% year-over-year, compared with expectations of a 3.8% drop.

- Imports plunged by 10.6%, versus the 7% decline analysts had expected.

Zoom out: Widely seen as inhumane, China's zero-COVID lockdowns repeatedly shuttered key Chinese industrial centers such as the southern industrial hubs of Shanghai, Shenzhen and Guangzhou, as well as ports such as Tianjin and Dalian further north. |     | | |  | | | | If you like this newsletter, your friends may, too! Refer your friends and get free Axios swag when they sign up. | | | | | | | | 5. Lowest price so far this year |  Data: FactSet; Chart: Axios Visuals Crude oil futures fell to their lowest level of the year Wednesday, amid growing concern about the state of the global economy, Matt writes. Why it matters: Crude oil prices are a tell on the global economy, which looks like it could be in trouble. Driving the news: The sell-off came despite ostensibly good news for the economy, as China phases out the COVID policies that pushed the nation's growth rate well below goals set by officials. - Growth for the first nine months of 2022 was 3%, well below the 5.5% full-year target the government sets for China's GDP.

Yes, but: In theory, the end of zero-COVID should be a good thing for global business, if it means the world's second-largest economy shakes off its malaise. The bottom line: The market seems to be saying that's a very big "if." |     | | | | | | A message from Walmart | | Walmart named one of LinkedIn's Top 20 Companies to Grow a Career | | |  | | | | Patrick Joseph began his Walmart career as a pharmacy intern. Today, he oversees 11 pharmacies and eight vision centers — and his story is just one of many. See how Walmart's focus on mentorship and advancement helps create more stories like Patrick's. | | | | Axios Markets was edited by Kate Marino and copy edited by Lisa Hornung |  | | Why stop here? Let's go Pro. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

Post a Comment

0Comments