| | | | | | | | | | | Axios Markets | | By Emily Peck and Matt Phillips · Jun 09, 2022 | | ☀️ Good morning! We'll get into some weird job offer behavior today, recession angst, and check-in with two important regulators, Lina Khan and Gary Gensler. Let's go. Today's newsletter, edited by Kate Marino, is 1,093 words, 4.5 minutes. | | | | | | 1 big thing: Just kidding on that job offer |  | | | Illustration: Annelise Capossela/Axios | | | | Before accepting a job at Twitter, 23-year-old Iris Guo turned down five other offers, Emily writes. - Twitter paid well — $180,000 a year including bonuses and equity — and it's a well-established public company. What could go wrong?

A lot: Late last month, Twitter pulled the rug out, rescinding Guo's offer for an associate product manager role, along with a handful of others. "You wouldn't expect a big company to do something like that," Guo, who graduated from college in December, tells Axios. Why it matters: Tech companies are hitting the brakes on record levels of hiring over the past two years. - The pullback is happening so fast that instead of the usual mix of layoffs and slower backfills, employers like Coinbase, Redfin, Twitter and some startups are rescinding lucrative job offers — a practice last seen used during the financial crisis.

- It is a surprising twist, coming at a time of record unemployment and labor shortages, showcasing the economy's current weirdness and fast-changing nature.

State of play: This is a trend picking up speed, as more leaders are seeing rescission as a feasible strategy, says Erin Grau, co-founder of Charter, a media and services company focused on the future of work. - HR leaders are now looking at this as a cost-cutting strategy, she says. "A lot of people who never thought this was an option, it has now become an option."

Besides being disappointing and frustrating for those suddenly without jobs — it's also a bad look for the companies. - "It's totally embarrassing and going to damage your employer brand long term, eroding trust with candidates and current employees, too," Grau says.

Yes, but: Rescinding job offers is better than layoffs, experts say, and a way to quickly reduce what is often a tech company's top operating cost — payroll. - Twitter and Coinbase are paying severance to those whose job offers they rescinded. "Better than nothing, for sure," says Guo.

- One product manager who saw his $300,000 a year role at Coinbase vanish, tells Axios he almost would've preferred a layoff. "At least I would have [Coinbase] on my resume," he says. He's now scrambling to get his old job back and get out of his agreement to rent a new apartment — since he no longer needs to relocate.

The bottom line: This is a bummer, but it's a phenomenon so far mostly confined to tech and mostly for roles that pay extremely well. Given the relative health of the job market, these workers will likely get snapped up fast — though the market is weird, as I said. - Guo says she has an offer from a startup she rejected in favor of Twitter. "I wish I had chose [that company] at the time."

Go deeper. |     | | | | | | 2. Catch up quick | | 🛢 U.S. and allies meet to try to restrain global oil prices. (WSJ) 🐦 Twitter plans shareholder vote by August for Musk takeover bid. (Reuters) ⚓️ Texas LNG plant explosion temporarily halts about 20% of U.S. gas shipments abroad. (Bloomberg) |     | | | | | | 3. Recession angst, explained |  | | | Illustration: Allie Carl/Axios | | | | The pressure households feel from decades-high inflation is tainting their view of a strong economy — and heightening recession angst, Axios' Courtenay Brown writes. Why it matters: This is the challenge for the Biden administration, which has gone to great lengths to tout the booming labor market. But stubborn inflation may trump all. A recent YouGov poll found that a majority of Republicans (70%) and a sizable share of Democrats (40%) think the U.S. is currently in a recession. - Respondents who said they had the hardest time affording gas, food, car payments or rent were most likely to believe the country is in a recession.

Where it stands: The official recession arbiters have not formally declared a downward shift in the business cycle. In fact, the chances they will seem slim, at least for now, with key indicators pointing to a healthy economy. The good: The economy has added jobs at an eye-popping pace of 400,000 per month in the last three months. Job openings are near record-highs, and layoffs are at all-time lows. Spending is strong as consumers indulge more on services. The bad: Real wages are down, and purchasing power is compressing. That squeezes lower-income households especially, those who spend a disproportionate share of their income on what keeps getting more expensive: energy and food. The bottom line: Inflation is showing signs of leveling off. But even as prices stop rising as quickly, consumers will still face high prices — a challenge for the Fed and the Biden administration. |     | | | | | | A message from Axios | | What matters this year in VC, PE and M&A | | |  | | | | What's new: Learn what's moving markets and driving valuations across Health Tech, Fintech, Retail, Climate, and Media. Download the report. | | | | | | 4. FTC's new stance: Litigate, don't negotiate |  | | | Photo illustration: Annelise Capossela. Photo: Saul Loeb/ Getty Images | | | | FTC Chair Lina Khan has a warning for would-be dealmakers: She'll sue to stop anticompetitive mergers rather than negotiate settlements with companies, Axios' Margaret Harding McGill reports. Why it matters: This approach adds a layer of uncertainty for companies with designs on M&A, at a time when inking deals is already getting more difficult — thanks to volatile markets and the rapidly rising cost of debt financing. - Effectively, companies now have to work out for themselves in advance whether they need to sell or spin off parts of their business to win regulators' approval.

In an interview with Axios, Khan said the pattern of companies coming to the FTC with illegal deals and expecting agency staff to spend months working to "fix" them through divestiture or other means is not happening under her watch. - "That is not work that the agency should have to do," Khan said. "That's something that really should be fixed on the front end by parties being on clear notice about what are lawful and unlawful deals."

- Khan said the agency hasn't banned the current approach, in which companies try to meet FTC requirements under the terms of a consent decree. But, she added, "We're going to be focusing our resources on litigating, rather than on settling."

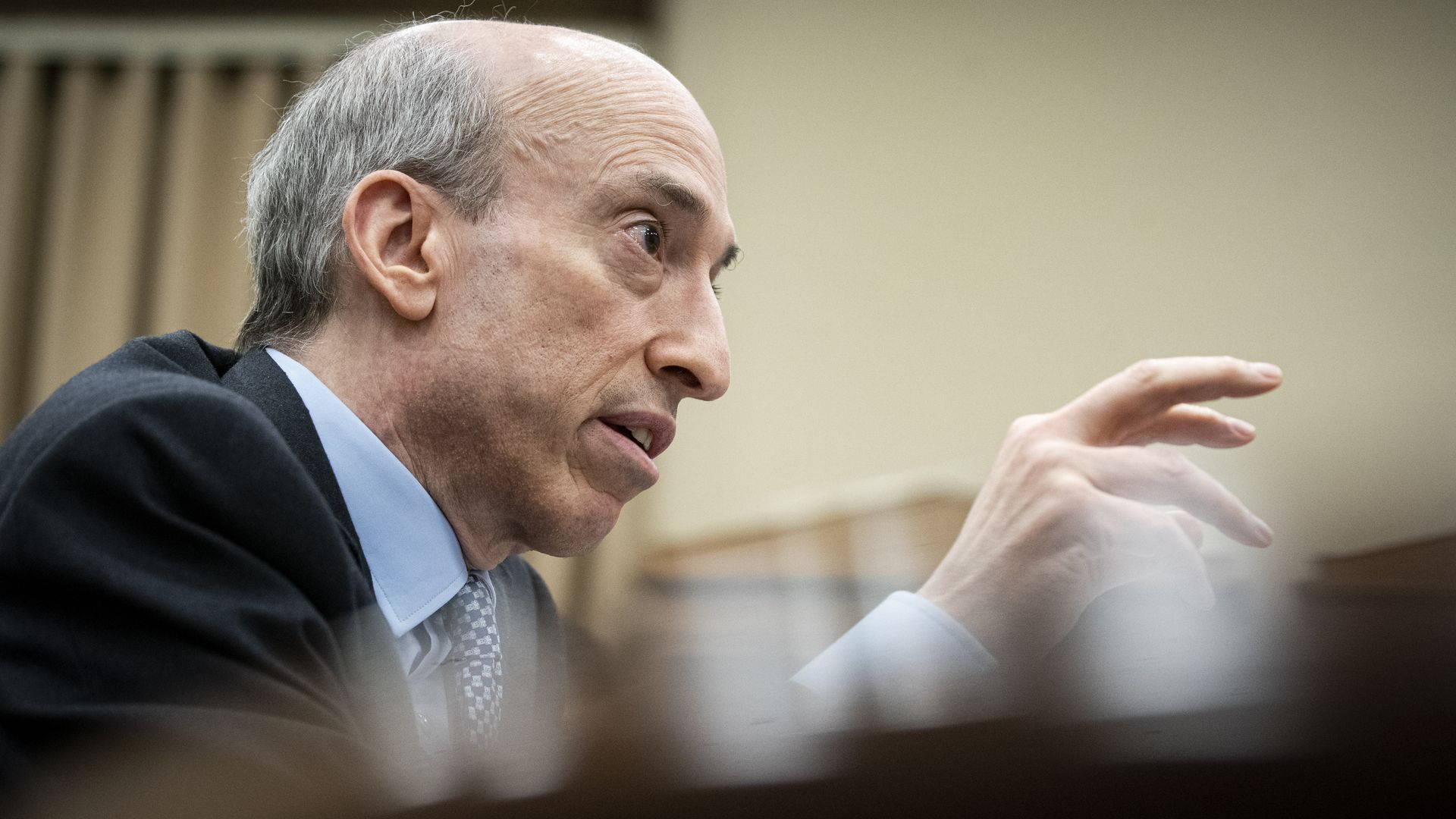

Keep reading. |     | | |  | | | | If you like this newsletter, your friends may, too! Refer your friends and get free Axios swag when they sign up. | | | | | | | | 5. Quoted: Gary Gensler on "free" retail trading |  | | | Photo: Al Drago/Getty Images | | | | "Just let me just say this. I think it's misleading. There's a cost to retail to this current system. And the cost is that two or three highly concentrated market makers are buying your order flow." — Securities and Exchange Commission chair Gary Gensler Why it matters: Gensler's comments, made yesterday at a Wall Street conference, come as the SEC prepares to roll out new proposals to overhaul the way the U.S. stock market functions. - The proposals will likely include scrutiny of the controversial practice of having large electronic brokerage firms — known as market makers — pay for the ability to execute the orders of individual (or retail) traders.

- Critics say the practice is rife with conflicts of interest, but supporters say it has helped bring about commission-free trading of stocks.

|     | | | | | | A message from Axios | | What matters this year in VC, PE and M&A | | |  | | | | What's new: Learn what's moving markets and driving valuations across Health Tech, Fintech, Retail, Climate, and Media. Download the report. | | | | 📕 1 thing Kate loves: Any book by Eric Larson. When it comes to telling true stories of past eras in painstaking and fascinating detail, no one's better. I especially love "Dead Wake," a delicious page-turner about the real people on board the Lusitania for its final, fatal voyage in 1915. |  | It's called Smart Brevity®. Over 200 orgs use it — in a tool called Axios HQ — to drive productivity with clearer workplace communications. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment