| | | | | | | Presented By Q.ai | | | | Axios What's Next | | By Joann Muller, Jennifer A. Kingson and Alex Fitzpatrick · Aug 02, 2022 | | "You don't have to own a boat," goes the old bit of money advice. "You just have to be friends with someone who does." But as Joann reports today, you may be in luck even if your friends are just as boatless as you. Today's Smart Brevity count: 1,068 words ... 4 minutes. | | | | | | 1 big thing: The summer of sharing |  | | | Illustration: Sarah Grillo/Axios | | | | It's the summer of sharing, as people seeking a taste of the luxe lifestyle book everything from boats to swimming pools on flourishing, Airbnb-style rental marketplaces, Joann Muller reports. Why it matters: People can increasingly rent the lifestyle they desire for a fraction of the cost of ownership. That's created a cottage industry for entrepreneurs to manage their own mini-fleets of rental cars, boats or homes for listing. The big picture: Fifteen years after Airbnb debuted as a cheap hotel alternative, peer-to-peer sharing is established in our culture. You can now rent someone else's home, car, swimming pool, backyard, private tennis court and more. - Pool-sharing site Swimply, for example, has boomed amid the pandemic. It has hosted more than 150,000 bookings on its platform this year, up from just 800 in 2019, a spokeswoman says. It's now planning to add tennis courts, private gyms and more.

- Explore Eden is building an online marketplace to connect campers with private landowners.

Driving the news: Miami-based Boatsetter this week raised $38 million to expand its business, which counts 50,000 boat listings in 700 locations worldwide and aims to reinvent the $60 billion boating industry. Details: Boatsetter, co-founded in 2014, matches boat owners with people who want to get out on the water. - Users can rent boats by the hour or day — or grab yachts for longer luxury vacations.

- Inexperienced boaters can hire licensed captains.

Of note: Unlike other watercraft rental companies, Boatsetter is the first to offer peer-to-peer boat rental insurance, says Jaclyn Baumgarten, co-founder and CEO. What we're seeing: Peer-to-peer sharing is becoming more professional and less about earning a little extra cash to offset the cost of your car or boat. - One Miami-based captain, for example, lists six boats for rent on Boatsetter and nets about $100,000 annually from her charter business, says Baumgarten.

- The same is happening at peer-to-peer car rental site Turo, where one Miami entrepreneur lists 22 vehicles for rent, often packaging them with Airbnb properties he also manages. He told Axios he can pocket a $30,000 profit in a good month.

A different business model comes from Kindred, a members-only home-swapping network that started among a group of friends seeking a change of scenery for remote work during the pandemic. - It's a "give-to-get" model: You earn points toward booking a place by renting out your own home.

- Membership is $300 a year, and entitles you to rent other members' homes for about $30 a night — far below a typical hotel or Airbnb. Longer stays are cheaper, and cleaning costs are extra.

The catch: You have to be "accepted" as a member as Kindred matches supply and demand. Right now, Kindred lists over 500 homes across 20 U.S. cities. The bottom line: What's mine is yours — for a fee — in the new sharing economy. Share this story. |     | | | | | | 2. Why EVs are stuck in the slow lane — for now |  | | | Illustration: Sarah Grillo/Axios | | | | Electric vehicles are poised for their biggest policy boost in U.S. history — yet plenty of barriers are slowing widespread adoption, Axios' Ben German reports. Why it matters: EVs are a key tool for cutting carbon from transportation, the largest source of U.S. planet-warming emissions. Where it stands: Electric cars made up almost 6% of U.S. passenger vehicle sales in the first quarter, but they remain under 1% of the country's overall auto fleet. Here's what's in the way of faster adoption: Sticker prices: The average EV in June cost nearly $67,000 — well above the average gas-powered car. Availability: While automakers are ramping up output and rolling out new models, EVs remain relatively scarce, and buyers often have long wait times. Acceptance and education: Surveys show lots of consumers are at least EV-curious, but taking the plunge can be another matter. Charging access: Drivers' confidence that they can find plenty of places to charge up — and quickly — is key. The power of incumbency: People don't buy cars very often! Read the rest. |     | | | | | | 3. E-bike startup Bolts without a trace |  | | | Illustration: Brendan Lynch/Axios | | | | Miami-based e-bike sharing startup Bolt Mobility has unexpectedly slammed the brakes in several markets, TechCrunch reports. Details: Bolt has "stopped operating in at least six U.S. cities," including Portland, Oregon; Burlington, Vermont; and Richmond, Virginia. - One city official told TechCrunch that Bolt's bikes sit dead and abandoned.

Why it matters: As venture capital money dries up in the face of economic uncertainty, micromobility companies may be among the early casualties — potentially creating big headaches for the cities where they operate. What they're saying: "All of our contacts at Bolt ... have gone radio silent and have not replied to our emails," a Burlington, Vermont, official told TechCrunch. - Bolt did not respond to Axios' request for comment.

The backstory: Back in 2018, cities across China were inundated with unused two-wheelers as a glut of bike-sharing supply triggered a market crash. Yes, but: One snafu does not a trend make — yet. |     | | | | | | A message from Q.ai | | Get a $100 bonus when you start investing like a pro | | |  | | | | Q.ai lets you invest like a pro — for free. Just open an account and pick an investing theme or themes. Leave the rest to the award-winning AI, which will continuously manage risk for you. Even better: Double your investment. Deposit $100 or more and get a $100 sign-up bonus. Get started today. | | | | | | 4. No quick fix for chips |  | | | Illustration: Sarah Grillo/Axios | | | | The billions in funding Congress approved last week to boost domestic production of computer chips will take years to make a dent in the problems at hand, Axios' Margaret Harding McGill reports. Why it matters: Computer chips are vital for everything from phones to cars to gaming consoles, but demand is outpacing supply — if you're having trouble getting something you want right now, the chip shortage may be to blame. The details: The bill includes $52.7 billion in semiconductor industry funding, among other provisions. Yes, but: It can take three to five years to build new semiconductor manufacturing facilities, known as "fabs." The big picture: Rather than solving short-term problems, the bill is meant to entice companies to invest on American soil to avert future supply-chain snafus. Read the rest. |     | | | | | | 5. Protip: How to spot fake reviews |  | | | Illustration: Aïda Amer/Axios | | | | Following-up her recent story about the cost of fake online reviews, Axios' Emily Peck collected some tips on spotting fraudulent feedback. Why it matters: It turns out spotting a fake review is harder than you'd think. But there are things you can do, including... - Consider the source: Be skeptical of reviews on a brand's website, where they've likely curated the responses, one expert told Emily.

- Check the dates: If there's a cluster of positive reviews posted in a relatively short amount of time, that's a sign something shady is going on. Maybe there's a Facebook campaign promising "reviewers" free stuff if they post a rating, for instance.

- Five stars, red flag: If a business has all five-star reviews, or if a five-star review directly follows a negative review, that's a bad sign, said another expert.

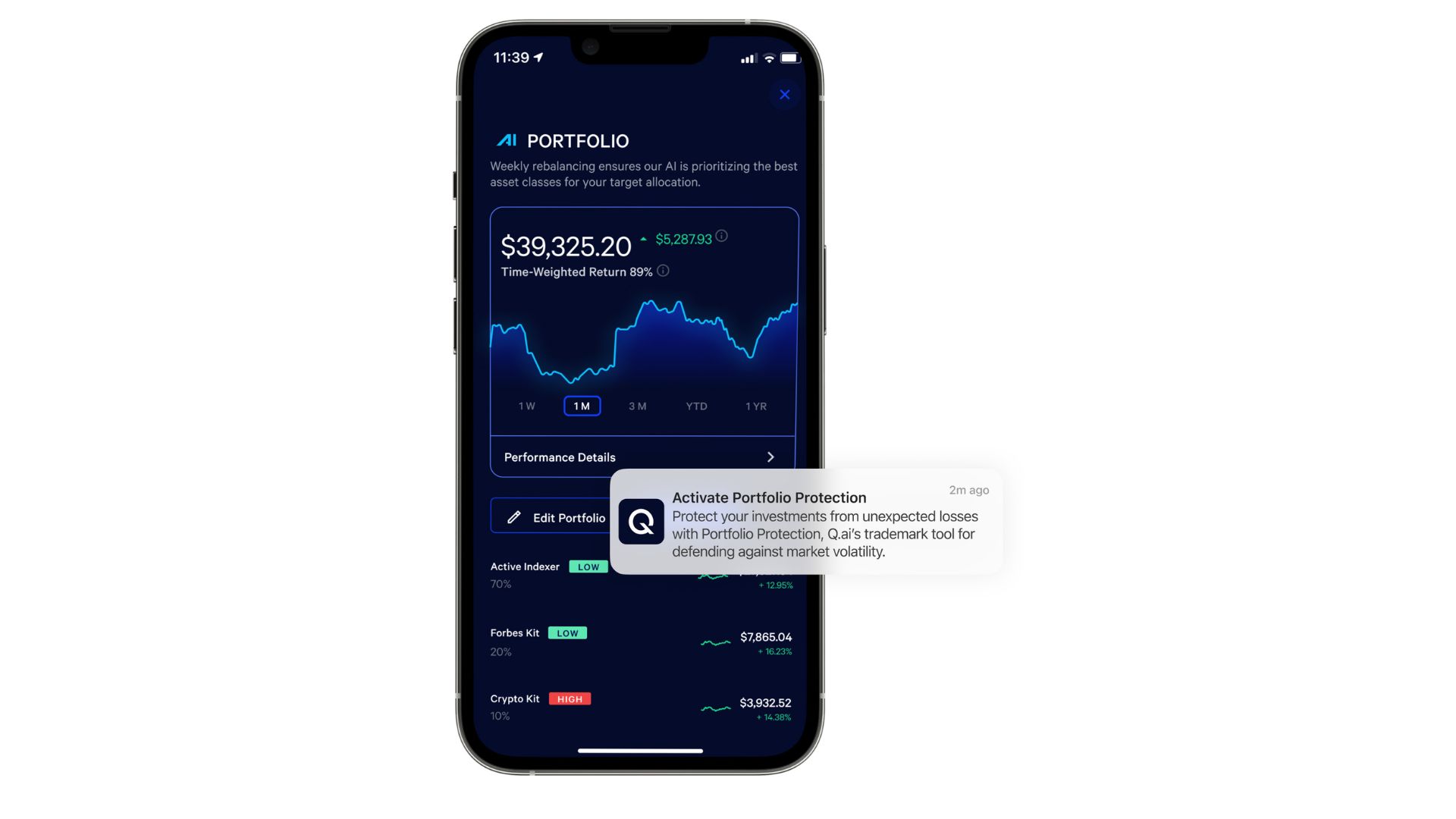

Read the rest. |     | | | | | | A message from Q.ai | | Let Q.ai's AI help you build wealth | | |  | | | | You use AI every day— your phone, voice assistant and even car. Why not use it to make smarter investment decisions? Q.ai uses AI to constantly monitor and manage investment portfolios, keeping them balanced and offsetting inevitable risks. Even better: Get a $100 bonus when you deposit $100. | | | | A hearty thanks to What's Next copy editor Amy Stern. Was this email forwarded to you? Get your daily dose of What's Next magic by signing up here for our free newsletter. |  | | Are you a fan of this email format? It's called Smart Brevity®. Over 300 orgs use it — in a tool called Axios HQ — to drive productivity with clearer workplace communications. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment