| | | | | | | Presented By Global X ETFs | | | | Axios Generate | | By Ben Geman and Andrew Freedman · Oct 07, 2022 | | 💃🏿🕺Made it! Friday. Today's newsletter has a Smart Brevity count of 1,271 words, 5 minutes. 👀 Join Axios reporters in Washington, D.C., at 8am ET on Oct. 11 for a global look at energy security and climate change. Guests include DOE deputy secretary David M. Turk. Register to attend in person or virtually. 🎶 2022 marks 40 years since Bruce Springsteen recorded an absolute gem that went unreleased for over a decade. It's today's intro tune... | | | | | | 1 big thing: The quest for climate dollars — and more creativity |  | | | Illustration: Sarah Grillo/Axios | | | | World Bank and International Monetary Fund meetings next week — and the coming United Nations climate summit — are bringing fresh efforts to boost spending needed for emissions cuts, Ben writes. Why it matters: Global investment levels aren't enough to keep Paris Agreement goals alive, even as low-carbon energy finance has surged for years, per the International Energy Agency and other analysts. Driving the news: The IMF this morning released proposals for scaling up private finance in emerging economies. "Public budgets are strained in the wake of the COVID-19 crisis, and borrowing conditions for emerging market sovereigns have tightened," it notes. What they're saying: One theme is the wider use of "innovative" financing instruments like green bonds, and ways to broaden the investor base. - Another point: Multilateral development banks (MDBs) and development finance institutions should place more emphasis on equity over debt finance.

- "[T]heir equity can draw in much larger amounts of private finance," IMF said in a blog post.

- It also says policy tools like more use of carbon pricing and better data disclosure can help guide markets.

Driving the news, part 2: Treasury Secretary Janet Yellen yesterday said the World Bank should overhaul its approach to climate and other "borderless" challenges. - Yellen, in a public critique of MDBs, said banks should further expand beyond traditional country-based lending models.

- Her remarks also call for "greater use of concessional resources, including grants, to fund investments where the benefits are shared more broadly by the world."

Zoom in: One example is aiding middle-income nations' move away from coal. "If the global community benefits from investments in climate, then the global community should help bear the cost." - Treasury also announced a nearly $1 billion U.S. loan to the multilateral Clean Technology Fund.

The intrigue: Yellen's remarks come as the World Bank faces criticism over its climate work and recent comments by president David Malpass. But the bank has been defending its efforts. What's next: Yellen said she'll discuss the ideas at next week's gatherings and join world leaders in urging the bank to quickly develop an "evolution roadmap." 💰💰💰The IMF analysis takes stock of capital needs in emerging markets and developing economies. "Estimates vary, but these economies must collectively invest at least $1 trillion in energy infrastructure by 2030 and $3 trillion to $6 trillion across all sectors per year by 2050 to mitigate climate change." |     | | | | | | 2. Charting the investment ratio |  Data: BloombergNEF; Chart: Tory Lysik/Axios A new report by the research firm BloombergNEF examines the worldwide investment ratio between fossil fuels and low-carbon sources, Ben writes. - It explores how this would need to change under various scenarios for meeting Paris Agreement goals.

Why it matters: The ratio has moved toward sources like renewables over time, but that's just a hint of what's needed. - This year there's almost parity, with a low-carbon-to-fossil ratio of 0.9 to 1, but that would need to change radically under Paris-friendly scenarios.

- "From 2021 to 2030, it reaches roughly 4:1 on average, meaning for each dollar invested in fossil fuel energy supply, four would be invested in low-carbon energy supply."

Check out the report. |     | | | | | | 3. White House stays coy on OPEC+ response |  | | | Illustration: Aïda Amer/Axios | | | | The White House is keeping its cards close to the vest amid a chorus of Beltway calls for aggressive responses to the OPEC+ production cut, Ben writes. Driving the news: There's new Capitol Hill momentum for "NOPEC" legislation that would authorize U.S. anti-trust lawsuits against OPEC members. - Senate Majority Leader Chuck Schumer said yesterday the cut — which has boosted oil prices — shows Saudi Arabia is helping Russia wage war on Ukraine.

- "We are looking at all the legislative tools to best deal with this appalling and deeply cynical action, including the NOPEC bill," he said.

- Meanwhile, some lawmakers are calling for cutting U.S. military support for the Saudis.

Yes, but: White House officials are emphasizing a range of options for seeking to blunt price increases and respond to the Saudis. But they haven't committed to anything beyond signaling plans for more releases from strategic reserves. - At a press briefing Thursday, Brian Deese, director of the National Economic Council, demurred on NOPEC.

- On the market side, he did not take a ban on exporting petroleum products off the table, something the industry opposes and says would not help consumers.

The intrigue: The White House has difficult choices. Bloomberg points out that NOPEC is a "geopolitical Pandora's Box, raising the potential for sweeping, unintended consequences." However, Atlantic Council fellow Thomas S. Warrick, in a blog post, argued the production cuts will backfire on Saudi Arabia. "Democrats in Congress, especially, are likely to remember this in future votes on defense budgets and commitments to Gulf security," he writes. Go deeper: Biden's Choice After OPEC Cuts: Woo Saudi Arabia, or Retaliate? (NYT) |     | | | | | | A message from Global X ETFs | | Build a greener investment portfolio | | |  | | | | Government policies and private sector commitments to combat climate change are driving demand for more sustainable buildings. We recently explored the long-term investment case for companies involved in the development, management and technology powering green buildings. Learn more. | | | | | | 4. Coral reefs' climate problems multiply |  | | | Illustration: Natalie Peeples/Axios | | | | NOAA has released a new plan to tackle a mysterious, plague-like affliction that's decimating coral reef populations off the Florida Keys and throughout the Caribbean, Axios' Ayurella Horn-Muller reports. Why it matters: Some say not enough is being done to address the impacts of stony coral tissue loss disease — which is made worse by climate change — on coral reefs in the Caribbean, where local economies depend on their continued survival. - Much of the broader consequences of the disease — and what even causes it — are still unknown.

- "For coral disease research, we're still kind of in the Dark Ages," Andy Bruckner, research coordinator at the NOAA Florida Keys National Marine Sanctuary, told reporters Wednesday.

Zoom in: From the Bahamas to Grenada, NOAA has identified the disease in 22 Caribbean countries and territories, up from 13 in 2020. - Part of NOAA's plan proposes spending over $36 million on establishing a U.S. Caribbean coral rescue effort.

- The new proposal comes two years after the agency released a strategic plan — and this one has an implementation timeline of five years, throughout which funding must still be secured.

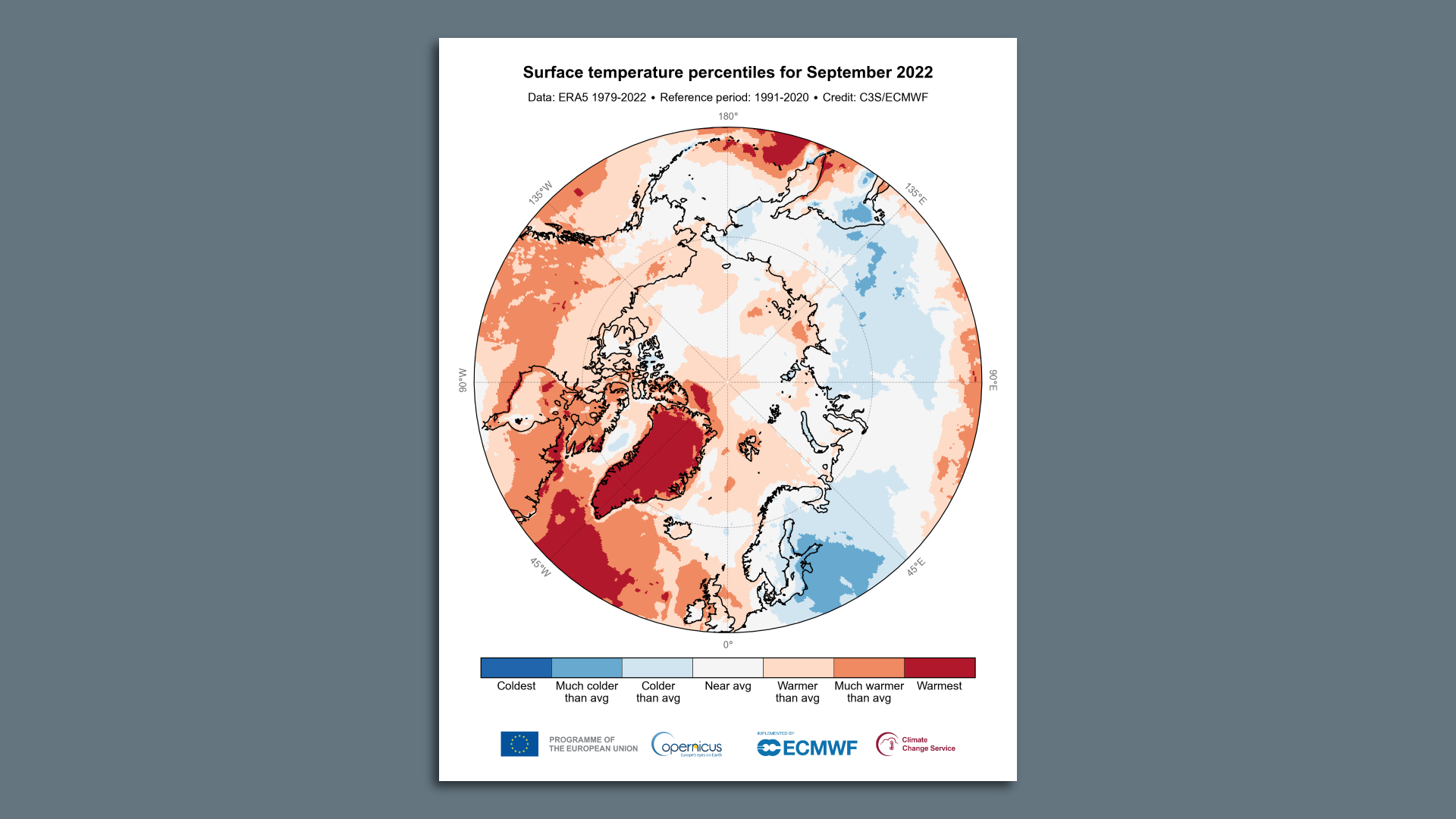

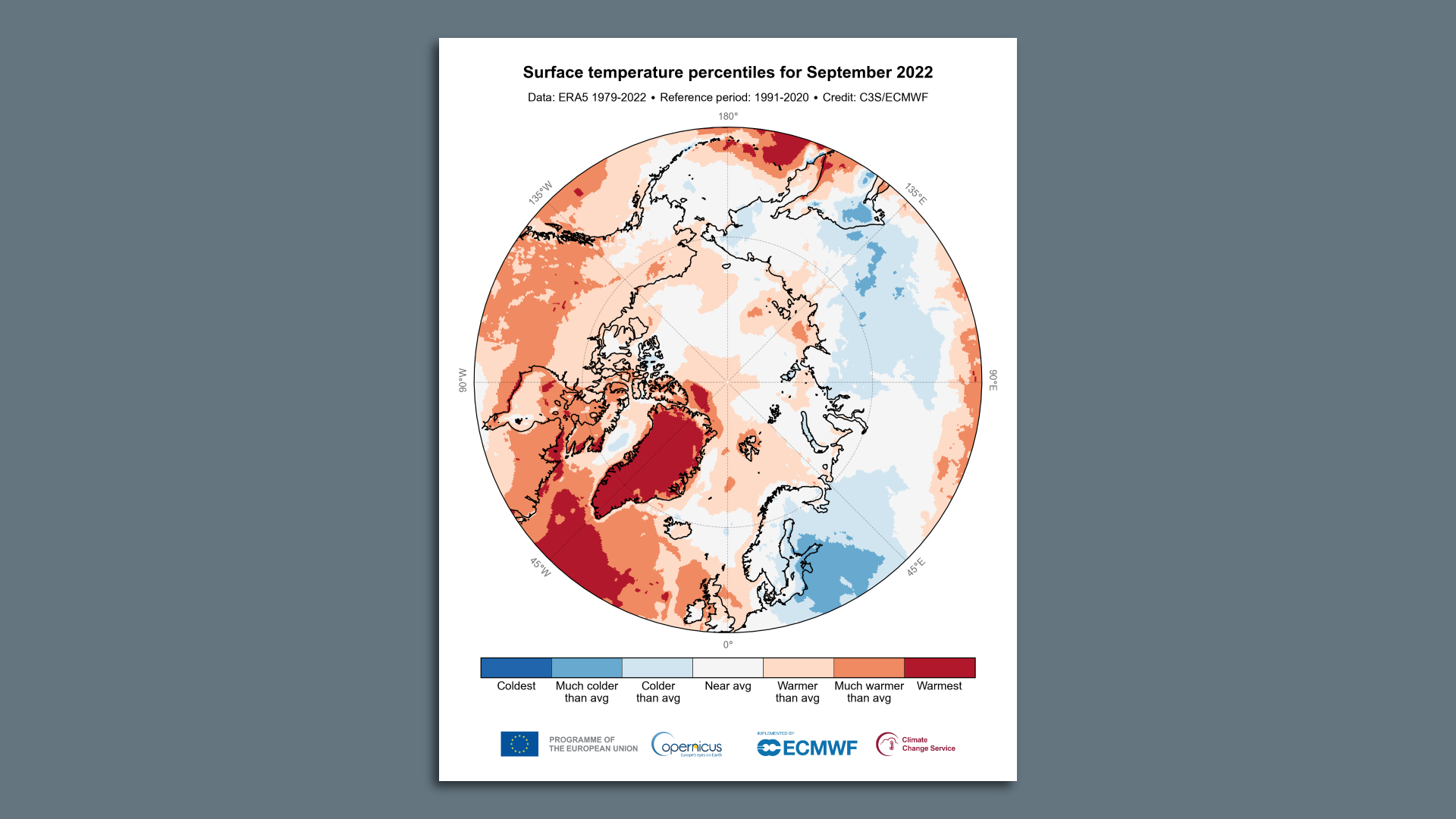

Threat level: Given what's at stake for Caribbean communities already dealing with pollution and climate change wiping out reefs, multiple researchers told Axios that the pace of the disease warrants urgency and intervention. Read the whole story. |     | | | | | | 5. Greenland's extreme September may echo in 2023 |  | | | Average near surface air temperature percentiles for September, with Greenland showing up as "warmest." (Copernicus Climate Change Service) | | | | Greenland's record-warm September may set up the ice sheet for a bigger melt season next year, Andrew writes. The big picture: According to the Copernicus Climate Change Service, a persistent flow of air from the south-southwest transported mild, moisture-laden air across the ice sheet last month. - September started with a record-breaking melt event, with temperatures soaring above freezing even at the top of the ice sheet.

Zoom in: Then, the second surge of mild air, rain and inland snow took place on Sept. 24-25, when ex-Hurricane Fiona, which knocked out power to Puerto Rico and hammered eastern Canada, also brought heavy rain and snow to the Arctic. - During both events, meltwater percolated into the ice sheet and refroze, forming slabs known as lenses.

What's next: These could act to increase meltwater runoff into the ocean during the 2023 melt season, adding to sea level rise, Xavier Fettweis of the University of Liège told Axios. - Fettweis said the rare September warm spells, which also made the snowpack denser, may limit the Greenland ice sheet's ability to retain meltwater.

- "We will see the consequences of this exceptionally warm September month next summer," he told Axios via email.

|     | | | | | | 6. 🏃🏽♀️Catch up fast on biz: Tesla, Munich Re, VC | | 🚛 Tesla CEO Elon Musk said an electric semi-truck is really, finally going into production, with PepsiCo as the first customer. Axios' Rebecca Falconer has more. 🛢️ Insurance behemoth Munich Re announced it will no longer insure or invest in the development of new oil-and-gas fields. Go deeper via Reuters. 🏭 The "green iron" startup Electra raised $85 million from backers including Breakthrough Energy Ventures, Amazon, and mining giant BHP's venture arm. Bloomberg has more. |     | | | | | | A message from Global X ETFs | | Build a greener investment portfolio | | |  | | | | Government policies and private sector commitments to combat climate change are driving demand for more sustainable buildings. We recently explored the long-term investment case for companies involved in the development, management and technology powering green buildings. Learn more. | | | | 📬 Did a friend send you this newsletter? Welcome, please sign up. 🙏Thanks to Mickey Meece and David Nather for edits to today's newsletter. We're off for the holiday Monday, so we'll see you back here Tuesday! |  | | Why stop here? Let's go Pro. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment