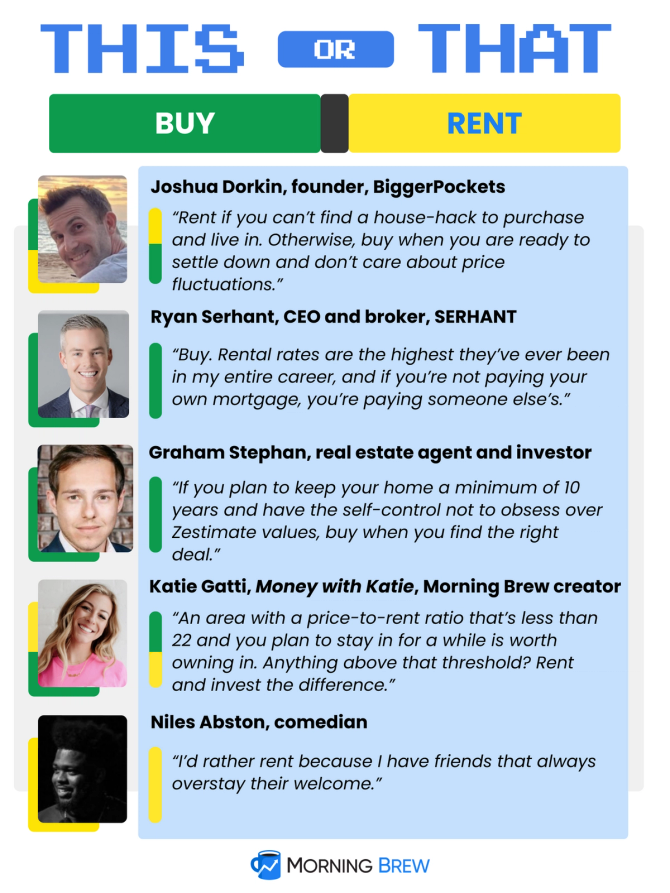

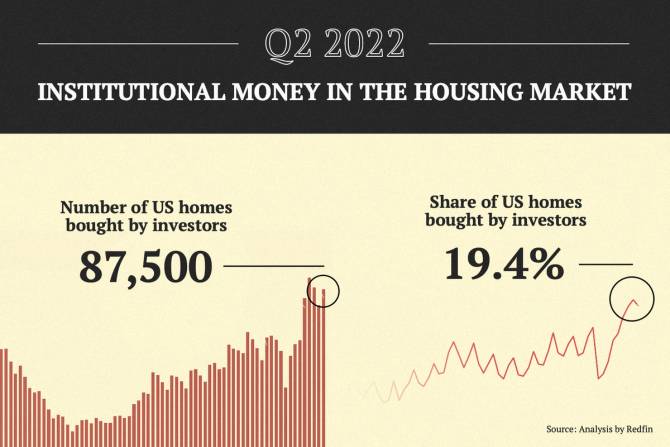

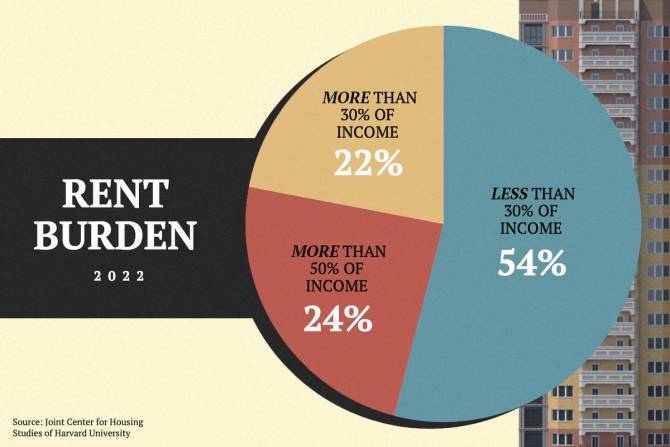

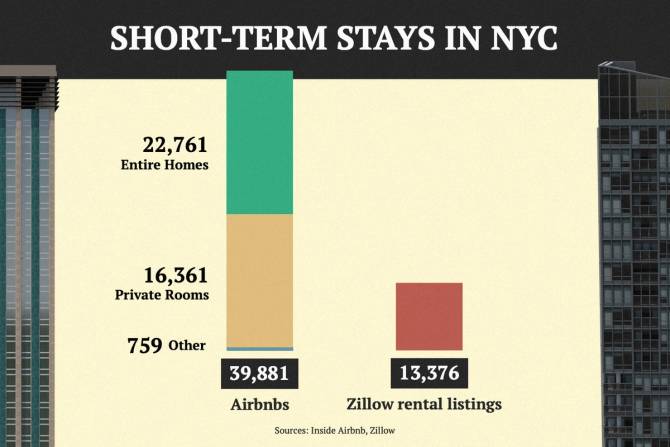

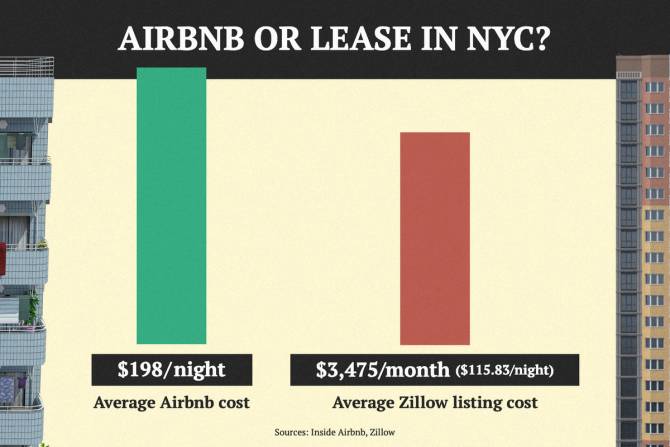

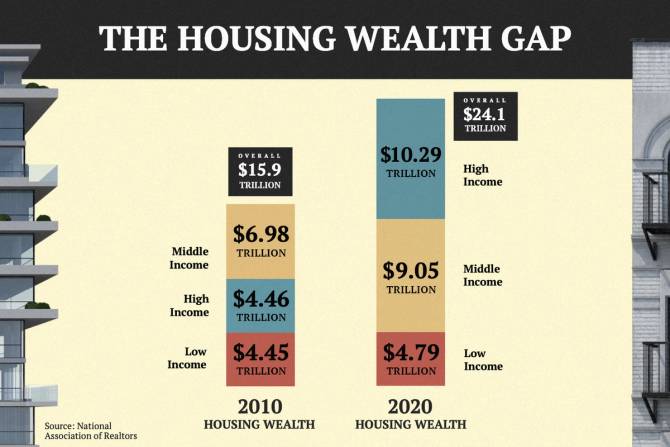

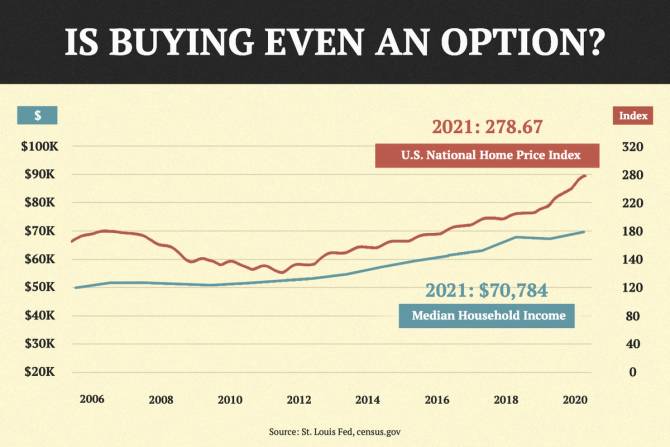

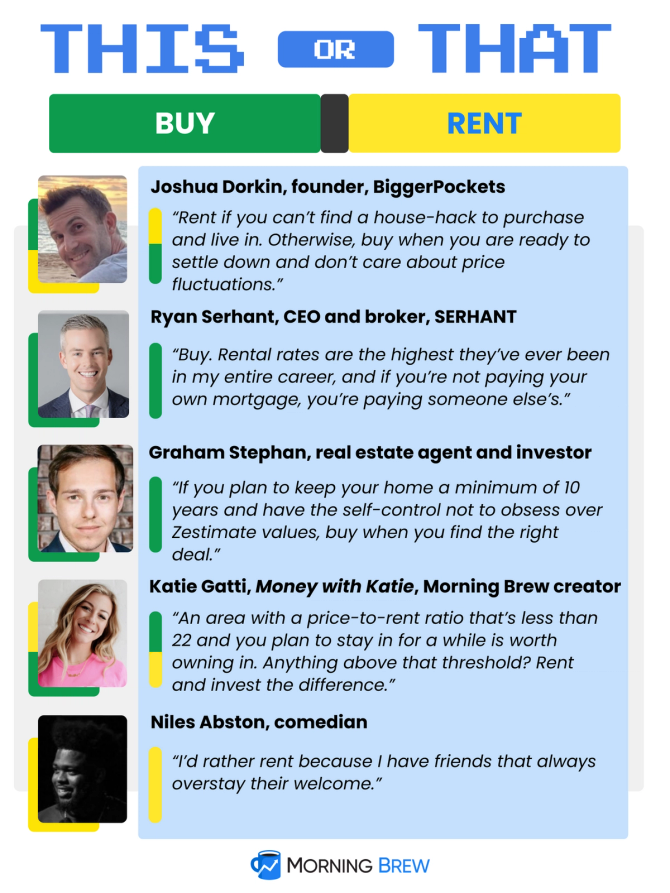

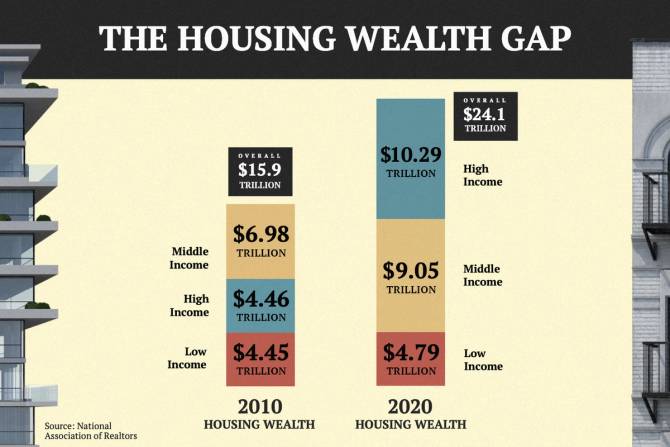

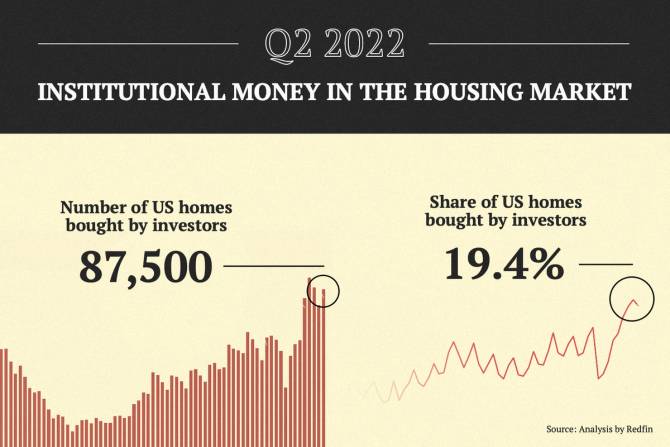

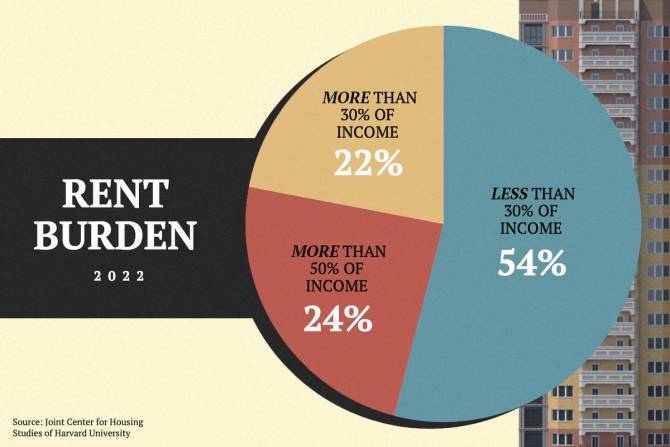

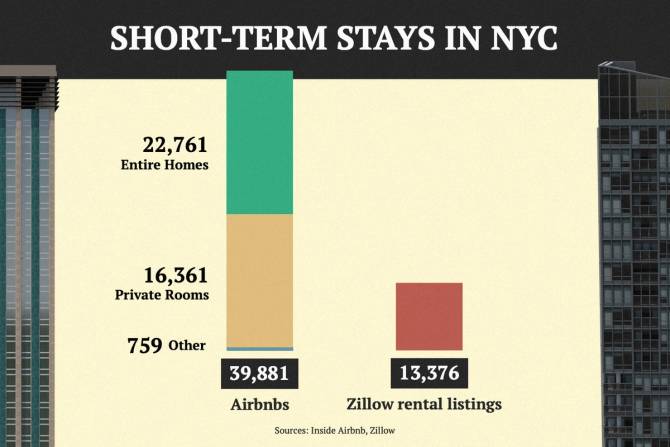

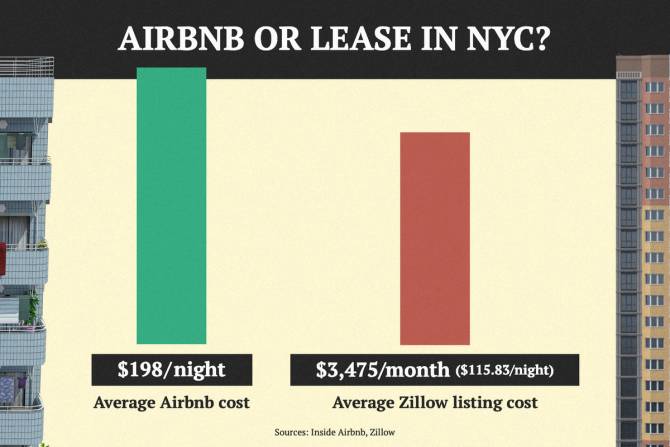

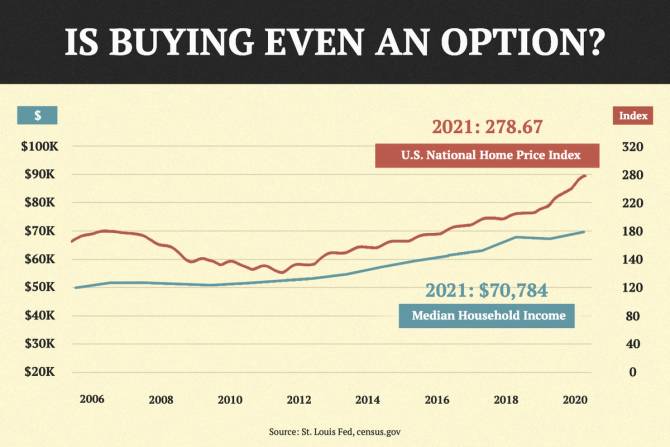

| | | | | |  Francis Scialabba | | IN THIS ISSUE | The state of American real estate | Buyer beware | Selling Tampa's Sharelle Rosado | | | | "I really want to go to the park, but I can't until I'm done with this."—Tariq, aka "Corn Kid," expressing fatigue while talking about corn with the New York Times "btw we have a quiet car  "—Amtrak responding to Southwest Airlines giving their passengers ukuleles and ukulele lessons in partnership with Guitar Center "—Amtrak responding to Southwest Airlines giving their passengers ukuleles and ukulele lessons in partnership with Guitar Center "Why are people doubting me? Don't you know I'm a libra ?"—Cardi B tweeting about people doubting her despite being a Libra | | |  —Sherry Qin | | | At the peak of 2021's homebuying rush, as mortgage rates fell and families fled to the suburbs, buyers went a little crazy securing their dream homes. A prospective buyer in New Jersey offered $75,000 over the asking price and got rejected. Another buyer in Austin, Texas, landed their dream home by buying the seller's next house for them. And in Bethesda, Maryland, a homebuyer got creative and offered to name her first-born child after the seller. (She lost.) But now that the housing market is cooling and inflation is near its 40-year high, three in four recent homebuyers have expressed regrets. They are most remorseful about spending too much money. (And buyers who actually named their baby after the seller probably have regrets of a different kind.) Almost one-third of buyers surveyed recently said they paid over the asking price, with buyers paying a median of $65,000 over the list price. Remorseful buyers are vocal on Reddit forums like r/realestate and r/personalfinance. One Redditor wrote that she bid $30,000 over the asking price and won, but she said she now regrets the decision "daily." Another paid $50,000 over asking and "can't stop looking at housing websites and comparing every little thing side by side" to justify his decision, he wrote in a thread: "Now I feel like a complete idiot." The survey also found that 80% of homebuyers had to compromise on their priorities, including location, square footage, or the spacious walk-in closet they had always longed for. For those who opted for a fixer-upper, they found that the costs of maintenance and repairs were astronomical. Buyer's remorse isn't new or unusual. A 2014 survey also found 80% of homebuyers wanted a do-over. When the butterflies of fulfillment fade a few months after moving in, regrets inevitably surface. That glittering swimming pool that might have seemed like a great idea now eats up time and budget. The stakes for pandemic buyers, however, are a little higher. In July, home prices dropped for the first time in three years. That's good news for some, but could leave buyers who paid well over asking underwater. Plus, the drop won't necessarily make houses more affordable for house-hunters who are on the prowl now: The current average 30-year mortgage rate is 6.29% (and likely to rise), compared to 2.72% in November 2021, which adds hundreds of dollars to monthly payments. Home inventory is increasing, but it's still 43% lower than it was before the pandemic. With all the financial pressure, you may still ink a deal with plenty of regret. But here's the thing: Home values inevitably go up and down, and while your swimming pool might be filled with tears of regret, you can remind yourself of how much money you're saving from record-low mortgage rates. So stop checking your house's value on Redfin and Zillow and Realtor (just us?) and enjoy a swim. — Sherry Qin | | | A Sunday crossword that nods to the news of the week. Play it here. | | | | | We've got news for you: Real estate investing is packed with potential. In our world of economic uncertainty, putting your Benjamins in physical property can be a resilient, rewarding way to grow your bank account over time. But real estate investing is not just a quick kicker. From maintenance costs to tax confusion, it can be a challenge even for headline-grabbing tycoons. Luckily for you, The Motley Fool has the scoop. They've always got their finger on the pulse of the market, and right now they have insight into 5 REITs (real estate investment trusts) that are screaming, "Buy!" Choose The Motley Fool as your real estate correspondent now. | | | | Morning Brew/Grant Thomas Finding a place to live in 2022 hasn't exactly been a breeze. Rents have skyrocketed, and mortgage rates have nearly doubled from their 2020 lows. As any Zillow lurker knows, prices are out of control for those bold enough to consider buying a house. The crisis is particularly hard on low-income renters who have seen an even greater share of their income go to housing and have fewer affordable options. It's also been rough for first-time buyers, even as cities offer assistance programs and banks expand no-down payment mortgage programs. It's not just in big, notoriously expensive cities like New York and San Francisco. Costs are up across the country. After record-low mortgage rates gave more people the chance to buy and eviction moratoriums triggered by the Covid-19 crisis kept struggling households afloat, the tide is turning. Those too-good-to-be-true Covid rent deals are gone, as the average cost of a one-bedroom apartment is up 27% since last year. For buyers, the higher mortgage rates can mean paying an average $600 more a month than homebuyers who scooped up places in 2020 and 2021, when interest rates were hovering around 3%. While low- and middle-income people struggle, the wealth gap is widening. Rent and mortgage payments are devouring the majority of income for many people. According to the Department of Housing and Urban Development, a household is "cost-burdened" if it spends more than 30% of income on housing. In 2020, 30% of households nationwide fit that description. And the rent-or-buy divide is furthering income inequality in America. As landlords rake in rent for overpriced one-bedrooms without dishwashers or views (forget in-unit laundry!), homeowners are still seeing their property values rise and their wealth grow, though that might be slowing down. Investors are finding the world's largest asset class, residential real estate, extremely attractive as an opportunity for financial returns. That's moving the needle further on who has property and who is left to wonder if they'll ever get the chance to hold a deed. The costs may be peaking. The average home price hit $413,800 in June and fell to $403,800 in July, according to the National Association of Realtors. But even as costs cool, they remain far above last year's averages and still far out of reach of many people. Here are some graphics to illustrate the current conditions of the real estate market for both prospective renters and homeowners. You'll see why it's so attractive to operate an Airbnb in New York, and how the housing wealth gap is widening the gap between those who have keys and those who do not. Plus, we'll show you a new type of landlord. Corporations are becoming the most likely landlord.  Lots of people are paying too much in rent.  There are more short-term rentals in New York than available leases  ...and they can make more money.  The housing wealth gap has widened, with high-income owners gaining 71% of the housing wealth increase from 2010 to 2020.  Morning Brew/Grant Thomas Morning Brew/Grant ThomasBuy vs. rent? Well...  —Amanda Hoover & Ashwin Rodrigues, Illustrations by Grant Thomas | | | Broomvector Sharelle Rosado is a former US Army paratrooper and a current real estate powerhouse. In 2019—the same year she retired from the military—Rosado founded Allure Realty, a Black-owned, all-women luxury real estate company. After Rosado strategically slid into the DMs of the executive producer of the hit reality show Selling Sunset, Allure Realty got its own show, Selling Tampa. It's streaming now on Netflix. What's the best advice you ever received? Don't wait around for things to happen—go out and make them happen. Whether you win or fail, at least you attempted it. What's the most embarrassing song you'll admit to liking publicly? Some of those Disney songs from the movies. When you have kids, especially little ones running around the house, you tend to get those Disney songs stuck in your head. Who wouldn't?! What fictional person do you wish were real? Superwoman! I think it would be awesome for someone like that to be real. Although I think all women are superwomen! Wouldn't it be amazing for an actual superhero to be real?! What real person do you wish were fictional? That's a hard question 'cause there's so many! I think it's probably best if I keep that one to myself. Let's just say A LOT of people wish this person was fictional. Next question, please! How would you explain TikTok to your great-grandparents? It's a fun social media app that lets you watch funny, interesting, and bingeworthy content. I always find that when I'm on there, I keep scrolling and scrolling. Next thing you know, it's been an hour! What always makes you laugh? My kids are always making me laugh! From just the normal everyday comments they make to the TikToks they try to create in the kitchen while I'm making dinner. Especially my son, Denim. He's a whole character and always is doing things that make me crack up. If you were given a billboard in Times Square, what would you put on it? I would put myself and my team of amazing superstar agents! I love helping others and showcasing others, so I would love to see it for them and for my company, Allure Realty! —Interview by Ashwin Rodrigues

| | | | | | Think outside the investment property. There's more than one way to invest in real estate. Don't have the cash (or risk appetite) for an entire property? REITs let everyday investors get in on a larger portfolio of properties. Check out The Motley Fool's top 5 REIT picks under $49 right here. | | | | How much to expect (to pay) when expecting: The costs of giving birth in the US can be astronomical, even though under the Affordable Care Act most birth-related charges should be covered by health insurance. Our pals at Money Scoop explain why that is. [Money Scoop] "No tech for apartheid": Another day, another scandal for Big Tech. Google and Amazon are facing new protests over contracts with the Israeli government and military, which employees say will enable the further surveillance of Palestinians. The worker-led protests focused on Project Nimbus: Amazon and Google's joint $1.2 billion, multiyear contract with the Israeli government to provide cloud computing services (including AI tools), build data centers, and set up other cloud infrastructure. [Emerging Tech Brew] iPhone, therefore I am: Even though my iPhone 11 Pro works perfectly fine, some people might judge me for not upgrading to Apple's latest, slightly tweaked, offering. Nearly one out of three iPhone users thinks a new phone is a "necessity," while one out of five thinks that not having the latest phone is a sign that someone is struggling financially. The ghost of Steve Jobs is gleefully rubbing his hands together in delight. [Retail Brew] From boring to billions: Nora chats with Eric Ryan, serial entrepreneur and co-founder of Method, OLLY, Welly, and Cast, about building brands and disrupting DTC industries that are perceived as overly complicated or stagnant. [Business Casual] The best thing we read this week: If you're asking yourself why movies like Schindler's List make you feel absolutely nothing while watching Adam Sandler in a fat suit break out of a futuristic hospital to tell his son that "family comes first" makes you have a lot of feelings, then you have to read this. Why exactly does Adam Sandler's masterpiece Click make so many men cry? Someone is finally brave enough to explain the phenomenon. [Gawker] Stay the course: Not ready for real estate investing? Keep growing your wealth with long-term picks from The Motley Fool. Peep the latest "Double Down" recs when you sign up for Stock Advisor today.* *This is sponsored advertising content. | | |  —Amanda Hoover |  | Written by Rohan Anthony, Stassa Edwards, Amanda Hoover, Sherry Qin, Ashwin Rodrigues, and Holly Van Leuven Was this email forwarded to you? Sign up here WANT MORE BREW? Industry news, with a sense of humor → - CFO Brew: your go-to source for global finance insights

- Emerging Tech Brew: AI, crypto, space, autonomous vehicles, and more

- Future Social: the Brew's take on the world of social media

- Healthcare Brew: the comprehensive industry guide for administrators, medical professionals, and more

- HR Brew: analysis of the employee-employer relationship

- IT Brew: moving business forward; innovation analysis for the CTO, CIO & every IT pro in-between

- Marketing Brew: the buzziest happenings in marketing and advertising

- Retail Brew: retail trends from DTC to "buy now, pay later"

Tips for smarter living →  Podcasts → Business Casual, Founder's Journal, Imposters, and The Money with Katie Show Podcasts → Business Casual, Founder's Journal, Imposters, and The Money with Katie Show  YouTube YouTube Accelerate Your Career with our Courses → | ADVERTISE // CAREERS // SHOP // FAQ

Update your email preferences or unsubscribe here.

View our privacy policy here.

Copyright © 2022 Morning Brew. All rights reserved.

22 W 19th St, 4th Floor, New York, NY 10011 | | |

No comments:

Post a Comment