| | | | | | | Presented By ICE | | | | Axios Generate | | By Ben Geman and Andrew Freedman · Jun 09, 2022 | | 🍩 Good morning! Today's newsletter, edited by Mickey Meece, has a Smart Brevity count of 1,199 words, 5 minutes. 🚨 Today at 12:30 ET: An Axios virtual event about misinformation's effects on climate action and health. Guests include White House climate adviser Gina McCarthy. Register 🎶At this moment in 1998, the late DMX was atop the Billboard album charts with "It's Dark and Hell Is Hot," which has today's intro tune... | | | | | | 1 big thing: Ditching coal is expensive — and a huge bargain |  Data: Global Carbon Project; Chart: Axios Visuals A new International Monetary Fund study finds huge economic benefits from phasing out coal globally even under somewhat modest estimates of the monetary damages from carbon emissions, Ben writes. - The study adds to literature showing that failure to stem greenhouse gases is far more expensive than investments in accelerating clean energy.

Why it matters: Coal is the largest global source of CO2 and coal-fired power generation reached new records last year. The big picture: The working paper's "baseline" estimate shows a net gain of roughly $78 trillion through 2100 due to avoided damages from climate change and health problems. - That's based on comparing the benefits of avoided emissions against the costs of ending coal and replacing it with renewables.

- "This represents around 1.2% of current world GDP every year until 2100," the authors write. The study calls for more aggressive international financing and policy efforts to end coal.

What they found: That net gain factors in an estimated $29 trillion in financing needs to fully phase out coal globally, with almost half the investment needed in Asia. - The annual investment costs to cover these financing needs would amount to "0.5% to 3.5% of wealthy countries' GDP, with a front-loading at around 6% of wealthy countries' GDP."

- But it adds: "[A]s the proverb goes, there is no gain without pain, and as we show here the gain is colossal, far larger than the pain."

Yes, but: "The cost estimate does not include compensation for affected workers, but this is likely to be small relative to the overall net gains from the transition," an IMF summary states. Zoom in: The paper arrives at this $78 trillion "carbon arbitrage" estimate using a "social cost of carbon" of $75 per ton. - The "social cost" metric is a tool commonly used by regulators and scientists.

- It estimates damages from effects of global warming like rising sea levels and flood risks, changes to human health and farm output, and more.

- The authors call the $75 per ton figure consistent with "lower end estimates," noting the net benefits of ending coal grow with higher SCC values.

Read the analysis. |     | | | | | | 2. Two big energy rollouts: charging and hydrogen |  | | | Illustration: Shoshana Gordon/Axios | | | | The Biden administration just floated draft regulations setting standards for federally financed EV charging stations as officials aim to spur a large national buildout, Ben writes. The big picture: The minimum standards aim to ensure chargers are reliable and have similar payment systems, charging speeds, pricing and other consistent features. - "Everyone should be able to find a working charging station when and where they need it without worrying about paying more or getting worse service because of where they live," Transportation Secretary Pete Buttigieg told reporters.

- "You shouldn't have to sort to half a dozen apps on your phone just to be able to pay," he said. The NYT has more.

Why it matters: President Biden has set a goal of a national network of 500,000 public charging stations in place by 2030, and the bipartisan infrastructure law provides over $5 billion for the effort. In another energy milestone, the Energy Department on Wednesday announced the closure of a $504.4 million loan guarantee to the Advanced Clean Energy Storage Project in Delta, Utah, Andrew writes. Of note: This is the first completed loan guarantee for a new clean energy technology project from DOE's Loan Programs Office since 2014, the agency said in a statement. Driving the news: It will help finance construction of the world's largest clean hydrogen storage facility, located in salt caverns. The hydrogen stored there would be used to help generate electricity at a hydrogen-capable power plant. - The project could help achieve the administration's long-shot goal to power the country with 100% clean electricity by 2035.

What's next: The loan program office still has about $2.5 billion left in loan guarantee authority to dole out for "innovative clean energy" projects, DOE said. |     | | | | | | 3. 🏃🏽♀️Catch up fast: Climate, VC, gas exports | | Several climate bills faltered in the European Parliament, signaling what the FT calls the "politically complicated" task of moving emissions plans amid inflation and high energy costs. Driving the news: Measures to overhaul the bloc's carbon trading system, levy carbon border taxes and create a "social climate fund" ran aground Wednesday, per multiple reports. Why it matters: It could delay the timeline for enacting the overall plan to cut EU emissions by 55% by 2030 compared to 1990 levels, Reuters reports. Lawmakers will keep negotiating in an effort to attempt new votes, those outlets report. Also on our radar... ⚠️ The Freeport LNG terminal in Texas suffered an explosion Wednesday. No injuries were reported, per ABC News. But it will shut the facility for at least three weeks, reports say. - The incident "takes away a major supplier to markets already strained by European buyers shunning Russian LNG over its invasion of Ukraine...and by resurgent demand in China," Reuters reports.

- It notes that Freeport accounts for roughly 20% of U.S. LNG processing.

⛏️ Mining giant Vale launched a $100 million corporate venture capital fund, aiming to finance tech that cuts waste, supplies metals for energy transition, and more. Bloomberg has more. |     | | | | | | A message from ICE | | Accidental greenwashing: helping asset managers avoid it | | |  | | | | As investor appetite for sustainable funds booms, greenwashing is a growing concern. What you're missing: For asset managers who face a huge choice of data sets, it can also be accidental. But there are steps they can take to verify the attributes of their product. | | | | | | 4. A new climate fund for underrepresented founders |  | | | Illustration: Aïda Amer/Axios | | | | The Los Angeles Cleantech Incubator is launching a green-loan program for Black, brown and women early-stage startup founders, Axios' Alan Neuhauser reports. Why it matters: The program is funded through a $6 million pool of capital and is a step toward increasing funding to this group of founders, where VC money is in short supply. - Startups with a founder who identified as Latino received 2% of startup venture funding last year, according to Crunchbase. That was the same amount that went to women founders, Bloomberg reported.

- Venture funding for Black-led startups was 3% of the 2020 total, according to Reuters.

What's happening: The LACI Cleantech Debt Fund will offer loans of $25,000 to $250,000. - It will aim to back about 100 early-stage startups over five years. Unlike traditional bank loans, the fund won't require personal collateral or credit scores in underwriting.

- Sobrato Philanthropies and Homecoming Capital are anchor investors. The Wells Fargo Foundation provided a grant to cover initial operating costs and loan loss reserves.

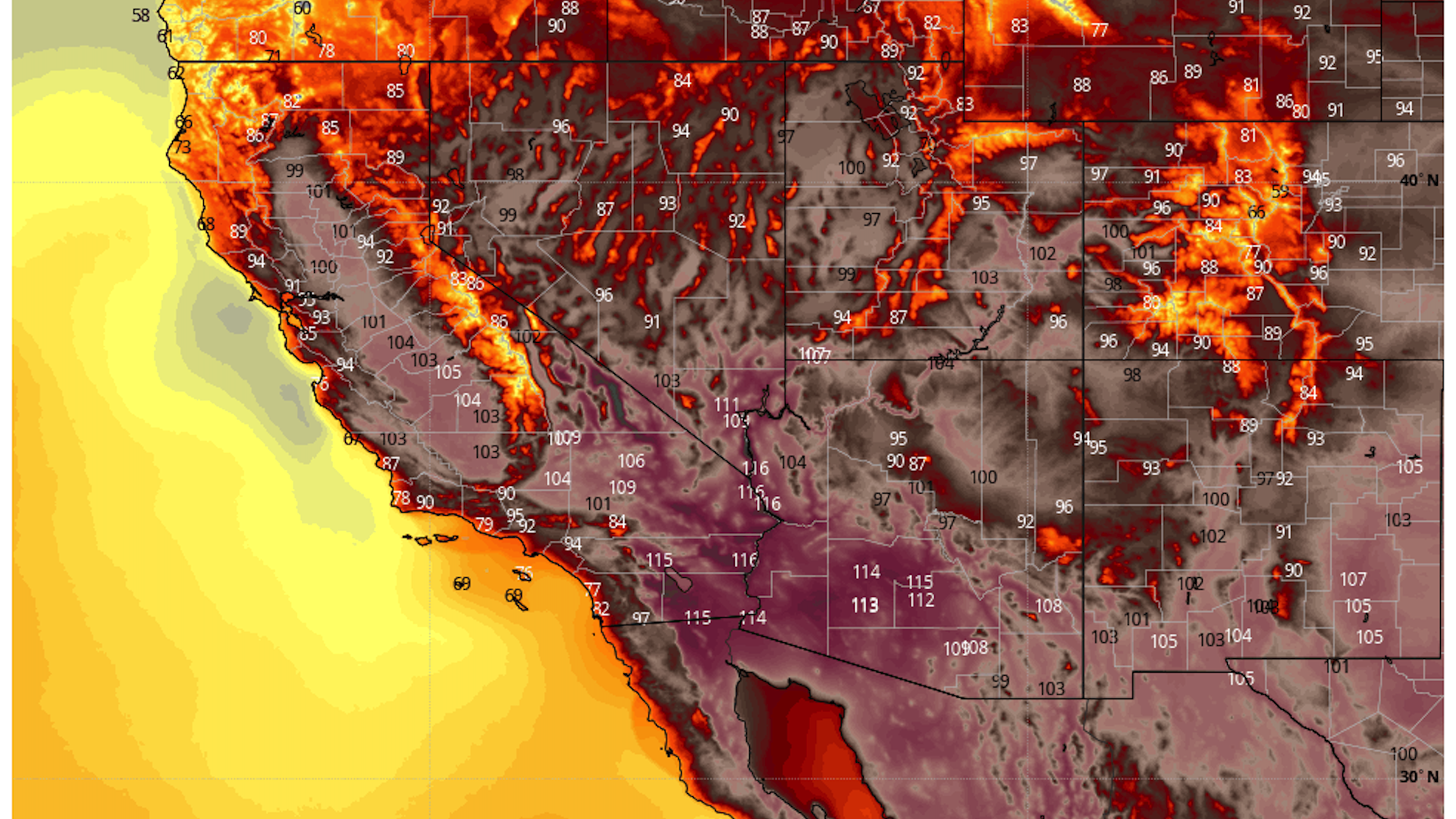

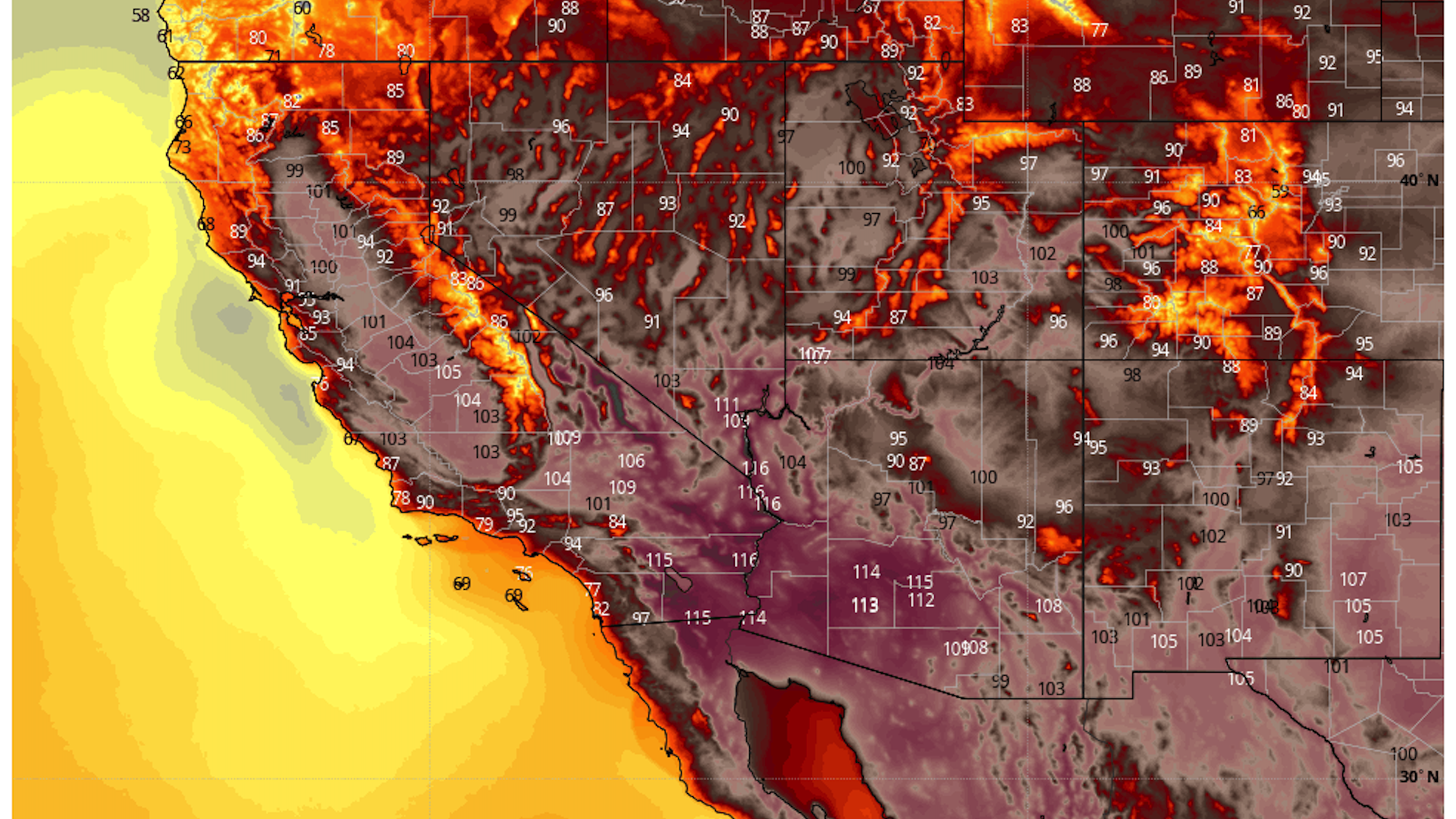

Sign up for the essential Axios Pro Climate Deals newsletter, where this item first appeared. |     | | | | | | 5. Heat wave threatens records in Southwest |  | | | Map showing computer model projection of high temperatures on June 11. (Weatherbell.com) | | | | Thirty-one million people are under heat watches and warnings in the Southwest into the weekend as a heat dome strengthens over the region, Andrew writes. Threat level: Temperatures are forecast to climb into the 110s Fahrenheit in Phoenix through Sunday, with the National Weather Service warning of "very high heat risk" and cautioning the heat will be excessive "even by local standards." - Daily temperature records will be threatened in Las Vegas through the weekend.

- In Death Valley, Calif., the hottest place in the U.S., temperatures could reach or exceed 120°F for the first time this year, tying or breaking daily records.

- The heat will extend into California where triple-digit temperatures are forecast in Sacramento for the next three days. Outdoor labor will be especially dangerous, the NWS warns.

- Overnight low temperatures are forecast to remain elevated in Central and Southern California, likely breaking records Thursday and Friday nights.

Context: Dry soils from the global warming-related megadrought in the region will help send temperatures soaring. - More frequent and severe heat waves are one of the clearest manifestations of human-caused global warming, studies show.

|     | | | | | | A message from ICE | | Volatile markets drive demand for RINs and RVO risk management | | |  | | | | Renewable Identification Numbers (RINs) help track compliance with the U.S. Renewable Fuel Standard (RFS) program. Take note: RIN prices have been volatile, and there are risks of a reset of the entire RFS program this year. ICE's Global Head of Oil Market Research Mike Wittner analyzes the market. | | | | 📬 Did a friend send you this newsletter? Welcome, please sign up. And thanks for reading! We'll see you back here tomorrow. |  | It's called Smart Brevity®. Over 200 orgs use it — in a tool called Axios HQ — to drive productivity with clearer workplace communications. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment