| | | | | | | | | | | Axios Pro Rata | | By Dan Primack · Jul 06, 2022 | | | | | | Top of the Morning |  | | | Illustration: Aïda Amer/Axios | | | | Authentic Brands Group and Bolt Financial have kissed and made up, announcing this morning that they've settled the breach of contract lawsuit brought by ABG earlier this year. Why it matters: The e-commerce market is too challenged right now for strategic partners to be fighting each other, rather than trying to protect their businesses. Backstory: ABG had hired Bolt to apply its one-stop checkout technology to brands like Lucky and Forever 21, with terms stating that ABG could get a 5% equity stake in Bolt were certain gross transaction volumes reached. - In its suit, ABG alleged the software was delivered late, and that Bolt improperly changed the terms of the GMV threshold needed to exercise the warrants.

- Bolt was most recently valued by VCs at $11 billion, although it's since changed CEOs and laid off around one-third of its workforce.

What to know: The companies say that NYSE-listed ABG does now become a Bolt shareholder, without disclosing specific percentages. - Bolt CEO Maju Kuruvilla, however, suggested to me last night that the figure falls short of 5% to which ABG was originally entitled.

- "If we wanted to give what they asked, there wouldn't have been a lawsuit," said Kuruvilla, who took over in late January from controversial founder Ryan Breslow (who's now Bolt's executive chair). "Clearly there was a settlement which makes sense for both sides."

- ABG and Bolt will continue to work together on the Lucky and Forever 21 brands, and possibly other ABG brands going forward.

Balance sheet: Kuruvilla also said that Bolt has nearly three years of cash runway, and that onetime plans to raise new funding at a $14 billion valuation have been put on indefinite hold. The bottom line: Bolt still has a ton of challenges ahead, as it seeks to validate that $11 billion valuation. But battling in court with one of its highest-profile customers is no longer one of them. |     | | | | | | The BFD |  | | | Illustration: Sarah Grillo/Axios | | | | Providence Equity Partners committed up to $500 million in equity to help form The North Road Co., a new global content studio led by Peter Chernin. Why it's the BFD: This reflects growing private equity interest in independent production companies, which can get paid upfront by distributors via licensing deals. So long as streamers keep searching for original content, we'll keep seeing more of these deals. Details: North Road will combine three existing studios: Chernin Entertainment ("The Greatest Showman," "Ford v Ferrari"), the U.S. assets of Red Arrow Studios ("Love is Blind") and Words + Pictures. - North Road secured $300 million in debt financing from Apollo Global Management, in addition to the Providence investment. A source tells Axios that the Red Arrow purchase was valued at around $180 million (4.9x EBITDA).

The bottom line: "North Road launches with a huge set of intellectual property and a team of seasoned executives, making it pretty formidable." — Sara Fischer, Axios |     | | | | | | Venture Capital Deals | | 🚑 ClinChoice, a Chinese contract research organization, raised $150m in Series E funding. Legend Capital led, and was joined by Taikang Life Insurance, Sherpa Healthcare Partners and insiders including Lilly Asia Ventures and Apricot Capital. http://axios.link/YOZn 🚑 WeDoctor, a Chinese digital hospital, raised more than $150m in funding led by a state-backed industrial investment fund in eastern Shandong province. Return backers include Sequoia China, CIC Capital, AIA Group and Tencent. http://axios.link/2yjZ • Flexe, a Seattle-based programmatic logistics firm for retailers and brands, raised $119m in Series D funding at a post-money valuation north of $1b. BlackRock was joined by insiders Activate Capital, Madrona Ventures, Prologis Ventures, Redpoint Ventures, T. Rowe Price and Tiger Global. www.flexe.com • Swimlane, a Boulder, Colorado-based low-code security automation startup, raised $70m. Activate Capital led, and was joined by insiders Energy Impact Partners and 3Lines VC. www.swimlane.com • YAP, a UAE-based neobank, raised $41m from Aljazira Capital, Abu Dawood Group, Astra Group and Audacia Capital. http://axios.link/mdIz • Sharebite, a New York-based corporate food delivery platform, raised $39m in Series B funding. Prosus led, and was joined by Fiserv and Contour Venture Partners. http://axios.link/TpKA • Celus, a German AI startup focused on circuit board engineering, raised €25m in Series A funding. Earlybird VC led, and was joined by DI Capital and insiders Speedinvest and Plug and Play. www.celus.io • Rebellions, a South Korean AI chipmaker, raised $22.8m in Series A extension funding from KT. http://axios.link/oW7T • BKN301, a San Marino-based banking-as-a-service startup, raised €15m in Series A funding. Abalone Group led, and was joined by PayU, Azimut Digitech Fund, CRIF and GNB Swiss Investments. http://axios.link/fBtf • Finalis, a New York-based broker-dealer platform for dealmakers, raised $10.7m in seed funding from ANIMO Ventures, Chaac Ventures, Ulu Ventures, Tribe Capital and The Fund. www.finalis.com • Cauldron, a London-based web3 gaming startup, raised $6.6m, per TechCrunch. Cherry Ventures led, and was joined by Cassius, Seedcamp and Playfair. http://axios.link/HMXY • APFusion, a Champagne, Ill.-based B2B marketplace for the auto salvage market, raised $6.5m in seed funding. Left Lane Capital and Bedrock Capital co-led, and were joined by insider M25. www.apfusion.com • Xelix, a London-based accounts payable solution, raised $5m. Fintop Capital led and was joined by Passion Capital and Localglobe. www.xelix.com |     | | | | | | A message from Axios | | What matters this year in VC, PE and M&A | | |  | | | | What's new: The latest Axios Pro industry report is here. Learn what's moving markets and driving valuations across Health Tech, Fintech, Retail, Climate, and Media. Download the report. | | | | | | Private Equity Deals | | ⚡ Actis acquired a stake in Omega Energia, a listed Brazilian renewable energy generation company. www.omegaenergia.com.br • AnaCap Financial Partners invested in pfs, a Madrid-based provider of software and tech risk lifecycle management solutions. www.pfsgroup.es • FTV Capital invested $75m for a minority stake in DataArt, a New York-based custom enterprise software developer. www.dataart.com 🚑 Gilde Healthcare acquired a majority stake in Chr. Diener, a German contract manufacturer of surgical devices. http://axios.link/SOy4 ⚡ New Fortress Energy (Nasdaq: NFE) formed a liquefied natural gas joint venture with Apollo Global Management, and sold 11 LNG vessels and storage facilities to the JV for $2b. http://axios.link/Bjtn • Repairify, a Plano, Texas-based portfolio company of Kinderhook Industries, acquired Automotive Training Group, a technical training company that offers both live and virtual classes. • Sycamore Partners bought Goddard Systems, franchisor of The Goddard School, from Wind River Holdings. www.goddardschoolfranchise.com |     | | | | | | SPAC Stuff | | 🍞 Panera Bread, the quick-serve chain bought by JAB Holding for $7.5b in 2017, said its investment agreement had expired with restaurateur Danny Meyer and his USHG Acquisition Corp. (NYSE: HUGS) SPAC. - USHG last year agreed to an unusual deal through which it would have invested in Panera's IPO, rather than acquiring Panera via reverse merger. That IPO hasn't yet occurred, and Meyer says that USHG will seek out a new target.

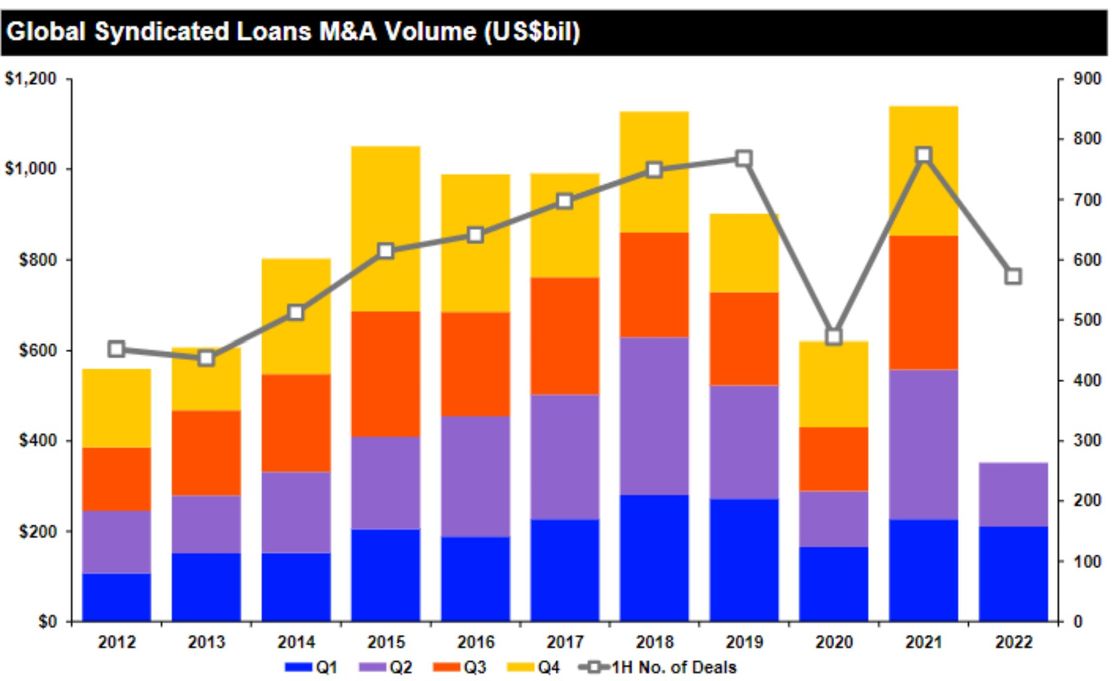

|     | | | | | | Liquidity Events | | ⚡ Apollo Global Management and Blackstone Credit are seeking a buyer for Canadian oil and gas producer Ridgeback Resources, which could fetch more than C$1b, per Reuters. http://axios.link/5Y36 • Nexo, a Swiss crypto lender, entered exclusive talks to buy troubled Singapore-based rival Vauld, which last year raised $25m in a Series A round led by Valar Ventures. http://axios.link/o3gl |     | | | | | | More M&A | | • Amazon (Nasdaq: AMZN) signed an option to acquire a 2% equity stake in Grubhub, as part of a strategic partnership. Current Grubhub owner Just East Takeaway (Ams: TKWY) has been exploring a sale of the business, which it acquired just last year for $7.3b. http://axios.link/eqCo ⚡ Germany's government may acquire a stake in Uniper, an energy utility that is the country's largest buyer of Russian gas, per Handelsblatt. http://axios.link/tjwD 🚑 One Medical (Nasdaq: ONEM), an SF-based primary care platform with a $2b market cap, is reviewing options after receiving takeover interest, per Bloomberg. http://axios.link/xQbb • Sports talk: The NFL's Seattle Seahawks and the NBA's Portland Trail Blazers eventually will be for sale, but not right now. That's according to Jody Allen, who oversees the trust that has owned the teams since her brother Paul's death. http://axios.link/GGq6 |     | | | | | | Fundraising | | • Armen is targeting €400m for its debut fund with a €500m hard cap, per PE International. The European PE firm was founded by Thierry Baudon (ex-Mid Europa Partners), Dominique Gaillard (Ardian) and Laurent Bénard (Capza). http://axios.link/7HST 🚑 Telegraph Hill Partners, an SF-based VC and growth equity firm focused on health tech and life sciences, raised $525m for its fifth fund. www.thpartners.net |     | | | | | | It's Personnel | | • Peter Morrow has left Sycamore Partners, the retail-focused private equity firm he co-founded in 2011, per Buyouts. http://axios.link/enDQ • Jérome Joaug, a venture partner with Aster Capital, joined British climate VC firm Carbon13 as an entrepreneur-in-residence. www.carbonthirteen.com • Pantera Capital hired former JPMorgan banker Samir Shah as COO. http://axios.link/ZFlV |     | | | | | | Final Numbers | | Global M&A activity fell 21% in the first half of 2022, but acquisition-related financing tumbled even further — down 37% to $279 billion, per Refinitiv. |     | | | | | | A message from Axios | | What matters this year in VC, PE and M&A | | |  | | | | What's new: The latest Axios Pro industry report is here. Learn what's moving markets and driving valuations across Health Tech, Fintech, Retail, Climate, and Media. Download the report. | | | | ✔️ Thanks for reading Axios Pro Rata! Please ask your friends, colleagues and TV producers to sign up. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment